U.S. Oral Solid Dosage Contract Manufacturing Market Size and Trends

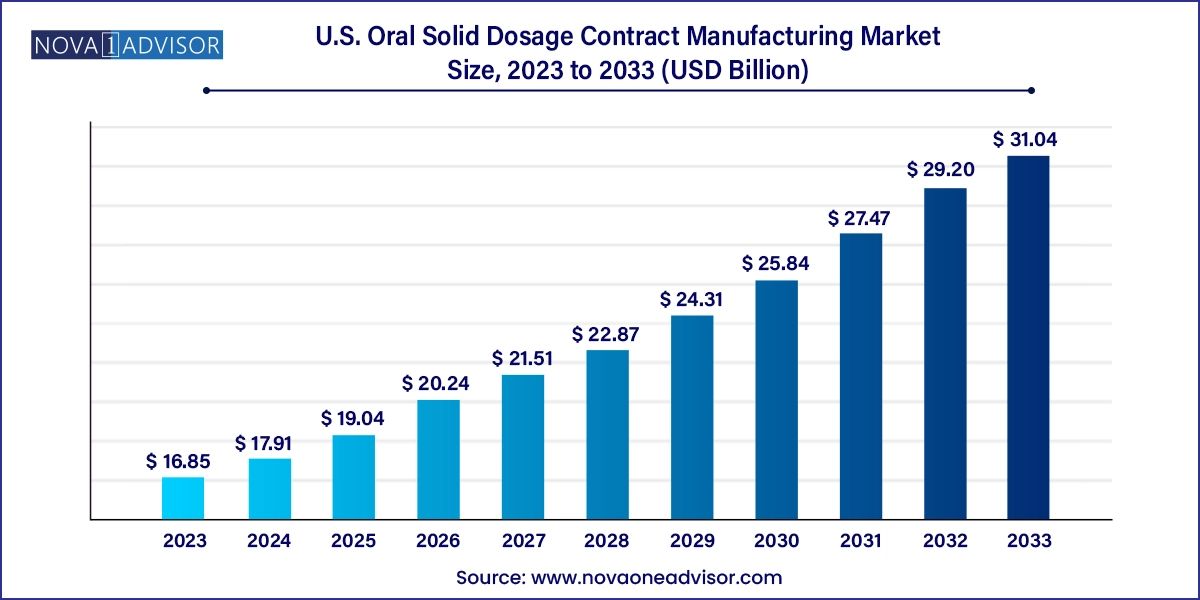

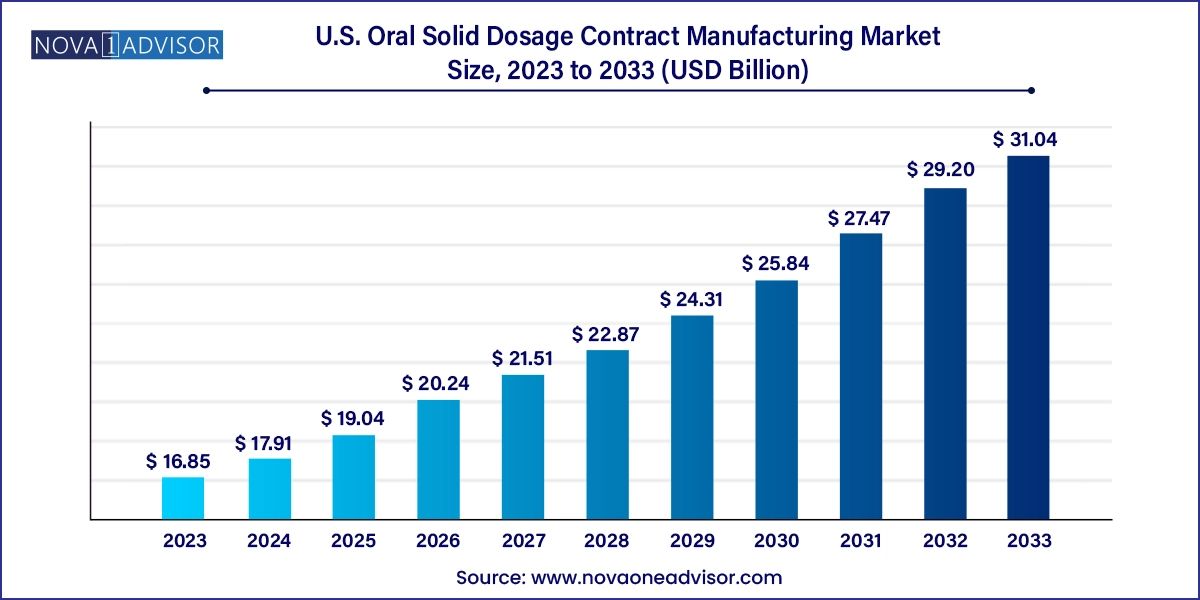

The U.S. oral solid dosage contract manufacturing market size was exhibited at USD 16.85 billion in 2023 and is projected to hit around USD 31.04 billion by 2033, growing at a CAGR of 6.3% during the forecast period 2024 to 2033.

