U.S. Orthopedic Spine Navigation Systems Market Size and Trends 2026 to 2035

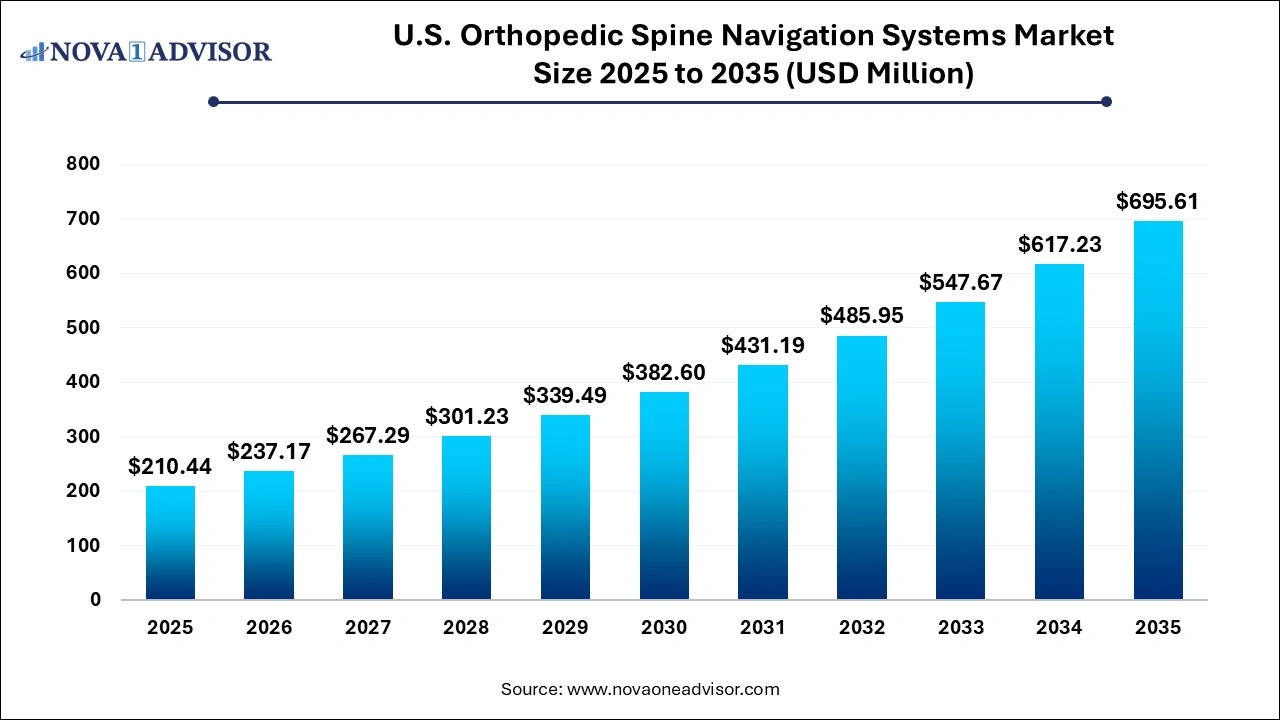

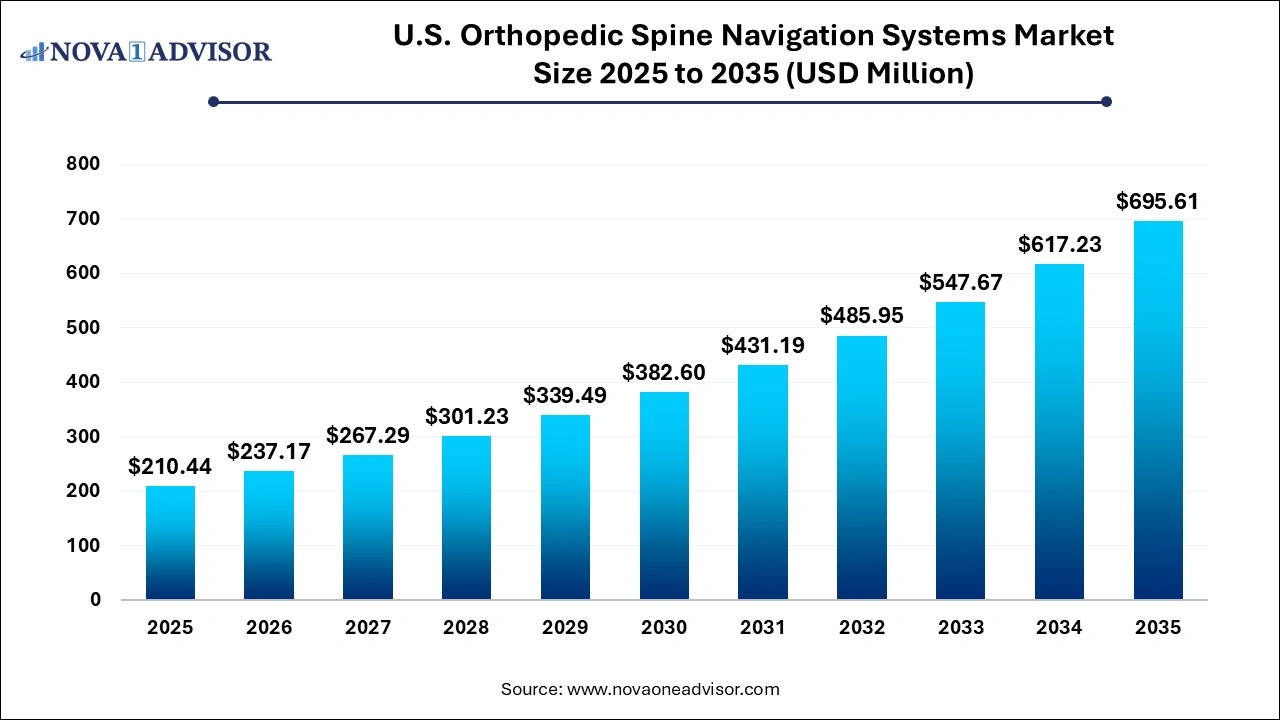

The U.S. orthopedic spine navigation systems market size was exhibited at USD 210.44 million in 2025 and is projected to hit around USD 695.61 million by 2035, growing at a CAGR of 12.7% during the forecast period 2026 to 2035.

Key Takeaways:

- The optical segment held the largest revenue share of 40.1% in 2025.

