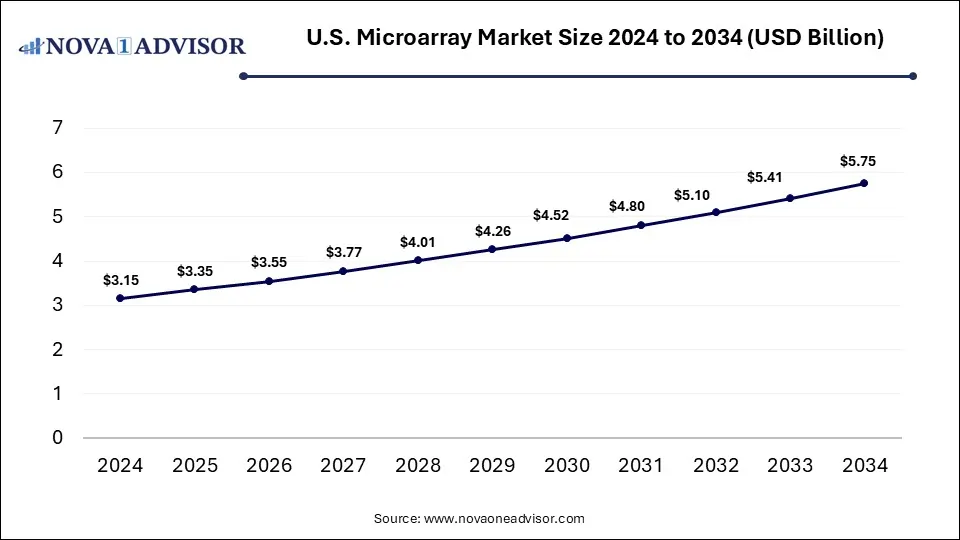

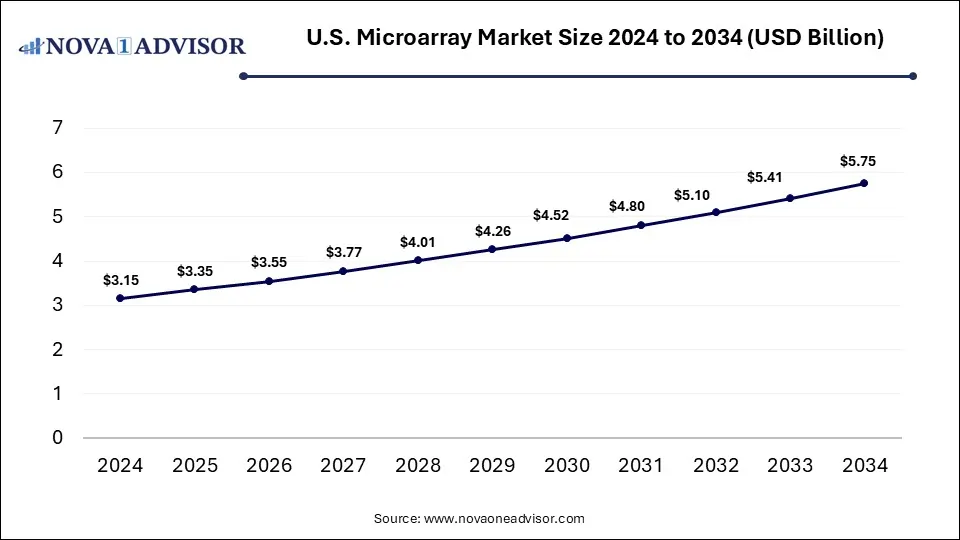

U.S. Microarray Market Size and Forecast 2025 to 2034

The U.S. microarray market size is calculated at USD 3.15 billion in 2024, grows to USD 3.35 billion in 2025, and is projected to reach around USD 5.75 billion by 2034, growing at a CAGR of 6.2% from 2025 to 2034. The growth of the U.S. microarray market can be linked to the rising demand for personalized medicine, increased emphasis on high-throughput analysis of biological molecules, and expanding applications in areas like drug discovery and cancer research.

