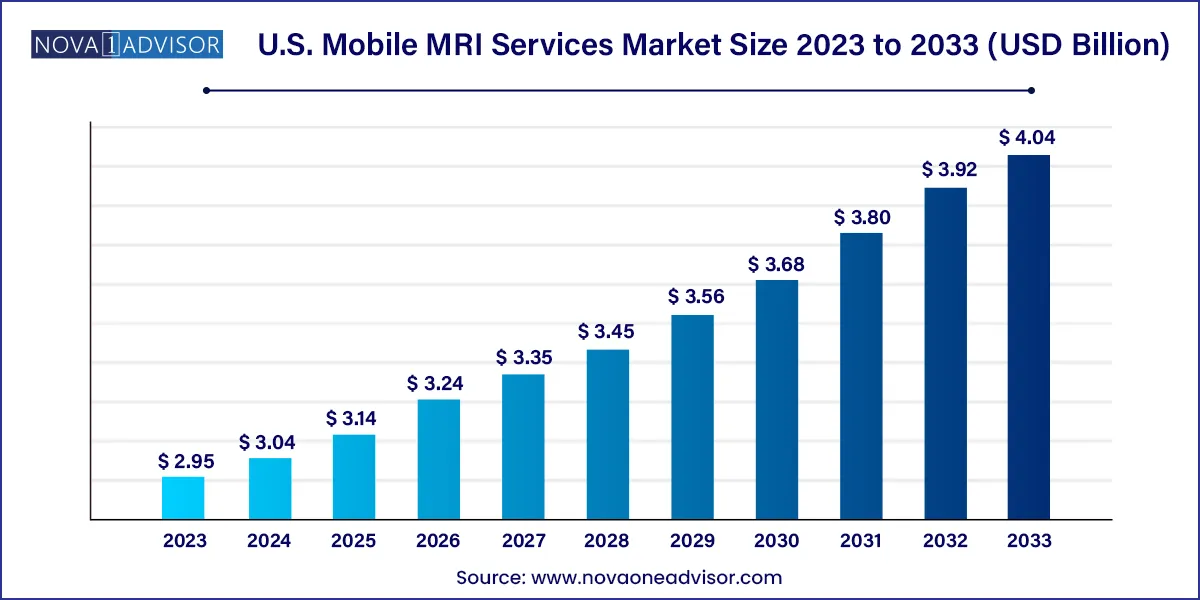

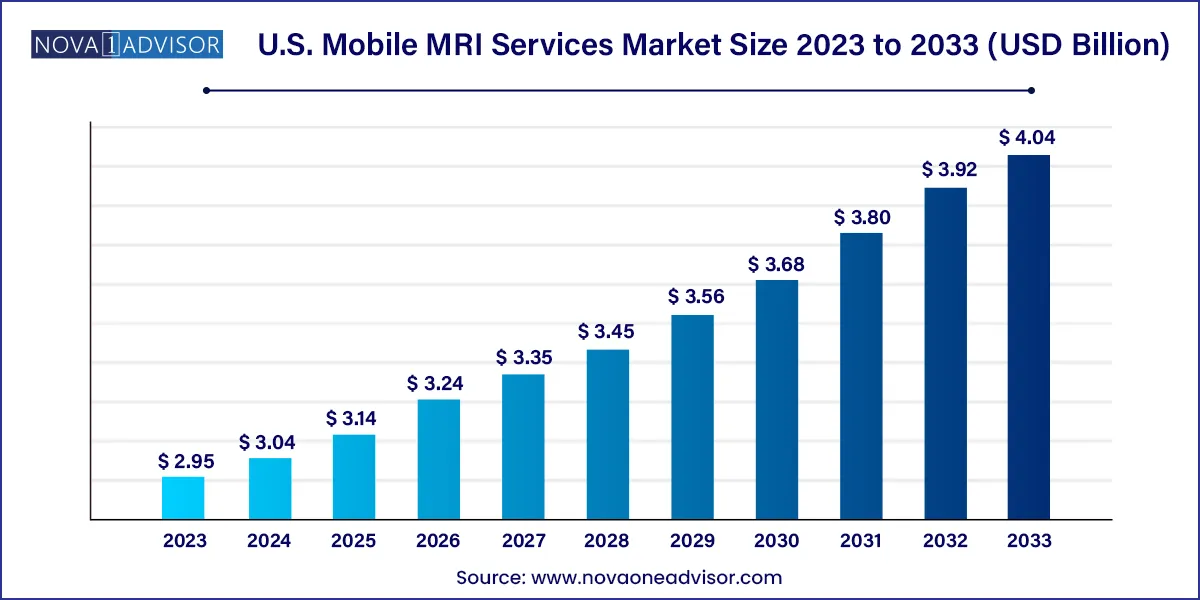

U.S. Mobile MRI Services Market Size and Growth

The U.S. mobile MRI services market size was exhibited at USD 2.95 billion in 2023 and is projected to hit around USD 4.04 billion by 2033, growing at a CAGR of 3.2% during the forecast period 2024 to 2033.

Key Takeaways:

- The neurological segment held the largest market share of 37.19% in 2023 and is expected to expand at the fastest CAGR during the forecast period.

