U.S. Molecular Diagnostics Market Size and Trends 2026 to 2035

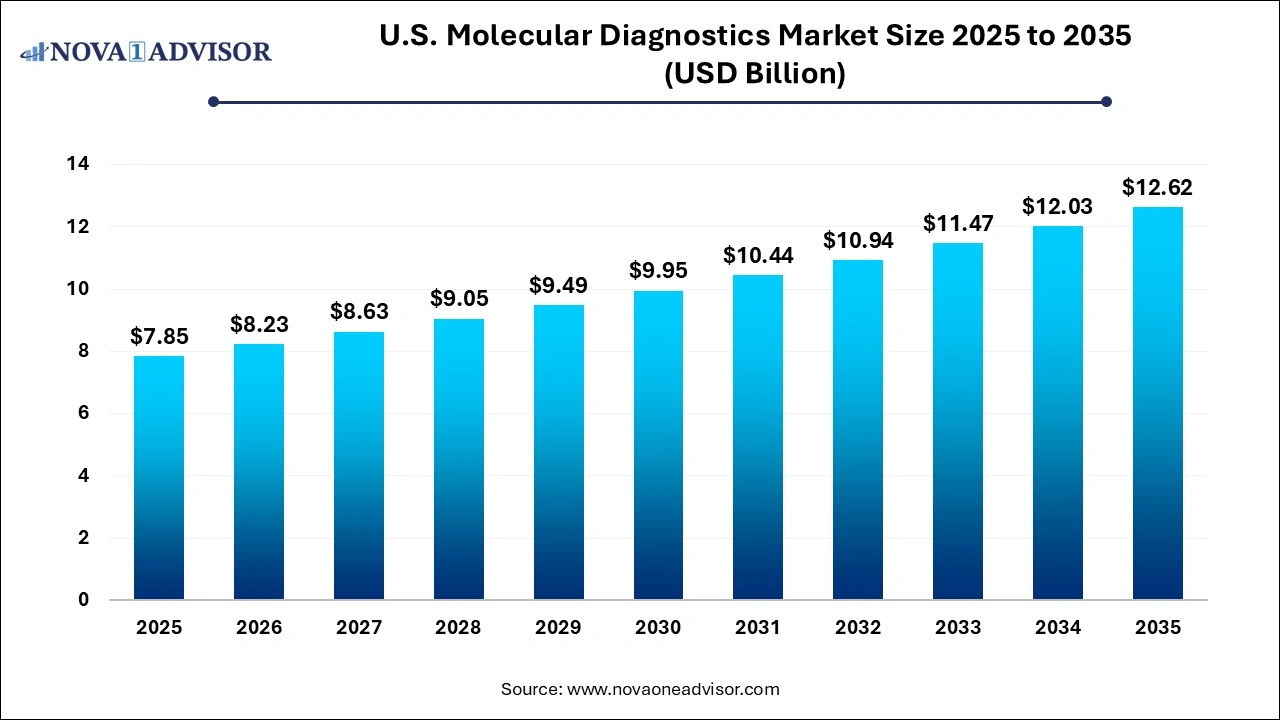

The U.S. molecular diagnostics market size was exhibited at USD 7.85 billion in 2025 and is projected to hit around USD 12.62 billion by 2035, growing at a CAGR of 4.86% during the forecast period 2026 to 2035.

U.S. Molecular Diagnostics Market Key Takeaways:

- The respiratory disease segment dominated the market with a share of 41.79% in 2025.

- The healthcare-associated infections segment is anticipated to witness the fastest growth from 2026 to 2035.

