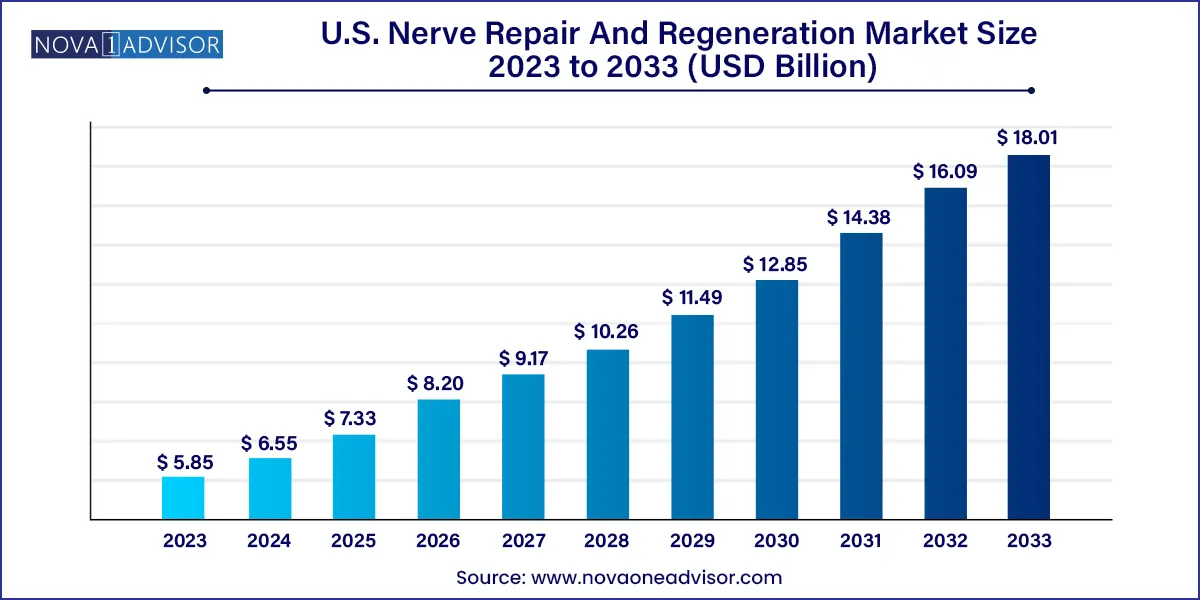

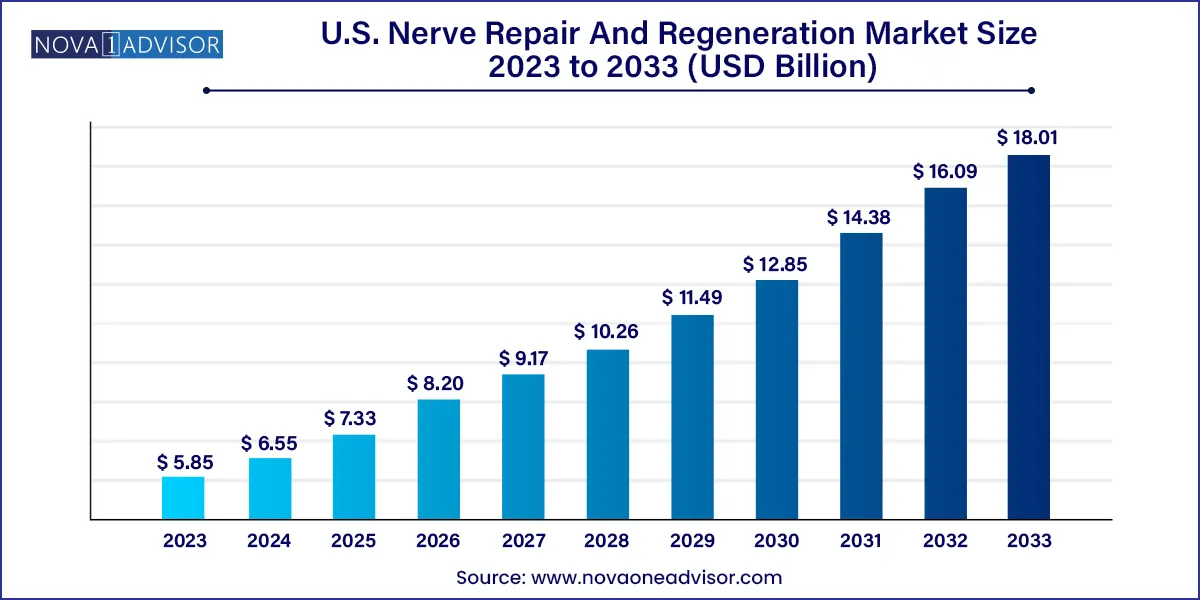

The U.S. nerve repair and regeneration market size was estimated at USD 5.85 billion in 2023 and is projected to hit around USD 18.01 billion by 2033, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

Key Takeaways:

- The neurostimulation and neuromodulation devices segment held the largest market share of 66.09 % in 2023.