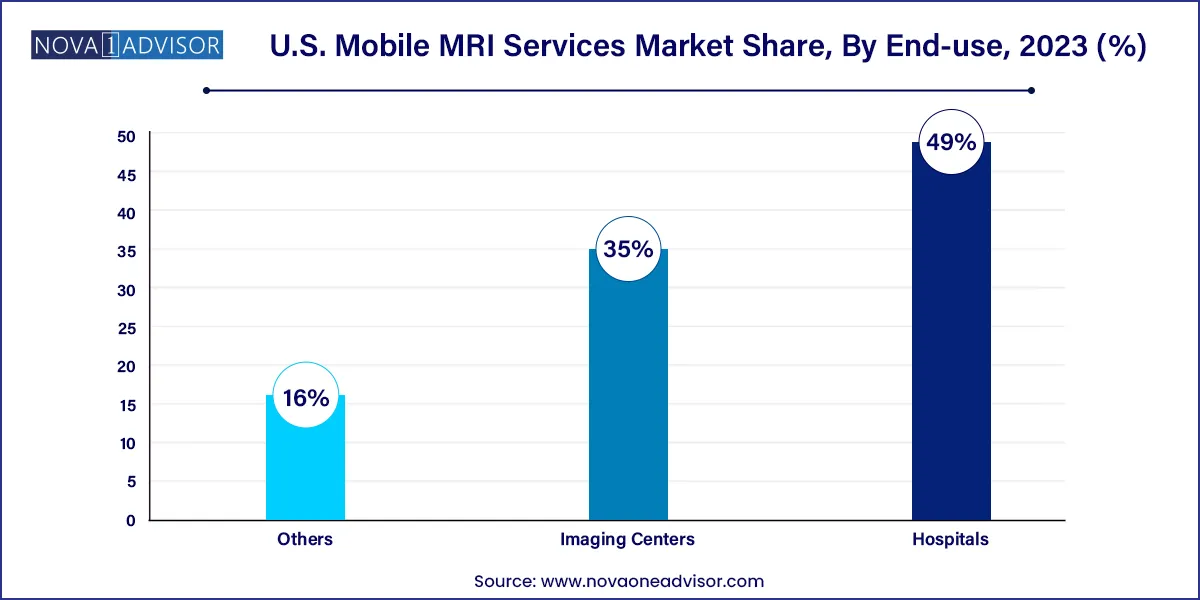

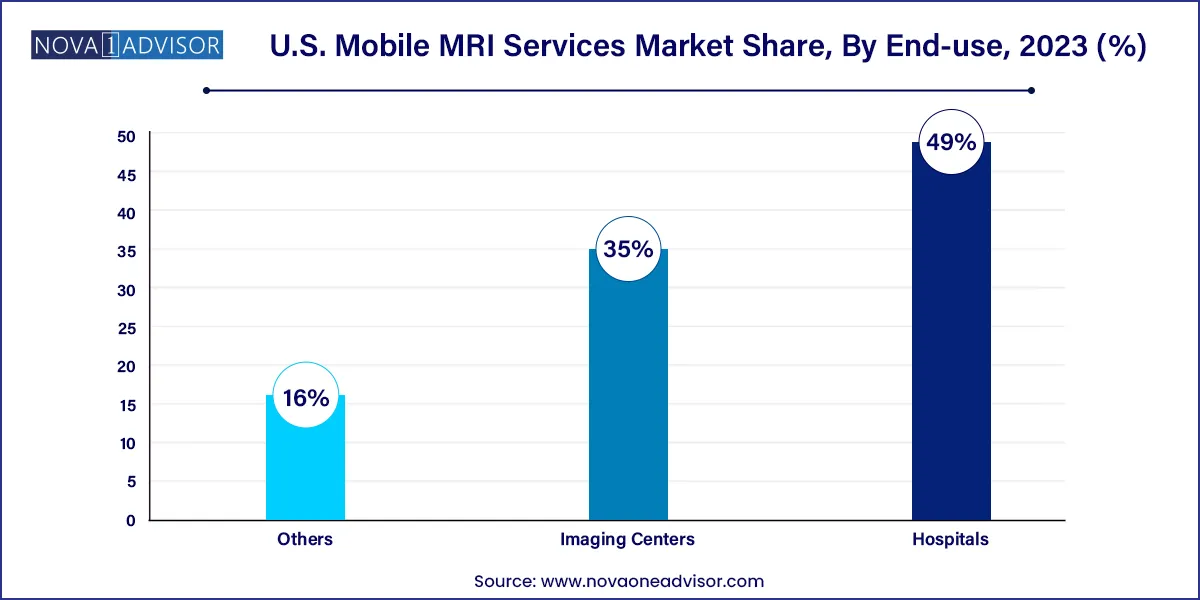

- The hospital segment held the largest revenue share of 49.0% in 2023 and is further expected to expand at the fastest CAGR of 3.7% over the forecast period.

- The imaging centers segment is also anticipated to witness a significant CAGR over the forecast period.

Market Overview

The U.S. Mobile MRI (Magnetic Resonance Imaging) Services Market is undergoing a dynamic transformation driven by the evolving landscape of healthcare accessibility, technological innovation, and cost optimization. Mobile MRI services offer a critical solution to the challenge of limited imaging infrastructure, particularly in rural and underserved areas where fixed imaging centers are not always viable. These services utilize specially designed vehicles equipped with MRI scanners that can be transported and deployed across multiple locations, expanding diagnostic reach without requiring heavy infrastructure investments.

The market is gaining traction not only for its flexibility and scalability but also for its role in improving patient outcomes through early and accurate diagnosis. Magnetic resonance imaging is a non-invasive technique used for diagnosing a range of conditions, from neurological disorders to cardiovascular diseases. However, traditional MRI infrastructure demands substantial capital, real estate, and power resources. Mobile MRI services present a more efficient alternative, especially in locations where patient volume or budget constraints do not justify a full-fledged facility.

Healthcare institutions including hospitals, community clinics, and independent imaging centers are increasingly adopting mobile MRI units to expand their diagnostic offerings. These services also cater to temporary needs, such as during renovations, equipment upgrades, or seasonal increases in patient load. Moreover, the growing demand for diagnostic imaging fueled by aging demographics, chronic disease prevalence, and personalized treatment planning has underscored the need for accessible and on-demand MRI services.

The rise of mobile health (mHealth) initiatives, flexible leasing and subscription models, and public-private partnerships are further driving the market. In the post-pandemic era, mobile MRI services have become even more relevant due to the focus on decentralizing healthcare and minimizing patient contact in hospital settings. The convergence of portable imaging technologies, cloud data integration, and remote diagnostics is poised to reshape how imaging is delivered in the United States.

Major Trends in the Market

-

Integration of AI in MRI Image Analysis: Mobile MRI units are increasingly equipped with AI-powered software for rapid and accurate image interpretation, reducing diagnostic turnaround times.

-

Subscription-Based MRI Services: Healthcare providers are moving toward leasing and subscription-based mobile MRI models to reduce capital expenditure.

-

Growth of Tele-radiology Support: Mobile MRI services are now frequently linked with tele-radiology platforms to enable instant analysis and reporting from off-site radiologists.

-

Deployment in Rural and Underserved Areas: Public health initiatives and community outreach programs are supporting mobile MRI rollouts in locations lacking fixed imaging infrastructure.

-

Technological Miniaturization: Lighter, faster, and more energy-efficient MRI machines are enabling easier installation on mobile units.

-

Temporary Replacement During Facility Renovations: Hospitals and imaging centers are using mobile units to maintain service continuity during upgrades or equipment downtimes.

-

Increased Demand in Sports Medicine: Athletic organizations are leveraging mobile MRI services for rapid injury assessment during sports events and training camps.

