U.S. Non-destructive Testing Market Size and Trends

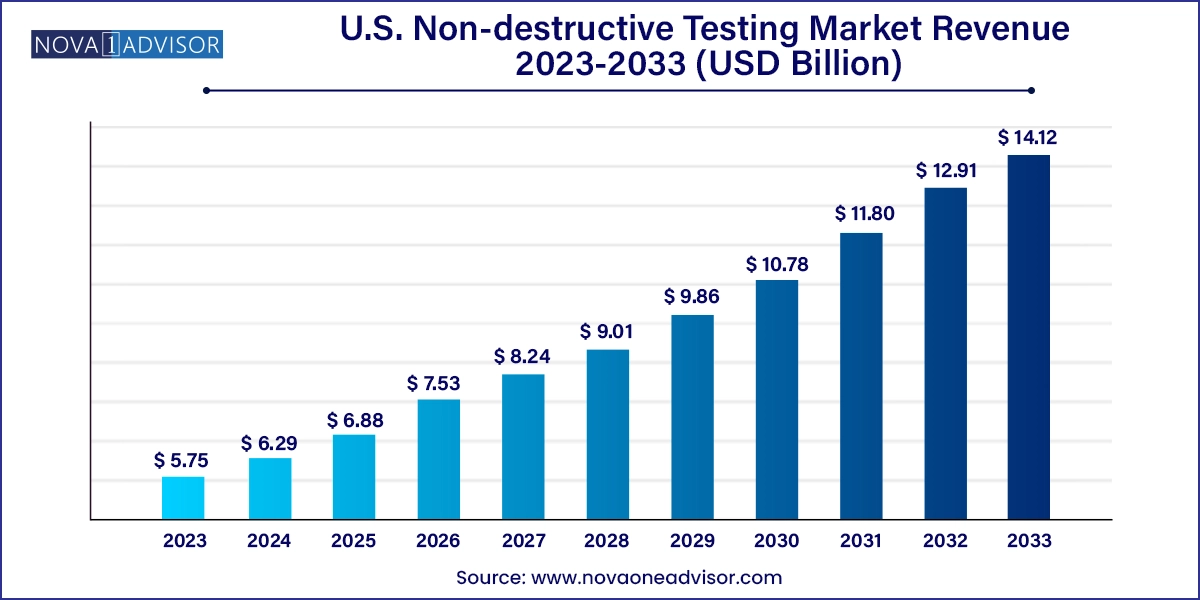

The U.S. non-destructive testing market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 14.12 billion by 2033, growing at a CAGR of 9.4% during the forecast period 2024 to 2033.

U.S. Non-destructive Testing Market Key Takeaways:

- The services segment dominated the market with the largest revenue share of 77.1% in 2023

