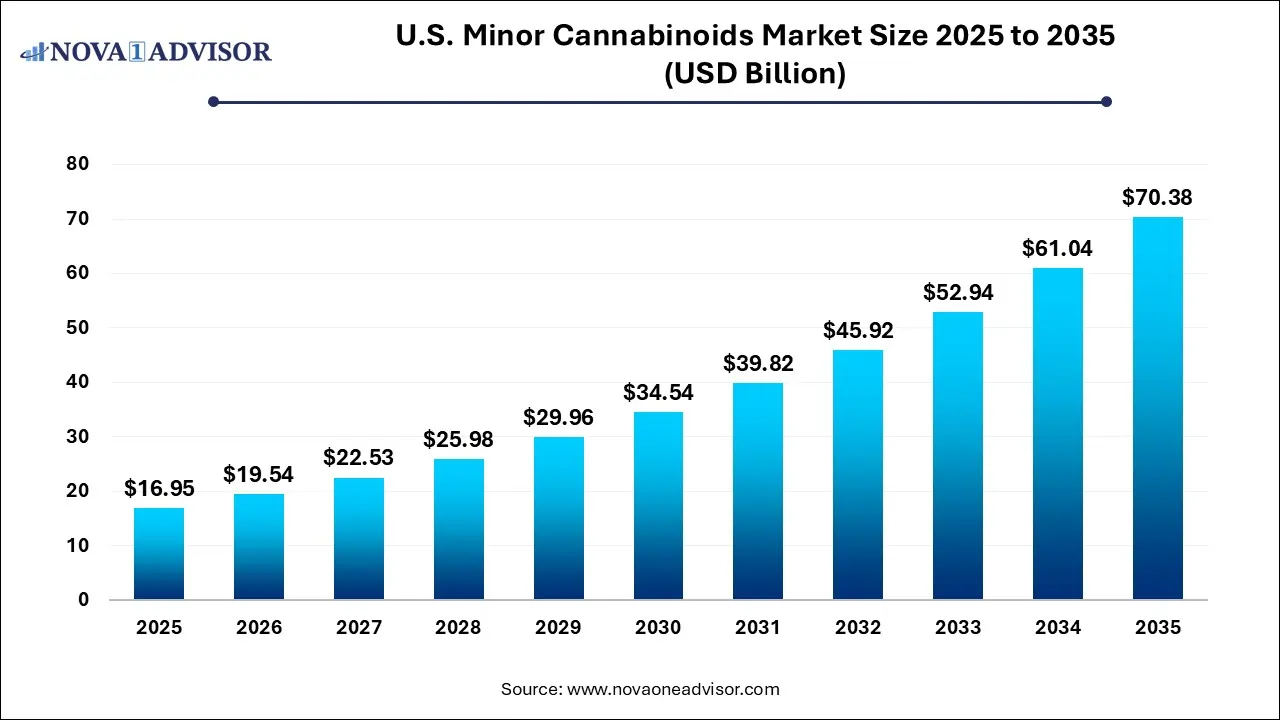

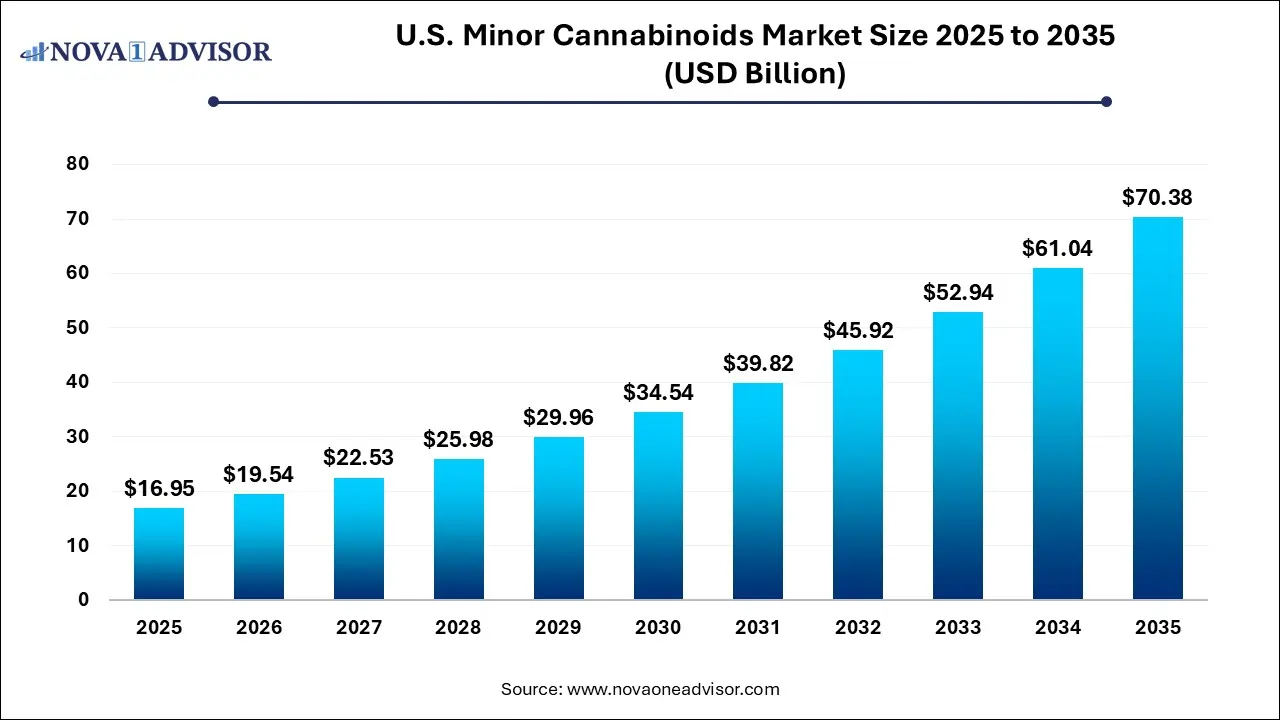

U.S. Minor Cannabinoids Market Size and Growth

The U.S. minor cannabinoids market size was exhibited at USD 16.95 billion in 2025 and is projected to hit around USD 70.38 billion by 2035, growing at a CAGR of 15.3% during the forecast period 2026 to 2035.

U.S. Minor Cannabinoids Market Key Takeaways:

- The tetrahydrocannabivarin (THCV) segment dominated the market with a revenue share of 25.% in 2025.

- The cannabigerolic acid (CBGA) segment is expected to witness the fastest CAGR from 2026 to 2035.

- The neurological disorders segment held a significant revenue share in 2025.

- The others application segment held the largest revenue share in 2025.

- The pain management segment is anticipated to grow at significant CAGR from 2026 to 2035.

Market Overview

The U.S. minor cannabinoids market is undergoing a pivotal transformation, rapidly evolving from niche scientific research to commercial application across pharmaceutical, nutraceutical, wellness, and cosmetics sectors. While cannabidiol (CBD) and tetrahydrocannabinol (THC) have historically dominated the cannabinoid discussion, the growing interest in lesser-known cannabinoids—such as cannabigerol (CBG), cannabinol (CBN), tetrahydrocannabivarin (THCV), and others—is reshaping the cannabinoid economy. These “minor” cannabinoids, though present in lower concentrations in cannabis plants, exhibit promising therapeutic potential, including anti-inflammatory, neuroprotective, analgesic, and anti-anxiety properties.

