U.S. Medical Weight Loss Clinics Market Size and Growth

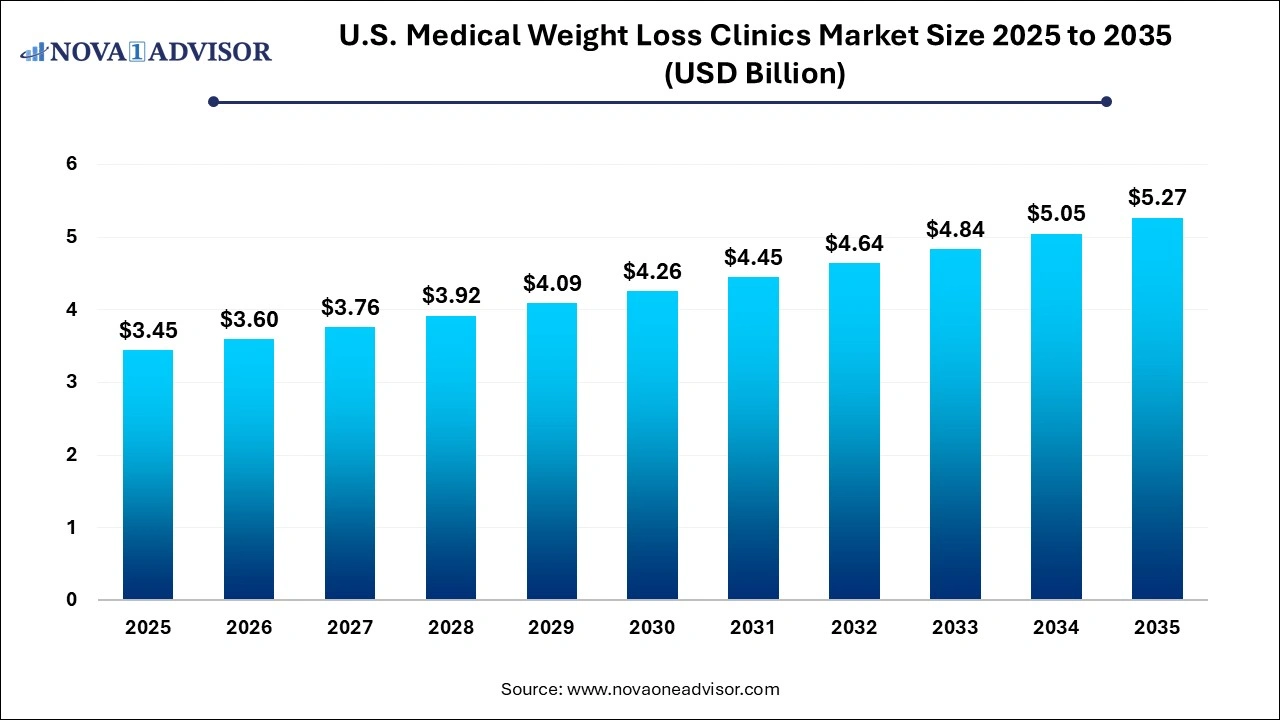

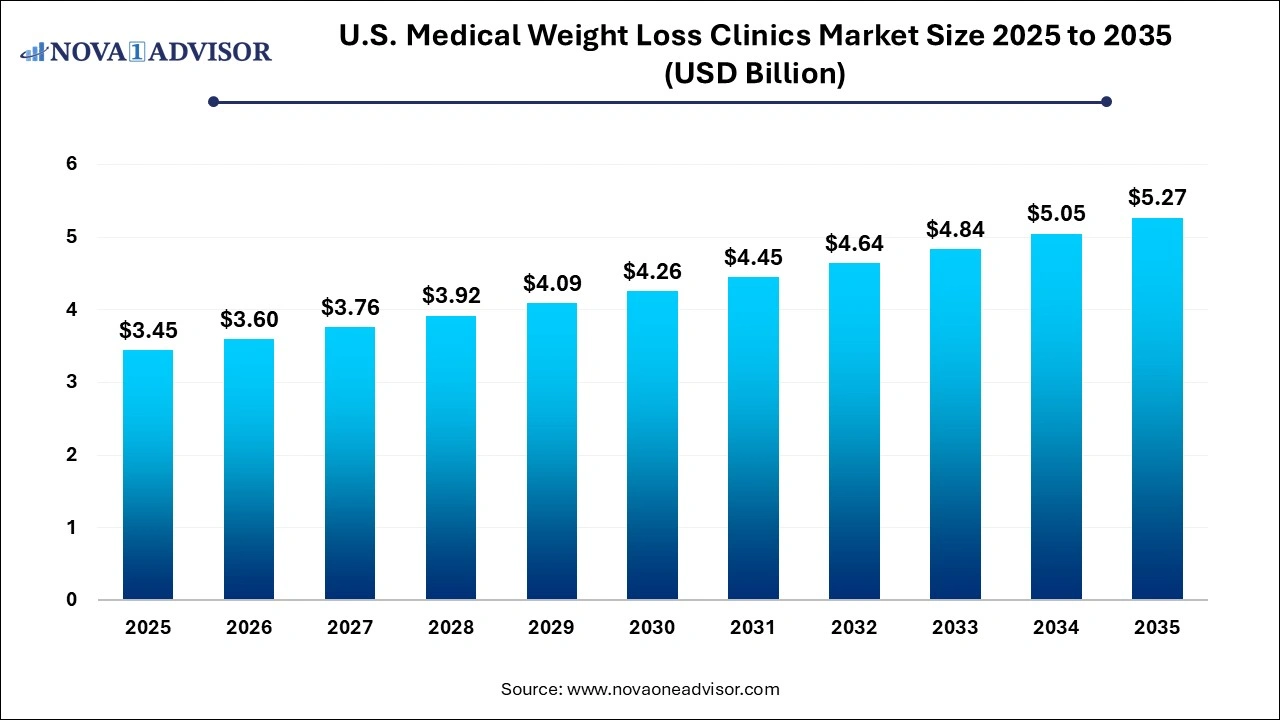

The U.S. medical weight loss clinics market size was exhibited at USD 3.45 billion in 2025 and is projected to hit around USD 4.50 billion by 2035, growing at a CAGR of 4.33% during the forecast period 2026 to 2035.

Key Takeaways:

- The standalone segment dominated with a revenue share of 60.61% in 2025.

- The hospital-based segment is expected to witness the fastest growth over the forecast period.

- The Southeast region dominated with the largest revenue share of 24.0% in 2025.

- Moreover, the Northeast segment is expected to witness significant growth over the forecast period.

U.S. Medical Weight Loss Clinics Market Overview

The U.S. medical weight loss clinics market has experienced significant evolution over the past decade, responding to a growing public health concern: obesity. With more than 42% of American adults classified as obese, and an even larger percentage considered overweight, the nation is grappling with a crisis that has deep-seated implications on public health, healthcare costs, and productivity. In this context, medical weight loss clinics have emerged as vital healthcare providers delivering structured, physician-supervised programs that go beyond traditional diet and exercise regimens.

These clinics provide multidisciplinary care often involving physicians, dietitians, behavioral therapists, and fitness experts to customize weight loss strategies tailored to an individual’s medical profile. Unlike commercial programs, medical clinics often address underlying issues such as metabolic disorders, thyroid problems, diabetes, and psychological factors that contribute to obesity. Treatment options range from lifestyle counseling and nutritional therapy to FDA-approved anti-obesity medications and, in some cases, referrals for bariatric surgery.

The market is being reshaped by several converging forces. Advances in obesity pharmacotherapy, increased insurance coverage, public health campaigns, and celebrity endorsements of weight loss drugs like GLP-1 agonists (e.g., Wegovy and Ozempic) have led to unprecedented consumer interest. Meanwhile, digital health platforms are enabling clinics to expand beyond physical locations, offering remote consultations, continuous monitoring, and virtual support groups.

As healthcare systems shift toward preventative and value-based care models, medical weight loss clinics are increasingly viewed not just as cosmetic services, but as integral players in managing chronic diseases such as type 2 diabetes, hypertension, and cardiovascular conditions. With rising demand and technological innovation, the U.S. medical weight loss clinics market is set to expand robustly in the years ahead.

