U.S. Microprocessor Market Size and Trends

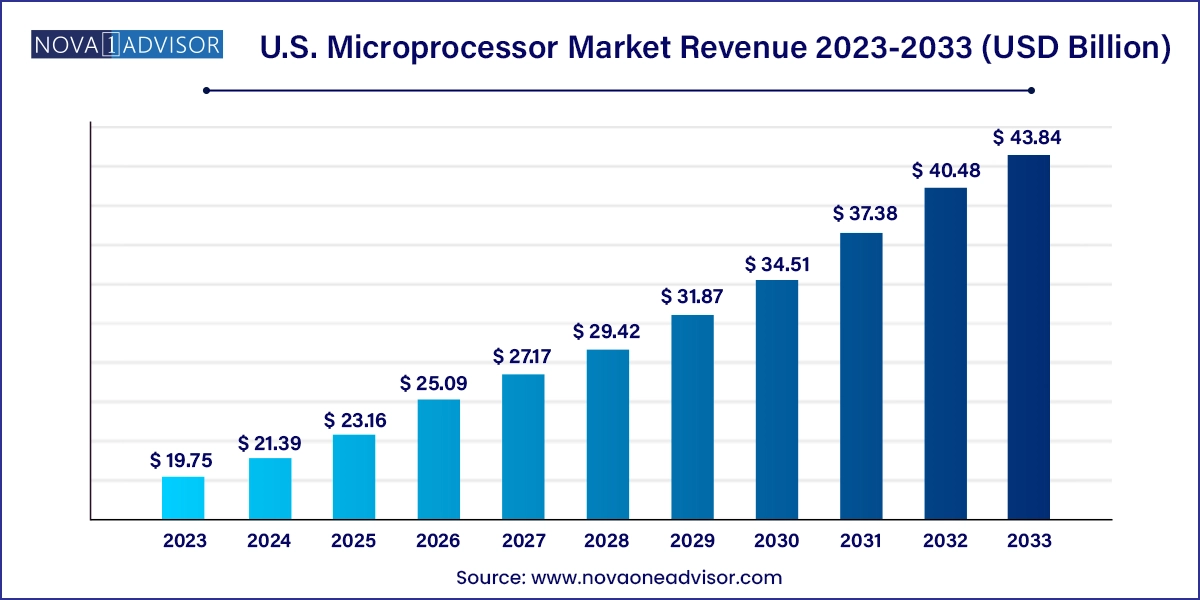

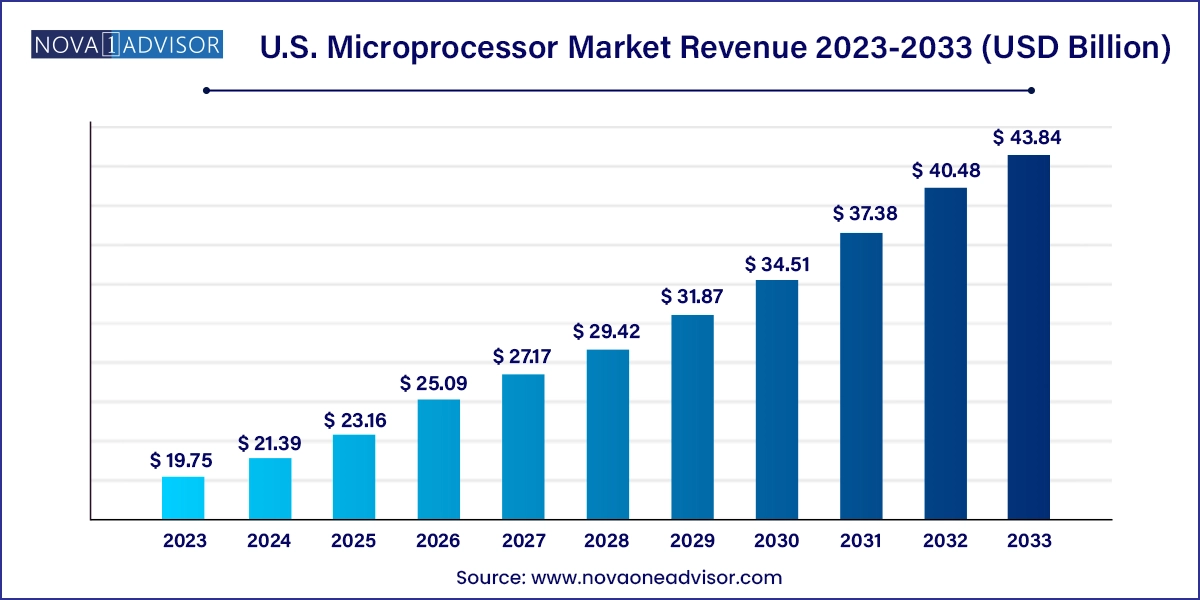

The U.S. microprocessor market size was exhibited at USD 19.75 billion in 2023 and is projected to hit around USD 43.84 billion by 2033, growing at a CAGR of 8.3% during the forecast period 2024 to 2033.

U.S. Microprocessor Market Key Takeaways:

- The ARM MPU segment is anticipated to witness the fastest CAGR of 8.8% over the projected period of 2024 to 2033.