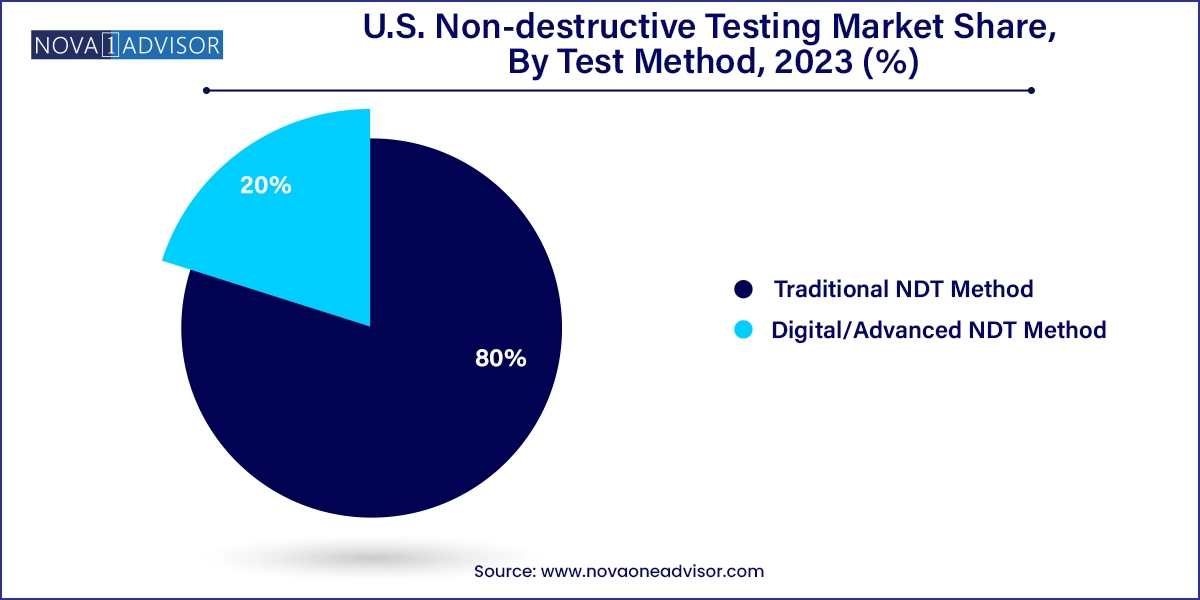

- The traditional test method segment dominated the U.S. market with the largest revenue share of 80.0% in 2023.

- The manufacturing vertical segment dominated the market with the largest revenue share of 21.6% in 2022.

Market Overview

The U.S. non-destructive testing (NDT) market stands as a pivotal cornerstone for maintaining safety, quality, and reliability across various industrial sectors, including oil & gas, aerospace, construction, power generation, and automotive. NDT techniques enable the inspection and evaluation of materials, components, or assemblies without causing damage, thereby preserving structural integrity while identifying potential flaws or failures before they result in catastrophic consequences. As regulatory scrutiny intensifies and industries lean toward preventive maintenance and digitization, the NDT market is evolving into a high-tech service segment that blends engineering, data science, and robotics.

NDT's importance in the U.S. is underpinned by the nation's expansive industrial infrastructure. From aging oil pipelines in Texas to aircraft fleets in Florida and nuclear plants across the Midwest, non-invasive inspection solutions play a crucial role in operational safety and asset longevity. Increasing investments in energy and defense, along with rising public infrastructure projects, are further catalyzing the demand for advanced NDT technologies. Moreover, digital transformation has enabled real-time defect detection, remote monitoring, and predictive analytics—leading to a new era of smart inspection solutions.

In 2024, the market continues to be driven by a convergence of traditional practices and advanced technologies. Companies are increasingly integrating NDT into their risk management strategies, and service providers are offering customized testing packages to meet industry-specific needs. The U.S., being a technology leader, also serves as a launchpad for innovations such as AI-powered defect recognition, robotic inspection arms, and drone-based scanning for inaccessible assets.

Major Trends in the Market

-

Rise of Advanced NDT Techniques: Methods like Phased Array Ultrasonic Testing (PAUT), Time-of-Flight Diffraction (TOFD), and Digital Radiography are gaining ground over traditional techniques due to superior accuracy and automation capabilities.

-

Integration of AI and Machine Learning: AI-driven algorithms are now being used to automate defect detection, reduce human error, and streamline reporting in inspection processes.

-

Remote and Robotic Inspection: Drones and robotic crawlers are being deployed to inspect confined, hazardous, or hard-to-reach areas, especially in pipelines, refineries, and nuclear power plants.

-

Digital Twins for Predictive Maintenance: NDT data is increasingly being integrated into digital twin frameworks, enabling real-time monitoring and predictive analytics for critical infrastructure.

-

Portable and Wireless NDT Equipment: Field-ready, lightweight devices that transmit data wirelessly are being adopted for greater mobility and rapid diagnostics.

-

NDT-as-a-Service (NDTaaS): Subscription-based models and managed service contracts are emerging, allowing companies to outsource regular inspections without high capital investments.

-

Stringent Regulatory Oversight: Compliance with ASME, ASTM, FAA, and API standards is driving consistent demand for testing services across aerospace, oil & gas, and construction sectors.

