U.S. Mental Health And Addiction Treatment Centers Market Size and Trends

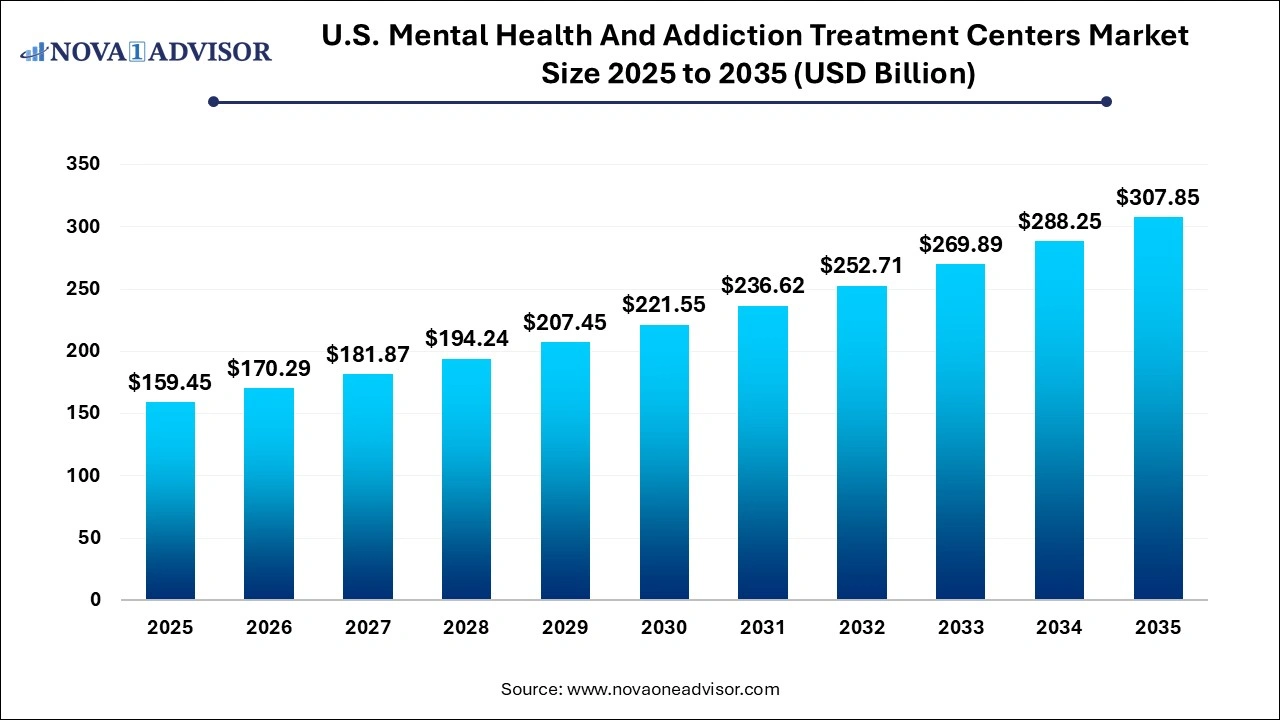

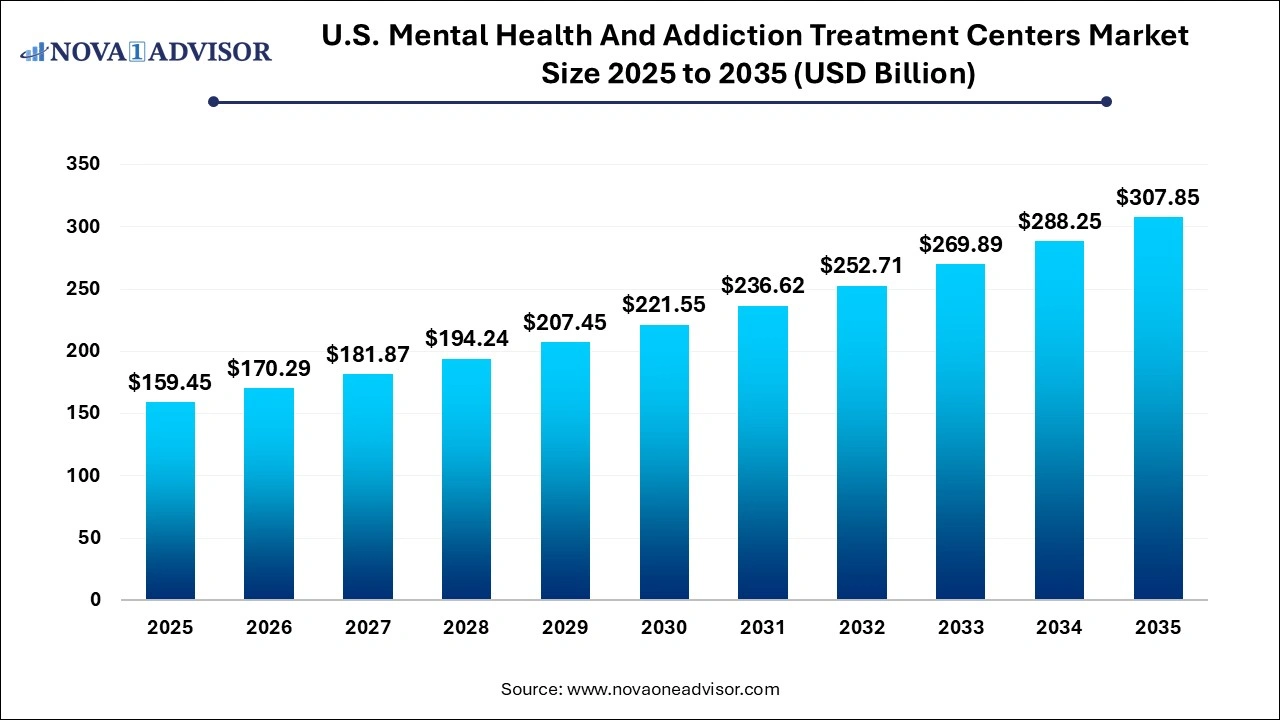

The U.S. mental health and addiction treatment centers market size was exhibited at USD 159.45 billion in 2025 and is projected to hit around USD 307.85 billion by 2035, growing at a CAGR of 6.8% during the forecast period 2026 to 2035.

Key Takeaways:

- By disorder, the mood disorder segment held the largest share of 23.7% in 2025.

- Furthermore, the anxiety disorder segment is anticipated to grow at the fastest rate over the forecast period.

- By services, the outpatient treatment centers segment held the largest share of 42.0% in 2025.

