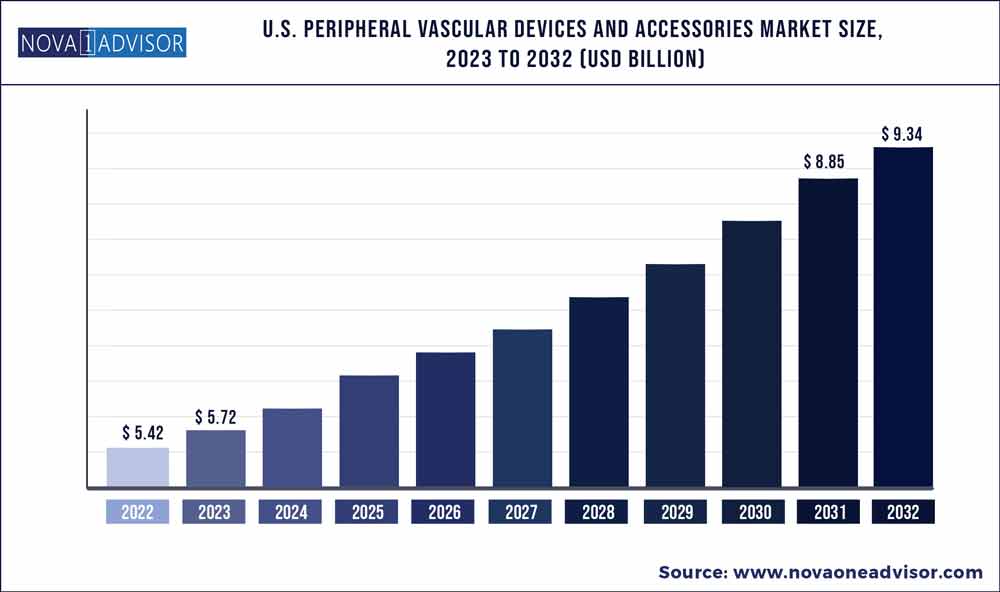

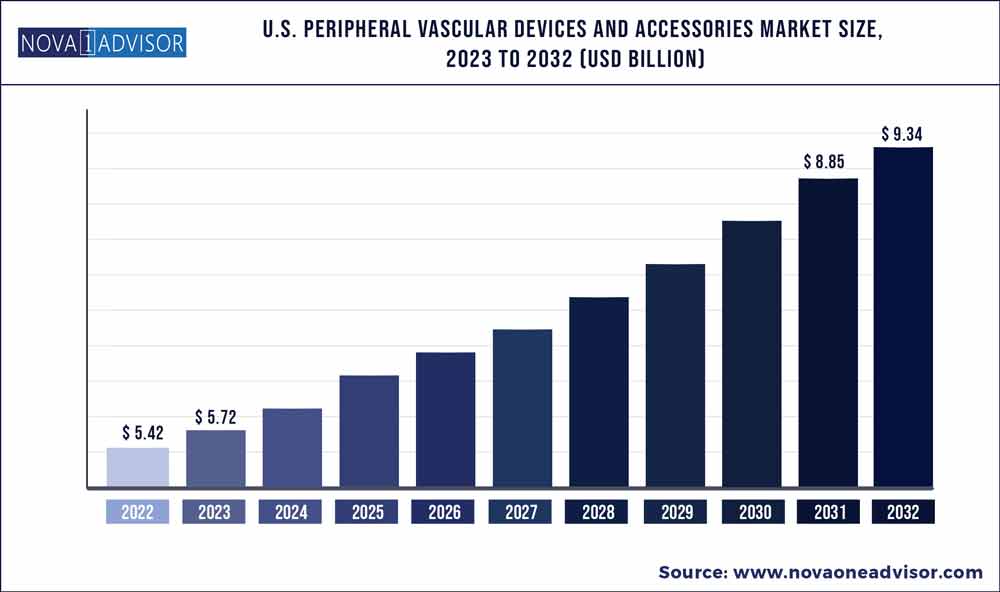

The U.S. peripheral vascular devices and accessories market size was exhibited at USD 5.42 billion in 2022 and is projected to hit around USD 9.34 billion by 2032, growing at a CAGR of 5.6% during the forecast period 2023 to 2032.

Key Takeaways:

- Based on product, peripheral vascular stents dominated the market for peripheral vascular devices and accessories and accounted for the largest revenue share of 38.6% in 2022.