U.S. Microarray Market Key Takeaways

- By product and services, the consumables segment dominated the market with the largest share in 2024.

- By product and services, the instruments segment is expected to show the fastest growth over the forecast period.

- By type, the DNA microarrays segment held the largest market share in 2024.

- By type, the protein microarrays segment is expected to register fastest growth during the forecast period.

- By application, the research applications segment captured the largest market share in 2024.

- By application, the disease diagnostics segment is expected to show the fastest growth during the forecast period.

- By end use, the research & academic institutes segment generated the highest market revenue in 2024.

- By end use, the diagnostic laboratories segment is expected to register the fastest CAGR over the forecast period.

What Fuels the Expansion of the U.S. Microarray Market?

A microarray can be referred to as a lab-on-a-chip technology used for simultaneous detection of the expression of thousands of genes or other biological molecules. They are widely used for gene expression analysis as well as in genotyping and mutation detection like identification of variations in DNA sequences like single nucleotide polymorphisms (SNPs). The expansion of the U.S. microarray market is driven by the increased use in research activities for obtaining comprehensive data quickly and efficiently, rising applications in in agriculture and environmental studies for pathogen detection and genetic analysis of crops, integration of AI and automation, as well as growing emphasis on biomarker discovery and validation. There is a rising shift towards consumer genetics and direct-to-consumer (DTC) genetic testing services in the U.S., which drives the demand for microarrays.

What Are the Key Trends in the U.S. Microarray Market in 2025?

- In July 2025, Vibrant Wellness, launched its upgraded gut microbiome test, the Gut Zoomer panel, featuring expanded microbial and metabolite coverage, a multi-method detection platform for deeper clinical insights, and a refined report format. The Gut Zoomer leverages sandwich ELISA, PCR, LC-MS/MS, and protein microarray technologies for evaluating the gut ecosystem from different angles.

- In June 2025, Emory University and Micron Biomedical launched the first-in-human clinical trial for a next-generation rotavirus vaccine, CC24, which is delivered through dissolvable microarray technology and has commenced participant enrolment for the same. The study sponsored by the U.S. Centers for Disease Control and Prevention (CDC) marks the first clinical evaluation of any vaccine or drug delivered via patch or microarray.

How is AI Impacting the U.S. Microarray Market?

Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly being used in microarray technologies in the U.S. to enhance data interpretation, prediction and for developing personalized medicine approaches.

AI algorithms can be applied for automated analysis of vast amounts of microarray data, in biomarker discovery as well as to reveal complex gene regulatory networks, enabling better understanding of biological processes. Based on microarray data, AI algorithms can be trained for classifying diseases, predicting patient outcomes and to evaluate drug responses.

U.S.-based companies such as Agilent Technologies, Illumina, and Thermo Fisher Scientific are actively developing and deploying AI-powered microarray solutions.

Report Scope of U.S. Microarray Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.35 Billion |

| Market Size by 2034 |

USD 5.75 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product and Services, By Type, By Application, By End Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Agilent Technologies, Inc., Arrayit Corporation (ARYC), Bio-Rad Laboratories, Inc., Illumina, Inc., Merck KGaA, Microarrays Inc., Molecular Devices, LLC (Danaher Corporation), PerkinElmer Inc., RayBiotech, Inc., Schott (Applied Microarrays), Thermo Fisher Scientific Inc. |

Market Dynamics

Drivers

Multitude of Applications

A major driver is the widespread applications across various fields, particularly in healthcare and research, as well as the ability of microarray technologies to analyze thousands of biological samples simultaneously, enabling crucial insights. Diverse applications of microarray technology such as studying gene expression profiling, in disease diagnosis and classification, for drug discovery and development as well as in toxicological research for identifying toxicity biomarkers and assessing the safety of chemicals and pharmaceuticals, further driving their adoption. Additionally, the broadening applications in various other fields like alternative splicing detection, comparative genomics, copy number variation (CNV) detection, functional genomics, forensic science, mutation detection and pharmacogenomics are boosting the market potential.