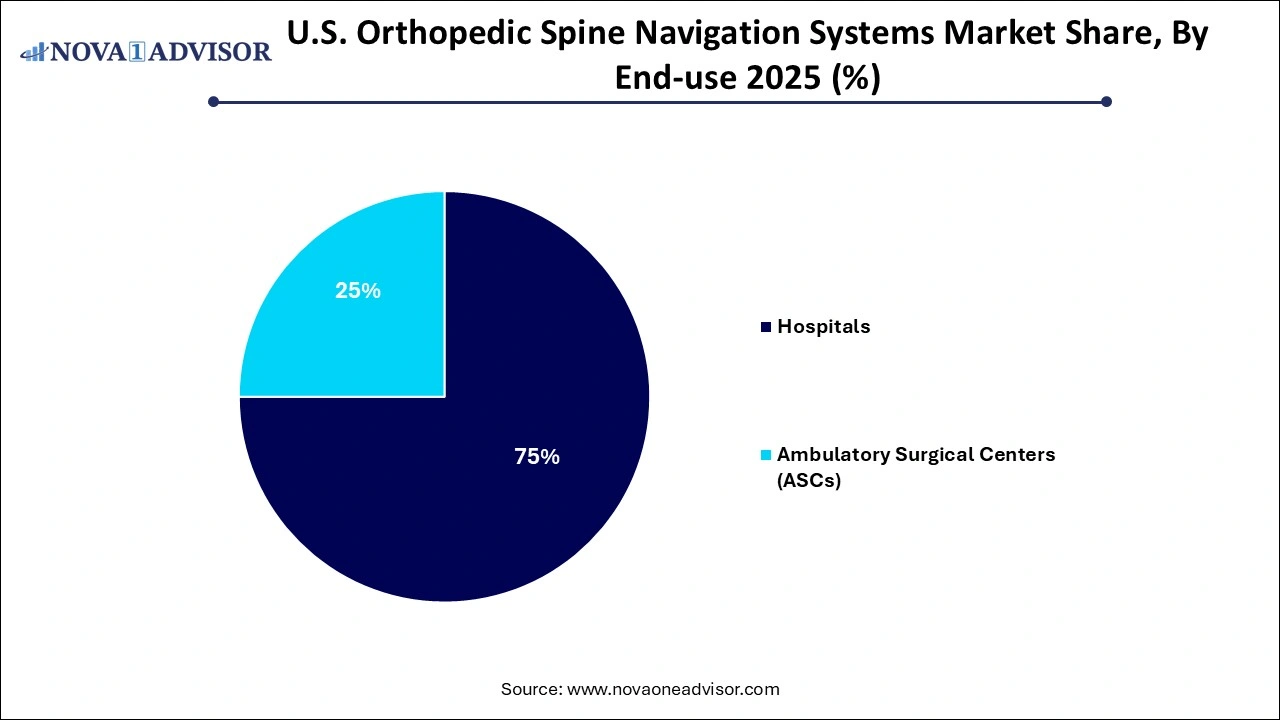

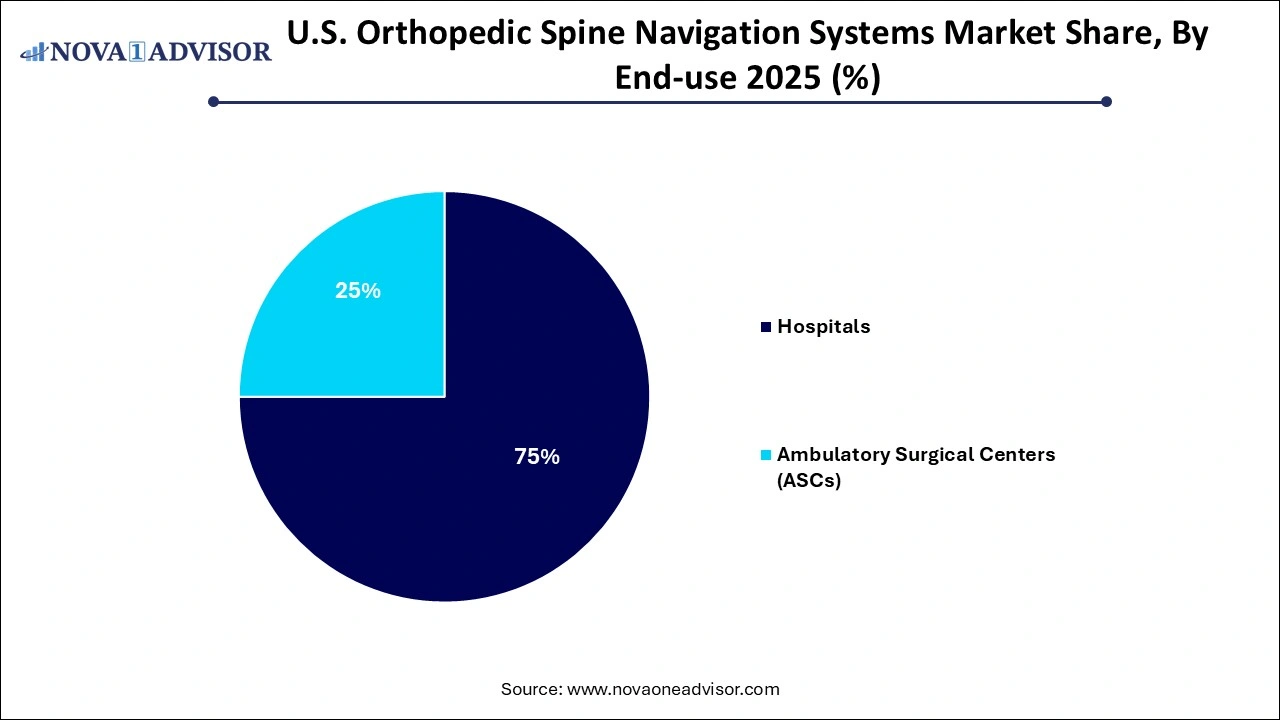

- The hospital segment held the largest share of 75% in 2025.

- The ASCs segment is projected to grow at the fastest CAGR of 13.6% over the forecast period.