-

Training and Certification Demand: The growing technological complexity in NDT is fueling demand for certified professionals skilled in both traditional and digital methods.

Report Scope of U.S. Non-destructive Testing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.29 Billion |

| Market Size by 2033 |

USD 14.12 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Offering, Test Method, Vertical |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Bureau Veritas; Fischer Technologies Inc.; MISTRAS Group, Inc.; Comet Group (YXLON International GmbH); MME Group; TWI Ltd; Nikon Metrology Inc.; Olympus Corporation; Sonatest; Zetec Inc. |

Market Driver: Infrastructure Modernization and Safety Compliance

A key driver propelling the U.S. NDT market is the urgent need to modernize aging infrastructure while complying with safety regulations. The U.S. has more than 2.6 million miles of pipelines, thousands of bridges, aging nuclear power plants, and aerospace fleets that require routine inspection. Following high-profile failures such as bridge collapses or pipeline leaks, federal and state regulatory agencies have imposed stricter inspection schedules. For instance, the Infrastructure Investment and Jobs Act (2021) allocated $1.2 trillion, a portion of which is directed toward refurbishing and monitoring critical assets—much of which involves NDT-based evaluation. As industries transition from reactive to predictive maintenance models, NDT solutions become a strategic imperative, ensuring uptime, reducing liability, and extending asset life cycles.

Market Restraint: High Capital Investment and Skilled Labor Shortage

Despite the critical importance of NDT, the sector is restrained by the high costs associated with advanced testing equipment and the shortage of trained technicians. Phased array systems, digital radiography units, and automated ultrasonic inspection equipment come with significant capital costs, making it harder for small and mid-tier service providers to adopt. Additionally, the industry faces a gap in certified personnel who can operate sophisticated systems and interpret complex data. According to the American Society for Nondestructive Testing (ASNT), the shortage of Level II and III certified professionals continues to widen, threatening the market’s ability to scale with demand. Training and certification also require time and resources, creating bottlenecks in workforce readiness.

Market Opportunity: Growth of Digital/Advanced NDT Techniques

An emerging opportunity lies in the adoption of digital and advanced NDT techniques that offer higher accuracy, data integration, and remote diagnostics. Methods such as Digital Radiography (DR), Phased Array Ultrasonic Testing (PAUT), and Time-of-Flight Diffraction (TOFD) are quickly replacing older techniques due to their superior defect resolution and compatibility with software platforms for analytics. Aerospace and defense sectors, in particular, are transitioning toward these advanced methods for fatigue detection and composite inspection. Additionally, digital NDT generates high volumes of actionable data that can be used for building digital twins, supporting maintenance scheduling, and automating compliance reports—enabling service providers to offer more value-added services to clients.

U.S. Non-destructive Testing Market By Offering Insights

Services dominate the U.S. NDT market, as a large number of organizations prefer outsourcing inspections to specialized vendors rather than maintaining in-house teams and equipment. These services cover field inspections, remote monitoring, data interpretation, and certification. Industries like oil & gas, aerospace, and manufacturing rely on expert NDT contractors for periodic checks, quality assurance during fabrication, and regulatory compliance. Service providers often offer multi-method packages tailored to client needs, with some integrating AI analytics and cloud reporting to enhance efficiency.

Equipment is the fastest-growing segment, especially in sectors with high production volume and automation. Aerospace and defense contractors, automotive assembly lines, and large refineries are investing in in-house inspection infrastructure to gain operational control and reduce long-term service costs. The shift toward digital and portable devices, such as handheld ultrasonic testers and wireless radiography scanners, has also boosted equipment adoption. Manufacturers are embedding these tools into smart production lines to enable real-time flaw detection and self-correcting processes.

U.S. Non-destructive Testing Market By Test Method Insights

Traditional NDT methods continue to dominate, particularly Ultrasonic Testing (UT), Visual Inspection (VT), and Magnetic Particle Testing (MPT). These methods are widely accepted, cost-effective, and ideal for metals, welds, and surface crack detection. Ultrasonic Testing, in particular, is extensively used in pipeline inspection, aerospace maintenance, and construction quality checks. Despite the influx of new technology, traditional methods remain relevant due to their versatility, lower learning curve, and regulatory compliance status.

