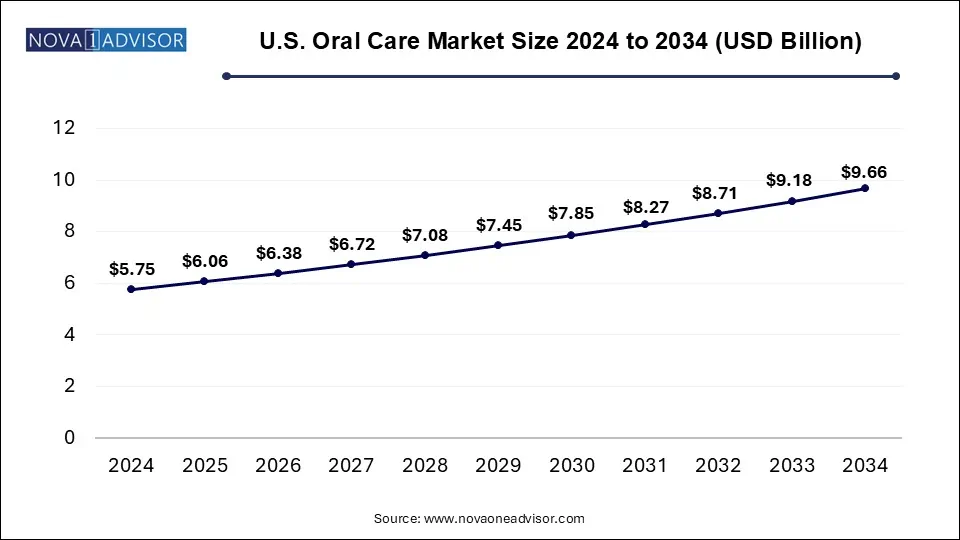

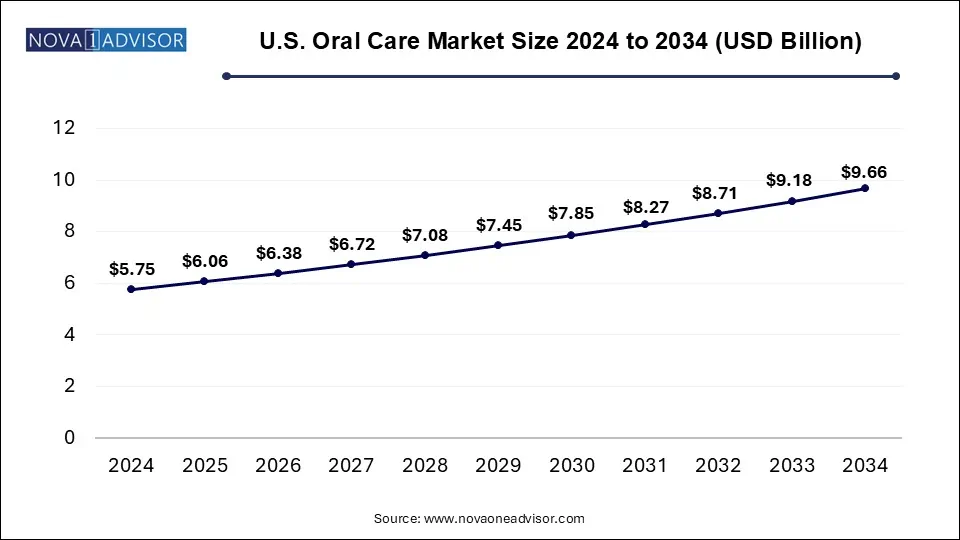

U.S. Oral Care Market Size and Growth

The U.S. oral care market was valued at USD 5.75 billion in 2024 and is projected to reach USD 9.66 billion by 2034, registering a CAGR of 5.33% from 2025 to 2034. The U.S. oral care market growth is attributed to the increasing awareness of dental hygiene.

U.S. Oral Care Market Key Takeaways

- By product insights, the toothbrushes segment dominated the U.S. oral care market in 2024.

- By product insights, the mouth/rinse segment is expected to grow fastest during the forecast period.

- By distribution channel insights, the supermarkets or hypermarkets segment dominated the U.S. oral care market in 2024.

- By distribution channel insights, the online retail segment is expected to grow the fastest during the forecast period.

U.S. Oral Care Market By Overview

The U.S. oral care market deals with the practice of keeping the mouth disease-free and clean. It includes flossing and brushing the teeth and visiting the dental clinic regularly for cleaning, exams, and dental X-rays. Some common oral health problems include periodontitis, gingivitis, bad breath, cavities, gum diseases, and dental caries. Various oral care products in the market result in healthier teeth and gums and enable the maintenance of oral health. The increasing prevalence of dental problems, increasing preference for cosmetic dentistry and increase in disposable income are expected to drive the market growth.

