U.S. Mobile IV Hydration Therapy Market Size and Research

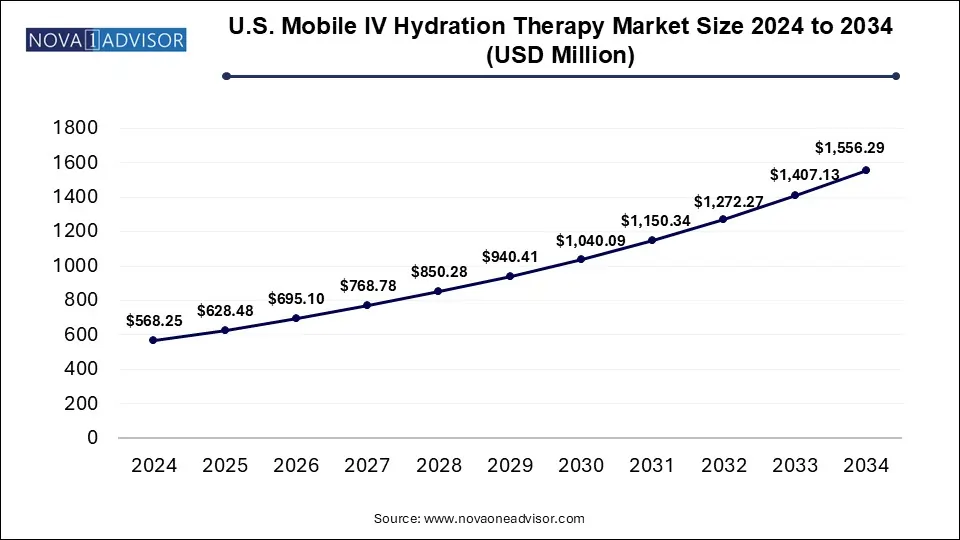

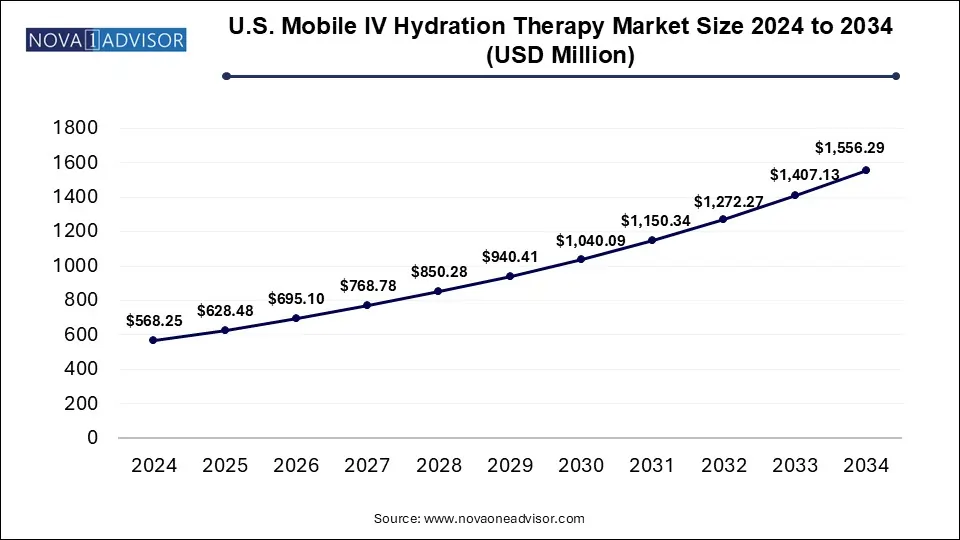

The U.S. mobile IV hydration therapy market size was exhibited at USD 568.25 million in 2024 and is projected to hit around USD 1,556.29 million by 2034, growing at a CAGR of 10.6% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, the medical application segment accounted for the highest share of the market at 48%.

- The wellness and aesthetic segment is projected to register the most rapid expansion throughout the forecast timeframe.

- The energy boosters category captured the largest portion of the therapy market with a 27% share in 2024.

- The skincare therapy segment is anticipated to witness the fastest compound annual growth rate (CAGR) during the projected period.

Market Overview

The U.S. mobile IV hydration therapy market has experienced a significant evolution in recent years, driven by increasing consumer preference for convenience-based wellness solutions and growing health consciousness. This form of therapy, which involves intravenous delivery of fluids, vitamins, electrolytes, and medications, has moved beyond traditional hospital settings and is now widely available through on-demand, concierge-style mobile services. These services cater to a diverse clientele, including athletes, business professionals, travelers, and individuals seeking hangover recovery, immune support, or skin rejuvenation.

