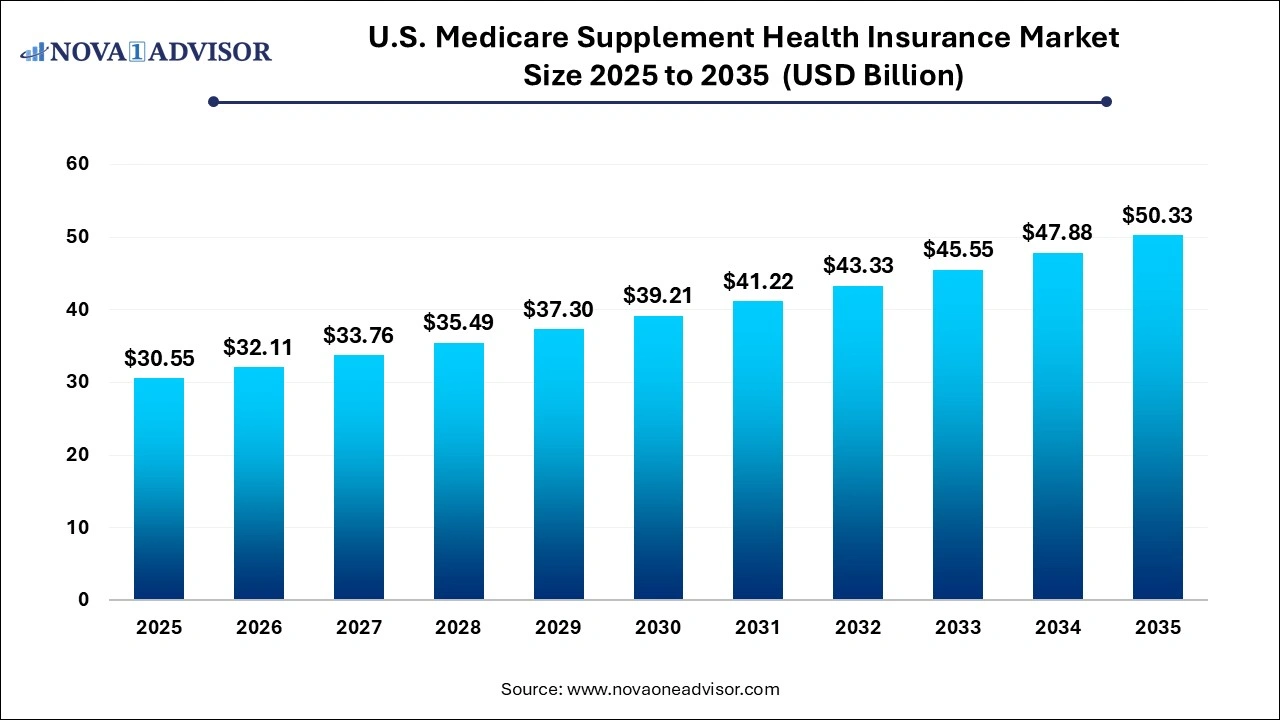

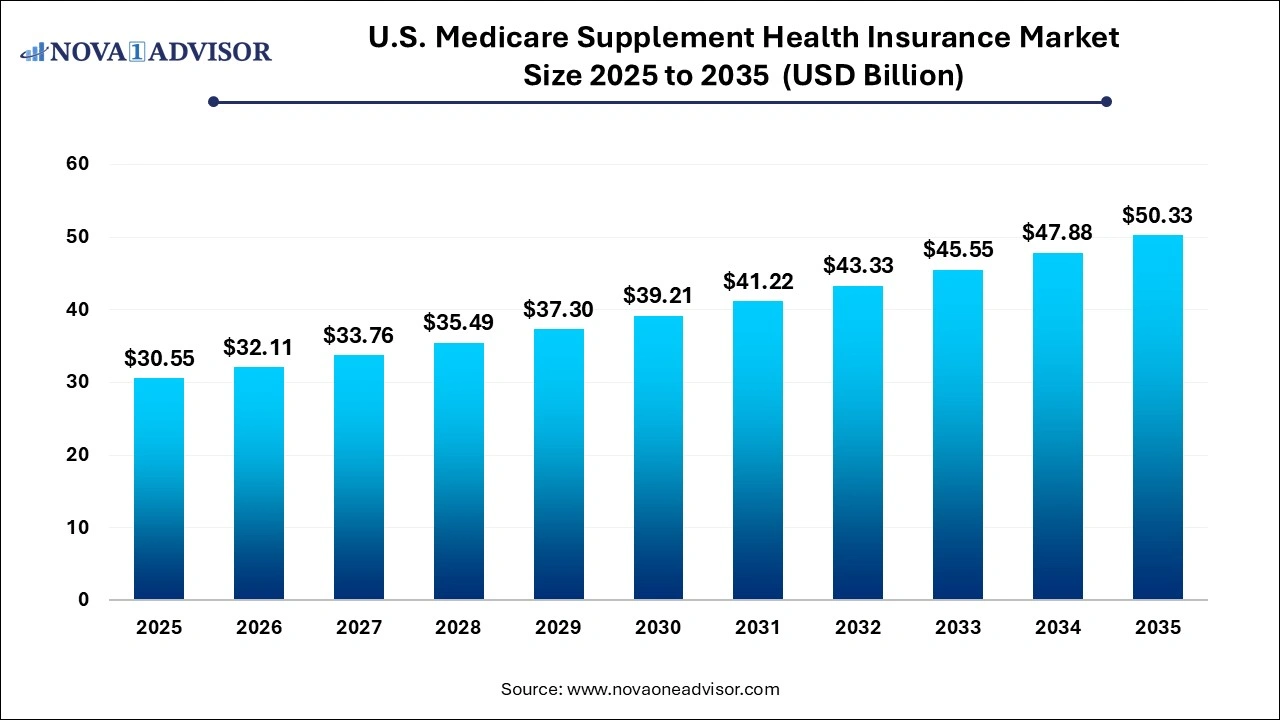

U.S. Medicare Supplement Health Insurance Market Size and Growth

The U.S. medicare supplement health insurance market size was exhibited at USD 30.55 billion in 2025 and is projected to hit around USD 50.33 billion by 2035, growing at a CAGR of 5.10% during the forecast period 2026 to 2035.

Key Takeaways:

- Individuals aged 65 or older dominated the U.S. medicare supplement health insurance market in 2025.

