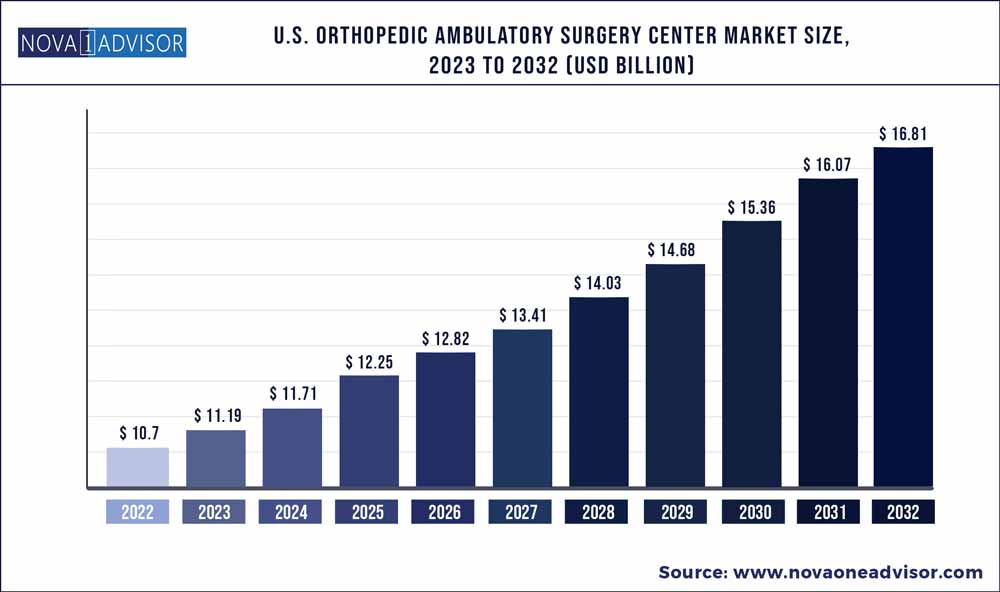

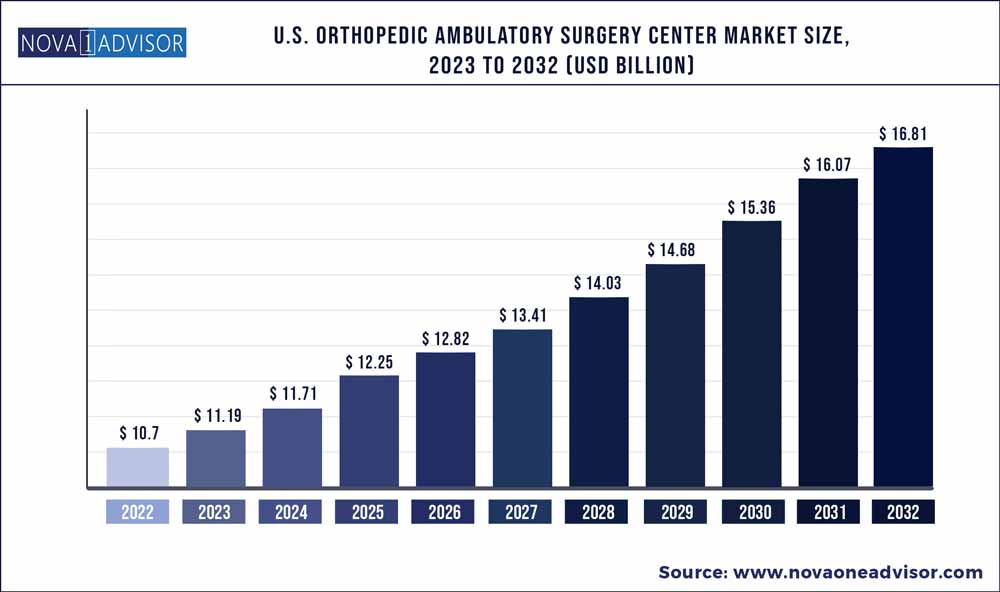

The U.S. orthopedic ambulatory surgery center market size was exhibited at USD 10.7 billion in 2022 and is projected to hit around USD 16.81 billion by 2032, growing at a CAGR of 4.62% during the forecast period 2023 to 2032.

Key Pointers:

- The fracture repair segment accounted for the largest market share of 37.8% in 2022.

- The knee replacement segment is anticipated to witness significant growth over the forecast period owing to the growing reimbursement policies by the CMS for knee replacement surgeries at the ASCs

- For instance, in January 2020, total knee replacement surgeries performed in an ASC setting became eligible for Medicare reimbursement, which facilitated the shift of patients from hospital settings to ASCs

- The U.S. government is considering the role of these centers as an important aspect of healthcare and is undertaking initiatives to ensure proper reimbursement, fueling market growth. For instance, in November 2022, CMS issued the 2023 final payment rules for HOPDS and ASCs. The CMS finalized a 3.9% update, which is the combination of a 4.2% update of inflation and a reduction in productivity of around 0.4% mandated by the Affordable Care Act

