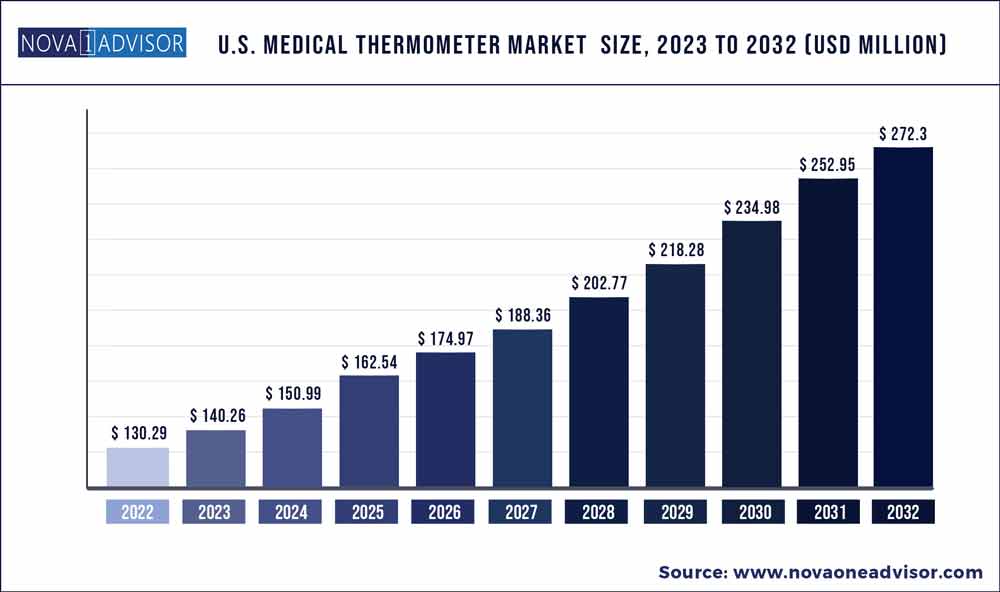

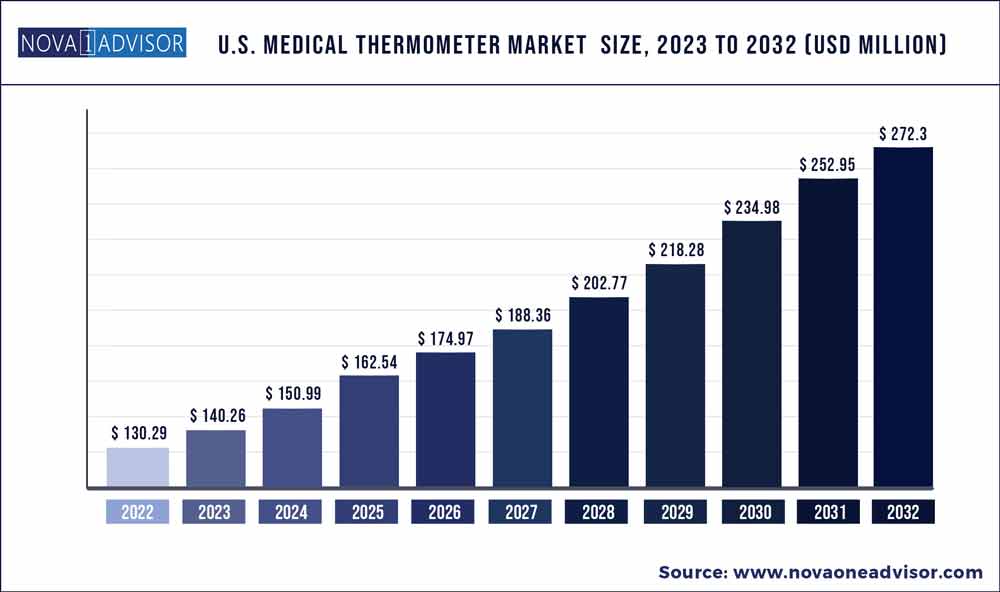

The U.S. medical thermometer market size accounted for USD 130.29 million in 2022 and is estimated to achieve a market size of USD 272.3 million by 2032, growing at a CAGR of 7.65% from 2023 to 2032.

Key Pointers:

- The mercury-free segment led the overall market in 2022 accounting for the highest share of over 60.9%

- The oral segment led the overall market in 2022 accounting for the highest share of over 60.19%.