Digital/Advanced NDT methods are witnessing the fastest growth, led by Phased Array Ultrasonic Testing (PAUT) and Digital Radiography (DR). These techniques offer higher precision, 3D visualization, and automated scanning capabilities. For example, PAUT is now widely used in aircraft fuselage and turbine blade inspections, while DR is increasingly employed in automotive parts and oil pipeline diagnostics. Advanced methods enable data retention, remote analysis, and AI-assisted decision-making—key features in predictive maintenance programs.

U.S. Non-destructive Testing Market By Vertical Insights

Oil & Gas remains the largest vertical in the U.S. NDT market, particularly across downstream and midstream operations. From refinery pipelines to LNG terminals, periodic inspections are essential to detect corrosion, wall thinning, and micro-fractures. Federal mandates by the Pipeline and Hazardous Materials Safety Administration (PHMSA) also require stringent testing protocols. Service providers often deploy a mix of ultrasonic, eddy current, and radiographic techniques in this sector. As investments in shale gas and offshore drilling rise, demand for high-frequency, automated NDT services also increases.

Aerospace & Defense is the fastest-growing vertical, driven by technological advancement, strict safety requirements, and the increasing use of composite materials. Aircraft structures demand flaw detection with extremely high accuracy due to safety-critical nature. Methods like TOFD and PAUT are standard for inspecting aircraft wings, fuselages, and engine components. Companies like Boeing and Lockheed Martin are embedding NDT into their production quality cycles. Additionally, the increasing adoption of drones and robotic scanners in aircraft hangars is a testament to this sector’s rapid digitization.

Country-Level Analysis

In the U.S., non-destructive testing is intricately woven into the operational fabric of key sectors. States like Texas, Louisiana, and Pennsylvania see high NDT activity in the oil & gas sector. California and Washington are aerospace hubs requiring advanced inspection routines. Nuclear plants in Illinois, Michigan, and South Carolina undergo stringent testing as part of the NRC compliance protocols. Moreover, the Department of Transportation mandates regular bridge and railway inspections, ensuring continuous demand for services in the construction vertical.

Federal initiatives like the Bipartisan Infrastructure Law and modernization efforts in the Department of Defense are injecting capital into asset evaluation and monitoring. The push for renewable energy also encourages NDT usage in wind turbine inspections and solar panel installations. As industries expand into automation and digitization, the demand for remote and AI-assisted inspection solutions continues to rise in the U.S.

U.S. Non-destructive Testing Market Recent Developments

-

April 2023 – Mistras Group launched its "SmartPredictor" AI analytics platform for real-time interpretation of ultrasonic and radiographic inspection data, enhancing defect classification accuracy and accelerating decision-making.

-

February 2023 – Olympus (Evident Scientific) introduced the OmniScan™ X3 64-channel PAUT system in the U.S., targeting high-resolution inspections for aerospace and nuclear components.

-

January 2023 – GE Inspection Technologies (a Baker Hughes company) announced the integration of its portable digital radiography systems with Microsoft Azure cloud, enabling seamless remote inspections and predictive maintenance analytics.

-

November 2023 – Applus+ RTD expanded its robotic inspection services in the Gulf Coast region, deploying magnetic crawler-based UT and DR systems for petrochemical plant turnarounds.

-

September 2023 – Intertek Group enhanced its NDT training academy in Texas with a focus on advanced methods like TOFD and PAUT, addressing the skills gap and certification needs of the industry.

Some of the prominent players in the U.S. non-destructive testing market include:

- Bureau Veritas

- Fischer Technologies Inc.

- Mistras Group, Inc

- Comet Group (YXLON International GmbH)

- MME Group

- TWI Ltd

- Nikon Metrology Inc.

- Olympus Corporation

- Sonatest

- Zetec Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. non-destructive testing market

Offering

Test Method

-

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT Method

-

- Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

Vertical

-

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Others