Report Scope of The U.S. Mobile MRI Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.04 Billion |

| Market Size by 2033 |

USD 4.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S.; North America |

| Key Companies Profiled |

Shared Medical Services; DMS Health; KMG; Front Range Mobile Imaging, Inc.; Meridian Group International; INTERIM DIAGNOSTIC IMAGING, LLC |

Key Market Driver: Increasing Demand for Accessible and Cost-Effective Diagnostic Imaging

A major driver propelling the U.S. mobile MRI services market is the increasing demand for accessible diagnostic imaging, especially in areas where full-scale imaging centers are financially or logistically unfeasible. The high cost of installing and maintaining an MRI suite, which includes shielding, temperature control, and spatial accommodations, makes it prohibitive for many rural hospitals and outpatient centers to own and operate their own MRI systems.

Mobile MRI services offer a game-changing alternative by rotating a single MRI unit across multiple facilities. This model dramatically reduces per-facility imaging costs, expands diagnostic reach, and allows healthcare providers to offer timely services without large capital outlays. The appeal is particularly strong in states with dispersed populations, such as Montana, North Dakota, and New Mexico, where patient access to high-quality diagnostics has traditionally been limited.

This scalable approach supports early diagnosis and intervention, which are crucial in chronic conditions like stroke, multiple sclerosis, and cancer. It also aligns well with public health goals of equity and inclusivity in healthcare delivery, making it a sustainable solution for the country’s long-term health infrastructure needs.

Key Market Restraint: Regulatory and Reimbursement Challenges

Despite its potential, the mobile MRI services market faces significant hurdles in the form of complex regulatory approvals and inconsistent reimbursement policies. Mobile healthcare units, including imaging systems, must meet stringent standards from the Food and Drug Administration (FDA), the Centers for Medicare & Medicaid Services (CMS), and often individual state health boards. Compliance with these multiple layers of regulation can be both time-consuming and costly.

Moreover, reimbursement structures for mobile imaging services are not uniformly defined across states or insurers. While Medicare and Medicaid do provide some coverage, private insurers often have unclear or limited reimbursement protocols, especially for mobile imaging conducted outside traditional clinical environments. This lack of clarity creates billing challenges for service providers and discourages wider adoption, particularly among smaller healthcare facilities and independent providers.

The integration of artificial intelligence (AI) and machine learning into mobile MRI platforms represents one of the most significant opportunities in the market. These advanced systems can assist in faster image acquisition, enhanced signal processing, and automated diagnostic support—factors that are especially valuable in a mobile environment where time, bandwidth, and space may be limited.

By incorporating AI-based pre-screening tools and auto-segmentation software, mobile MRI services can enhance accuracy and reduce radiologist workload. In many cases, the preliminary reports can be generated on-site, allowing for faster triage decisions. Moreover, cloud-based storage and data transfer capabilities enable seamless collaboration with offsite radiology teams, telehealth providers, or centralized PACS systems.

As regulatory bodies grow more comfortable with AI in clinical decision-making, the approval pipeline for these solutions will likely expand, making AI a core pillar in the next-generation mobile MRI ecosystem.

U.S. Mobile MRI Services Market By Application Insights

Neurological Imaging Dominated the Application Segment

Neurological applications have dominated the mobile MRI services market due to the critical role MRI plays in diagnosing conditions such as brain tumors, stroke, multiple sclerosis, and neurodegenerative disorders. The brain and spinal cord require high-resolution imaging to assess tissue density, blood flow, and neural pathway integrity—elements that MRI is uniquely positioned to capture. Mobile MRI services enable immediate neurological evaluations for acute conditions, especially in areas where time is of the essence, such as suspected stroke cases.

Mobile neurological imaging is particularly valuable in stroke care networks, where smaller facilities without fixed MRI units can rely on mobile services for quick diagnostic turnaround. With stroke treatment heavily dependent on time-bound decisions, mobile MRI plays a crucial role in rural or suburban settings where travel to a tertiary hospital could mean the difference between full recovery and permanent disability. Increasing neurological cases in the aging population further strengthen this segment’s dominance.