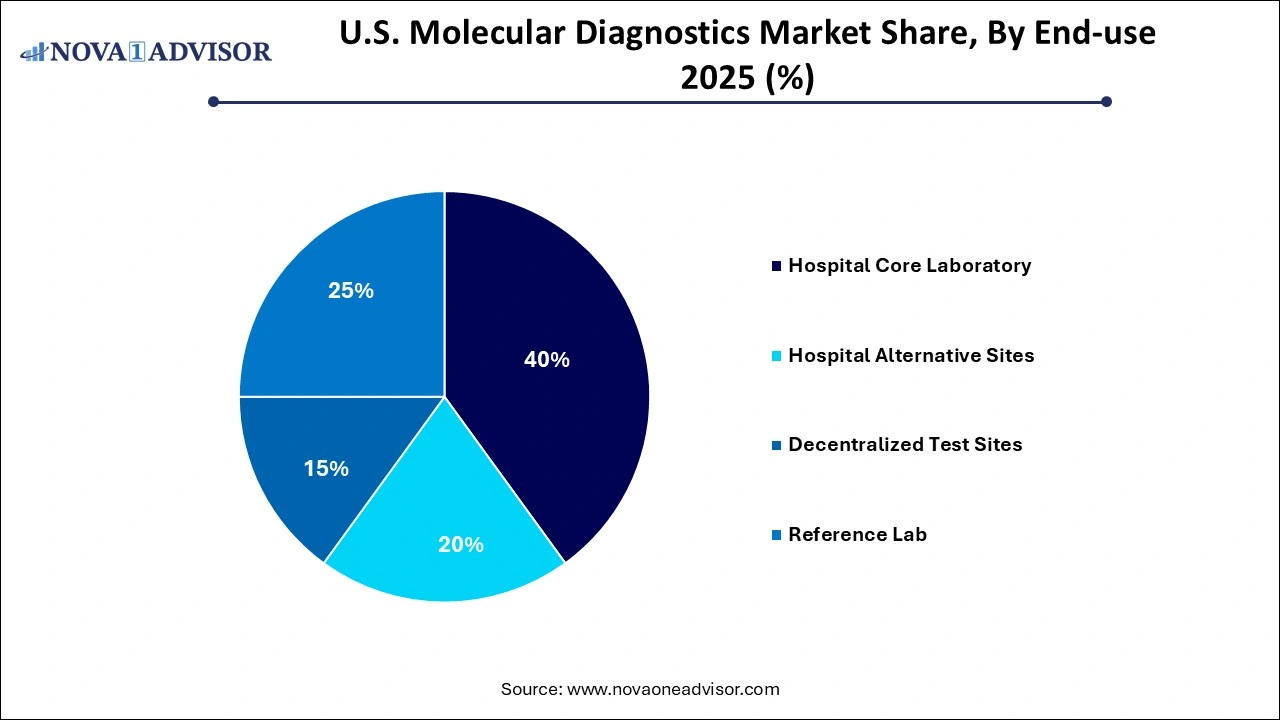

- The hospital core laboratory held the largest share of 40% of the market for U.S. molecular diagnostics in 2025.

- Reference labs are also expected to register a considerable CAGR during the forecast period.

U.S. Molecular Diagnostics Market Overview

The U.S. molecular diagnostics market represents one of the most mature and technologically advanced segments in the global diagnostics industry. Characterized by robust investment in R&D, the prevalence of chronic and infectious diseases, and a well-established healthcare infrastructure, the market is on a growth trajectory. Molecular diagnostics, which utilize techniques such as polymerase chain reaction (PCR), nucleic acid amplification, and next-generation sequencing (NGS), offer precision in detecting genetic materials DNA or RNA from pathogens or patient samples.

In recent years, the demand for molecular diagnostic tests in the U.S. has grown rapidly due to their accuracy, speed, and adaptability in addressing multiple conditions across disease areas such as oncology, infectious diseases, and genetic disorders. The COVID-19 pandemic further accelerated adoption, highlighting the significance of molecular testing in outbreak response and surveillance. Moreover, ongoing innovations in point-of-care molecular diagnostic platforms and multiplex testing capabilities are driving widespread adoption in decentralized settings, including outpatient clinics and physician offices.

With a supportive regulatory framework from the FDA, favorable reimbursement scenarios, and increasing consumer awareness, the molecular diagnostics market in the U.S. is expected to remain competitive and innovation-centric over the next decade.

Major Trends in the U.S. Molecular Diagnostics Market

-

Adoption of Point-of-Care Molecular Diagnostics: Growing emphasis on rapid diagnostics in emergency care and decentralized locations has led to the development of compact, user-friendly devices.

-

Rising Application in Oncology: Molecular diagnostics are becoming critical for personalized oncology treatment plans, especially for biomarkers like EGFR, KRAS, and BRAF.

-

Increased Demand for Multiplex Panels: Labs are shifting to multiplex molecular panels for respiratory, gastrointestinal, and STI testing to improve turnaround times and cost-efficiency.

-

Integration of AI and Machine Learning: AI is being leveraged for interpreting complex sequencing data, improving diagnostic accuracy and clinical decision-making.

-

Consumer Genomics and Direct-to-Consumer Testing: Companies are exploring at-home molecular testing kits, driven by rising consumer interest in personal health data.

-

Technological Advancements in PCR and NGS: Innovations are enabling faster, cheaper, and higher-throughput testing across a broad spectrum of diseases.

-

Shift Toward Syndromic Testing: Healthcare providers are increasingly favoring syndromic approaches, particularly for respiratory infections and GI illnesses.

-

Growth in Liquid Biopsy Adoption: Non-invasive testing options, especially for cancer detection and monitoring, are gaining prominence.

