U.S. Osteoarthritis Injectables Market Size and Trends

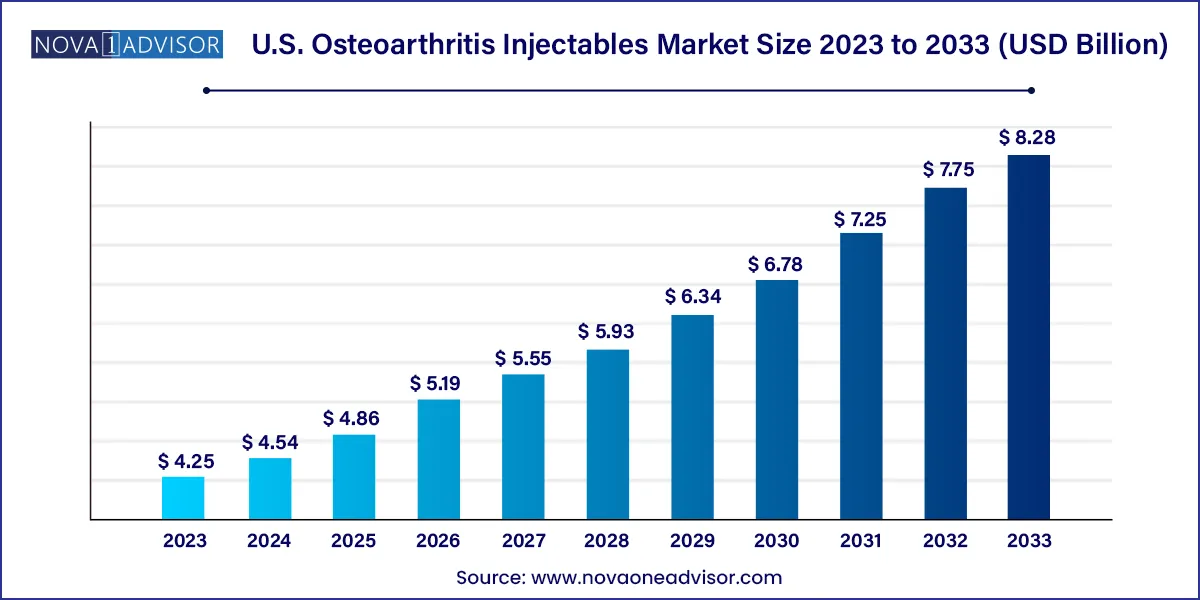

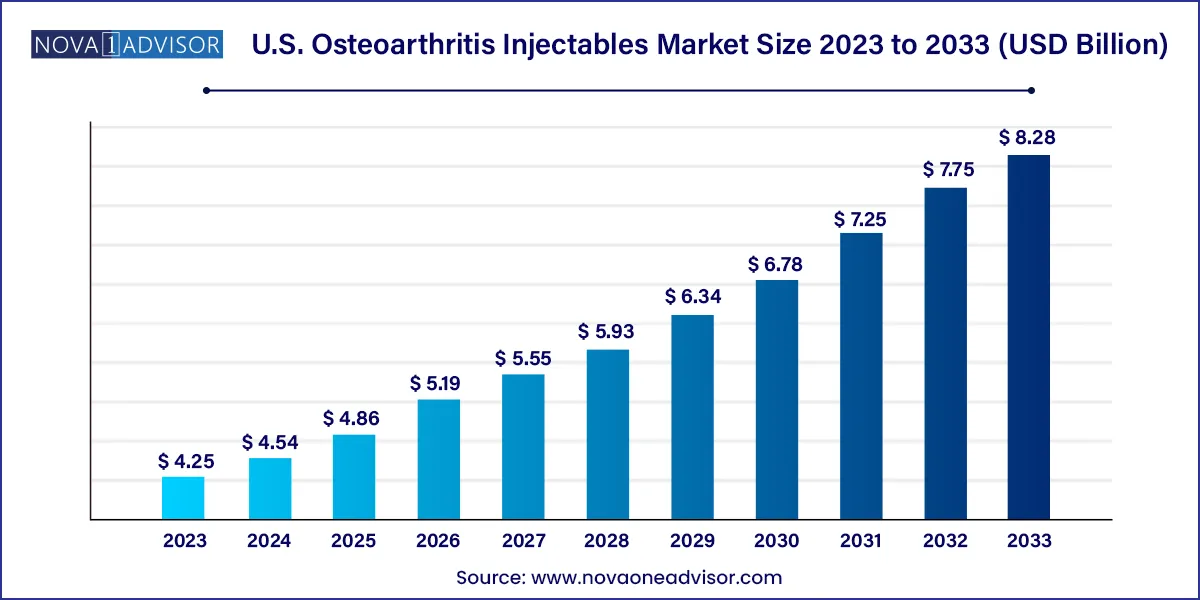

The U.S. osteoarthritis injectables market size was estimated at USD 4.25 billion in 2023 and is expected to be worth around USD 8.28 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 6.9% during the forecast period 2024 to 2033.

U.S. Osteoarthritis Injectables Market Key Takeaways

- Hyaluronic Acid (HA) injections segment dominated the U.S. osteoarthritis injectables market, accounting for a share of 38.17% in 2023.

- The corticosteroid injections segment is anticipated to witness a lucrative market growth over the forecast period.

- Knee osteoarthritis segment dominated the market, accounting for a share of 42.19% in 2023.

- The hip osteoarthritis segment is anticipated to witness a significant CAGR over the forecast period.

