U.S. Over the Counter (OTC) Drugs Market Size and Top Companies

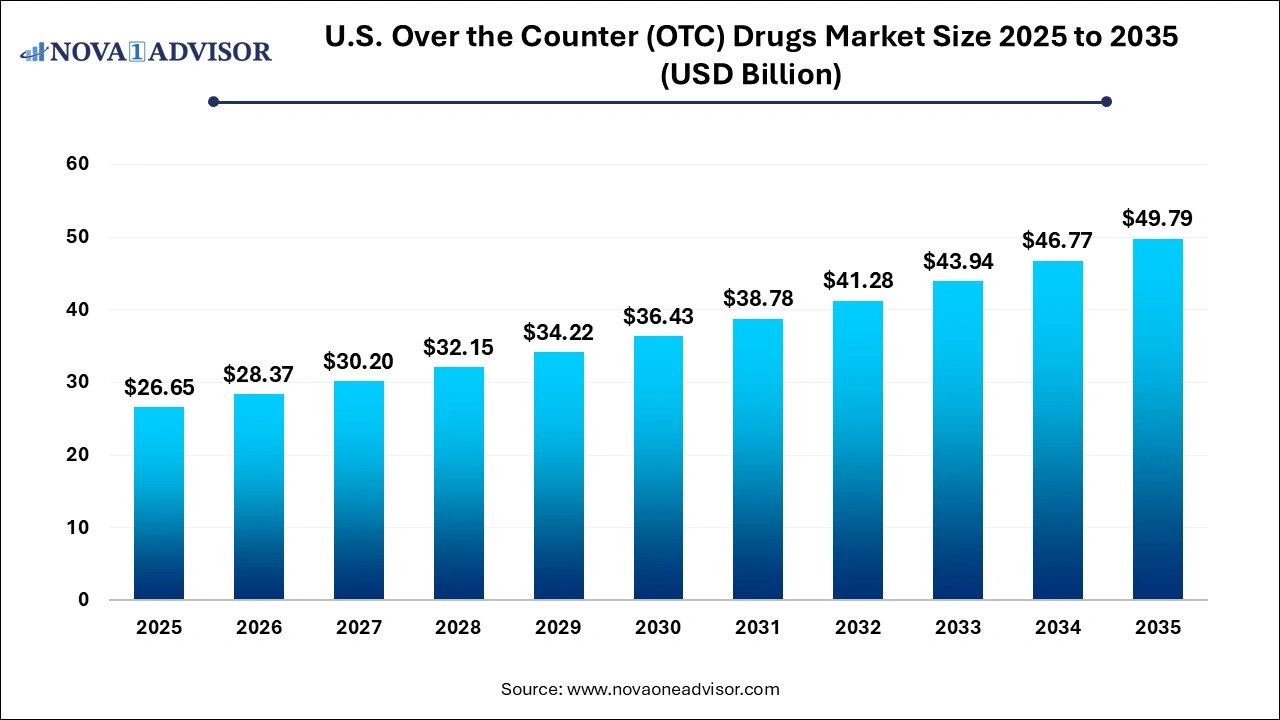

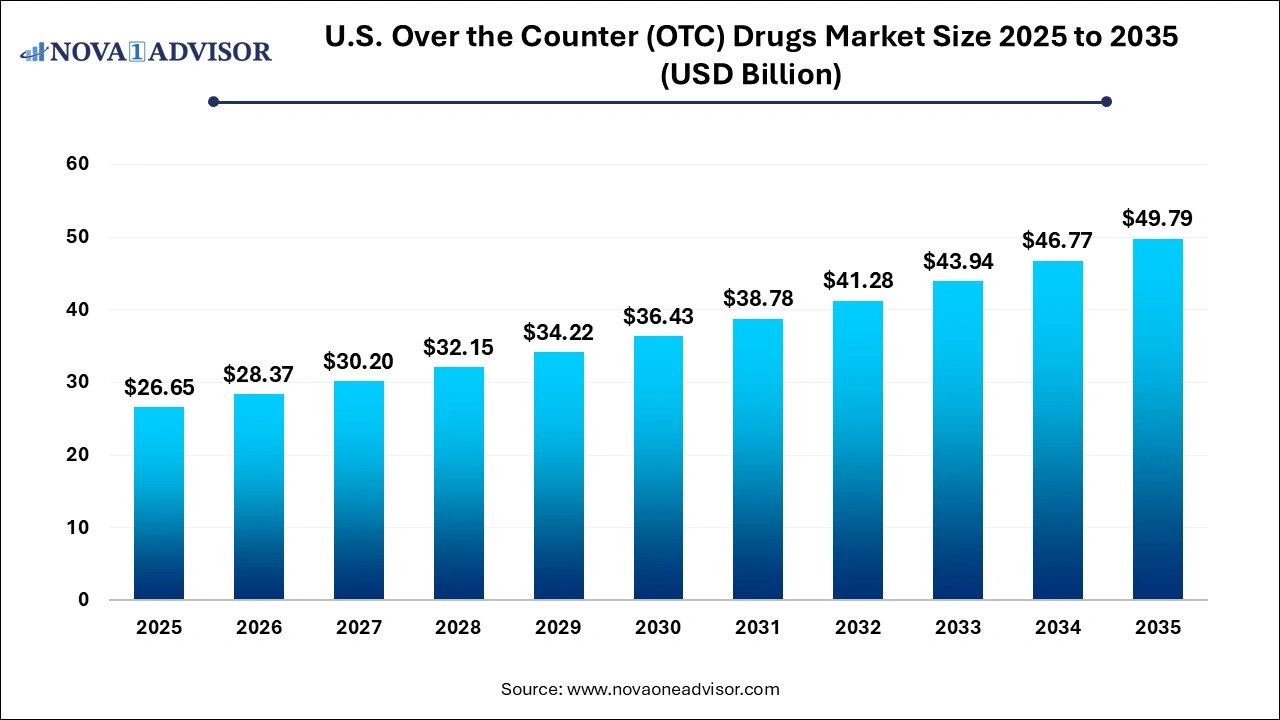

The U.S. over the counter (OTC) drugs market size was estimated at USD 26.65 billion in 2025 and is expected to be worth around USD 49.79 billion by 2035, poised to grow at a compound annual growth rate (CAGR) of 6.45% during the forecast period 2026 to 2035.

U.S. Over the Counter (OTC) Drugs Market Key Takeaways

- By product type, the cough & cold products segment held the largest share of the market in 2025, the segment is observed to witness a notable growth during the forecast period.

- By dosage form, the tablets segment dominated the market with the largest share in 2025.

- By route of administration, the oral segment held the largest share of the market and is expected to sustain the position throughout the forecast period.

- By distribution channel, the drug stores & retail pharmacies segment dominated the U.S. over the counter (OTC) drugs market in 2025.

U.S. Over the Counter (OTC) Drugs Market Overview

The U.S. Over-the-Counter (OTC) drugs market is a significant segment of the pharmaceutical industry, characterized by non-prescription medications available directly to consumers without a doctor's prescription. This market encompasses a wide range of products, including pain relievers, cold and flu remedies, digestive aids, allergy medications, and skincare treatments, among others. The market's growth is fueled by various factors, including the increasing trend of self-medication, driven by consumers' desire for convenience and accessibility. Moreover, the rising prevalence of minor ailments and conditions, coupled with the expanding aging population and growing awareness of preventive healthcare, contribute to the market's expansion. Technological advancements and innovations in formulation techniques also play a crucial role in enhancing the efficacy and safety of OTC drugs, further driving market growth. Regulatory initiatives aimed at streamlining the approval process for OTC drugs contribute to market dynamics by fostering product innovation and market competitiveness. Overall, the U.S. OTC drugs market is poised for continued growth, driven by evolving consumer preferences, demographic trends, and regulatory developments.