Scientific research, combined with consumer demand for targeted cannabinoid therapies, is pushing the boundaries of cannabis-based health solutions. This shift is aided by the increasing accessibility of advanced extraction and biosynthesis technologies, enabling cost-effective isolation and production of rare cannabinoids. Additionally, federal regulatory ambiguity around hemp-derived cannabinoids—particularly those containing less than 0.3% delta-9 THC—has encouraged innovation and commercialization within this segment.

In the U.S., a growing number of startups and established cannabis brands are investing in minor cannabinoid formulations aimed at mood regulation, sleep enhancement, appetite suppression, and inflammation management. These products are appearing in diverse forms, from tinctures and soft gels to skincare and functional beverages. While still in its early stages, the minor cannabinoids market in the U.S. holds significant potential as consumer awareness and clinical validation continue to rise.

Major Trends in the Market

-

Biotechnological Advancement in Cannabinoid Synthesis: Companies are using fermentation and cellular agriculture to biosynthesize rare cannabinoids, reducing dependence on plant cultivation.

-

Rise of CBG and CBN-Infused Wellness Products: CBG is gaining popularity for its neuroprotective and anti-inflammatory effects, while CBN is marketed for sleep and relaxation.

-

Growth of Functional Products Combining Cannabinoids with Nutraceuticals: Formulations integrating cannabinoids with adaptogens, nootropics, and vitamins are entering the wellness space.

-

Focus on Non-Psychoactive Cannabinoids for Pediatric and Geriatric Use: Non-intoxicating compounds like CBDV and CBDA are gaining attention for seizure control and inflammation management in sensitive populations.

-

Expanding Retail Channels Including Pharmacies and Natural Product Stores: Beyond dispensaries, minor cannabinoid products are increasingly appearing in mainstream retail and e-commerce platforms.