- In addition, peripheral accessories are expected to be the fastest-growing segment, growing at a significant growth rate over the forecast period.

- The extra support tip segment dominated the U.S. peripheral vascular devices and accessories market with a revenue share of 49.6% in 2022.

- Furthermore, this segment is also expected to exhibit lucrative growth over the forecast period.

- In 2022, based on guidewire coating, hydrophilic guidewire coating accounted for the highest revenue share of 88.7% in the market

U.S. Peripheral Vascular Devices And Accessories Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 5.72 Billion |

| Market Size by 2032 |

USD 9.34 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.6% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product, Guidewire coating, Guidewire tip weight wire |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott Laboratories; Terumo Medical Corporation; Medtronic Inc.; Boston Scientific Corporation; Cordis; Philips; AngioDynamics, Inc.; Asahi Intecc Co. Ltd.; Becton Dickinson and Co; BIOTRONIK; Biosensors International Group; B. Braun; iVascular; Merit Medical; Cook Group Inc. |

Growing prevalence of venous diseases or Chronic Venous Insufficiency (CVI) is one of the key factors driving the growth of this market for peripheral vascular devices and accessories. In addition, growing geriatric population and increasing demand for minimally invasive endovascular procedures is further increasing its adoption.

Furthermore, increasing prevalence of atherosclerosis and Peripheral Arterial Disease (PAD) or Peripheral Vascular Disease (PVD) is one of the factors driving the market. In addition, rising geriatric population is contributing to the high incidence of PVD in the country as well as across the globe. For instance, according to CDC, in the U.S., nearly 8.5 million people have PAD, of which 12%-20% of people are above the age of 60. Thus, rising geriatric population, coupled with increasing prevalence of PAD is anticipated to boost the market for peripheral vascular devices and accessories in the coming years.

In addition, changing lifestyle and eating habits are some of the significant factors leading to an increase in the incidence of PVD, thereby boosting the demand for these devices. Various factors such as high consumption of alcohol, cigarettes, and tobacco products, and less physical activity, which is expected to propel the demand for peripheral vascular devices. For instance, according to the CDC, smoking and aging are among the risk factors for PAD.

Increasing demand for minimally invasive surgeries for treating vascular disease is an important factor driving the demand for peripheral vascular devices in the market. Minimally invasive procedures facilitate or accelerate the recovery process and cause fewer traumas to patients, thereby increasing its preference among patients. Moreover, these procedures require shorter hospital stays, which makes them more cost-effective for patients. Hence, these benefits are expected to increase the demand for peripheral vascular devices in the market.

Furthermore, minimally invasive procedures minimize post-surgery complications and reduce mortality rates. For instance, open bypass surgery was the standard for lower extremity vascular disease. However, it is associated with significant morbidity and mortality, and post-surgery complications, hence negatively impact the quality of life. Minimally invasive procedures, including balloon angioplasty, drug-eluting technologies, excisional atherectomy, or laser ablation that are significantly in improving quality of life. According to a research study published by the University of Wisconsin School of Medicine and Public Health, minor and major complications were less in patients undergoing balloon angioplasty in comparison with open surgical bypass. Hence, the increasing preference towards minimally invasive surgeries such as balloon angioplasty is likely to fuel the growth of the market for peripheral vascular devices and accessories in near future.

Moreover, an increasing number of products being recalled may negatively impact the brand image of the company, which eventually affects the demand for its existing product in the market. For instance, in 2018, Bard Peripheral Vascular, Inc. recalled Halo One Thin-Walled Guiding Sheath, which is used to guide or introduce interventional and diagnostic devices into arteries and veins. The product is recalled as the company reported that the sheath body may get detached from the sheath hub, and the sheath or its tip may become damaged during the procedure. The FDA has designated the product with Class I status, which is the most critical type of recall. Thus, product recalls of peripheral vascular devices are among the significant factors restraining market growth. However, with the changing scenario of regulations in the country and across the globe, the process of approval may become stringent in the coming years, which may reduce product recalls and promote market growth.

Product Insights

Based on product, peripheral vascular stents dominated the market for peripheral vascular devices and accessories and accounted for the largest revenue share of 38.6% in 2022. This high share is attributable to technological advancements in stent technology and the increasing demand for minimally invasive procedures. Furthermore, the peripheral stent market is majorly driven by a growing patient pool requiring immediate stent placement, technological innovations in peripheral vascular interventions, and a growing number of government initiatives.

In addition, peripheral accessories are expected to be the fastest-growing segment, growing at a significant growth rate over the forecast period. Growing demand for peripheral accessories in peripheral vascular interventions is one of the major factors expected to propel the growth of the market for peripheral vascular devices and accessories in the coming years. Moreover, the development of better accessories, beneficial during the peripheral vascular interventions, and enhancing the ease of accessibility is likely to boost the adoption of peripheral accessories in the coming years.

Guidewire Tip Weight Wire Insights

The extra support tip segment dominated the U.S. peripheral vascular devices and accessories market with a revenue share of 49.6% in 2022. Torque movement, fine control, and support provided for the treatment of complex and diffuse lesions are some of the key factors fueling market growth. In addition, these types of guidewires are also beneficial in providing support to the delivery of bulky devices. Some of the examples of extra support tip guidewires provided by Boston Scientific are PT family: PT Choice, PT Graphix, and PT 2.

Furthermore, this segment is also expected to exhibit lucrative growth over the forecast period due to its use for treatment and diagnosis of chronic occlusions, distal lesions, and tortuous anatomies. In addition, enhancement in steerability and flexibility of the guidewire due to higher tip load, availability of hydrophilic and hydrophobic variants, and power of tackling complex lesions are some of the advantages boosting the adoption of extra support guidewires, thereby propelling the growth of the market during the forecast period.

Guidewire Coating Insights

In 2022, based on guidewire coating, hydrophilic guidewire coating accounted for the highest revenue share of 88.7% in the market for peripheral vascular devices and accessories. This is owing to easy accessibility and a more slippery nature when combined with water. Furthermore, factors such as a reduction in friction and increase in trackability are expected to propel the growth of the market for peripheral vascular devices and accessories during the forecast period.

In addition, this segment is expected to witness the highest CAGR owing to benefits such as tackling tortuous lesions and help in finding microchannels in occlusions. Furthermore, increasing innovations and advancements by various players is expected to increase the adoption of guidewires with a hydrophilic coating. For instance, NaviPro guidewire, provided by Boston Scientific, is 100 percent hydrophilic guidewire useful for smooth passage through tortuous lesions or anatomy. Therefore, due to the advantages provided by hydrophilic guidewires and the increasing number of innovative guidewires with a hydrophilic coating, the market is expected to witness lucrative growth over the forecast period.

Key Companies & Market Share Insights

Competition is strong among existing players owing to the rise in demand for minimally invasive procedures and increasing adoption of peripheral vascular devices coupled with technological advancements. The rising demand in the market for peripheral vascular devices and accessories is likely to promote the entry of new companies in the future.

Furthermore, increase in mergers and acquisitions and partnership activities to acquire new technologies are expected to boost the competition and propel the growth of the market for peripheral vascular devices and accessories. For instance, in September 2020, Medtronic announced the acquisition of Avenu Medical. This would help in strengthening the product portfolio of the company in the peripheral vascular access business. Therefore, increasing strategic initiatives by major players in the market for peripheral vascular devices and accessories is expected to propel the growth during the forecast period. Some of the prominent players in the U.S. peripheral vascular devices and accessories market include:

- Abbott Laboratories

- Terumo Medical Corporation

- Medtronic, Inc.

- Boston Scientific Corporation

- Cordis

- Philips

- AngioDynamics, Inc.

- Asahi Intecc Co. Ltd.

- Becton Dickinson and Co

- BIOTRONIK

- Biosensors International Group

- B. Braun

- iVascular

- Merit Medical

- Cook Group Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Peripheral Vascular Devices And Accessories market.

By Product

- Peripheral Stents

- Carotid Artery Stents

- Renal Artery Stents

- Femoral Artery Stents

- Iliac Artery Stents

- Other Peripheral Stents

- PTA Balloons

- Catheters

- Angiography Catheters

- Guiding Catheters

- IVUS/OCT Catheters

- Peripheral Accessories

- Guidewires

- Workhorse Guidewires

- Frontline Finesse Guidewires

- Extra Support Guidewires

- Specialty Guidewires

- Peripheral Vascular Closure Devices

- Introducer Sheaths

- Balloon Inflation Devices

By Guidewire Coating

- Hydrophilic Coating

- Hydrophobic Coating

By Guidewire Tip Weight Wire

- Floppy Tip

- Balanced Tip

- Extra Support Tip