Mobile IV therapy services offer the convenience of in-home, office, or hotel treatments, eliminating the need for clinic visits. The COVID-19 pandemic accelerated this trend, as many individuals sought home-based wellness treatments to minimize exposure risks. Today, mobile hydration services are integrated into a wider trend of personalized healthcare and preventative wellness, backed by the broader consumer movement toward biohacking and longevity practices.

Companies operating in this space often employ licensed nurses or paramedics, and many platforms allow users to book appointments via mobile apps. The versatility of services from immune boosters and migraine relief to beauty-focused drips has broadened market appeal. As awareness increases and social media influences consumer decisions, the U.S. mobile IV hydration therapy market is expected to witness sustained growth over the next decade.

Major Trends in the Market

-

On-Demand, App-Based Bookings: Many mobile IV therapy providers are leveraging digital platforms to allow patients to book services online or via mobile apps, enhancing accessibility and customer retention.

-

Celebrity and Influencer Endorsements: Influencer marketing has played a pivotal role in boosting awareness and credibility, particularly on platforms like Instagram and TikTok.

-

Integration with Wellness and Aesthetic Services: Providers are bundling IV therapy with services like Botox, body sculpting, or vitamin injections to create comprehensive wellness packages.

-

Growth in Preventative and Immune-Boosting Care: Following the pandemic, immune health remains a high priority, making immune-boosting drips a consistent top-seller.

-

Rise of Corporate Wellness Programs: Businesses are partnering with IV therapy providers to offer wellness benefits to employees, especially in high-stress industries like tech and finance.

-

Expansion into Rural and Suburban Markets: With growing demand outside urban centers, mobile IV therapy is reaching new demographics in less densely populated areas.

-

Focus on Athlete Recovery: Sports teams and fitness enthusiasts are increasingly using IV therapy for post-training recovery, especially in professional and collegiate athletics.

-

Compliance and Credentialing Emphasis: As regulation tightens, companies are investing more in licensed staff and standardized protocols to enhance safety and trust.

-

Customization and Subscription Models: Personalized drips and recurring service subscriptions are on the rise, offering consumers consistent wellness routines.

Report Scope of U.S. Mobile IV Hydration Therapy Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 628.48 Million |

| Market Size by 2034 |

USD 1,556.29 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 10.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Therapy, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room; DRIPBaR, Restore |

Market Driver: Rising Demand for Convenient and Personalized Healthcare

The most significant growth driver for the U.S. mobile IV hydration therapy market is the increasing demand for convenient, personalized healthcare experiences. In an age where time is a premium and consumers prioritize instant service, mobile IV therapy aligns perfectly with the needs of busy individuals, professionals, and wellness-focused consumers.

Instead of waiting at clinics or hospitals for hydration or nutritional support, users can schedule home visits at their convenience, often within an hour. The rising popularity of “biohacking” and personalized medicine also supports this trend, with clients choosing drips tailored to their physiological needs from immunity to energy, skin care, and cognitive function.

The gig economy and digital health revolution further bolster this convenience factor. Telehealth integration, mobile nurse dispatch systems, and contactless booking experiences make mobile IV hydration services more accessible than ever, fueling steady market expansion.

Market Restraint: Lack of Medical Oversight and Standardization

Despite its popularity, the mobile IV hydration therapy market faces scrutiny due to the lack of standardized medical oversight and regulatory inconsistencies across states. Unlike hospital-administered IV treatments, mobile services often operate in a gray area where protocols and licensing vary.

In some states, mobile IV therapy can be administered by nurses or paramedics under a physician’s standing order, while in others, more stringent supervision is required. This variation complicates market entry and raises concerns about patient safety, especially in cases where clients self-diagnose and choose treatments without appropriate medical evaluation.

Additionally, adverse events though rare can involve allergic reactions, fluid overload, or electrolyte imbalance. Without standardized training and credentialing, the risk of such complications may hinder consumer trust and slow market growth. The industry’s future depends heavily on transparent safety practices and tighter regulatory frameworks.

Market Opportunity: Expansion Through Corporate and Event-Based Wellness Services

One of the most promising opportunities for mobile IV hydration therapy in the U.S. lies in corporate wellness partnerships and event-based services. As companies increasingly invest in employee well-being to boost productivity and reduce burnout, mobile IV therapy emerges as a novel, high-impact offering for health-focused workplaces.

Wellness programs at tech firms, law offices, and even construction companies are beginning to include monthly hydration sessions, vitamin infusions, or stress-reducing therapies. The appeal lies in its portability and instant benefits hydrated employees often report better focus, energy, and reduced absenteeism.

In parallel, event-based services such as festival hydration lounges, bachelorette parties, weddings, and post-marathon recovery tents present a lucrative growth avenue. Providers like Reset IV and The DripBar are already capitalizing on this demand. The ability to serve large groups and deliver customized experiences positions these services as premium yet practical wellness solutions.