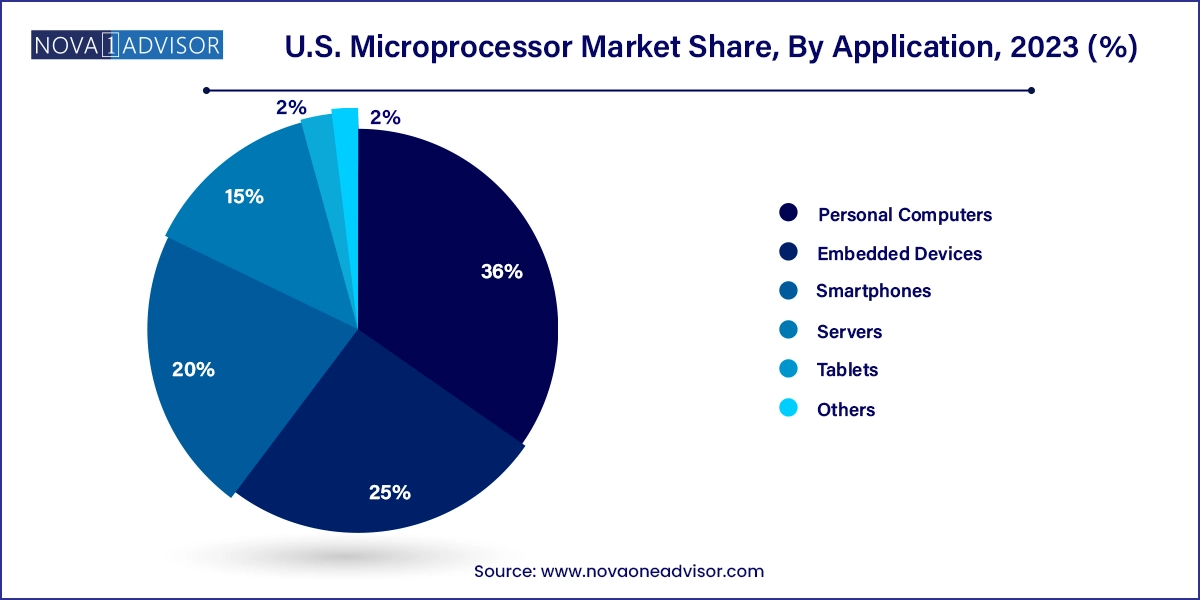

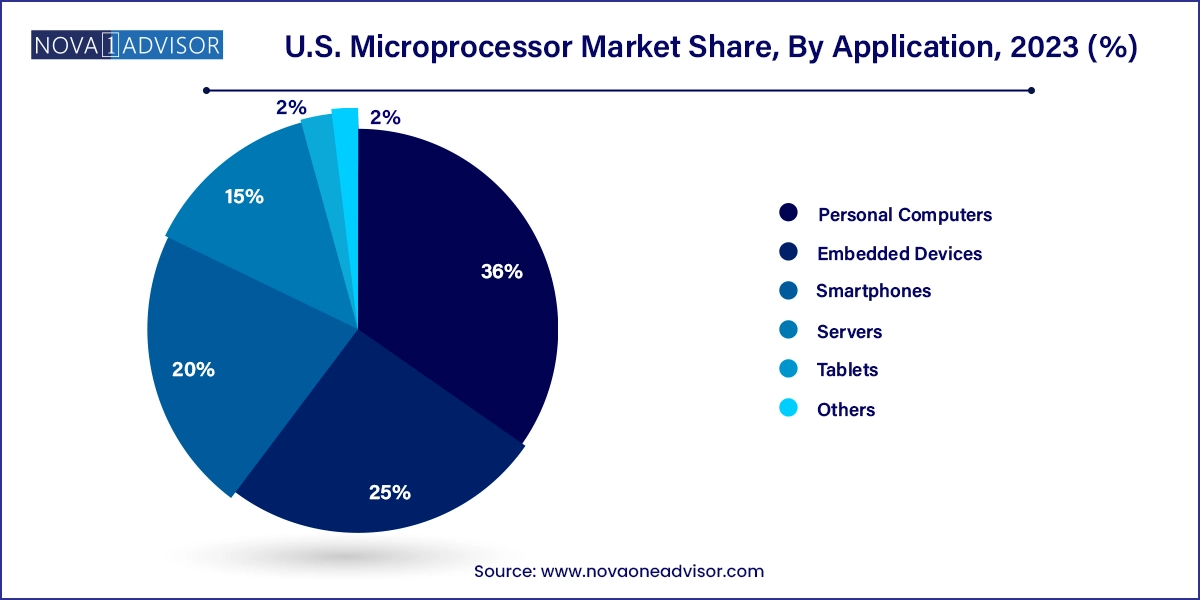

- The personal computer (PC) segment held the largest market share of more than 36% in 2023.

- The smartphone segment is anticipated to witness the fastest CAGR of 9.0% over the projected period.

Market Overview

The U.S. microprocessor market holds a foundational position within the broader semiconductor ecosystem, acting as the technological backbone for computing devices, embedded systems, and increasingly, artificial intelligence (AI)-driven applications. Microprocessors, which serve as the central processing unit (CPU) of a computer or an embedded device, have undergone revolutionary changes in architecture, performance capabilities, and end-use applications over the past decade. Their relevance is now extending far beyond personal computers, permeating sectors like automotive, defense, healthcare, consumer electronics, and energy systems.

The market in the U.S. is buoyed by strong domestic R&D investment, the presence of leading players such as Intel, AMD, Apple, and NVIDIA, and ongoing government initiatives to boost semiconductor manufacturing through legislation like the CHIPS and Science Act. As the world increasingly transitions into a data-driven and connected digital environment, microprocessors are enabling everything from high-performance computing (HPC) and 5G base stations to industrial automation and cloud infrastructure.