Report Scope of U.S. Molecular Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 8.23 Billion |

| Market Size by 2035 |

USD 12.62 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.86% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Disease, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Abbott; Siemens Healthcare GmbH; QIAGEN; F. Hoffmann-La Roche Ltd; Quest Diagnostics Incorporated; Danaher; Thermo Fisher Scientific, Inc.; Hologic Inc.; BD; Charles River Laboratories; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Agilent Technologies, Inc. |

Key Market Driver: Expansion of Infectious Disease Testing

A major driver of the U.S. molecular diagnostics market is the increased focus on infectious disease diagnostics, particularly post-pandemic. The COVID-19 pandemic showcased the strategic value of molecular diagnostics in providing accurate, real-time disease detection. This has led to institutional investments in preparedness for emerging infectious diseases.

For instance, the U.S. Centers for Disease Control and Prevention (CDC) has strengthened its partnerships with diagnostic manufacturers to develop tests for conditions like monkeypox, dengue, and antimicrobial-resistant organisms. Molecular tests are vital because of their speed and sensitivity in detecting pathogens, even during early stages or in asymptomatic carriers. Moreover, syndromic respiratory panels can now simultaneously test for SARS-CoV-2, influenza, RSV, and more, minimizing the diagnostic burden on laboratories.

This expanded use of diagnostics is not limited to pandemics routine use for hospital-acquired infections, sexually transmitted infections, and tuberculosis surveillance continues to rise, cementing infectious disease diagnostics as a cornerstone of market growth.

Key Market Restraint: High Cost of Advanced Tests

Despite their numerous advantages, the high cost of molecular diagnostic tests remains a significant barrier, particularly in outpatient or low-resource settings. High development costs, complex regulatory approval processes, and the need for sophisticated equipment contribute to elevated pricing.

Tests like NGS panels or syndromic multiplex assays can range from hundreds to thousands of dollars per test, making affordability a concern for uninsured or underinsured populations. Furthermore, reimbursement coverage can vary depending on the test, disease indication, and payer policy, leading to inconsistencies and potential access disparities.

Although cost-efficiency is improving with technology, affordability concerns remain, especially when scaling point-of-care molecular testing across a national healthcare system as vast as the United States.

Key Market Opportunity: Growth of Decentralized Testing

The rise of decentralized molecular testing environments presents a significant opportunity in the U.S. market. This includes hospital alternative sites, physician clinics, urgent care centers, retail health clinics, and even at-home settings.

Recent advances in microfluidics, lab-on-a-chip technologies, and user-friendly software interfaces have enabled the development of compact, CLIA-waived molecular testing platforms that can be operated with minimal training. Companies like Cepheid (Xpert Xpress) and Abbott (ID NOW) have already made substantial progress in this area.

Additionally, decentralized testing aligns well with broader healthcare goals—reducing hospital burden, delivering faster diagnoses, and improving patient outcomes through earlier intervention. As healthcare delivery continues shifting toward outpatient models and value-based care, molecular diagnostics are expected to become increasingly portable, rapid, and patient-centric.

Segmental Insights

By Disease Insights

The respiratory segment dominated the market in 2025 and continues to maintain its lead. The respiratory disease category saw a significant surge during the COVID-19 pandemic and remains a focal point due to the prevalence of conditions like influenza, respiratory syncytial virus (RSV), and emerging threats such as avian influenza or new coronavirus variants. Syndromic panels that detect multiple respiratory pathogens simultaneously are widely used in hospitals and urgent care settings to manage outbreaks efficiently. Technologies enabling quick turnaround times, such as isothermal amplification and rapid RT-PCR, are helping to minimize treatment delays and reduce transmission risks.

Simultaneously, the women’s health and sexually transmitted infection (STI) segment is projected to be the fastest-growing due to heightened public awareness, national screening programs, and a surge in multiplex testing adoption. The increasing burden of infections like HPV, chlamydia, and gonorrhea especially among younger populations has led to expanded testing guidelines. Moreover, growing research into the role of vaginal microbiomes and antimicrobial resistance in STIs is prompting demand for highly specific molecular assays. The availability of self-sampling kits and discreet at-home testing solutions is also expanding access, driving this segment forward.

By End-use Insights

Reference laboratories dominated the end-use segment owing to their infrastructure and testing volumes. These labs often handle high-throughput molecular assays using automated workflows and advanced analytical tools, making them the preferred destination for hospitals, clinics, and public health departments seeking outsourced diagnostic services. Their ability to process multiple test types ranging from oncology biomarkers to broad infectious disease panels provides a one-stop solution for healthcare providers. Companies like LabCorp and Quest Diagnostics have continued to expand their molecular diagnostics offerings to cater to this rising demand.