Major Trends in the U.S. Medical Weight Loss Clinics Market

-

Surging Popularity of Prescription Weight Loss Drugs: Clinics are seeing heightened demand for GLP-1 receptor agonists like Wegovy, Ozempic, and Mounjaro, often integrated into medical programs under physician supervision.

-

Integration of Telemedicine Services: Many clinics now offer virtual consultations, remote coaching, and mobile apps for dietary tracking and medication adherence.

-

Customized, Hormone-based Therapies: Clinics are leveraging hormonal analysis to tailor weight loss programs, especially for patients with metabolic or thyroid dysfunction.

-

Behavioral and Psychological Support Integration: There is growing incorporation of mental health services to address emotional eating, body image issues, and relapse prevention.

-

Corporate Wellness Programs Expansion: Employers are partnering with clinics to reduce employee healthcare costs and absenteeism through on-site or digital weight loss programs.

-

Insurance Reimbursement Improvements: More clinics are accepting insurance for medically necessary obesity treatments, improving accessibility for middle-income populations.

-

Data-Driven Care and Predictive Analytics: Clinics are adopting software tools to personalize programs based on body composition, genetic predispositions, and previous weight loss attempts.

-

Rise of Men’s and Women’s Focused Clinics: Gender-specific clinics are being established, offering hormone balancing and body contouring programs tailored to physiological differences.

Report Scope of The U.S. Medical Weight Loss Clinics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.60 Billion |

| Market Size by 2035 |

USD 5.27 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.33% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Ownership, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Cleveland Clinic (Obesity and Medical Weight Loss Center); Medical Weight Loss Clinic; Rivas Weight Loss; Medi IP, LLC (Medi-Weightloss); NYU Langone Hospitals; Stanford Health Care; UCLA Health; Long Island Weight Loss Institute; Cedars-Sinai; Allegheny Health Network; Options Medical Weight Loss; Med-Fit Medical Weight Loss |

One of the most powerful drivers of the U.S. medical weight loss clinics market is the soaring prevalence of obesity and its associated health complications. According to the CDC, more than 4 in 10 U.S. adults are obese—a rate that has been steadily climbing for the past two decades. Obesity is not only a cosmetic concern; it is a medical condition that significantly increases the risk of heart disease, stroke, type 2 diabetes, certain cancers, and joint disorders.

This widespread health challenge has led to a growing demand for physician-supervised interventions. While traditional weight loss methods—such as fad diets and gym memberships—often result in temporary success, medical weight loss programs are designed to produce sustainable results through clinical oversight and evidence-based strategies. Patients with obesity-related complications often require medically supervised care, including lab tests, prescription medications, and coordination with primary care providers. The escalating need to curb the obesity epidemic is fueling the growth and legitimization of medical weight loss clinics across the country

Market Restraint: High Cost of Treatment and Limited Access

Despite their benefits, medical weight loss programs often remain out of reach for a significant portion of the population due to high treatment costs and limited geographic access. Although some insurance plans now cover obesity treatments, including counseling and pharmacotherapy, many do not offer comprehensive coverage. Out-of-pocket costs for consultations, lab tests, medications, and ongoing coaching can range from hundreds to thousands of dollars per year, particularly at premium clinics.

Moreover, medical weight loss clinics are disproportionately located in urban or affluent suburban areas, leaving rural and underserved populations with fewer options. This accessibility gap is exacerbated by long wait times and a shortage of obesity medicine specialists in certain regions. As a result, millions of Americans who could benefit from clinical intervention remain reliant on non-medical alternatives or forgo treatment altogether. Addressing these cost and access barriers will be essential for ensuring equitable growth in the market.

Market Opportunity: Technology-Enabled Personalized Care Models

The integration of digital technologies into clinical weight loss programs presents a major opportunity for market expansion. From AI-powered dietary tracking apps to wearable fitness devices and remote monitoring tools, medical weight loss clinics are increasingly embracing hybrid care models that combine in-person visits with telemedicine and digital engagement.

Clinics that use patient-specific data—such as DNA testing, gut microbiome analysis, and real-time biometric feedback—can create highly personalized and adaptive treatment plans. For instance, companies like Calibrate and Sequence Health offer virtual programs that integrate clinical prescriptions with continuous metabolic monitoring. This kind of personalization not only improves outcomes but also enhances patient satisfaction and retention. With rising demand for convenience, privacy, and tailored solutions, technology-enabled care pathways are positioned to revolutionize the medical weight loss experience and open new markets.