Moreover, the rise of edge computing, the growing popularity of AI and ML workloads, and the demand for more power-efficient architectures are driving continuous innovation in microprocessor design. Companies are shifting from monolithic architectures to chiplet-based systems, exploring new instruction set architectures (ISAs), and pushing for hybrid integration of CPUs and GPUs. With the U.S. serving as a global innovation hub, the domestic microprocessor market is well-positioned for robust long-term growth.

Major Trends in the Market

-

Shift Toward Chiplet-Based and Heterogeneous Architectures: Modular microprocessors using chiplets (small functional dies) are being designed for greater scalability and efficiency.

-

Adoption of 64-bit ARM in Edge and Cloud Devices: 64-bit ARM processors are seeing increased traction in data centers and embedded systems due to their low power consumption and scalability.

-

Resurgence of Custom Microprocessor Development: Companies like Apple and Google are designing in-house chips (e.g., Apple’s M-series) to optimize performance across specific ecosystems.

-

Integration of AI and ML Capabilities: Microprocessors with built-in AI accelerators are gaining adoption in autonomous systems, smartphones, and industrial IoT.

-

Increased Focus on RISC-V Architectures: Open-source architecture like RISC-V is being explored as a cost-effective and customizable alternative to x86 and ARM.

-

U.S. Government Investments in Semiconductor Sovereignty: CHIPS Act funding is boosting domestic production capabilities, especially for advanced logic nodes.

-

SoC Proliferation in Automotive and Industrial Applications: Microprocessors are now embedded within systems-on-chip (SoC) solutions for specialized, high-reliability use cases.