Restraints

High Costs of Microarray Platforms and Emerging Technologies

The adoption and implementation of microarray technologies is expensive and requires significant investments in specialized equipment, reagents, consumables which can possibly limit their access, especially for smaller labs and institutions with restricted budgets. Moreover, vast amounts of complex data generated by microarrays calls for advanced bioinformatics tools and specialized expertise for operating the technology and interpreting results, further increasing the costs. Additionally, the competition from emerging alternatives such as next-generation sequencing (NGS) technologies, offering greater detail, accuracy, and scalability for complex genomic studies is potentially restraining the market growth.

Opportunities

Integration of Advanced Technologies

Microarray systems are being integrated with advanced technologies to develop a synergistic approach for enhancing their capabilities in genomic and proteomic analysis. AI and bioinformatics tools are being employed to enhance data analysis and interpretation. Automation of microarray workflows is increasing throughput, improving reproducibility and reducing manual errors, further driving the adoption of microarray platforms by high volume diagnostic laboratories and for large-scale research project. Although, next-generation sequencing (NGS) is a potential competitor of microarrays, combining these technologies together are enabling deeper and more comprehensive analysis, leading to maximum output from both platforms.

Segmental Insights

What Made Consumables the Dominant Segment in the Market in 2024?

By product and services, the consumables segment accounted for the largest market share in 2024. Consumables such as microarray chips, probes, reagents and labeling kits are in continuous demand for various microarray experiments. Increased R&D activities, adoption of microarray technology in diagnostic settings for oncology and infectious disease diagnostics, and rising investments by governments and private companies in areas like genomics and personalized medicine are contributing to the market growth. Manufacturers are focused on developing new consumables specifically designed for targeting certain genomic regions or diseases as well as on improving the sensitivity and specificity of reagents and probes for DNA, RNA, and protein analysis.

By product and services, the instruments segment is expected to register the fastest growth during the forecast period. The instruments segment market growth is driven by increased adoption of molecular diagnostics, rising investments in biotech startups innovating microarray technologies, strict industry regulations and supportive government incentives. Microarrays are important tools used for gene expression profiling, mutation analysis and biomarker discovery, which is essential for personalized medicine approaches focused on specific applications such as in oncology, infectious disease diagnosis and cytogenetics.

Development of high-density arrays, integration of AI, advancements in probe designs and data analysis software, automation as well as integration of smart sensors and IoT-based real time analytics are expanding the market potential.

How DNA Microarrays Segment Dominated the Market in 2024?

By type, the DNA microarrays segment dominated the market with the highest revenue share in 2024. The continuous progress in genomics research, launch of high-resolution microarray platforms, development of rapid genotyping and gene expression analysis tools, as well as rising collaborations for integrating microarrays in precision medicine are contributing to the segment’s market dominance. DNA microarrays are being used for comprehensive genomic profiling (CGP) and diagnostics in conditions like genetic disorders and chronic diseases, especially cancer for accurate identification and early diagnosis, leading to detection of disease-linked genetic markers and development of targeted therapies.

By type, the protein microarrays segment is expected to show the fastest growth over the forecast period. The ability of protein microarrays to analyze protein expression levels, identification of protein-protein interactions and for screening potential drug targets is driving their applications in biomarker discovery, proteomics research and drug screening. The increasing emphasis on personalized medicine approaches for tailoring treatments based on an individual’s protein profile is fuelling the adoption protein microarrays. Moreover, the rising demand for high-throughput proteomic analysis, launch of innovative protein microarray platforms and technologies, government support, and increased M&A activities among companies are driving the market growth.

Advancements in protein microarrays such as improved multiplexing capabilities with bead-based technologies, integration of AI and machine learning for enhancing data analysis, as well as the use of detection methods like chemiluminescence and fluorescence for protein quantification and interaction analysis with increased accuracy and reliability are expanding the market potential.

Why Did the Research Applications Segment Dominate the Market in 2024?

By application, the research applications segment held the biggest market share in 2024. Microarrays offer a high-throughput platform for analyzing large datasets, particularly in fields like cancer research, immunobiology and neurobiology requiring large-scale studies, further expediting research discoveries. The rising investments by private organizations and government in genomics and proteomics research, development of advanced data analysis tools and bioinformatics resources, innovative product launches and a robust ecosystem of dedicated academic and research institutions are driving the market growth. Several companies are offering user-friendly hardware and software solutions which includes integrated hardware-software packages like Illumina's DRAGEN Array and GenomeStudio.