U.S. Oral Solid Dosage Contract Manufacturing Market Key Takeaways:

- Based on product type, the tablets segment accounted for the largest market share of 32.13% in 2023.

- The capsules segment is anticipated to register lucrative growth during the forecast period.

- The controlled release segment dominated the market and accounted for the largest revenue share of 51.81% in 2023.

- The immediate release segment is expected to advance at a substantial CAGR during the forecast period.

- The large-size companies segment dominated the U.S. oral solid dosage contract manufacturing market with the highest revenue share of 55.77% in 2023.

- On the other hand, the medium and small size companies segment is expected to progress at a substantial CAGR during the forecast period.

Market Overview

The U.S. oral solid dosage (OSD) contract manufacturing market has evolved into a critical component of the pharmaceutical supply chain, driven by a combination of operational outsourcing strategies, cost-efficiency goals, and rising demand for high-quality formulations. Oral solid dosage forms, including tablets, capsules, powders, and granules, represent the most widely used drug delivery methods due to their convenience, stability, and cost-effectiveness. As pharmaceutical companies seek to streamline production and focus on core competencies such as R&D and marketing, the role of contract manufacturing organizations (CMOs) in producing OSDs has grown exponentially.

This market’s strength lies in its versatility and scalability. From blockbuster drug production to low-volume niche therapies, OSD contract manufacturers in the U.S. offer a range of services including formulation development, scale-up, commercial manufacturing, and packaging. Increasingly stringent regulatory standards from the FDA, combined with growing product complexity, have prompted pharmaceutical companies to collaborate with specialized CMOs equipped with advanced technologies, cleanroom infrastructure, and compliance expertise. The shift toward personalized medicine and growing demand for modified-release formulations are further enriching the scope of OSD contract manufacturing in the United States.

Major Trends in the Market

-

Rising demand for controlled and delayed release dosage formulations

-

Increased outsourcing by large pharma to reduce capital investment and enhance scalability

-

Adoption of continuous manufacturing and automation technologies

-

Expansion of contract manufacturing partnerships for generic and specialty drugs

-

Increasing preference for U.S.-based CMOs due to geopolitical uncertainties and FDA familiarity

-

Growth of high-potency oral solid dosage manufacturing capacity

-

Enhanced regulatory support for contract manufacturing collaborations

-

Focus on sustainability and eco-friendly manufacturing practices

Report Scope of U.S. Oral Solid Dosage Contract Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 17.91 Billion |

| Market Size by 2033 |

USD 31.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Mechanism, End-user |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Catalent, Inc.; Lonza; AbbVie Inc.; Aenova Group; Adare Pharma Solutions; Boehringer Ingelheim International GmbH; Jubilant Pharmova Limited; Patheon Pharma Services; Recipharm AB; Corden Pharma International; Siegfried Holding AG |

A primary driver of the U.S. OSD contract manufacturing market is the growing need for specialized formulations, particularly modified-release drugs that improve bioavailability and patient compliance. As pharmaceutical innovation expands to include complex therapeutic areas such as oncology, neurology, and cardiovascular diseases, formulation intricacies have become more pronounced. Companies are increasingly turning to CMOs with niche capabilities in hot melt extrusion, multilayer tablet production, and bioequivalence testing.

Simultaneously, the need for scalable manufacturing capable of adapting from clinical batch sizes to commercial volumes—has placed CMOs in a strategic position. Established contract manufacturers offer flexibility, rapid turnaround times, and validated processes that help clients minimize time to market. Their ability to handle API variability, technology transfers, and process validations ensures consistent quality, which is crucial for drug approval and commercialization.

Key Market Restraint: Regulatory and Quality Compliance Challenges

While contract manufacturing offers operational efficiency, it also introduces risks related to regulatory compliance and quality assurance. The U.S. FDA enforces rigorous Current Good Manufacturing Practice (cGMP) standards, and CMOs must consistently meet these benchmarks across all stages of production. Any lapses can result in warning letters, import alerts, or even shutdowns, severely affecting the supply chain.

Furthermore, managing client confidentiality, data integrity, and compliance across a multi-client, multi-product environment is inherently complex. Smaller CMOs may struggle with the capital investments required for quality upgrades, serialization, and advanced analytical capabilities. The complexity of tech transfer processes and batch validation also poses challenges, particularly when dealing with high-potency or sensitive compounds.

Key Market Opportunity: Growth in Generic and Specialty Drug Development

A significant opportunity for the U.S. oral solid dosage contract manufacturing market lies in the rising pipeline of generic and specialty drugs. As branded drugs face patent expirations, generic manufacturers are actively seeking reliable CMOs to produce bioequivalent versions at competitive costs. CMOs experienced in ANDA (Abbreviated New Drug Application) support and regulatory submissions have a clear advantage in this segment.