Report Scope of U.S. Minor Cannabinoids Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 19.54 Billion |

| Market Size by 2035 |

USD 70.38 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 15.3% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product Type, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Mile High Labs; GCM Holdings, LLC; GenCanna.; CBD. INC.; Rhizo Sciences; Laurelcrest; Fresh Bros Hemp Company; BulKanna; High Purity Natural Products.; ZERO POINT EXTRACTION, LLC |

Key Market Driver: Expanding Therapeutic Applications of Minor Cannabinoids

The expanding spectrum of therapeutic uses for minor cannabinoids is the primary driver of the U.S. market. While THC and CBD have paved the way for cannabinoid-based therapy, lesser-known compounds such as THCV, CBG, and CBN are showing differentiated mechanisms of action in preclinical and clinical studies. For instance, CBG exhibits antibacterial and anti-inflammatory properties, and is under investigation for inflammatory bowel disease and glaucoma. CBN has sedative potential, making it a candidate for sleep aids, while THCV has demonstrated appetite-suppressing effects with potential applications in weight management and type 2 diabetes.

This diversification of cannabinoid-based therapies opens doors to broader pharmaceutical interest, especially for conditions with limited treatment options. Pharmaceutical companies, biotech firms, and academic institutions are actively studying minor cannabinoids for epilepsy, neuropathic pain, neurodegenerative disorders, and cancer-related symptoms. As data accumulates and regulatory pathways mature, minor cannabinoids are poised to play a central role in the next generation of personalized cannabinoid medicine.

Key Market Restraint: Lack of Comprehensive Regulatory Clarity

A significant restraint facing the U.S. minor cannabinoids market is the lack of uniform federal regulation. Although the 2018 Farm Bill legalized hemp-derived cannabinoids (with less than 0.3% delta-9 THC), it did not establish a comprehensive framework for the production, marketing, and sale of individual compounds like THCV, CBG, or CBDA. This gray area leads to inconsistencies in enforcement and compliance across states.

For instance, the Food and Drug Administration (FDA) has not approved most minor cannabinoids for use in dietary supplements, resulting in limited consumer trust and hesitancy among major retailers. This regulatory uncertainty also hinders clinical research, investment, and insurance reimbursement for cannabinoid-based therapies. Without clearer guidance on dosage, safety, labeling, and permissible claims, market participants face legal and financial risk, slowing the pace of mainstream adoption.

Key Market Opportunity: Demand for Non-Psychoactive, Targeted Wellness Solutions

An exciting opportunity lies in the demand for non-psychoactive, purpose-driven cannabinoids that address specific wellness concerns such as sleep, anxiety, and inflammation. As consumers increasingly turn toward plant-based therapies and personalized wellness, minor cannabinoids offer targeted mechanisms without the high associated with THC. For example, CBN is positioned as a natural sleep enhancer, while THCV’s appetite-suppressing effect appeals to fitness and metabolic health markets.

This trend aligns with the broader movement toward “mood-focused” supplements, functional beverages, and lifestyle-centric formulations. Startups and legacy brands alike are developing cannabinoid-enhanced products designed for sleep, focus, recovery, or mood elevation. These differentiated use-cases present a significant opportunity for market growth, particularly as clinical validation and consumer education progress. With the integration of clean-label and organic positioning, these products are also gaining favor in wellness-focused consumer segments.

U.S. Minor Cannabinoids Market By Product Type Insights

Cannabigerol (CBG) dominated the U.S. minor cannabinoids market owing to its anti-inflammatory, antibacterial, and neuroprotective properties. CBG is often referred to as the "mother cannabinoid" due to its role as a precursor to other cannabinoids like THC and CBD. Unlike THC, it is non-intoxicating, which makes it more acceptable for use in mainstream wellness and healthcare products. CBG is increasingly used in tinctures, topicals, and skincare products targeting inflammation, acne, and oxidative stress. Due to its growing availability through biosynthesis and selective hemp cultivation, many wellness brands have launched CBG-infused products positioned as natural solutions for stress and focus.

Tetrahydrocannabivarin (THCV) is the fastest-growing product segment due to its unique appetite-suppressant and energy-enhancing effects. While structurally similar to THC, THCV acts as an appetite suppressant rather than stimulant, making it attractive for consumers pursuing weight management and metabolic health. THCV products are gaining popularity in fitness and diet-centric consumer groups, with formulations designed for energy boosting, blood sugar regulation, and cognitive clarity. Although its extraction is more challenging and costly due to low natural abundance, advancements in synthetic biology and fermentation are making THCV more commercially viable. The market is beginning to see pre-workout supplements and capsules infused with THCV, highlighting its future growth potential.

Cannabinol (CBN) is also showing significant traction, especially in the sleep and relaxation category. CBN is being marketed as a natural alternative to melatonin, often included in gummies, tinctures, and capsules aimed at improving sleep quality. Brands are leveraging CBN’s sedative reputation to develop nighttime formulations combining CBN with other sleep-supporting botanicals such as valerian root and L-theanine. This has made CBN a rising star among consumers struggling with sleep disorders or stress-related insomnia.