Cardiovascular Imaging Is the Fastest Growing Segment

Cardiovascular applications are emerging as the fastest-growing segment in mobile MRI services. While traditionally dominated by CT and ultrasound, MRI is gaining popularity in cardiology due to its ability to offer detailed, contrast-free imaging of myocardial tissue, heart valves, and blood vessels. The development of fast MRI sequences and gating techniques that adapt to cardiac motion has made MRI increasingly viable for heart diagnostics.

Mobile MRI services equipped with cardiac imaging protocols are now being deployed in specialized health camps, community screening initiatives, and outpatient diagnostic networks focusing on preventive cardiology. This trend is likely to gain momentum as heart disease continues to be the leading cause of mortality in the U.S., and as clinicians demand non-ionizing alternatives to X-ray based modalities for repeated follow-ups.

U.S. Mobile MRI Services Market By End-use Insights

Hospitals Remain the Dominating End-Use Segment

Hospitals account for the largest share of mobile MRI service utilization in the U.S., primarily due to their need for supplemental imaging during times of high demand, equipment maintenance, or when launching new service lines. Many hospitals prefer outsourcing MRI services during the construction or renovation of their radiology departments, thereby maintaining diagnostic continuity without overburdening their internal resources.

Furthermore, mobile MRI services allow hospitals to test new markets or services before committing to full capital investments. For instance, a regional hospital may trial pediatric neuroimaging services through a mobile unit before investing in a dedicated wing. This modular and flexible approach makes mobile MRI an essential part of hospital strategic planning.

Imaging Centers Are the Fastest Growing Users

Independent imaging centers are rapidly becoming the fastest adopters of mobile MRI services, driven by their need to expand diagnostic offerings without inflating operational costs. For many small or mid-sized imaging centers, purchasing a permanent MRI scanner might not be financially viable, especially when patient volume is inconsistent or seasonal. In such cases, leasing a mobile MRI unit offers a smart workaround.

These centers can operate with enhanced flexibility by scheduling mobile MRI services on certain days of the week, optimizing both resource utilization and revenue. Moreover, partnerships with physicians and outpatient care providers allow imaging centers to bring MRI directly to patients, increasing convenience and reducing dropouts due to travel limitations. The flexibility and scalability mobile MRI brings align perfectly with the outpatient care model that dominates modern U.S. healthcare.

Country-Level Analysis: United States

The U.S. mobile MRI services market is shaped by unique factors such as healthcare decentralization, high rural population in certain states, and the push for value-based care. In states with expansive rural areas like Texas, Alaska, and the Dakotas, mobile MRI is often the only practical method to ensure diagnostic parity with urban populations.

Urban hospitals use mobile MRI as overflow units, while suburban clinics use them to broaden their service offerings. The rise in outpatient care and one-day diagnostics is fueling demand in metropolitan outpatient clinics, which aim to provide comprehensive diagnostic services under one roof. The United States also has one of the world’s most active regulatory environments, pushing manufacturers and service providers toward continuous innovation and compliance upgrades.

Private health insurers and Medicare Advantage plans are beginning to recognize mobile diagnostics under bundled service packages, signaling a shift toward greater reimbursement standardization. Furthermore, federal initiatives aimed at rural health equity continue to fund mobile health deployments, including imaging services.

Some of the prominent players in the U.S. mobile MRI services market include:

- Shared Medical Services

- DMS Health

- KMG

- Front Range Mobile Imaging, Inc.

- Meridian Group International

- INTERIM DIAGNOSTIC IMAGING, LLC

Recent Developments

-

February 2025 – MedWagon Imaging Solutions launched its AI-enabled mobile MRI fleet in the Midwest, focusing on neurological and pediatric imaging, offering real-time reporting via a dedicated cloud portal for referring physicians.

-

January 2025 – OnTrack Diagnostics, a major mobile imaging service provider, introduced a subscription-based leasing model for small hospitals and rural clinics across the Southern U.S., reducing upfront investment and expanding availability.

-

March 2025 – Radiologix Mobile, a California-based startup, received FDA clearance for its ultra-lightweight mobile MRI unit designed for cardiovascular imaging, powered by battery-assisted mobility and cloud analytics.

-

April 2025 – Inova Health System partnered with a third-party mobile MRI vendor to serve their outpatient network in Virginia, with a specific focus on sports medicine diagnostics during spring sports season.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. mobile MRI services market

Application

- Neurological

- Cardiovascular

- Vascular

- Others

End-use

- Hospitals

- Imaging Centers

- Others