On the other hand, decentralized test sites are the fastest-growing end-use category, as healthcare delivery shifts away from centralized hospitals to more distributed care models. Clinics, urgent care centers, and mobile testing units increasingly prefer compact, rapid-result molecular devices that can be used without specialized laboratory infrastructure. Especially after the widespread deployment of portable PCR machines during the pandemic, the perception and acceptance of molecular diagnostics in non-lab environments have improved. Companies are investing heavily in CLIA-waived products to cater to this segment, which is expected to reshape the testing ecosystem in the U.S.

Country-Level Insights

The U.S. stands at the forefront of the molecular diagnostics landscape due to its well-developed biotechnology sector, proactive healthcare policy landscape, and advanced medical infrastructure. Federal agencies such as the NIH, CDC, and BARDA are actively involved in research funding, regulatory facilitation, and emergency preparedness—factors that significantly benefit domestic diagnostic developers.

The market also benefits from strategic academic-industry collaborations. For example, the collaboration between Stanford University and Illumina for genomic-based disease research has led to the commercial development of precision diagnostics. Additionally, cities like Boston, San Diego, and Raleigh-Durham serve as biotech hubs, providing fertile ground for innovation and commercialization of molecular tests.

The U.S. also faces a high burden of diseases that require molecular diagnostic intervention ranging from HPV-related cancers and antimicrobial-resistant infections to emerging zoonotic viruses. As a result, the country frequently pioneers the adoption of new diagnostic platforms, paving the way for global trends.

Some of the prominent players in the U.S. molecular diagnostics market include:

- Abbott

- Siemens Healthcare GmbH

- QIAGEN

- F. Hoffmann-La Roche Ltd

- Quest Diagnostics Incorporated

- Danaher

- Thermo Fisher Scientific, Inc.

- Hologic Inc.

- BD

- Charles River Laboratories

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Agilent Technologies, Inc.

Recent Developments

-

March 2025: Roche Diagnostics announced a new multiplex molecular panel for respiratory infections, including SARS-CoV-2, RSV, and influenza, approved by the FDA under Emergency Use Authorization.

-

January 2025: Thermo Fisher Scientific unveiled its next-generation qPCR system aimed at decentralized clinics and urgent care centers, focusing on usability and fast turnaround times.

-

November 2024: Abbott Laboratories expanded its ID NOW platform capabilities by integrating AI-powered result interpretation and extending test menus to include more STI-related pathogens.

-

October 2024: Bio-Rad Laboratories launched a new digital PCR system for oncology diagnostics that enhances sensitivity in detecting minimal residual disease.

-

August 2024: Cepheid (Danaher) introduced its expanded meningitis/encephalitis panel, featuring new targets like West Nile Virus and Chikungunya, aligning with CDC surveillance priorities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. molecular diagnostics market

Disease

- Healthcare-associated Infections (HAI)

-

- Methicillin-resistant Staphylococcus Aureus

- Staphylococcus Aureus

- Enterovirus

- Clostridioides Difficile

- Van A

- Sepsis Panel

-

- Flu

- Respiratory Syncytial Virus

- Paraflu

- Multidrug-resistant Tuberculosis

- Mycobacterium Avium-intracellulare

- Group A Streptococcal

- Adenovirus

- Human Metapneumovirus

- Rhinoviruses

- Middle East Respiratory Syndrome Coronavirus

- Tuberculosis

- Severe Acute Respiratory Syndrome Coronavirus 2

- Human Bocavirus-Infection

- Bordetella

- Mycoplasma Pneumonia

- Respiratory Panels

-

- Norovirus

- Helicobacter Pylori

- Shiga Toxin

- GI Parasite Panel

- GI Bacterial Panel

- GI Viral Panel

- GI Panels

-

- Chlamydia trachomatis (CT)/Neisseria Gonorrhoeae (NG)

- Trichomonas Vaginalis

- Mycoplasma Genitalium

- Human Papillomavirus

- Bacterial Vaginosis

- Gonorrhoea Colloquially

- Mycoplasma Genitalium Resistance

- Herpes Simplex Virus

- Group B Streptococcus

-

- Cytomegalovirus

- Epstein-barr Virus

- Varicella-zoster Virus

- BK virus

-

- Human Immunodeficiency Viruses

- Hepatitis C Viru

- Hepatitis B Virus

- Hepatitis E Virus

-

- Babesia

- Zika

- West Nile Virus

- Chikungunya Virus/dengue Virus

- Enhancer of Zeste Homolog 2

- PIK3CA

- Malaria

- Monkeypox Virus

-

- Meningitis Panel

- Lyme Panel

- UTI Panel

-

- Microsatellite Instability

- B-raf

- Epidermal Growth Factor Receptor

- Kirsten RAT SARCOMA VIRUS

- Others

End-use

- Hospital Core Laboratory

- Hospital Alternative Sites

- Decentralized Test Sites

- Reference Lab