U.S. Minor Cannabinoids Market By Application Insights

Pain Management dominated the minor cannabinoids application segment in the U.S. market. Cannabinoids such as CBG, CBGA, and CBDV have shown promising analgesic and anti-inflammatory properties in preclinical trials. These cannabinoids interact with endocannabinoid receptors to modulate pain signaling and reduce inflammatory responses. Given the opioid crisis in the United States, patients and healthcare providers are increasingly exploring non-addictive pain relief options. Minor cannabinoids, being both non-intoxicating and anti-inflammatory, are being considered for chronic pain conditions such as arthritis, fibromyalgia, and post-surgical recovery. Topicals, patches, and oral formulations containing these cannabinoids are becoming more prevalent in both medical and wellness settings.

Neurological Disorders are the fastest-growing application segment, primarily driven by increasing research into cannabinoids for epilepsy, neurodegeneration, and anxiety. For example, CBDA and CBDV have demonstrated anti-convulsant properties and are under investigation for rare epilepsy syndromes. Meanwhile, CBG is being explored for its potential in treating Huntington’s and Parkinson’s disease due to its neuroprotective effects. Pharmaceutical companies and academic research institutions are receiving grants and FDA guidance to explore minor cannabinoids in clinical settings. As awareness grows and therapeutic pathways are validated, this segment is likely to experience significant growth in both product development and regulatory approval.

Cancer-related applications are also emerging, especially as supportive treatments for chemotherapy-induced nausea, pain, and appetite loss. Although THC has long been used in this context, cannabinoids like THCV and CBGA offer complementary mechanisms without psychoactive effects, making them suitable for broader patient populations.

Country-Level Analysis: United States

In the United States, the minor cannabinoids market is characterized by rapid innovation, entrepreneurial activity, and a fragmented regulatory landscape. The 2018 Farm Bill catalyzed growth in the hemp-derived cannabinoid sector, enabling businesses to legally extract and sell cannabinoids other than delta-9 THC. However, a lack of FDA approval for most minor cannabinoids has led to a market dominated by dietary supplements, wellness products, and cosmetics rather than regulated pharmaceuticals.

Several U.S. states have taken independent steps to regulate cannabinoid sales, including labeling requirements, age restrictions, and lab testing mandates. These localized regulatory frameworks are creating both challenges and opportunities for manufacturers. At the same time, consumer demand for non-intoxicating, plant-based therapies is pushing national retailers and e-commerce platforms to carry cannabinoid-based products.

Academic research hubs—such as those at UCLA, Johns Hopkins, and University of Colorado—are also actively involved in studying minor cannabinoids, often partnering with private firms for translational research. The U.S. market remains a global leader in cannabinoid innovation, with a clear path forward for companies that navigate compliance while investing in clinical data and consumer education.

Some of the prominent players in the U.S. minor cannabinoids market include:

- Mile High Labs

- GCM Holdings, LLC (Global Cannabinoids)

- GenCanna.

- CBD. INC.

- Rhizo Sciences

- Laurelcrest

- Fresh Bros Hemp Company

- BulKanna

- High Purity Natural Products.

- ZERO POINT EXTRACTION, LLC

U.S. Minor Cannabinoids Market Recent Developments

-

CB Therapeutics (March 2025) announced the successful biosynthetic production of THCV using yeast fermentation technology, significantly reducing production costs and paving the way for mass-market THCV products.

-

Open Book Extracts (February 2025) launched a new line of functional CBG and CBN blends in collaboration with sleep and wellness brands, emphasizing customized cannabinoid ratios for mood and sleep support.

-

Kradle Life Sciences (January 2025) received an NIH grant to study the effects of CBDV and CBDA on pediatric neurological disorders, indicating increasing clinical interest in minor cannabinoids.

-

TruCBN (December 2024) released the first USDA-certified organic CBN sleep gummy, entering Whole Foods and major retail chains with broad consumer marketing focused on sleep and relaxation.

-

Willow Biosciences (November 2024) reported scale-up success of its biosynthetic CBGA and CBG production platform, allowing for more consistent purity in therapeutic-grade cannabinoids.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. minor cannabinoids market

By Product Type

- Cannabigerol (CBG)

- Cannabichromene (CBC)

- Cannabinol (CBN)

- Tetrahydrocannabivarin (THCV)

- Cannabigerolic Acid (CBGA)

- Others (Cannabidiolic Acid (CBDA), Cannabidivarin (CBDV), and other minor cannabinoids)

By Application

- Inflammation

- Pain Management

- Neurological Disorders

- Cancer

- Others