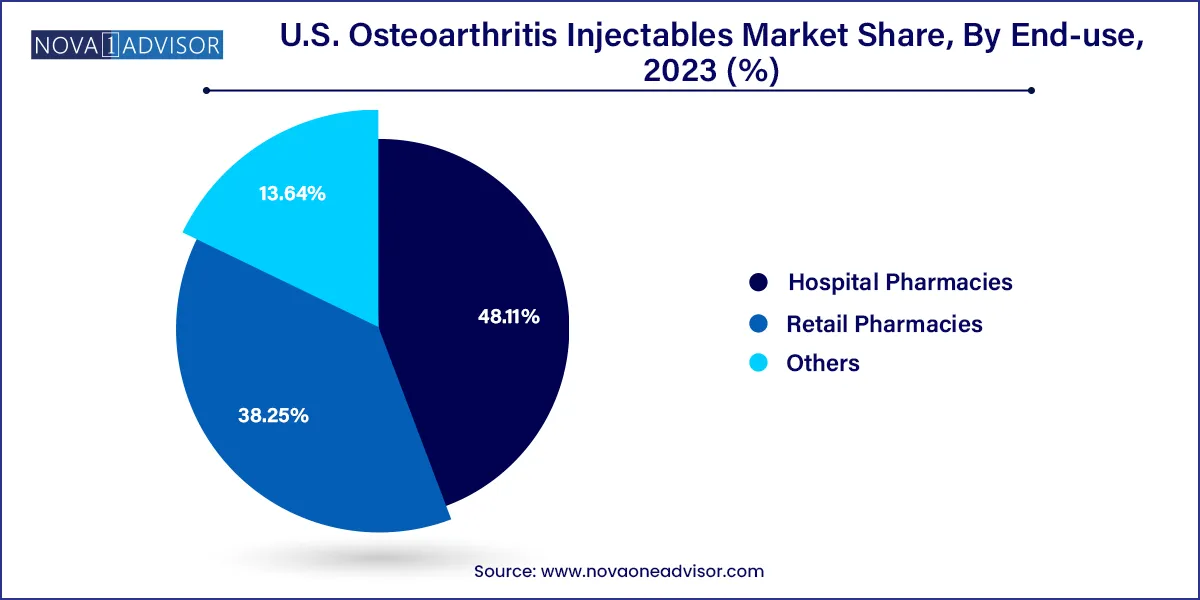

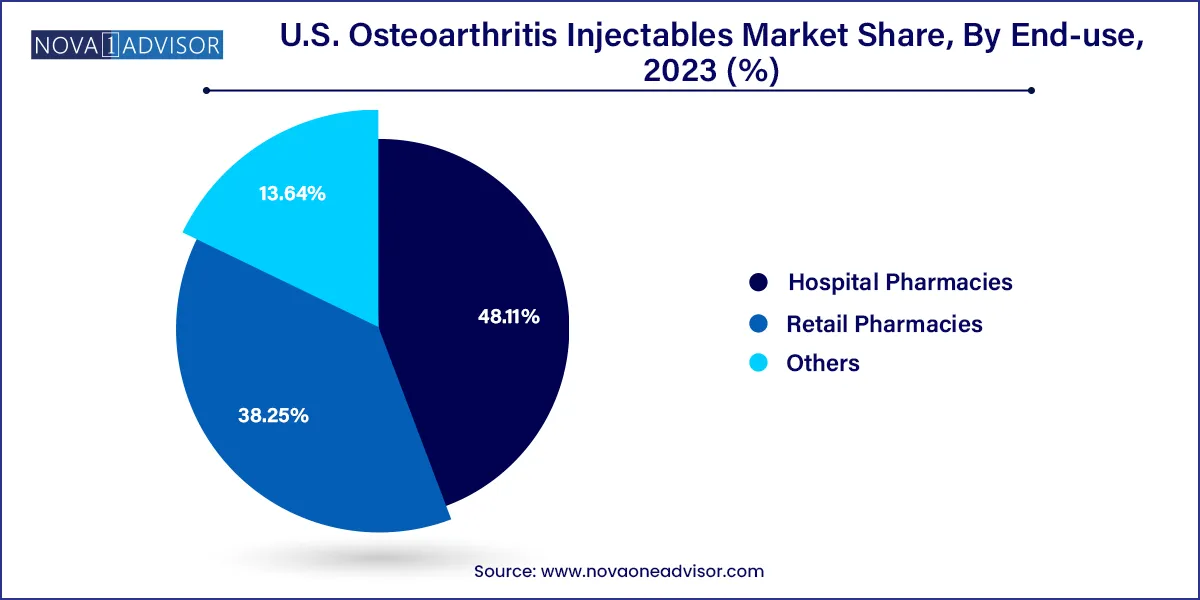

- Hospital pharmacies segment dominated the market with a share of 48.11% in 2023.

- The retail pharmacies segment is anticipated to witness the fastest CAGR over the forecast period.

Market Overview

The U.S. osteoarthritis injectables market is rapidly evolving as an essential component in the treatment of osteoarthritis (OA) a degenerative joint disease affecting millions of Americans. OA is the most common form of arthritis and a major cause of disability in older adults. It is characterized by the gradual degradation of joint cartilage, resulting in pain, stiffness, decreased mobility, and reduced quality of life. As traditional oral medications often fall short in managing pain effectively over the long term and may lead to gastrointestinal complications, injectable therapies have emerged as a more targeted and potent alternative.

Intra-articular (IA) injectables are increasingly being used to manage symptoms and delay the need for joint replacement surgeries. These treatments deliver medications directly into the affected joint, providing localized relief while minimizing systemic side effects. The U.S. market is experiencing growing demand for hyaluronic acid (HA), corticosteroids, platelet-rich plasma (PRP), and other advanced injectable therapies due to their effectiveness in reducing inflammation, improving lubrication, and stimulating tissue regeneration.

The aging population, growing obesity rates, and increasing physical inactivity across the U.S. contribute to the rising incidence of OA. According to the Centers for Disease Control and Prevention (CDC), over 32.5 million U.S. adults were diagnosed with osteoarthritis in 2023. This number is projected to grow significantly due to demographic shifts and lifestyle factors.

The osteoarthritis injectables market is further driven by innovations in regenerative medicine and biologics, increased awareness among patients and physicians, and favorable reimbursement structures for certain IA injections. As minimally invasive outpatient treatments continue to be preferred over surgical options, injectables are becoming a mainstay in both conservative management and pre-surgical protocols.

Major Trends in the Market

-

Rising Adoption of Regenerative Medicine: PRP and PTM injections are gaining momentum due to their potential for tissue healing and disease modification.

-

Shift Toward Viscosupplementation: HA injections remain popular for knee OA and are now being evaluated for hip and small joint use.

-

Increased Utilization in Younger Populations: Athletes and younger patients with early OA symptoms are seeking injectables to delay surgical intervention.

-

Technological Innovations in Delivery Systems: New precision-guided injection devices and ultrasound-assisted delivery systems are improving efficacy.

-

Growth of Outpatient Clinics and Orthopedic Specialties: More injections are being administered in ambulatory centers, driven by lower costs and quicker recovery.

-

Combination Therapies and Multi-ingredient Formulas: Emerging products are integrating HA with corticosteroids or PRP for enhanced therapeutic effects.

-

Expansion of Biologics and Allograft-based Therapies: Placental tissue and stem cell-based injectables are gaining traction despite regulatory challenges.

-

Greater Patient Awareness and Direct-to-Consumer Campaigns: Companies are investing in educating patients on the benefits of IA injections.