U.S. Orthopedic Ambulatory Surgery Center Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 11.19 Billion

|

|

Market Size by 2032

|

USD 16.81 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 4.62%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Procedure

|

|

Key companies profiled

|

Spectrum Orthopedics; Academy Orthopedics L.L.C.; Upstate Orthopedics Ambulatory Surgery Center; Washington Orthopedic Center; Southern California Orthopedic Institute; ProOrtho; Texas Health Orthopedic Surgery Center; Columbia Orthopedic Surgery Center; Chatham Orthopedic Surgery Center; The Orthopedic Surgery Center Of Arizona; HealthPartners; Specialty Orthopedics

|

The growth can be attributed to the lower cost of orthopedic surgeries in ambulatory surgery centers (ASCs) and rising investment in orthopedic ASCs. As per research conducted by the Rothman Orthopaedic Institute based in Philadelphia, and Hospital for Special Surgery based in New York, treatment in ASCs costs around 40% less compared to hospital-based outpatient departments. The number of outpatient orthopedic surgical procedures undertaken at ambulatory surgery centers (ASCs) has significantly increased in the past few years. The growing demand can be attributed to the lower cost of treatment at these centers for orthopedic surgeries. According to the study published in PubMed in March 2022, among 990,980 outpatient orthopedic surgeries performed from 2013 to 2018, the ASCs utilization rate increased from 31% to 34% for all the orthopedic procedures with a CAGR of 3.3% for lumbar microdiscectomy, 1.4% for anterior cruciate ligament, 1.8% for knee arthroscopy, 1.4% of carpal tunnel release, 1.2% for the repair of the arthroscopic rotator cuff, and 0.5% for the repair of the bunion.

The lower cost of treatment at ambulatory surgery centers (ASC)s compared to the HOPDs and the reduction of the duration of the procedure is expected to boost the market growth. ASCs are substantially faster and are preferred for low-acuity surgeries. As per an article published by International Association for Ambulatory Surgery in 2019, on average, ASCs require around 31.8 fewer minutes to operate on a patient compared to hospital-based outpatient departments.

The preference of orthopedic companies is growing toward the ASCs and many spine and orthopedic device manufacturers have partnered or are developing strategies to partner with ASCs to support and advance the mode of treatment. Companies including Smith+Nephew, Stryker, and Exactech are developing their service lines focused on ASCs and enhancing their technologies to support the performance of ASCs. For instance, in February 2020, Smith+Nephew launched a program dedicated to ASCs for the advancements of outpatient surgery programs. Moreover, the company has launched Positive Connections, an ASC division that aids customers in fulfilling their goals within ASC settings.

The COVID-19 pandemic has significantly impacted the orthopedic ASCs market during the initial period, owing to the postponement of nonurgent orthopedic surgeries and the decline in patient volumes due to stringent guidelines. Post-pandemic patients are shifting from hospital settings to outpatient settings for the treatment of orthopedic conditions, contributing to market growth. Moreover, hospitals are shifting toward acquiring ASCs post-pandemic owing to the shift in patient preference for ASCs due to the fear of exposure to COVID-19 in hospitals. For instance, in November 2021, Tenet Healthcare Corporation and United Surgical Partners International (USPI), its subsidiary, entered into a definitive agreement to acquire 92 ASCs owned by SurgCenter Development (SCD).

Procedure Insights

Based on procedure, the U.S. orthopedic ASC market has been segmented into ACL reconstruction, knee replacement, hip replacement, shoulder replacement, arthroscopy, foot & ankle, fracture repair, and others. The fracture repair segment accounted for the largest market share of 37.8% in 2022. This can be attributed to the growing cases of fractures in the U.S. and the low cost of treatment for fracture repairs in Ambulatory Surgery Centers (ASCs) compared to Hospital-based Outpatient Departments (HOPDs). Hence, fracture repair is shifting from hospital settings to orthopedic ASCs. As per the article published in ScienceDirect in 2019, around 6.3 million fractures occur in the U.S. and are treated each year.

Moreover, ankle fractures are the most common injuries in the U.S., accounting for around 10% of the total fractures annually in the country. As per the article published in the Sage journal in October 2022, the outpatient ankle fracture repair performed at ASCs cost around USD 12,315 compared to USD 35,944 in HOPDs and around USD 96,697 in hospital inpatient settings.

The knee replacement segment is expected to witness the fastest growth during the forecast period, owing to the migration of knee replacement patients from inpatient hospital settings to cost-effective ASCs & HOPDs. Other factors driving this segment are the changing reimbursement scenario for knee replacement surgeries in the U.S., focusing more on orthopedic ASCs.

The CMS payment updates shifted joint replacements toward ASC and outpatient settings, and studies demonstrated that the procedure can be performed safely in ASCs. There are more than 500 ASCs in the U.S. that perform total joint replacements, and there are 50 ASC facilities in California. With 42 ASC-equipped institutions, Florida is in 2nd place, followed by Maryland and Texas, each of which has 32 facilities capable of performing total joint replacements.

Some of the prominent players in the U.S. orthopedic ambulatory surgery center Market include:

- Spectrum Orthopedics

- Academy Orthopedics L.L.C.

- Upstate Orthopedics Ambulatory Surgery Center

- Washington Orthopedic Center

- Southern California Orthopedic Institute

- ProOrtho

- Texas Health Orthopedic Surgery Center

- Columbia Orthopedic Surgery Center

- Chatham Orthopedic Surgery Center

- The Orthopedic Surgery Center Of Arizona

- HealthPartners

- Specialty Orthopedics

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. orthopedic ambulatory surgery center market.

By Procedure

- Fracture Repair

- ACL Reconstruction

- Knee Replacement

- Hip Replacement

- Shoulder Replacement

- Arthroscopy

- Foot & Ankle

- Others