By application, the disease diagnostics segment is anticipated to register the fastest CAGR during the predicted timeframe. The rising prevalence of chronic illnesses, infectious diseases and hereditary conditions is driving the adoption of microarrays in disease diagnostics. In infectious disease diagnostics, microarrays facilitate the simultaneous detection and identification of multiple pathogens and their associated traits, such as antibiotic resistance as well as diagnosis of polymicrobial infections. Furthermore, the increase in number of clinical laboratories and diagnostic centres, expanding capabilities of microarray technologies, and growing emphasis on precision oncology and personalized medicine are boosting the market expansion.

What Made Research & Academic Institutes the Dominant Market Segment in 2024?

By end use, the research & academic institutes segment dominated the market with the largest share in 2024. The rise in funding by the government, private firms and venture capitalists in genomics and proteomics research, molecular biology as well as personalized medicine approaches are driving the demand for microarray technology, particularly in research and academic institutes who are the major end-users. These institutes use microarray technologies for various applications, including biomarker discovery in cancer research, gene expression profiling, genotyping, which contributes to the advancements in understanding disease mechanisms and development of new and targeted therapies. Additionally, high-throughput capabilities and cost-effectiveness of microarray platforms is facilitating the conduction of large-scale research projects in academic settings.

By end use, the diagnostic laboratories segment is expected to show the fastest CAGR during the forecast period. The market growth can be linked to the increased adoption of microarray platforms for precision diagnostics and personalized medicine, continuous advancements in microarray technology as well as government initiatives and funding for strengthening healthcare infrastructure and diagnostic technologies. The rising awareness of preventive healthcare is driving more individuals to take regular diagnostic tests for early detection of potential health issues.

Country-Level Analysis

The U.S. microarray market is experiencing significant growth, driven by factors such as rising incidences of cancer and chronic diseases, robust healthcare infrastructure, availability and access to advanced diagnostic technologies, and increased collaborations among private sector companies and academic institutions to expedite research findings into practical applications. Government funding for R&D activities through agencies like the National Institutes of Health (NIH) is expanding the market potential.

Major players in the U.S. market are focused on diversifying their product portfolios through the integration hardware-software solutions and innovations such as customizable arrays designs and high-throughput scanners. Strategic acquisitions and partnerships by companies to expand their capabilities and services offerings of microarray technologies is fuelling the market growth.

Some of the Prominent Players in the U.S. Microarray Market

- Agilent Technologies, Inc.

- Arrayit Corporation (ARYC)

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Merck KGaA

- Microarrays Inc.

- Molecular Devices, LLC (Danaher Corporation)

- PerkinElmer Inc.

- RayBiotech, Inc.

- Schott (Applied Microarrays)

- Thermo Fisher Scientific Inc.

Recent Developments in the U.S. Microarray Market

- In April 2025, AliveDx submitted the 510(k) premarket notification for its MosaiQ AiPlex® Connective Tissue Diseases (CTDplus) microarray to the U.S. Food and Drug Administration (FDA). The MosaiQ AiPlex CTDplus multiplex assay is developed for improving the accuracy and speed of systematic connective tissue disease diagnosis while streamlining laboratory workflows.

- In February 2025, PathogenDx, a leading provider of next-generation microarray technology, launched its rebranded D3 Array Combined, D3 Array Bacterial and D3 Array Fungal assays which will deliver value in turn-around time, cost and throughput to testing labs. The newly launched assay will replace the DetectX-Combined, DetectX-Bacterial and DetectX-Fungal assays.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Microarray Market.

By Product and Services

- Consumables

- Instruments

- Software & Services

By Type

- DNA Microarrays

- Protein Microarrays

- Others

By Application

- Disease Diagnostics

- Drug Discovery

- Research Applications

- Others

By End Use

- Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Research & Academic Institutes

- Others