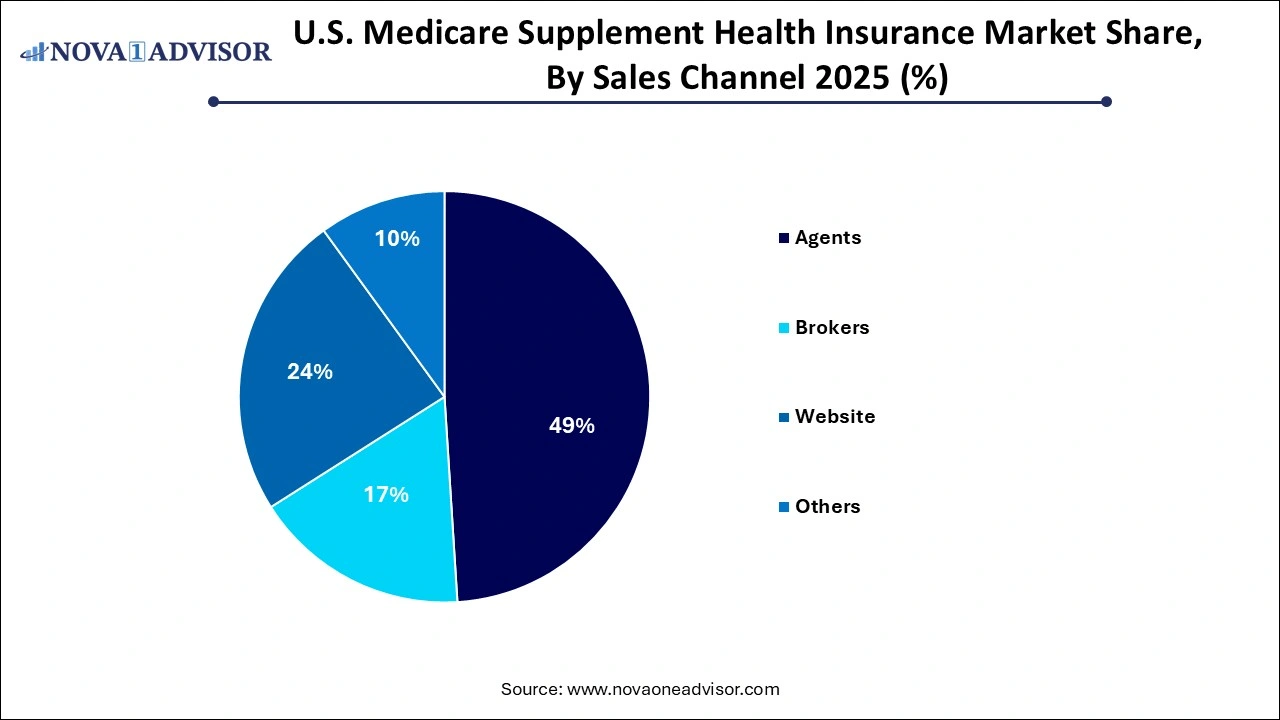

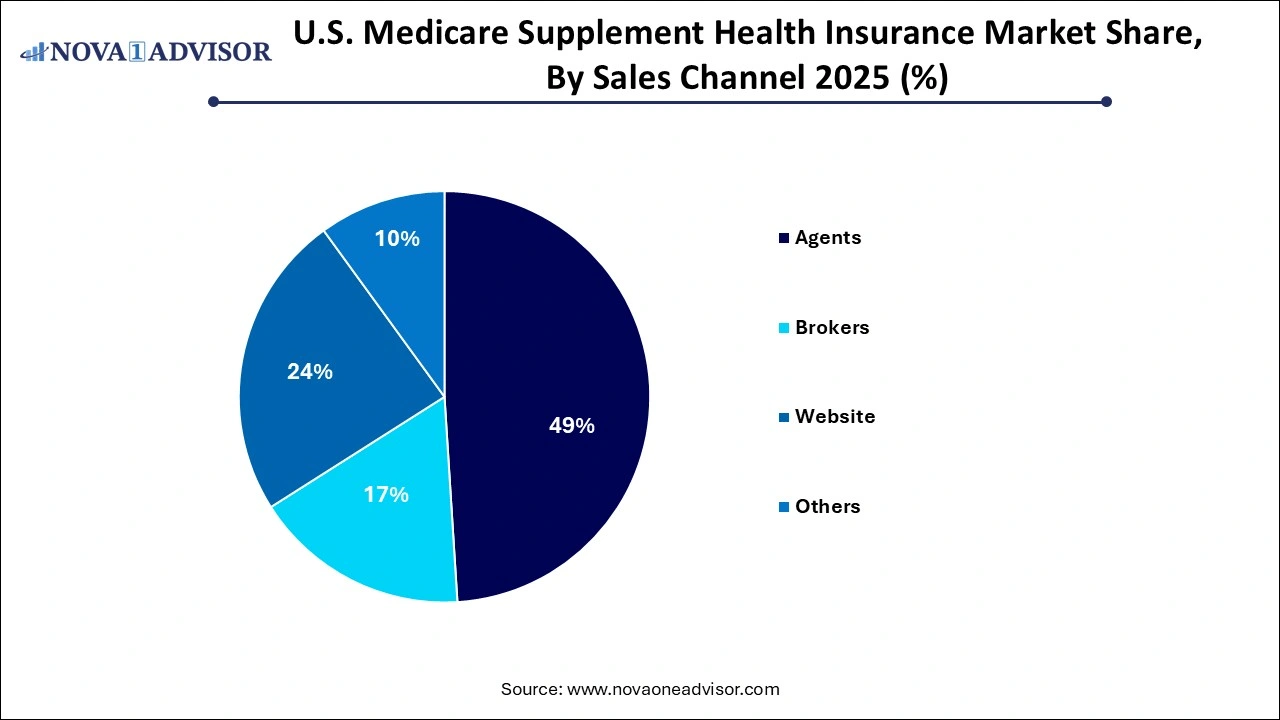

- In 2025, the agents segment dominated the market with 48% of the revenue share.

- The West section is expected to witness maximum growth over the forecast period.

U.S. Medicare Supplement Health Insurance Market Overview

The U.S. medicare supplement health insurance market commonly referred to as the Medigap market is a significant component of the broader senior healthcare insurance ecosystem. Designed to complement Original Medicare (Parts A and B), Medigap policies help cover costs that Medicare does not pay, such as copayments, coinsurance, and deductibles. As healthcare expenses rise and the senior population expands, Medigap plans have become increasingly vital for millions of Americans seeking financial predictability and comprehensive coverage.

As of 2024, over 14 million Americans were enrolled in Medigap plans, with penetration highest among individuals aged 65 and older who prefer the flexibility and provider access offered by Original Medicare over Medicare Advantage plans. Medigap remains especially popular in rural regions where Medicare Advantage networks may be limited and among those with chronic conditions requiring frequent medical attention. Unlike Medicare Advantage, Medigap allows beneficiaries to see any provider that accepts Medicare, without network restrictions or prior authorization barriers.

The market is structured around standardized plans (A–N), with each offering a unique combination of benefits. Plans G and N are the most popular, particularly after Plan F previously the most comprehensive was closed to new enrollees in 2020. Medigap plans are sold by private insurers, including major carriers like UnitedHealthcare, Aetna, Humana, and Cigna, often through independent brokers, websites, or captive agents.