Specialty drugs, which may involve orphan indications, pediatric dosing, or fixed-dose combinations, also require expert formulation and flexible manufacturing infrastructure. Many emerging biotech firms lack the in-house capabilities to scale such products and therefore outsource to CMOs. These trends present a growth path for U.S.-based contract manufacturers that can offer integrated development-to-commercialization solutions, particularly under expedited FDA pathways.

U.S. Oral Solid Dosage Contract Manufacturing Market By Product Type Insights

Tablets dominate the U.S. oral solid dosage contract manufacturing market, accounting for the largest share due to their widespread use in both prescription and over-the-counter (OTC) medications. Tablets are favored for their stability, patient compliance, ease of manufacturing, and cost-efficiency. CMOs in the U.S. have significantly expanded their capabilities in tablet compression technologies, coating systems, and customized release profiles, enabling them to handle a broad spectrum of therapeutic compounds.

Capsules are the fastest-growing segment, driven by their compatibility with a range of active ingredients and patient preference for easier swallowing. Capsule formulations allow for multiparticulate dosage forms, taste masking, and rapid drug release. The growing demand for nutraceuticals, probiotics, and personalized supplements has further accelerated CMO investments in capsule filling and packaging technologies.

U.S. Oral Solid Dosage Contract Manufacturing Market By Mechanism Insights

Immediate release formulations hold the dominant position, especially for generic drugs and acute care medications where rapid onset of action is desired. These formulations are typically simpler to develop and manufacture, allowing for high-volume production and faster time-to-market. CMOs with immediate release capabilities often serve both branded generics and consumer health segments.

In contrast, controlled release mechanisms are gaining momentum, particularly for chronic conditions that require steady plasma drug concentrations over extended periods. Controlled release technologies enhance compliance and therapeutic efficacy. U.S.-based CMOs are increasingly offering specialized services in matrix systems, osmotic pumps, and multi-particulate layering, responding to pharmaceutical clients seeking differentiation in competitive markets.

U.S. Oral Solid Dosage Contract Manufacturing Market By End-user Insights

Large pharmaceutical companies are the primary clients for OSD contract manufacturing, leveraging CMOs to handle volume production, second-source validation, or supply redundancy. These firms often outsource legacy products to focus internal resources on new molecule development and biologics. Strategic outsourcing agreements with large CMOs allow for co-development of high-complexity formulations and risk-sharing models.

Medium and small pharmaceutical firms represent the fastest-growing client base, as they often lack the infrastructure for in-house manufacturing. These companies depend on CMOs for clinical trial material production, regulatory submission support, and commercial supply. The U.S. market is seeing a rise in startups and virtual pharma firms pursuing niche therapies, all of whom require turnkey manufacturing partnerships to succeed.

Country-Level Analysis (United States)

The U.S. oral solid dosage contract manufacturing landscape is supported by world-class regulatory oversight, a highly skilled workforce, and strong R&D capabilities. States such as New Jersey, Pennsylvania, California, and North Carolina serve as pharmaceutical manufacturing hubs, hosting leading CMOs and facilitating partnerships between biotech innovators and service providers.

The increasing emphasis on domestic manufacturing, spurred by supply chain vulnerabilities exposed during the COVID-19 pandemic, is further elevating the profile of U.S.-based CMOs. Federal initiatives supporting reshoring and public-private partnerships for drug manufacturing security are expected to enhance domestic production capacity for essential oral solid medications.

Some of the prominent players in the U.S. oral solid dosage contract manufacturing market include:

- Catalent, Inc.

- Lonza

- AbbVie Inc.

- Aenova Group

- Adare Pharma Solutions

- Boehringer Ingelheim International GmbH

- Jubilant Pharmova Limited

- Patheon Pharma Services

- Recipharm AB

- Corden Pharma International

- Siegfried Holding AG

Recent Developments

-

March 2025: Catalent announced the expansion of its oral solid manufacturing site in Winchester, Kentucky, with new capacity for controlled release tablets and automated packaging lines.

-

February 2025: Thermo Fisher Scientific completed the acquisition of a specialty CMO focused on pediatric oral solid formulations in New Jersey, expanding its development pipeline.

-

December 2024: Alcami Corporation secured a multi-year contract with a midsize pharma firm to produce high-potency solid dosage drugs under a dedicated suite in North Carolina.

-

October 2024: Lonza Pharma & Biotech launched a new continuous manufacturing platform at its U.S. site for oral tablets and capsule dosage forms.

-

August 2024: PCI Pharma Services announced upgrades to its tablet and capsule manufacturing capabilities in Philadelphia, including real-time quality control systems.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. oral solid dosage contract manufacturing market

Product Type

- Tablets

- Capsules

- Powders

- Granules

- Others

Mechanism

- Immediate Release

- Delayed Release

- Controlled Release

End-user

- Large Size Companies

- Medium & Small Size Companies

- Others