-

Demand for Low-Power Embedded Devices: Power efficiency is becoming a primary design goal, especially for wearable tech, portable medical devices, and smart sensors.

Report Scope of U.S. Microprocessor Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.39 Billion |

| Market Size by 2033 |

USD 43.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Architecture Type. Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Advanced Micro Devices, Inc.; Intel Corporation; Marvell Semiconductor Components Industries, LLC; Toshiba Electronic Devices & Storage Corporation; Texas Instruments Incorporated; Microchip Technology Inc.; Nvidia Corporation; MediaTek Inc.; Broadcom Inc.; Qualcomm Technologies, Inc. |

Market Driver: Proliferation of AI, Cloud, and Edge Computing

A significant growth driver in the U.S. microprocessor market is the rising demand for high-performance processing capabilities fueled by AI workloads, cloud services, and edge computing applications. As enterprises shift their computing operations from centralized data centers to the edge for latency-sensitive tasks, there’s an increasing need for processors that can handle complex computations in real-time.

AI inference, in particular, has placed a spotlight on microprocessors that integrate neural processing units (NPUs) and GPU-like capabilities. Whether in autonomous vehicles, smart surveillance, or industrial robotics, the ability to execute AI models on-device—without offloading to the cloud—is reshaping microprocessor specifications.

In addition, hyperscale cloud providers like Amazon AWS, Google Cloud, and Microsoft Azure are either designing their own chips (e.g., AWS Graviton) or partnering with semiconductor companies to deploy advanced processors optimized for specific cloud tasks such as ML training, real-time analytics, and serverless computing. This multifaceted demand from cloud to edge is reshaping the microprocessor landscape in the U.S., spurring investments in both general-purpose and domain-specific processors.

Market Restraint: Complexity in Fabrication and Supply Chain Dependencies

Despite technological advancements, the microprocessor market faces significant restraints, primarily stemming from the complexity of semiconductor fabrication and global supply chain vulnerabilities. Designing high-end microprocessors—especially those at or below 5nm node technology—requires billions in R&D and highly sophisticated manufacturing infrastructure. Only a few foundries globally (e.g., TSMC, Intel, and Samsung) are capable of producing these chips at volume.

The 2020–2023 global chip shortage highlighted the fragility of supply chains and the U.S.'s dependency on overseas fabrication. Although the CHIPS Act seeks to bring semiconductor manufacturing back to U.S. soil, the build-out of advanced foundries takes years and faces challenges related to skilled labor, environmental permits, and equipment delays.

Furthermore, the increasing complexity in chip design, driven by the convergence of CPU, GPU, and AI workloads, adds to design validation time, increases power and heat management issues, and makes backward compatibility more difficult to maintain across multiple platforms.

Market Opportunity: Rising Demand for Specialized Processors in Automotive and Medical Devices

The growing integration of electronics in automotive and medical applications presents a lucrative opportunity for the U.S. microprocessor market. As vehicles become smarter and more autonomous, microprocessors are central to the functioning of ADAS (advanced driver-assistance systems), infotainment units, battery management systems, and vehicle-to-everything (V2X) communication protocols. Companies like Tesla, GM, and Ford are partnering with chipmakers or developing in-house silicon to support their electric and self-driving platforms.

In the medical domain, microprocessors are powering a new wave of digital health devices—ranging from portable diagnostic tools and wearables to robotic surgery platforms and connected inhalers. These applications require high reliability, low power consumption, and regulatory compliance, leading to demand for purpose-built microprocessors.

The U.S.'s leadership in medical technology and growing investments in healthcare digitization further magnify this opportunity. Processors tailored for healthcare edge devices, patient monitoring systems, and AI-driven diagnostics are expected to be a key focus area for semiconductor companies in the coming years.

U.S. Microprocessor Market By Architecture Type Insights

x86 architecture dominated the U.S. microprocessor market, particularly in personal computing, enterprise servers, and legacy embedded systems. Developed initially by Intel and now widely used by AMD as well, x86 processors offer strong backward compatibility, high performance, and robust ecosystem support, making them the default architecture for desktops and laptops in the U.S. Even with emerging competition from ARM, x86 maintains a stronghold due to established developer tools, driver availability, and operating system support—especially Windows-based environments.