The growing senior population, combined with rising out-of-pocket healthcare costs and evolving consumer expectations, positions the Medigap market as a critical growth segment. Insurers are responding with digital enrollment tools, wellness service integrations, and broader support offerings to attract and retain Medicare-eligible consumers in a competitive space.

Major Trends in the U.S. Medicare Supplement Health Insurance Market

-

Digital Transformation of Sales and Enrollment: Insurers are leveraging online portals and AI-powered tools to simplify plan comparisons and enrollment processes.

-

Rising Popularity of Plans G and N: With Plan F discontinued for new beneficiaries, Plan G has become the most comprehensive option, while Plan N is growing rapidly due to its lower premium.

-

Bundling with Ancillary Services: Medigap carriers are adding dental, vision, hearing, and wellness benefits as riders or bundled add-ons.

-

Expansion of Direct-to-Consumer (DTC) Platforms: Brokers and carriers are heavily investing in e-commerce models and phone-based advisory centers.

-

Targeted Marketing to Younger Medicare Beneficiaries (65–70 Age Group): Insurers are focusing on the newly eligible cohort with digital-first campaigns and wellness integration.

-

Focus on Chronic Disease Management: Plans are incorporating value-added services such as telehealth check-ins and chronic condition monitoring.

-

Increased Regulatory Scrutiny: State insurance departments and CMS are enforcing tighter oversight of marketing practices and price transparency.

-

Broker Consolidation and Technology Adoption: Independent brokers are joining larger tech-driven platforms to enhance reach and efficiency.

Report Scope of The U.S. Medicare Supplement Health Insurance Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 32.11 Billion |

| Market Size by 2035 |

USD 50.33 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.12% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Demographic, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

Northeast; Midwest; South; West |

| Key Companies Profiled |

Cigna Health & Life Insurance Company; Anthem Blue Cross; United Healthcare Insurance Company; Mutual of Omaha; Humana; State Farm Mutual Automobile Insurance Company; National Health Insurance Company; United American Insurance Company; Washington National Insurance Company; Everence Association, Inc. |

Market Driver: Growth in Medicare-Eligible Population and Rising Out-of-Pocket Costs

A major driver of the U.S. Medicare Supplement Health Insurance Market is the expanding Medicare-eligible population and their rising exposure to healthcare costs. According to the U.S. Census Bureau, by 2030, more than 73 million Americans will be over the age of 65—approximately one in five citizens. While Medicare covers many medical expenses, it still leaves beneficiaries responsible for thousands of dollars in potential out-of-pocket costs each year.

Original Medicare Part A and Part B do not include a cap on out-of-pocket spending, making seniors financially vulnerable in the event of hospitalization, complex procedures, or frequent physician visits. Medigap plans offer the security of predictable costs and often reduce administrative hassles. For example, Plan G covers virtually all Medicare-approved expenses except for the Part B deductible, giving beneficiaries comprehensive protection and budget predictability.

The combination of demographic trends and healthcare inflation ensures sustained demand for supplemental coverage. Medigap allows older Americans to age with financial dignity, access the providers of their choice, and manage chronic or emerging health conditions without fear of unpredictable costs.

Market Restraint: Limited Enrollment Flexibility and Higher Premiums

One of the key restraints of the Medigap market is the limited enrollment windows and potential for premium discrimination based on health status in most states. While the initial Medigap open enrollment period allows beneficiaries to enroll in any plan without medical underwriting, this six-month window begins when individuals first enroll in Medicare Part B. After that, in most states, insurers can deny coverage or charge higher premiums based on pre-existing conditions.

This creates challenges for those who initially chose Medicare Advantage and later wish to switch to Original Medicare with a Medigap plan. They may face obstacles due to health changes or financial instability. Additionally, Medigap premiums can be significantly higher than Medicare Advantage plans, which often have low or zero-dollar premiums due to government subsidies.

Medigap policies also do not include built-in drug coverage (Part D), requiring beneficiaries to purchase separate policies, which adds to complexity and cost. These structural limitations can dissuade new enrollees or financially constrained seniors from choosing Medigap, despite its flexibility and provider access advantages.

Market Opportunity: Enhancing Medigap Plans with Value-Added Services and Digital Access

A growing opportunity in the market lies in bundling Medigap policies with value-added services and expanding digital enrollment access, especially to appeal to the tech-savvy aging population. Today’s 65-year-olds are more digitally engaged than previous generations, using smartphones and online platforms for healthcare research, telemedicine, and financial planning.

Insurers are responding by offering plans with optional wellness benefits like gym memberships, health coaching, vision/hearing care, and mental health support. For example, UnitedHealthcare now includes Renew Active fitness benefits with many Medigap plans. These additions help differentiate offerings in a commoditized market and improve member satisfaction and retention.

The growth of digital platforms also allows carriers and brokers to reach new enrollees efficiently. AI-driven comparison tools, electronic applications, and personalized plan matching improve conversion rates and reduce acquisition costs. As enrollment assistance shifts online, companies that provide intuitive, educational, and secure user experiences will capture greater market share—especially among younger Medicare beneficiaries.

Segmental Insights

By Demographic Insights

Individuals aged 65 or older dominate the Medigap market, as they represent the primary target population for Medicare. These consumers typically seek coverage stability and value predictable healthcare costs, making Medigap an ideal solution. Many are retirees with fixed incomes who value flexibility in provider choice and dislike the restrictions or referral requirements often associated with Medicare Advantage plans. Carriers market heavily to this group, especially during the six-month open enrollment period, often offering added benefits and long-term rate stability to incentivize early selection.

The under-65 disabled demographic is the fastest growing, driven by increased enrollment in Social Security Disability Insurance (SSDI) and corresponding Medicare eligibility after the mandatory 24-month waiting period. This group includes individuals with long-term disabling conditions such as multiple sclerosis, end-stage renal disease (ESRD), or ALS. Although Medigap coverage is not guaranteed issue in all states for this group, several states like New York, California, and Missouri require insurers to offer coverage regardless of health status. Rising healthcare complexity among disabled individuals and policy advocacy for equitable access are pushing more carriers to develop products and pricing models that include this underserved group.

By Sales Channel Insights

Agents remain the dominant sales channel for Medigap policies due to the complexity of coverage options and the personalized assistance many seniors prefer when evaluating plans. Independent agents and captive representatives provide side-by-side comparisons, answer regulatory questions, and assist with enrollment logistics. Their deep knowledge of localized provider networks, supplemental benefits, and underwriting requirements makes them invaluable to many first-time enrollees. In 2024, more than 60% of Medigap plans were sold through agents or brokers, according to industry sources.

Website and direct-to-consumer (DTC) channels are growing fastest, as tech-savvy baby boomers and Gen Xers age into Medicare eligibility. Online marketplaces like eHealth, GoHealth, and SelectQuote offer digital quoting tools, eligibility checks, and electronic applications. Insurers like Cigna and Aetna have also launched intuitive web portals with chat support, plan filters, and paperless document management. The COVID-19 pandemic accelerated comfort with digital solutions, and this momentum continues to reshape how seniors research and enroll in coverage. Companies that combine digital simplicity with live assistance are poised to lead this evolving channel.

U.S. Medicare Supplement Health Insurance Market By Regional Insights

The U.S. Medicare Supplement Health Insurance Market operates within a complex regulatory framework shaped by federal mandates and state-specific rules. Medicare is a national program, but Medigap policies are state-regulated, resulting in varied rules for guaranteed issue, rating structures (community-rated vs. attained-age), and standardization enforcement.

States such as Massachusetts, Minnesota, and Wisconsin have unique plan structures, while others enforce stricter guaranteed issue requirements. Meanwhile, federal legislation and CMS oversight shape plan standardization, marketing practices, and coordination with other Medicare parts.

Market adoption is highest in states where Medicare Advantage penetration is lower, or rural areas where provider access via PPOs is limited. Urban areas also see significant Medigap demand due to higher income retirees willing to pay for unrestricted access to specialists. The shifting demographics, policy refinements, and technological disruption across the U.S. make the Medigap landscape a dynamic, consumer-driven market that is deeply integrated into the American healthcare safety net.

Some of the prominent players in the U.S. medicare supplement health insurance market include:

- Cigna Health & Life Insurance Company

- Anthem Blue Cross

- United Healthcare Insurance Company

- Mutual of Omaha

- Humana

- State Farm Mutual Automobile Insurance Company

- National Health Insurance Company

- United American Insurance Company

- Washington National Insurance Company

- Everence Association, Inc.

Recent Developments

-

February 2024 – UnitedHealthcare launched enhanced Medigap Plan G and N options nationwide, including value-added wellness benefits such as access to gym memberships, telehealth sessions, and hearing aid discounts.

-

January 2024 – Cigna Healthcare expanded its Medigap plan footprint to four new states and rolled out a digital enrollment tool allowing real-time policy comparisons, simplified underwriting, and chatbot support.

-

November 2023 – Humana announced a strategic partnership with a nationwide chain of pharmacies to offer Medigap members exclusive discounts on over-the-counter medications and wellness screenings.

-

September 2023 – Mutual of Omaha introduced a hybrid Medigap product bundled with dental and vision coverage, targeting rural markets where standalone supplemental insurance is less accessible.

-

July 2023 – Blue Cross Blue Shield affiliates in several states launched targeted outreach programs to younger Medicare beneficiaries (ages 65–70) with digital education campaigns and interactive video consultations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. medicare supplement health insurance market

Demographic

- Individuals Aged 65 or Older

- Individuals Aged Under 65 with an Eligible Disability

Sales Channel

- Agents

- Brokers

- Website

- Others

Regional

- Northeast

- Midwest

- West Group

- South