U.S. Medical Weight Loss Clinics Market By Ownership Insights

Hospital-based clinics currently dominate the U.S. medical weight loss clinics market, leveraging established healthcare infrastructure, insurance networks, and referral systems. These clinics are often integrated into larger hospital systems or outpatient centers and offer a multidisciplinary approach combining endocrinology, cardiology, nutrition, and behavioral health services. Patients with complex comorbidities such as diabetes, hypertension, and metabolic syndrome often prefer hospital-based settings for their comprehensive capabilities. These clinics also benefit from institutional trust, access to electronic health records, and affiliation with research programs that enable the use of advanced treatments and clinical trials.

However, standalone clinics are emerging as the fastest-growing segment, thanks to their agility, branding, and consumer-focused models. These clinics typically offer boutique services, shorter wait times, and a personalized patient experience. Companies like Red Mountain Weight Loss and Medi-Weightloss have pioneered franchised models that blend lifestyle coaching with pharmacological and nutritional interventions. Additionally, standalone operators often innovate faster, adopting new technologies such as virtual consultations, app-based engagement, and retail partnerships. As more consumers seek direct-to-clinic solutions without navigating hospital bureaucracy, this segment is expected to witness sustained growth.

U.S. Medical Weight Loss Clinics Market By Regional Insights

The United States presents a highly fragmented yet opportunity-rich market for medical weight loss clinics. Nationally, demand is highest in states with elevated obesity rates such as Mississippi, Louisiana, West Virginia, and Oklahoma where over 35% of adults are classified as obese. However, urban hubs like New York, Los Angeles, and Miami have witnessed a different kind of boom, driven by affluent consumers seeking physician-supervised aesthetic weight loss solutions including peptide injections, lipotropic compounds, and non-invasive fat reduction technologies.

Nationwide public health campaigns and policy initiatives, such as the CDC’s National Center for Chronic Disease Prevention, are supporting community-based interventions and increasing awareness about medically supervised weight loss. Insurance companies are also playing a larger role, with providers like Cigna, Aetna, and Blue Cross offering expanded coverage for obesity treatments in compliance with Affordable Care Act mandates. Federal interest in curbing obesity-related spending—projected to account for $190 billion annually in direct medical costs ensures that support for this industry will likely persist.

Some of the prominent players in the U.S. medical weight loss clinics market include:

- Cleveland Clinic

- Medical Weight Loss Clinic

- Rivas Weight Loss

- Medi IP, LLC (Medi-Weightloss)

- NYU Langone Hospitals

- Stanford Health Care

- UCLA Health

- Long Island Weight Loss Institute

- Cedars-Sinai

- Allegheny Health Network

- Options Medical Weight Loss

- Med-Fit Medical Weight Loss

Recent Developments

-

April 2024 – Sequence Health Partners with WeightWatchers for Telehealth Expansion: Sequence, a telehealth platform offering prescription weight loss treatments, deepened its partnership with WeightWatchers to launch a new hybrid program integrating GLP-1 medications with behavioral coaching.

-

March 2024 – Red Mountain Weight Loss Opens New Locations in Texas: Red Mountain announced the opening of five new clinics across Texas, citing rising demand for medically supervised weight loss in the Southwest.

-

February 2024 – Calibrate Receives $70 Million in Series C Funding: Calibrate, a telehealth company specializing in weight loss with GLP-1 medications, secured funding to expand its clinical infrastructure and digital platform capabilities nationwide.

-

January 2024 – Hims & Hers Health Launches Weight Loss Program: Telehealth giant Hims & Hers entered the weight loss market with a subscription-based program offering virtual medical consultations and prescription treatments like semaglutide.

-

December 2023 – Obesity Care Advocacy Network Lobbies for Medicare Coverage Expansion: OCAN pushed for policy reforms to expand Medicare coverage for anti-obesity medications, seeking to make clinical treatments more accessible to older Americans.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 20353. For this study, Nova one advisor, Inc. has segmented the U.S. medical weight loss clinics market

Ownership

- Hospital-based

- Standalone

Regional

- Southeast

- Southwest

- Northeast

- Midwest

- West