ARM MPU (Microprocessor Unit) is the fastest-growing architecture segment, driven by its adaptability across mobile, embedded, and increasingly, server-side applications. ARM’s power-efficient design is ideal for smartphones, tablets, and smart home devices, but its influence is expanding into data centers (e.g., Apple M-series chips, Amazon Graviton) and automotive electronics. Within ARM, the 64-bit segment is gaining faster traction than 32-bit, as modern applications require greater addressable memory and processing power. ARM-based chips are also central to IoT devices and AI-enabled edge computing, further expanding their role in the U.S. market.

U.S. Microprocessor Market By Application Insights

Personal computers remained the dominant application for microprocessors, primarily driven by sustained demand in consumer, education, and enterprise computing. Intel and AMD dominate this space with their Core and Ryzen series respectively, offering multi-core performance suited for general tasks, gaming, content creation, and productivity. Despite the growth of mobile computing, desktops and laptops remain relevant due to their processing power, larger screens, and compatibility with a wide range of software platforms used in offices and institutions.

Smartphones are the fastest-growing application, especially with the U.S. being a major hub for premium smartphone development and consumption. Apple’s in-house M and A series chips—based on ARM architecture—set industry benchmarks in performance and efficiency. In addition, 5G rollouts and the rise of AI-driven apps have raised the bar for processing capabilities in smartphones. Companies like Qualcomm are constantly innovating in mobile SoCs, which integrate high-performance CPUs, GPUs, and AI accelerators into a single die.

Country-Level Analysis

The United States is both a consumer and innovator in the microprocessor market. It is home to global semiconductor giants like Intel, AMD, NVIDIA, and Apple, all of whom are at the forefront of cutting-edge chip design and fabrication. The U.S. federal government has made semiconductor independence a national priority, with legislation like the CHIPS and Science Act allocating over $52 billion to encourage domestic chip production and reduce dependence on overseas foundries.

States like California, Texas, Oregon, and Arizona have become key microprocessor manufacturing and design hubs. Intel’s expansion in Arizona, GlobalFoundries' operations in New York, and TSMC’s new fab construction in Phoenix demonstrate the country's growing fabrication footprint. Moreover, the Silicon Valley ecosystem provides a fertile environment for startups exploring new ISAs, such as RISC-V, and disruptive packaging technologies like 3D stacking and chiplet integration.

The U.S. also benefits from an advanced academic and research environment, with institutions like MIT, Stanford, and UC Berkeley contributing to processor innovation. Furthermore, strong partnerships between chip companies and hyperscale cloud providers fuel custom processor development optimized for AI, analytics, and data center workloads.

U.S. Microprocessor Market Recent Developments

-

April 2024 – AMD launched its next-generation Ryzen 9000 series desktop processors, based on 3nm chiplet architecture, offering improved IPC (instructions per cycle) and power efficiency.

-

March 2024 – Intel revealed its “Lunar Lake” microarchitecture at its Developer Conference in San Jose, optimized for next-gen AI PCs with integrated NPU accelerators.

-

February 2024 – Apple began production of its M4 chip for iPads and MacBooks, featuring enhanced GPU and ML performance built on TSMC’s 3nm process.

-

January 2024 – Qualcomm announced the Snapdragon X Elite, a Windows-focused ARM processor aimed at challenging the x86 dominance in laptops with improved battery life and integrated AI features.

-

December 2024 – NVIDIA partnered with a major U.S. cloud provider to deploy its Grace CPU Superchip in high-performance computing clusters aimed at AI model training and inferencing.

Some of the prominent players in the U.S. microprocessor market include:

- Advanced Micro Devices, Inc

- Intel Corporation

- Marvell Semiconductor Components Industries, LLC

- Toshiba Electronic Devices & Storage Corporation

- Texas Instruments Incorporated

- Microchip Technology Inc.

- Nvidia Corporation

- MediaTek Inc.

- Broadcom Inc.

- Qualcomm Technologies, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. microprocessor market

Architecture Type

-

-

- Consumer Electronics

- Networking & Communication

- Automotive

- Industrial

- Medical Systems

- Aerospace & Defense

- Energy

Application

- Smartphones

- Personal Computers

- Servers

- Tablets

- Embedded Devices

- Others