Segmental Analysis

Therapy Outlook: Immune Boosters Dominate, Skin Care Rising Fast

Immune booster IV drips accounted for the largest share in the U.S. mobile IV hydration therapy market. This segment’s dominance is largely attributed to heightened immune health awareness post-COVID-19. Immune drips typically contain a blend of Vitamin C, zinc, glutathione, and B-complex vitamins nutrients known to support immune function and help the body combat viral infections. These treatments are often sought during flu season, before travel, or as a general wellness measure.

Additionally, immune booster packages are frequently promoted by influencers and health coaches, adding to their popularity. Providers often bundle these services with flu shots or telehealth consultations, enhancing their perceived value and safety.

On the other hand, the skin care therapy segment is witnessing the fastest growth. As the beauty and aesthetic industries converge with wellness, IV treatments designed to promote collagen production, reduce pigmentation, and improve skin glow are gaining ground. These drips often include glutathione, biotin, and Vitamin C, and appeal primarily to younger demographics interested in non-invasive cosmetic enhancements. Their popularity is especially evident in cities like Los Angeles and Miami, where aesthetics play a central role in consumer lifestyle decisions.

Application Outlook: Wellness & Aesthetic Services Dominate, Sports Segment Gaining Momentum

Wellness and aesthetic applications represent the largest market share in terms of application. This dominance stems from the versatility and widespread consumer appeal of these treatments. From hangover recovery and jet lag to beauty-focused infusions, these services cater to the wellness-oriented millennial and Gen Z audiences. The convenience of receiving treatments at home or a boutique spa further fuels their popularity.

Moreover, the emphasis on holistic self-care and mental well-being is leading to increased bookings for vitamin-rich, mood-enhancing infusions. Social media influencers frequently showcase their wellness routines, normalizing IV therapy as part of a self-care regimen. Companies like IV Drips, Hydreight, and The I.V. Doc have structured their business models around this exact lifestyle alignment.

Conversely, the sports application segment is growing at the fastest pace. Athletes, both professional and amateur, increasingly rely on IV therapy for muscle recovery, rehydration, and performance enhancement. These treatments are particularly popular after endurance events, such as marathons or triathlons, where rapid electrolyte replenishment is essential. College sports programs and local fitness centers are beginning to collaborate with IV providers to offer on-site sessions after tournaments and intense training sessions.

Country-Level Analysis: United States

Within the U.S., mobile IV hydration therapy adoption shows notable variation across states and cities, influenced by local regulation, consumer demographics, and healthcare infrastructure. California, Florida, Texas, and New York are among the most active markets, largely due to their affluent populations, urban density, and strong wellness cultures.

For instance, Los Angeles and Miami are hotspots for aesthetic and skin-focused IV treatments, often integrated with med spa services. New York City sees high demand from corporate clients, tourists, and busy professionals, with mobile units frequently serving Wall Street firms or high-end hotels. In contrast, Texas cities like Austin and Dallas report growing traction in both athletic recovery and wellness segments, supported by active fitness communities.

Meanwhile, suburban and rural areas are starting to show interest as companies expand their footprint beyond major metros. Franchising models are particularly successful in spreading access to smaller markets, making mobile IV hydration a coast-to-coast phenomenon. Regulatory evolution remains a key factor in shaping the service landscape across different U.S. states.

Some of The Prominent Players in The U.S. Mobile IV Hydration Therapy Market Include:

- Drip Hydration

- DriPros IV Hydration Wellness

- wHydrate

- Renew Ketamine & Wellness Center

- R2 Medical Clinic

- AliveDrip

- Hydrate IV

- Hydration Room

- DRIPBaR, Restore

Recent Developments

-

March 2025: Hydreight, a leading U.S. mobile IV provider, announced an expanded partnership with a nationwide home healthcare network to deliver combined IV therapy and urgent care services.

-

January 2025: Reset IV launched its first brick-and-mortar wellness lounge in Las Vegas, offering both mobile and on-site IV hydration services under one integrated platform.

-

November 2024: The DripBar announced a new franchise expansion initiative across 10 U.S. states, including underserved rural markets, tapping into growing demand outside urban centers.

-

September 2024: Reviv introduced its AI-enabled appointment scheduling system, allowing users to get personalized IV recommendations based on health surveys and wearables.

-

June 2024: I.V. League Hydration reported a 45% year-over-year increase in corporate wellness bookings, citing growing interest from law firms and tech companies on the East Coast.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Therapy

- Immune Boosters

- Energy Boosters

- Skin Care

- Migraine

- Others

By Application

- Medical

- Wellness & Aesthetic

- Sports