- The biomaterials segment is expected to grow at the highest CAGR during the forecast period.

- The neurostimulation and neuromodulation surgeries segment held the largest market share of 39.12 % in 2023.

- The stem cell therapy segment is expected to grow at the highest CAGR during the forecast period.

Market Overview

The U.S. nerve repair and regeneration market represents a critical and rapidly evolving sector within the broader healthcare industry. With increasing prevalence of neurological disorders, such as Parkinson’s disease, Alzheimer’s, epilepsy, and traumatic nerve injuries, the demand for advanced treatment options has surged. The market encompasses a variety of cutting-edge technologies and therapeutic strategies aimed at restoring function to damaged nerves. These include biomaterials, nerve conduits, neurostimulation and neuromodulation devices, as well as advanced surgical procedures like nerve grafting and stem cell therapy.

Driven by an aging population and the rising incidence of nerve-related trauma and chronic conditions, the market has experienced a robust growth trajectory. According to projections, the market is expected to grow substantially over the next decade, supported by continued technological innovation, enhanced research funding, and growing patient awareness about available therapies.

Moreover, the U.S. is home to some of the world's most influential medical device manufacturers and research institutions, placing it at the forefront of innovation in the field. Regulatory support from agencies like the FDA and initiatives promoting the development of regenerative medicine further enhance the market's potential.

Major Trends in the Market

-

Increasing Adoption of Neuromodulation Devices: Rising preference for devices like spinal cord and vagus nerve stimulators to manage chronic pain and neurological diseases.

-

Advancements in Biomaterials: Development of bioresorbable polymers and hydrogels to facilitate nerve regeneration.

-

Rising Popularity of Stem Cell Therapy: Increasing research and clinical trials focusing on the efficacy of stem cells in regenerating nerve tissues.

-

Growing Investments in R&D: Government and private sector funding directed toward neurotechnologies and regenerative medicine.

-

Shift Towards Minimally Invasive Procedures: Growing demand for surgical techniques that reduce recovery time and procedural risks.

-

Integration of AI and Robotics in Surgery: Adoption of smart surgical tools and robotic systems to enhance precision in nerve repair surgeries.

-

Personalized Medicine Approaches: Development of patient-specific regenerative therapies based on genetic and molecular profiling.

-

Collaborations and Mergers: Increased strategic partnerships among biotechnology firms and device manufacturers to accelerate product development.

U.S. Nerve Repair And Regeneration Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 6.55 Billion |

| Market Size by 2033 |

USD 18.01 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, surgery |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; Medtronic plc. |

Segments Insights:

By Product Insights

Neurostimulation and neuromodulation devices dominated the U.S. nerve repair and regeneration market. These devices are widely used to manage chronic neuropathic pain, epilepsy, depression, and other neurological disorders. Spinal cord stimulation devices, in particular, account for a substantial share due to their effectiveness in alleviating pain by altering nerve activity. The growing acceptance of these technologies among physicians and patients, alongside increasing clinical evidence supporting their efficacy, has fueled their dominance.

Within this segment, vagus nerve stimulation (VNS) devices are the fastest-growing sub-segment, owing to their expanding application in the treatment of treatment-resistant depression and epilepsy. VNS devices deliver electrical impulses to the vagus nerve, modulating neural activity and restoring balance in the brain. In July 2023, LivaNova PLC received FDA clearance for an updated VNS system with advanced analytics, further boosting interest and adoption in this field. As more off-label applications emerge, the VNS market is expected to accelerate rapidly.

Biomaterials are also gaining significant traction and are projected to witness robust growth. These include nerve conduits and scaffolds made from biodegradable polymers that support axonal regrowth. Researchers are experimenting with various synthetic and natural materials to improve biocompatibility and functionality. Companies such as Axogen Inc. are actively developing new conduit designs to enhance surgical outcomes. The demand for biomaterials is further driven by the rise in peripheral nerve injuries and the need for supportive, cost-effective alternatives to autografts.