The U.S. oral care market is highly characterized by new oral care products and technological innovation. This is due to the increasing importance of oral care, the increasing high level of merger and acquisition activity, and the increasing consumer shift towards innovative products. In addition, awareness of oral care coupled with the increased per capita disposable income further accelerated the demand for creative oral care products using teledentistry platforms and smart technology.

Key Trends Contributing to U.S. Oral Care Market Growth

- Rising technological advancements: The rising technological advancements can help in the effective treatment and diagnosis of oral diseases which are expected to drive market growth.

- Increasing awareness: The increasing awareness of oral health, particularly in developing and underdeveloped countries is further expected to enhance the growth of the U.S. oral care market.

- Novel Diagnostics: The growing development of novel AI-based diagnostics determines the growth of dental problems which increases the demand for oral care.

Report Scope of U.S. Oral Care Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.06 Billion |

| Market Size by 2034 |

USD 9.66 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.33% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Distribution Channels |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Colgate-Palmolive Company; GlaxoSmithKline plc; Procter & Gamble; Johnson & Johnson Services, Inc; Unilever plc; Henkel AG & Co. KGaA; Sunstar Suisse S.A.; KYOCERA Medical Corp.; Church & Dwight Co., Inc. |

Latest Innovations Creates Market Opportunities

The integration of advanced technologies such as augmented reality, 3D printing, and artificial intelligence presents market opportunities. Dentists can enhance patient experience and improve the precision of treatments by implementing these technologies. AI can analyze various factors such as bacterial content and saliva composition to detect early signs of dental problems.

AI can also analyze images from various imaging techniques such as X-rays, enabling efficiency and accuracy. Internet of Things (IoT)-based devices such as smart toothbrushes can provide real-time feedback and monitor brushing patterns. In addition, the increasing demand for environmental sustainability is further expected to enhance the growth of the U.S. oral care market in the coming years.

High Cost of Oral Care Hinders The Market Growth

The high cost of dental care treatment is the major challenge hindering market growth. Advanced oral care treatments such as root canals and deep cleaning are more expensive, hindering patient adherence. Hence, many patients particularly in middle-income and low-income countries cannot afford oral care treatment. Leading to patient non-adherence, many people become anxious or have a fear of dental procedures is further expected to restrain the growth of the U.S. oral care market.

Segment Insights

U.S. Oral Care Market By product

The toothbrushes segment dominated the U.S. oral care market in 2024. The segment growth in the market is attributed to the increasing advanced features such as automatic and rapid bristle motions and advantages such as higher efficiency and customized attributes.

- For instance, in September 2024, an innovator in oral care, Great Gums launched its revolutionary products, the Great Gums One and the Great Gums Clinical Grade toothbrushes. These toothbrushes are designed to enhance overall oral health and offer superior plaque removal.

Whereas the mouthwash/rinse segment is expected to grow fastest during the forecast period. To improve the overall experience of consumers of all age groups and improve their oral health, major manufacturers in the U.S. oral care market are focusing on high efficiency and innovative products, which may drive the segment growth.

U.S. Oral Care Market By Distribution Channel

The supermarkets or hypermarkets segment dominated the U.S. oral care market in 2024. Hypermarkets or supermarkets sell a diverse variety of products such as dental floss breath freshener, mouthwashes, toothpaste, toothbrushes, etc. The employees provide reliable product information to the customers in hypermarkets or supermarkets to avoid consumer confusion regarding product brands. On the other hand, the online retail stores segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by increasing discounts on oral care products and rising internet integration in underdeveloped and developing areas.

Some of The Prominent Players in The U.S. oral care market Include:

- Colgate-Palmolive Company

- GlaxoSmithKline plc

- Procter & Gamble

- Johnson & Johnson Services, Inc

- Unilever plc

- Henkel AG & Co. KGaA

- Sunstar Suisse S.A.

- KYOCERA Medical Corp.

- Church & Dwight Co., Inc.

U.S. Oral Care Market Recent Developments

- In February 2025, Colgate-Palmolive launched a revolutionary three-product system, the Colgate Total® Active Prevention System designed to empower consumers to take control of their oral health with a preventative solution. The system includes a mouthwash, a state-of-the-art toothbrush, and reformulated toothpaste.

- In October 2024, a global leader in health technology, Royal Philips launched the No.1 dental professional-recommended sonic toothbrush brand Philips Sonicare across the globe in partnership with Aspen Dental. The aim behind this launch was to Aspen Dental’s national network of over 1,100 locations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. oral care market

By Product

-

- Manual

- Electric (Rechargeable)

- Battery-powered (Non-rechargeable)

- Others

-

- Cleaners

- Fixatives

- Floss

- Others

-

- Cosmetic Whitening Products

- Fresh Breath Dental Chewing Gum

- Tongue Scrapers

- Fresh Breath Strips

By Distribution Channels

- Hypermarkets/Supermarkets

- Pharmacies and drug stores

- Convenience Stores

- Online retail stores

- Other