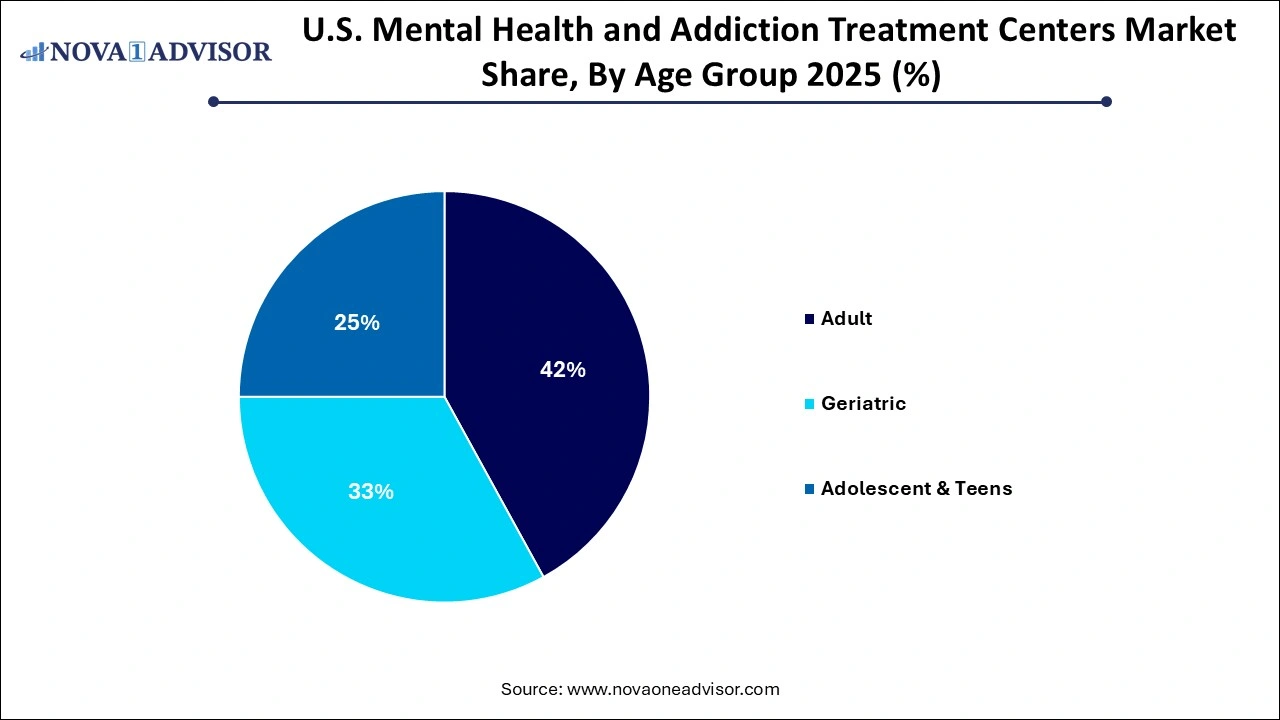

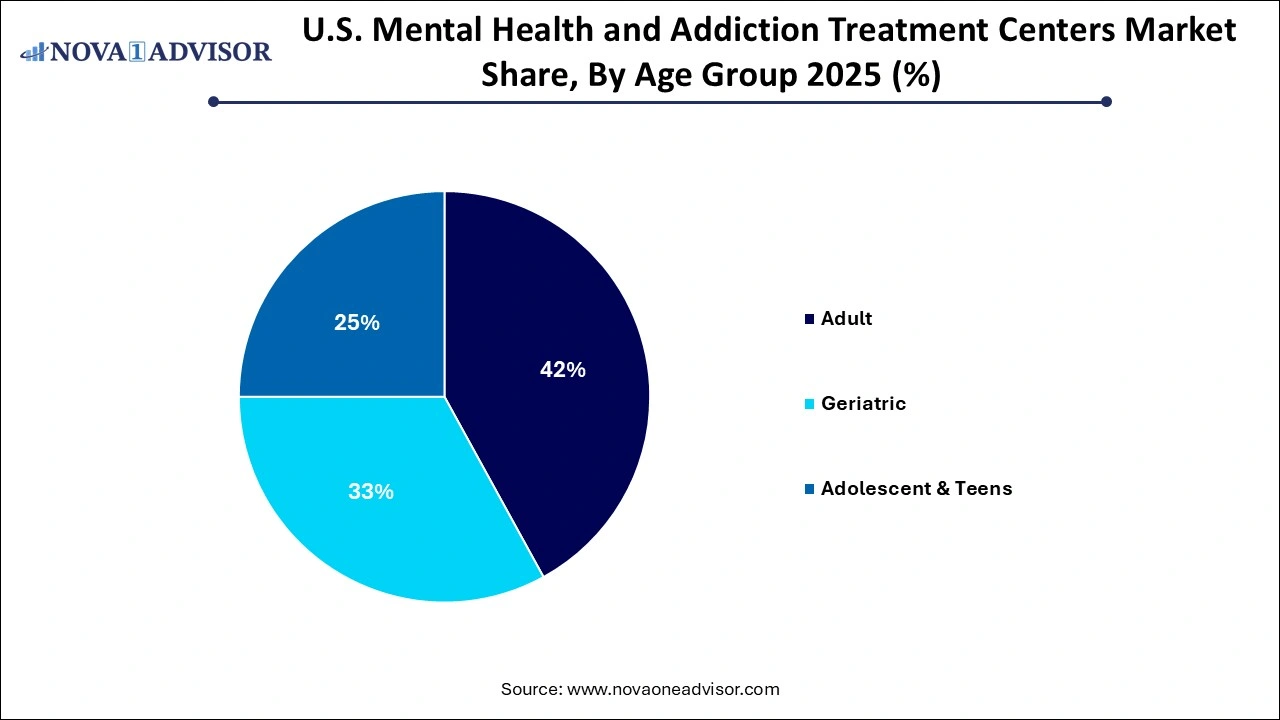

- In 2025, the adult age group segment held the largest share of 41.0%.

- The adolescent & teens segment is anticipated to grow at the fastest rate over the forecast period.

U.S. Mental Health And Addiction Treatment Centers Market Overview

The mental health and addiction treatment landscape in the United States has undergone a fundamental transformation over the past decade. Once stigmatized and underfunded, mental health has now emerged as a national healthcare priority, especially in the aftermath of the COVID-19 pandemic, which brought mental health issues to the forefront of public discourse. Rising prevalence of mental illnesses, drug overdoses, anxiety disorders, and suicide rates particularly among young adults and marginalized populations—has created an urgent need for comprehensive, accessible, and affordable treatment services.

Treatment centers across the U.S. have responded by expanding their scope, integrating mental health and substance abuse treatment into holistic care programs that address both clinical and behavioral needs. Facilities today offer a mix of inpatient, outpatient, and residential services, supported by multidisciplinary teams including psychiatrists, psychologists, therapists, social workers, and peer counselors. While traditional models focused heavily on institutionalization or acute interventions, the current trend leans toward community-based care, trauma-informed treatment, and recovery-oriented approaches.

Addiction treatment, in particular, has seen a surge in demand, especially related to the opioid crisis. According to the National Institute on Drug Abuse, over 2.7 million Americans suffer from opioid use disorder (OUD), and nearly 100,000 died of drug overdoses in 2023. This crisis has compelled lawmakers to fund rehabilitation centers, support medication-assisted treatment (MAT) programs, and regulate treatment facilities more rigorously.

Furthermore, technological innovations such as teletherapy, mobile mental health apps, and AI-powered cognitive behavioral therapy (CBT) platforms are reshaping how care is delivered. The U.S. government and private insurers have also improved coverage for mental health services, thanks to legislation like the Mental Health Parity and Addiction Equity Act (MHPAEA) and provisions within the Affordable Care Act (ACA).

As the demand for specialized treatment facilities continues to grow, the U.S. market for mental health and addiction treatment centers is poised for long-term expansion, with a focus on quality, accessibility, and patient-centered outcomes.

Major Trends in the U.S. Mental Health And Addiction Treatment Centers Market

-

Integration of Mental Health and Substance Abuse Services: Treatment centers are increasingly offering integrated programs that address co-occurring disorders in a unified care model.

-

Growth in Telehealth and Virtual Therapy: The rise of online therapy platforms and telepsychiatry has expanded access, especially in rural or underserved regions.

-

Expansion of Medication-Assisted Treatment (MAT): MAT programs using drugs like Suboxone and methadone are gaining acceptance as evidence-based approaches for addiction recovery.

-

Focus on Trauma-Informed and Culturally Competent Care: Treatment programs are evolving to incorporate sensitivity to trauma history, race, gender identity, and cultural background.

-

Private Equity and Corporate Consolidation: The industry is experiencing consolidation, with major behavioral health companies acquiring smaller centers to expand national footprints.

-

Adoption of AI and Digital Tools in Therapy: Cognitive behavioral therapy apps and AI tools are being integrated into patient programs for self-guided interventions.

-

Increased Government and Employer Support: Public funding for community mental health services and employer-sponsored mental wellness initiatives are growing.

-

Insurance and Parity Law Enforcement: Efforts are intensifying to enforce parity laws requiring mental health coverage equal to physical health benefits.

Report Scope of The U.S. Mental Health And Addiction Treatment Centers Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 170.29 Billion |

| Market Size by 2035 |

USD 307.85 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Disorder, Treatment Centers, Age Group |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Acadia Healthcare; Behavioral Health Network, Inc. (BHN); Promises Behavioral Health; Pyramid Healthcare Inc; Haven Corporate; Universal Health Services, Inc. (UHS); Aware Recovery Care.; CareTech Holdings Plc; American Addiction Centers |

Market Driver: Rising Prevalence of Mental Illness and Substance Use Disorders

A primary driver behind the growth of the U.S. mental health and addiction treatment centers market is the escalating prevalence of mental illness and substance use disorders. According to the National Alliance on Mental Illness (NAMI), approximately 1 in 5 adults in the U.S. experience mental illness each year, and nearly 1 in 15 live with both a mental health and substance use disorder. The COVID-19 pandemic exacerbated these issues by triggering increased rates of isolation, financial stress, grief, and trauma.

This widespread need has led to a dramatic surge in demand for treatment facilities capable of addressing complex psychological and chemical dependency issues. Depression, anxiety, and post-traumatic stress disorder (PTSD) are among the most reported concerns. Furthermore, the opioid epidemic, coupled with rising methamphetamine and alcohol misuse, has overwhelmed existing addiction treatment resources. The increased visibility of these challenges has also softened stigma, encouraging more individuals to seek help, thereby increasing service utilization rates across treatment centers nationwide.