By Surgery Insights

Direct nerve repair/neurorrhaphy is the most widely performed surgical intervention in the U.S. nerve repair and regeneration market. This procedure involves the direct suturing of severed nerve ends and is commonly applied in cases of clean-cut traumatic injuries. Given the minimal complexity and high success rates when conducted promptly, this surgery remains a staple in nerve repair protocols across the country. Orthopedic and plastic surgeons often favor neurorrhaphy due to its rapid execution and minimal resource requirements, making it a first-line approach in emergency nerve injuries.

Meanwhile, stem cell therapy is the fastest-growing surgical intervention, driven by its potential to revolutionize regenerative treatments. While still considered investigational in many settings, the growing body of clinical trials and FDA-regulated studies is paving the way for wider adoption. In May 2023, a multicenter Phase II trial in the U.S. reported promising outcomes for stem cell-based therapy in restoring motor function after spinal trauma. These advancements, along with a favorable regulatory framework, are encouraging hospitals and specialty clinics to integrate stem cell procedures into their treatment repertoire.

Nerve grafting also continues to play a vital role, especially in bridging nerve gaps where direct repair is not feasible. Both autografts (from the patient’s own body) and allografts (from donors) are used, with increasing focus on synthetic alternatives to reduce donor site morbidity. Companies like Checkpoint Surgical have introduced advanced nerve graft products, expanding surgeon options and improving patient outcomes.

Country-Level Analysis

The United States stands as a global leader in the nerve repair and regeneration market due to its robust healthcare infrastructure, concentration of leading biotech firms, and proactive regulatory bodies. The country has witnessed a surge in medical research grants and commercialization of novel therapies, particularly in academic medical centers and innovation hubs like Boston, San Francisco, and Houston.

Furthermore, U.S.-based hospitals and neurosurgical centers are often the first to adopt cutting-edge technologies. For example, the Mayo Clinic and Cleveland Clinic are actively participating in trials for new neuromodulation devices and stem cell therapies. Government initiatives such as the BRAIN Initiative and the NIH's Blueprint Neurotherapeutics Network have bolstered R&D activity in neural repair.

The demand is also being driven by the high incidence of injuries associated with road accidents, sports, and military service. The U.S. Department of Veterans Affairs (VA) has supported regenerative treatments for veterans suffering from peripheral nerve injuries, contributing to expanding clinical applications. In addition, insurance providers are increasingly recognizing the long-term cost benefits of regenerative therapies, improving accessibility for patients.

Recent Developments

-

February 2024: Axogen Inc. announced the expansion of its nerve repair product portfolio with the launch of Axoguard Nerve Cap XL, designed to manage pain associated with nerve end neuromas. This product is expected to enhance Axogen's reach in orthopedic and reconstructive surgery markets.

-

August 2023: Medtronic plc received FDA approval for its Percept™ PC Deep Brain Stimulation system equipped with BrainSense™ technology, allowing real-time recording of brain signals. This innovation supports more precise and personalized treatment of neurological conditions.

-

July 2023: LivaNova PLC launched an upgraded vagus nerve stimulation (VNS) therapy system that integrates cloud-based monitoring tools, enhancing real-time patient tracking and clinician decision-making.

-

March 2023: Stryker Corporation announced the acquisition of a neurotechnology-focused startup developing minimally invasive tools for nerve repair, strengthening its foothold in the neurosurgical device market.

Key U.S. Nerve Repair And Regeneration Company Insights

Some of the prominent U.S. nerve repair and regeneration companies include NeuroPace, Inc., Medtronic, Stryker, AxoGen Corporation, Abbott (ST. Jude Medical), Baxter International (Synovis Micro Companies Alliance, Inc.), Boston Scientific Corporation, Polyganics, and Integra LifeSciences. New product launches and mergers & acquisitions are the key strategic undertakings of the participants in this vertical.

Innovation and new product development are expected to play a crucial role for the market players. Market players are in the process of introducing advanced products to capture a higher market share. There is a high demand for advanced specialized products with high technical capabilities which require more capital, and this is expected to restrict the entry of new players.

Key U.S. Nerve Repair And Regeneration Companies:

- AxoGen, Inc.

- Stryker Corporation

- St. Jude Medical, Inc.

- Baxter International, Inc.

- Polyganics B.V.

- Boston Scientific, Inc.

- Integra Lifesciences Corporation

- Cyberonics, Inc.

- Medtronic plc.

- Comp10

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Nerve Repair And Regeneration market.

By Product

- Biomaterials

- Neurostimulation And Neuromodulation Devices

- Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation Devices

- Vagus Nerve Stimulation Devices

- Gastric Electric Stimulation Devices

By Surgery

- Direct Nerve Repair/Neurorrhaphy

- Nerve Grafting

- Stem Cell Therapy

- Neurostimulation And Neuromodulation Surgeries