Report Scope of the U.S. medical thermometer Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 140.26 million

|

|

Market Size by 2032

|

USD 272.3 million

|

|

Growth Rate from 2023 to 2032

|

CAGR of 7.65%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Device, Patient Demographic, Point of measurement

|

The presence of significant players, the rising prevalence rate of infectious illnesses, the growing R&D efforts, technological advancement, and the rising individual concerns about self-healthcare management all contribute to the growth of the market. The U.S. has the highest proportion due to supporting healthcare legislation, a large number of patients, and a developed healthcare sector. According to the CDC, in April 2020, about 15.5 Million people in the U.S. visited physicians' offices with infectious and parasitic disorders as the major diagnosis. Furthermore, according to MedAlertHelp statistics from 2022, 5-20% of Americans get influenza each year. Besides, the CDC said that the 2019-2020 flu season resulted in 35 Million illnesses, 380,000 hospitalizations, 20,000 fatalities, and 16 Million physician visits.

Moreover, the increasing prevalence of other diseases, such as dengue, swine flu, and malaria, further drive demand for these devices for the assessment of precise body temperature. According to the CDC, every year, approximately 2,000 cases of malaria are diagnosed in the country. Thus, the increasing prevalence of infectious illnesses in the population coupled with an upsurge in patient visits to healthcare facilities, are foreseen to fuel demand for medical thermometers, subsequently adding to the market growth.

Additionally, novel product introductions are projected to boost market growth in this country. For example, in February 2022, Calera launched a wearable thermometer. Enabled with a tiny sensor and an AI-based system. Similarly, in October 2020 GreenTEG introduced Core medical as a clinical thermometer in the U.S. In addition, Masimo launched the Radius T Continuous Thermometer for customers in October 2020. Wireless Radius T detects body temperature by continually transferring data and customizable temperature notifications to the User's smartphone. Such innovative and expanding product introductions are likely to contribute to the medical thermometer market’s growth throughout the forecast period.

COVID-19 had a substantial positive influence on the growth, owing to an increase in body temperatures among COVID-19-infected patients. Since high fever is a major symptom of COVID-19 and other infectious diseases, there had been a sudden surge in demand for thermometers due to the need for temperature screening and monitoring. With the community spread of the infection across the globe, including the U.S., over-the-counter sales of thermometers in the consumer market are rising. Citizens were informed to self-screen and monitor themselves at regular intervals. Thus, rising awareness about the significance of body temperature monitoring as an effective way to identify illnesses before clinical diagnosis drives product demand.

In addition, increasing operations by emerging and small-sized players and rapid technological advancements are also contributing to the market growth. COVID-19 also paved the way for the development of novel thermometers, helping to market expansion throughout the pandemic. For instance, Kinsa, Inc., distributed around 7,500 Bluetooth-enabled smart thermometers to community-based organizations and underserved individuals. This thermometer can pair up with a smartphone app, and allow tracking of real-time COVID-19 hot spots across the U.S. Such novel product advancements for monitoring patients' temperatures are projected to contribute to market growth.

Moreover, the ban on traditional mercury in-glass fever thermometers in 13 states of the U.S. California, Connecticut, Illinois, Indiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Hampshire, Rhode Island, Oregon, and Washington, boosts the sale of non-contact thermometers. The government has passed laws banning the production and sale of mercury thermometers. Through various initiatives, such as the mercury pollution prevention program, the United States Environmental Protection Agency (USEPA) has been spreading awareness about the harmful effects of mercury. Currently, infrared thermometers are being widely used for screening body temperature in public places, given their non-contact benefit.

Some of the prominent players in the U.S. medical thermometer Market include:

- Baxter (Hillrom Holdings Inc.)

- Cardinal Health

- 3M

- McKesson Corporation

- Mediaid, Inc.

- Innovo Medical

- Microlife Corporation

- American Diagnostic Corporation

- Exergen Corporation

- Kinsa Inc.

- Braun Healthcare

- Amsino International, Inc.

- Medline Industries, Inc.

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor has segmented the U.S. medical thermometer market.

By Device

- Mercury-free

- Infrared Radiation Thermometer

- Digital Thermometers

- Others

- Mercury-based

By Patient Demographic

By Point Of Measurement