U.S. Orthopedic Spine Navigation Systems Market Overview

The U.S. orthopedic spine navigation systems market is undergoing a significant transformation, driven by the convergence of advanced imaging technology, robotics, and surgical precision. As spinal disorders and surgical interventions become increasingly prevalent in the aging population, the demand for real-time, image-guided surgical systems has grown rapidly. Spine navigation systems allow surgeons to plan and execute complex procedures with greater confidence and accuracy, enhancing both patient outcomes and operational efficiency.

These systems serve as GPS-like tools in the operating room, helping surgeons accurately visualize the anatomy of the spine during procedures such as spinal fusion, scoliosis correction, tumor resection, and trauma repair. Navigation systems reduce reliance on fluoroscopy, thereby minimizing radiation exposure to both patients and staff, while improving implant placement and reducing revision surgeries.

The U.S. has been at the forefront of adopting orthopedic navigation solutions, owing to its advanced healthcare infrastructure, favorable reimbursement frameworks for spinal procedures, and high demand for minimally invasive surgeries (MIS). Spine surgeries often require extreme precision due to the proximity of the spinal cord and nerve roots. Navigation systems—especially when paired with intraoperative 3D imaging or robotic-assisted platforms play a crucial role in reducing intraoperative errors and enhancing the surgeon’s ability to make real-time decisions.

Spine surgeons, particularly in high-volume centers, are increasingly using navigation systems not just for complex cases but also in routine procedures to reduce variability and improve outcomes. Companies in this space are actively investing in R&D to create smaller, more user-friendly, and cost-efficient platforms. As the surgical landscape becomes more data-driven, orthopedic spine navigation systems are expected to become standard-of-care tools rather than luxury additions.

Major Trends in the U.S. Orthopedic Spine Navigation Systems Market

-

Integration of Robotics with Navigation Systems: Robotic-assisted spine surgeries are becoming more prevalent, often using navigation systems to enhance surgical precision.

-

Adoption of Minimally Invasive Spine Surgery (MISS): Surgeons are favoring MISS procedures, which are more complex and benefit significantly from real-time navigation assistance.

-

Shift Toward Image-less Navigation Solutions: New technologies are reducing the need for preoperative CT scans, using real-time intraoperative imaging and registration techniques.

-

Increased Demand for Intraoperative Imaging Integration: Systems that pair seamlessly with O-arm, C-arm, or CT imaging devices are gaining traction due to better anatomical visualization.

-

Use of Artificial Intelligence in Navigation Systems: AI is being employed to optimize surgical planning and identify anatomical landmarks automatically during procedures.

-

Surge in Outpatient Spine Surgeries: As more spine surgeries move to ambulatory surgical centers (ASCs), there's a growing interest in compact and mobile navigation systems.

-

Focus on Radiation Reduction: Navigation technology is increasingly being adopted to reduce the cumulative radiation dose during spinal procedures.

-

Training and Simulation Modules: Companies are launching simulators and virtual reality environments for training spine surgeons on navigation-assisted procedures.

Report Scope of The U.S. Orthopedic Spine Navigation Systems Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 237.17 Million |

| Market Size by 2035 |

USD 695.61 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 12.7% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

B. Braun Melsungen AG; Stryker; Medtronic; Smith+Nephew; Johnson & Johnson Services, Inc. (DePuy Synthes); Zimmer Biomet; Kinamed, Inc.; Globus Medical; OrthAlign; Novarad Corp. |

Market Driver: Rising Burden of Spinal Disorders and Degenerative Diseases

A significant driver of the U.S. orthopedic spine navigation systems market is the growing prevalence of spinal disorders, degenerative diseases, and an aging population. Conditions such as herniated discs, spinal stenosis, scoliosis, and degenerative disc disease are common among older adults. According to the National Spinal Cord Injury Statistical Center, nearly 17,000 new spinal cord injuries occur in the U.S. each year, and millions suffer from chronic back pain linked to musculoskeletal deterioration.

As the U.S. population continues to age, demand for surgical interventions particularly spinal fusions and deformity corrections is surging. These procedures are often complex, requiring precise implant placement and careful navigation around critical neurovascular structures. Spine navigation systems enhance the surgeon’s ability to conduct such interventions with greater confidence, accuracy, and safety. The growing clinical need, combined with increased awareness among both physicians and patients, is driving widespread adoption of advanced navigation platforms in the orthopedic surgery domain.