Market Restraint: Workforce Shortages and Burnout

A major constraint for the U.S. mental health and addiction treatment market is the critical shortage of trained professionals and widespread burnout among existing staff. Mental health providers—including psychiatrists, addiction counselors, social workers, and psychiatric nurses—are facing unsustainable workloads, especially in high-demand and rural areas. According to the Health Resources and Services Administration (HRSA), over 160 million Americans live in federally designated Mental Health Professional Shortage Areas.

Workforce burnout, exacerbated by emotionally taxing caseloads and administrative pressures, is leading to high turnover rates and early retirements. Moreover, training programs are not graduating new professionals fast enough to meet the demand. This supply-demand imbalance severely limits the ability of treatment centers to scale, extend hours, or add new services. In some cases, facilities are forced to turn away patients or operate waitlists, undermining the timely delivery of care.

Market Opportunity: Expansion of Adolescent and Preventive Mental Health Services

One of the most significant opportunities in the U.S. market is the growing focus on adolescent mental health and preventive treatment. Children and teens are facing unprecedented levels of mental health challenges, including depression, anxiety, eating disorders, and suicidal ideation. Data from the CDC shows that suicide is the second leading cause of death among people aged 10-24 in the U.S. This alarming trend has triggered national and state-level initiatives to expand school-based mental health programs and pediatric behavioral health services.

Treatment centers are uniquely positioned to support early intervention strategies by opening specialized units for adolescents and teens. Services tailored for this demographic including trauma-informed therapy, social skills training, and family counseling—are seeing increasing demand. Furthermore, as awareness grows around the importance of mental health education, more schools, juvenile justice systems, and community organizations are partnering with treatment centers to offer screenings and early-stage interventions. This proactive approach is likely to yield long-term benefits by reducing hospitalization and improving lifelong outcomes.

U.S. Mental Health And Addiction Treatment Centers Market By Disorder Insights

Substance abuse disorders dominated the market due to the growing impact of the opioid epidemic, rising alcohol misuse, and increasing use of synthetic drugs. Facilities treating opioid use disorder (OUD) have seen an overwhelming surge in admissions, particularly in states like Ohio, West Virginia, and Kentucky. The focus on medication-assisted treatment (MAT) programs—where FDA-approved medications are paired with therapy—has proven effective in reducing relapse rates and fatalities. Government support through grants and legal settlements against pharmaceutical companies has further accelerated investments in addiction-specific treatment infrastructure.

However, anxiety disorders are emerging as the fastest-growing disorder type, particularly in the post-pandemic era. Generalized anxiety disorder (GAD), panic disorder, and social anxiety are being reported at alarming rates, especially among youth and working professionals. As daily stressors compound with economic uncertainties, digital overload, and social disconnection, more individuals are seeking cognitive behavioral therapy (CBT), mindfulness-based stress reduction (MBSR), and medication management. Treatment centers are now expanding their outpatient therapy offerings and virtual group sessions to address this escalating concern.

U.S. Mental Health And Addiction Treatment Centers Market By Treatment Centers Insights

Outpatient treatment centers dominate the market, offering flexible care solutions without requiring overnight stays. These centers cater to individuals with mild to moderate conditions, providing therapy, counseling, and medication management on a part-time basis. Outpatient services are popular due to their affordability, accessibility, and compatibility with work or school schedules. Furthermore, many centers now offer intensive outpatient programs (IOPs) and partial hospitalization programs (PHPs), which offer more structured care than standard outpatient visits while still allowing patients to live at home.

Conversely, residential treatment centers are expected to be the fastest-growing segment, as they provide long-term, immersive care for individuals dealing with severe, treatment-resistant conditions. These centers are designed for comprehensive therapy in controlled environments, often lasting 30 to 90 days or more. Residential programs are particularly effective for co-occurring disorders, trauma-related conditions, and adolescent behavioral health. With rising parental concern and insurance expansion, more patients are being referred to residential programs for structured recovery plans, including recreational therapy, equine therapy, and family integration.

U.S. Mental Health And Addiction Treatment Centers Market By Age Group Insights

The adult segment leads the market, accounting for the highest patient population across all types of mental health and addiction treatment centers. Adults face a wide range of psychological challenges—ranging from work-related stress and burnout to long-standing mood and substance use disorders. Adults are also more likely to self-refer, utilize employee assistance programs (EAPs), or be mandated to attend treatment through courts or HR policies. The adult group benefits from broader insurance coverage, accessibility to digital therapy tools, and workplace mental health initiatives, making them a primary target for most treatment providers

However, the adolescent and teens segment is growing at the fastest pace, driven by rising incidences of self-harm, cyberbullying, eating disorders, and early substance use. Schools and pediatricians are increasingly identifying warning signs and referring youth to specialized facilities. Treatment centers have responded by opening age-specific units with youth-oriented therapy, peer support groups, and education continuity programs. Social media’s influence on mental health, coupled with academic pressures and identity issues, makes this age group vulnerable creating a massive opportunity for early intervention and preventive care services.

Country-Level Analysis: United States

The U.S. government has taken multiple steps to reinforce the nation’s mental health infrastructure. In 2023, the Department of Health and Human Services (HHS) announced expanded grants under the Substance Abuse and Mental Health Services Administration (SAMHSA), targeting state-run mental health initiatives and addiction services. The introduction of the 988 Suicide & Crisis Lifeline is also revolutionizing crisis response services nationwide, reducing dependence on 911 for mental health emergencies.

States are implementing mental health reform bills to expand access to inpatient beds, regulate teletherapy practices, and increase Medicaid reimbursement rates for mental health providers. Private health insurers are also under pressure from state regulators and parity laws to cover mental health care at the same level as physical care. Additionally, collaborations between community health centers, nonprofits, and treatment networks are increasing the availability of culturally competent and trauma-informed care.

Technology adoption has become widespread. From digital CBT apps like Woebot to platforms like BetterHelp and Talkspace, Americans are increasingly turning to virtual solutions for therapy and counseling. This aligns with national goals to decentralize mental health care from hospitals to communities, reduce stigma, and reach populations that may otherwise not seek help.

Some of the prominent players in the U.S. mental health and addiction treatment centers market include:

Recent Developments

-

March 2024 – Acadia Healthcare Expands Residential Treatment Capacity: Acadia Healthcare announced the opening of two new residential treatment centers in Texas and Illinois to meet the rising demand for adolescent behavioral health services.

-

February 2024 – UHS and MercyOne Collaborate on Mental Health Campus: Universal Health Services (UHS) partnered with MercyOne to establish a new mental health hospital in Des Moines, Iowa, with plans to open in late 2025. The facility will provide inpatient psychiatric services for adults and adolescents.

-

January 2024 – Brightside Health Launches AI-Powered Therapy Tools: Brightside Health introduced AI-assisted CBT modules to its online platform, enabling hybrid care models with therapist oversight. The tool aims to reduce wait times and improve treatment adherence.

-

December 2023 – New Funding for 988 Crisis Lifeline: The federal government allocated an additional $500 million in funding to enhance the infrastructure and staffing of the 988 national mental health crisis hotline.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. mental health and addiction treatment centers market

Disorder Type

- Mood Disorder

- Substance Abuse Disorders

- Anxiety Disorder

- Psychotic Disorders

- Eating Disorders

- Personality Disorders

- Others

Treatment Centers Type

- Outpatient Treatment Centers

- Inpatient Treatment Centers

- Residential Treatment Centers

- Other Treatment Options

Age Group

- Adult

- Geriatric

- Adolescent & Teens

However, the adolescent and teens segment is growing at the fastest pace, driven by rising incidences of self-harm, cyberbullying, eating disorders, and early substance use. Schools and pediatricians are increasingly identifying warning signs and referring youth to specialized facilities. Treatment centers have responded by opening age-specific units with youth-oriented therapy, peer support groups, and education continuity programs. Social media’s influence on mental health, coupled with academic pressures and identity issues, makes this age group vulnerable creating a massive opportunity for early intervention and preventive care services.

However, the adolescent and teens segment is growing at the fastest pace, driven by rising incidences of self-harm, cyberbullying, eating disorders, and early substance use. Schools and pediatricians are increasingly identifying warning signs and referring youth to specialized facilities. Treatment centers have responded by opening age-specific units with youth-oriented therapy, peer support groups, and education continuity programs. Social media’s influence on mental health, coupled with academic pressures and identity issues, makes this age group vulnerable creating a massive opportunity for early intervention and preventive care services.