U.S. Over the Counter (OTC) Drugs Market Growth Factors

The growth of the U.S. Over the Counter (OTC) drugs market can be attributed to several key factors. Firstly, the increasing prevalence of minor ailments and conditions, coupled with rising consumer awareness about self-medication, has driven demand for OTC drugs. Additionally, the convenience and accessibility offered by OTC drugs, without the need for a prescription, have contributed to their popularity among consumers. Moreover, advancements in technology and formulation techniques have led to the development of more effective and safer OTC drug products, further fueling market growth. Furthermore, the expanding aging population in the United States, along with a growing focus on preventive healthcare, has stimulated demand for OTC drugs aimed at managing chronic conditions and promoting overall wellness. These factors, combined with regulatory initiatives aimed at streamlining the OTC drug approval process, are expected to continue driving growth in the U.S. OTC drugs market in the foreseeable future.

U.S. Over the Counter (OTC) Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 28.37 Billion |

| Market Size by 2035 |

USD 49.79 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.45% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product Type, By Dosage Form, By Route of Administration, and By Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Bayer AG, Takeda Pharmaceutical Company Ltd., Pfizer, Johnson & Johnson Services Inc., Sanofi S.A., Novartis AG, Boehringer Ingelheim International GmbH, GlaxoSmithKline PLC, Mylan, UPM Pharmaceuticals, and Others. |

U.S. Over the Counter (OTC) Drugs Market Dynamics

Driver: Increasing prevalence of various disease

Acute and chronic illnesses such as respiratory, neurological, orthopedic, and cardiovascular conditions are becoming more prevalent in the US. Every year in the US, heart failure is diagnosed in over 550,000 persons. The Centers for Disease Control and Prevention (CDC) estimate that every year, over 790,000 Americans suffer from a heart attack; of them, about 580,000 experience their first heart attack and 210,000 experience their second. Diabetes, hypertension, tobacco use, obesity, and other risk factors are making chronic cardiac, neurological, and orthopedic illnesses more common.