Market Restraint: High Capital Investment and Operational Complexity

Despite their benefits, spine navigation systems require substantial capital investment and entail a steep learning curve, which can deter adoption among smaller hospitals and ambulatory centers. The initial cost of acquiring a spine navigation platform including associated intraoperative imaging systems can range from several hundred thousand to over a million dollars. This is often followed by ongoing maintenance fees, software updates, and training requirements.

Additionally, integrating these systems into the operating room workflow can be challenging. Surgeons must be trained not only in technical operation but also in interpreting image data and making real-time decisions based on navigation feedback. In environments where case volume is low or surgical staff turnover is high, the financial and operational return on investment may be difficult to justify. Consequently, many facilities delay adoption despite the known clinical advantages, limiting market penetration.

Market Opportunity: Expansion in Ambulatory Surgical Centers (ASCs)

One of the most promising growth opportunities in the U.S. orthopedic spine navigation systems market lies in the expanding presence of spine procedures in ambulatory surgical center (ASCs). With rising healthcare costs and a nationwide focus on value-based care, providers and payers are shifting procedures to lower-cost outpatient settings without compromising patient safety. Innovations in anesthesia, surgical techniques, and postoperative pain management have made it possible to perform spine surgeries—such as discectomies and one-level fusions in ASCs.

This shift is prompting demand for navigation systems that are compact, mobile, and easy to integrate into outpatient workflows. Manufacturers that offer lightweight, intuitive platforms with rapid setup times are well-positioned to capture this emerging market. Moreover, as ASCs expand their capabilities, payers are becoming more receptive to reimbursing high-acuity procedures performed in these settings. With the proper navigation tools, ASCs can maintain surgical precision while offering cost-efficient alternatives to inpatient surgery—marking a major inflection point in the industry.

Segmental Insights

By Technology Insights

The optical navigation systems segment currently dominates the U.S. orthopedic spine navigation systems market, thanks to its long-standing track record of high accuracy and reliability. These systems use infrared cameras and reflective markers to provide real-time tracking of instruments and patient anatomy. Optical systems are widely adopted in academic hospitals and tertiary care centers due to their ability to maintain precision during both open and minimally invasive procedures. Many leading platforms such as Medtronic’s StealthStation or Brainlab’s Curve rely on optical tracking to deliver consistent clinical outcomes across a broad range of spinal procedures.

On the other hand, the electromagnetic (EM) navigation systems segment is expected to grow at the fastest rate, largely due to its superior performance in constrained operating environments and its ability to maintain line-of-sight independence. EM systems use magnetic field sensors embedded in instruments to determine their position relative to the patient’s anatomy, which makes them ideal for minimally invasive and endoscopic procedures. As the market shifts toward outpatient MIS procedures that require compact and non-obtrusive navigation tools, EM-based systems offer practical advantages in mobility, cost, and usability—making them increasingly appealing to ASCs and smaller hospitals.

By End-use Insights

Hospitals remain the dominant end-users of spine navigation systems in the U.S., as they house high-acuity patients, advanced imaging infrastructure, and multidisciplinary surgical teams. Large hospitals and academic centers are more likely to invest in high-end navigation platforms with robotic integration, intraoperative CT compatibility, and full-spectrum neurosurgical capabilities. These institutions benefit from economies of scale, strong vendor relationships, and access to capital equipment budgets. Furthermore, hospitals handle a majority of complex spinal deformities, trauma cases, and multi-level fusion surgeries, which necessitate precise anatomical navigation and real-time imaging.

However, ambulatory surgical centers (ASCs) are poised to be the fastest-growing segment in the coming years. Fueled by payer policies favoring outpatient care, ASCs are increasingly performing low-to-moderate complexity spinal procedures. This trend is creating demand for smaller, more intuitive, and cost-effective navigation platforms tailored to the ASC workflow. Innovations such as portable C-arm-compatible navigation systems and integrated navigation carts are making it easier for ASCs to adopt this technology without the need for massive infrastructure upgrades. Companies that focus on affordability, ease of training, and rapid ROI will likely dominate this growing segment.

However, ambulatory surgical centers (ASCs) are poised to be the fastest-growing segment in the coming years. Fueled by payer policies favoring outpatient care, ASCs are increasingly performing low-to-moderate complexity spinal procedures. This trend is creating demand for smaller, more intuitive, and cost-effective navigation platforms tailored to the ASC workflow. Innovations such as portable C-arm-compatible navigation systems and integrated navigation carts are making it easier for ASCs to adopt this technology without the need for massive infrastructure upgrades. Companies that focus on affordability, ease of training, and rapid ROI will likely dominate this growing segment.

Country-Level Insights United States

In the U.S., the orthopedic spine navigation systems market is shaped by technological leadership, policy evolution, and reimbursement frameworks. The country’s robust medical technology ecosystem led by global players and medtech startups—has fostered rapid innovation in image-guided surgery. The Food and Drug Administration (FDA) has played a pivotal role by streamlining approval processes for navigation software and hardware through the 510(k) pathway, enabling faster commercialization.

Reimbursement is a key enabler, particularly for spinal fusions, tumor resections, and deformity corrections, which are often covered under Medicare and private insurance plans. CMS has introduced DRG-based payment systems that incentivize improved outcomes and shorter hospital stays two areas where navigation systems offer measurable impact. Furthermore, payer and provider networks are actively exploring bundled payment models for spine care, where intraoperative efficiency and precision become critical.

Academic institutions and training centers are also actively integrating navigation systems into residency programs, ensuring the next generation of spine surgeons is well-versed in their use. Additionally, the U.S. is witnessing the convergence of navigation with AI, robotics, and digital health platforms creating a synergistic environment for continuous innovation. Federal and private investments into minimally invasive surgery and outpatient care models further solidify the U.S. as a global leader in orthopedic navigation adoption.

Some of the prominent players in the U.S. orthopedic spine navigation systems market include:

Recent Developments

-

April 2024 – Medtronic Receives FDA Clearance for StealthStation S9: Medtronic launched an upgraded version of its flagship navigation system, featuring AI-assisted planning tools and seamless robotic integration for use in complex spine surgeries.

-

March 2024 – Brainlab Unveils Mobile Navigation Suite for ASCs: Brainlab introduced a portable navigation platform designed for outpatient settings, with real-time 3D imaging and wireless instrument tracking.

-

February 2024 – Globus Medical Expands Navigation-Robotic Ecosystem: Globus Medical announced a new software update to its ExcelsiusGPS system, improving workflow between imaging, navigation, and robotic positioning in spine surgeries.

-

January 2024 – NuVasive Announces Collaboration with Siemens Healthineers: NuVasive entered into a strategic partnership to integrate its Pulse platform with Siemens’ intraoperative imaging technologies, enhancing navigation-assisted surgical planning.

-

December 2023 – Stryker Acquires Mobius Imaging: Stryker completed its acquisition of Mobius Imaging to strengthen its spine surgery portfolio, integrating real-time imaging with its existing navigation and robotic systems.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. orthopedic spine navigation systems market

Technology

- Optical

- Electromagnetic

- Others

End-use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

However, ambulatory surgical centers (ASCs) are poised to be the fastest-growing segment in the coming years. Fueled by payer policies favoring outpatient care, ASCs are increasingly performing low-to-moderate complexity spinal procedures. This trend is creating demand for smaller, more intuitive, and cost-effective navigation platforms tailored to the ASC workflow. Innovations such as portable C-arm-compatible navigation systems and integrated navigation carts are making it easier for ASCs to adopt this technology without the need for massive infrastructure upgrades. Companies that focus on affordability, ease of training, and rapid ROI will likely dominate this growing segment.

However, ambulatory surgical centers (ASCs) are poised to be the fastest-growing segment in the coming years. Fueled by payer policies favoring outpatient care, ASCs are increasingly performing low-to-moderate complexity spinal procedures. This trend is creating demand for smaller, more intuitive, and cost-effective navigation platforms tailored to the ASC workflow. Innovations such as portable C-arm-compatible navigation systems and integrated navigation carts are making it easier for ASCs to adopt this technology without the need for massive infrastructure upgrades. Companies that focus on affordability, ease of training, and rapid ROI will likely dominate this growing segment.