-

Reimbursement Adjustments and Insurance Coverage Evolution: Payers are starting to recognize the long-term value of injectables in managing chronic OA.

-

Clinical Trials for OA Beyond the Knee: Companies are exploring injectables for hip and hand OA, addressing a broader market need.

U.S. Osteoarthritis Injectables Market Report Scope

Market Driver: Aging Population and Rising Osteoarthritis Prevalence

A primary driver of the U.S. osteoarthritis injectables market is the surging prevalence of osteoarthritis fueled by the aging American population. With the baby boomer generation entering older adulthood, the number of individuals experiencing joint degeneration is on the rise. The CDC estimates that by 2040, nearly 78 million U.S. adults will be diagnosed with arthritis, with osteoarthritis accounting for the majority of cases.

Elderly patients are more susceptible to cartilage degradation due to wear and tear over time. Many of them are unfit or unwilling to undergo invasive procedures like total knee or hip replacements, making intra-articular injections a favorable alternative for symptom control. These injectables not only relieve pain but also improve joint function and delay the need for surgical intervention, making them a critical solution in geriatric care.

Moreover, with increased life expectancy and a desire among seniors to remain active, the demand for non-surgical, functional joint support solutions such as injectables is growing steadily. This demographic factor serves as a foundational growth pillar for the U.S. market.

Market Restraint: Regulatory Challenges and Inconsistent Clinical Outcomes

One of the most notable restraints in the market is the regulatory uncertainty surrounding novel injectable therapies and inconsistent clinical efficacy across patient populations. While hyaluronic acid and corticosteroid injections have well-established FDA approval and usage protocols, newer therapies like PRP, PTM, and stem cell-based injectables often fall into gray regulatory zones, being categorized as experimental or investigational.

For instance, PRP injections are not universally covered by insurance due to mixed results in clinical trials and variability in preparation methods. Similarly, PTM injectables, although promising, are still undergoing evaluation for safety and efficacy. This lack of standardized protocols and regulatory oversight slows widespread adoption and hinders reimbursement.

Further, some patients do not respond well to certain injectables, especially in advanced stages of OA, leading to skepticism among providers. Until larger, randomized clinical trials provide definitive evidence and FDA offers clearer guidance, uptake of newer injectables may remain cautious and limited.

Market Opportunity: Expansion of Injections Beyond the Knee

A major untapped opportunity in the U.S. osteoarthritis injectables market is the expansion of treatments for osteoarthritis beyond the knee, especially in the hip and hand joints. While HA and corticosteroid injections are widely used for knee OA, there remains a significant unmet need in treating pain and functional impairment in other joints affected by OA.

Hip OA affects millions of Americans but is more challenging to manage due to anatomical depth and limited injectable approvals. Hand OA, especially in older women, often goes underdiagnosed and undertreated. As imaging techniques improve and new injection delivery systems emerge, administering IA injections in smaller or deeper joints becomes more feasible.

Several companies are investing in clinical trials for viscosupplementation and PRP injections targeting the hip and small joints. Successful expansion into these segments could dramatically broaden the addressable market, offering new revenue streams for manufacturers and better symptom relief for patients.

U.S. Osteoarthritis Injectables Market By Injection Type Insights

Hyaluronic Acid (HA) injections dominate the market, primarily due to their longstanding usage, safety profile, and effectiveness in providing pain relief and improved joint lubrication. Viscosupplementation with HA is especially popular for knee OA, and several formulations (single, dual, or multi-injection regimens) are approved by the FDA. Products like Synvisc-One and Euflexxa are well-established in orthopedic and rheumatology practices. HA injections are often preferred for patients who do not respond well to NSAIDs or who want to avoid corticosteroids due to systemic side effects.

Meanwhile, Platelet-rich Plasma (PRP) injections are the fastest-growing segment, owing to the increasing popularity of regenerative medicine and minimally invasive biologic approaches. PRP harnesses the patient’s own platelets to deliver growth factors that promote healing and reduce inflammation. Despite limited reimbursement and variable efficacy, PRP adoption is rising in sports medicine and among younger OA patients seeking to delay surgery. Ongoing research and improved PRP preparation techniques are expected to enhance outcomes and drive broader adoption in clinical settings.

U.S. Osteoarthritis Injectables Market By Anatomy Insights

Knee osteoarthritis is the most dominant segment due to its high prevalence and well-established treatment protocols for IA injections. The knee joint bears significant weight and is susceptible to wear, especially in older adults and those with a history of athletic injuries or obesity. As a result, it is the most common target for HA, corticosteroid, and PRP injections. The effectiveness of injectables in reducing knee OA symptoms is well-documented, leading to routine use in outpatient clinics and orthopedic settings.

In contrast, hip osteoarthritis is the fastest-growing segment, as improved injection techniques and ultrasound guidance have made it more accessible. The hip joint, previously considered difficult to access for IA therapy, is now being treated more regularly thanks to advances in interventional radiology and image-guided administration. With growing recognition of the burden of hip OA and limited surgical options for older or high-risk patients, demand for injectable treatments is expected to rise sharply in the coming years.

U.S. Osteoarthritis Injectables Market By End-use Insights

Hospital pharmacies remain the dominant end-use segment, largely because injections are commonly administered during outpatient visits within hospital-affiliated orthopedic or rheumatology clinics. Hospitals also benefit from bulk purchasing agreements and well-established supply chains for HA and corticosteroid injections. These institutions often serve as referral centers for patients requiring image-guided or specialty injection procedures.

Retail pharmacies and specialty clinics are emerging as the fastest-growing distribution channel, driven by patient demand for convenience and growing availability of injectables through independent practitioners. Many orthopedic and sports medicine centers now operate outside hospital systems, administering injections in ambulatory settings. Additionally, as more injectables receive FDA approval for home administration, retail pharmacies may begin playing a larger role in distribution and patient education.

Country-Level Analysis

The United States is the global leader in osteoarthritis injectable treatments, owing to its robust healthcare infrastructure, high OA prevalence, and early adoption of regenerative medicine technologies. American patients benefit from widespread access to orthopedic and sports medicine clinics, a large number of skilled practitioners trained in IA injection techniques, and relatively high insurance coverage for certain injectable therapies.

Regulatory agencies such as the FDA have approved multiple HA and corticosteroid formulations, creating a mature and regulated ecosystem for treatment delivery. Moreover, academic centers and private institutions across the U.S. are conducting clinical trials exploring novel injectable options, from stem cell-based products to hyaluronic acid hybrids. These trials will likely influence reimbursement trends and shape clinical guidelines in the near future.

Cities like New York, Los Angeles, and Chicago host some of the country’s most advanced joint preservation and pain management clinics, where injectable therapies are a core offering. Meanwhile, healthcare providers in smaller cities and suburban areas are increasingly incorporating injectables into primary care or urgent care models to address OA-related complaints—demonstrating nationwide market penetration.

U.S. Osteoarthritis Injectables Market Recent Developments

-

March 2025: Bioventus Inc. announced interim results from its clinical trial evaluating a next-generation single-injection HA product for both knee and hip OA, showing promising efficacy and safety profiles.

-

February 2025: Anika Therapeutics launched a new FDA-approved hybrid viscosupplement designed to deliver both pain relief and cartilage protection, offering an alternative to corticosteroids.

-

January 2025: Zimmer Biomet received regulatory clearance for its novel ultrasound-guided HA delivery device, enhancing precision and reducing procedure time for clinicians.

-

December 2024: CartiHeal announced plans to begin U.S. trials for its allograft-derived injectable cartilage regeneration product, targeting early-stage OA patients.

-

November 2024: Regenexx, a pioneer in biologic injections for orthopedic conditions, expanded its network of clinics offering PRP and PTM injections across 15 additional U.S. states.

U.S. Osteoarthritis Injectables Market Top Key Companies:

- Anika Therapeutics, Inc.

- Bioventus.

- Ferring Pharmaceuticals Inc.

- Sanofi S.A.

- Flexion Therapeutics, Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Royal Biologics

- Teva Pharmaceutical Industries Ltd.

U.S. Osteoarthritis Injectables Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Osteoarthritis Injectables market.

By Injection Type

- Hyaluronic Acid Injections

- Corticosteroid Injections

- Platelet-rich Plasma (PRP) Injections

- Placental Tissue Matrix (PTM) Injections

- Acetylsalicylic Acid (ASA) Injections

- Others

By Anatomy

- Knee Osteoarthritis

- Hip Osteoarthritis

- Hand Osteoarthritis

- Others

By End-use

- Hospital Pharmacies

- Retail Pharmacies

- Others