As the prevalence of chronic illnesses has increased, so has the usage of medications as people look for easy and efficient ways to manage their conditions. For instance, aspirin is frequently used in people with a history of heart disease or who are at high risk of developing heart disease to prevent heart attacks, strokes, and other cardiovascular disorders. In the same way, acetaminophen and ibuprofen are frequently used to lessen pain and inflammation brought on by ailments including headaches, chronic pain in the back, and arthritis. Thus, the increasing prevalence of various diseases drives the U.S. over the counter (OTC) drugs market.

Restraint: Safety concerns and regulatory challenge

OTC medications are typically regarded as safe when used as prescribed, however, abuse or overuse of them may raise safety issues. Making sure that products are safe for consumers is a continuous problem since certain components may have negative effects or interact with other treatments.

Furthermore, the market for over the counter drugs is governed by rules, and modifications to these regulations may affect the accessibility and promotion of certain OTC drugs. Regulatory obstacles may impact the status of already-approved OTC medications or delay the launch of new ones. Therefore, safety concerns and regulatory challenges might be a major impeding factor to the U.S. over the counter (OTC) drugs market's growth.

Opportunity: Growing approvals

The increasing approvals in the industry are expected to offer an attractive opportunity for market growth during the forecast period. For instance, in August 2023, the U.S. Food and Drug Administration (FDA) authorized ZURZUVAETM (zuranolone) 50 mg for people with postpartum depression (PPD), according to a statement from Biogen Inc. and Sage Therapeutics, Inc. For women with PPD, ZURZUVAE is the first and only oral, once-daily, 14-day medication that can significantly reduce depression symptoms.

Furthermore, a Complete Response Letter (CRL) was released by the FDA about the New Drug Application (NDA) for zuranolone, which is intended to treat the major depressive disorder (MDD) in adults. The CRL declared that further research or studies would be required since the application did not offer sufficient proof of efficacy to justify the approval of zuranolone for the treatment of MDD. Sage and Biogen are analyzing the comments and planning the next phase of action.

U.S. Over the Counter (OTC) Drugs Market By Product Type Insights

The cough & cold products segment held the largest share of the U.S. over the counter (OTC) drugs market in 2023. A wide variety of viruses can cause the common cold. The illness is usually harmless, and symptoms go away in two weeks on average. The growth in over the counter (OTC) medicine use in this category can be attributed to the rise in the number of persons who are afflicted with cough, cold, and flu. As a last option, consumers rely on over-the-counter medications for cough, cold, or flu symptoms.

- For instance, the CDC reports that the common cold results in 22 million lost school days annually in the US. In addition, about 1 billion Americans have colds annually.

The tablets segment held the largest share of the U.S. over the counter (OTC) drugs market in 2023. Over the counter tablets are available in a wide range of therapeutic areas, such as digestive health, allergy relief, cold and flu treatment, pain management, and more. To treat various ailments, tablets may contain a single active ingredient or a mixture of active compounds. Additionally, customers frequently choose tablets for self-medication since they are a practical and simple dosing type. They may be taken without water in some situations due to their discreet and portable design, which makes them popular.

U.S. Over the Counter (OTC) Drugs Market By Route of Administration Insights

The oral segment held the dominating share of the market in 2025. The segment is observed to sustain the position in the upcoming period. Oral drugs provide a convenient method of medication delivery, allowing patients to take their medication at home or on the go without the need for medical supervision. This convenience promotes better adherence to treatment plans.

In addition, compared to some other routes of administration (such as injections or intravenous infusions), taking medications orally is generally less invasive and more comfortable for patients. Thus, these advantages drive the segment expansion.

U.S. Over the Counter (OTC) Drugs Market By Distribution Channel Insights

The drug stores & retail pharmacies segment held the largest share of the U.S. over the counter (OTC) drugs market in 2025. Drug stores and retail pharmacies provide a diverse range of OTC drugs that cater to different health needs. This includes pain relievers, cough and cold medications, allergy remedies, digestive aids, vitamins, and more. Thus, the availability of these products allows consumers to address common health concerns without visiting a healthcare provider for a prescription.

U.S. Over the Counter (OTC) Drugs Market Recent Developments

- In July 2023, a leading manufacturer of consumer self-care products Perrigo Company plc announced that Opill®, a daily oral contraceptive that solely contains progestin, has been authorized by the FDA for use by people of all ages as an over-the-counter (OTC) medication. The first birth control pill to be sold over-the-counter in the US was called Opill.

- In June 2023, Foster & Thrive, a carefully chosen private brand of over-the-counter (OTC) health and wellness products, was recently introduced by McKesson Corporation MCK. The launch will include OTC items bearing the Health Mart and Sunmark brands, to unify the company's private brand portfolio.

U.S. Over the Counter (OTC) Drugs Market Top Key Companies:

U.S. Over the Counter (OTC) Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Over the Counter (OTC) Drugs market.

By Product Type

- Vitamin and Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Antacids

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies