U.S. Pet Insurance Market Size, Share, Growth, Report 2025 to 2034

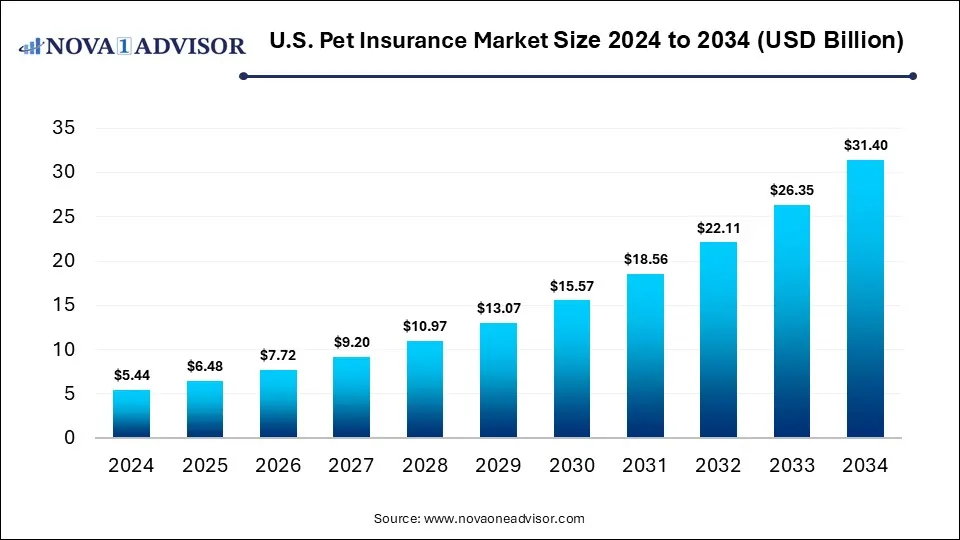

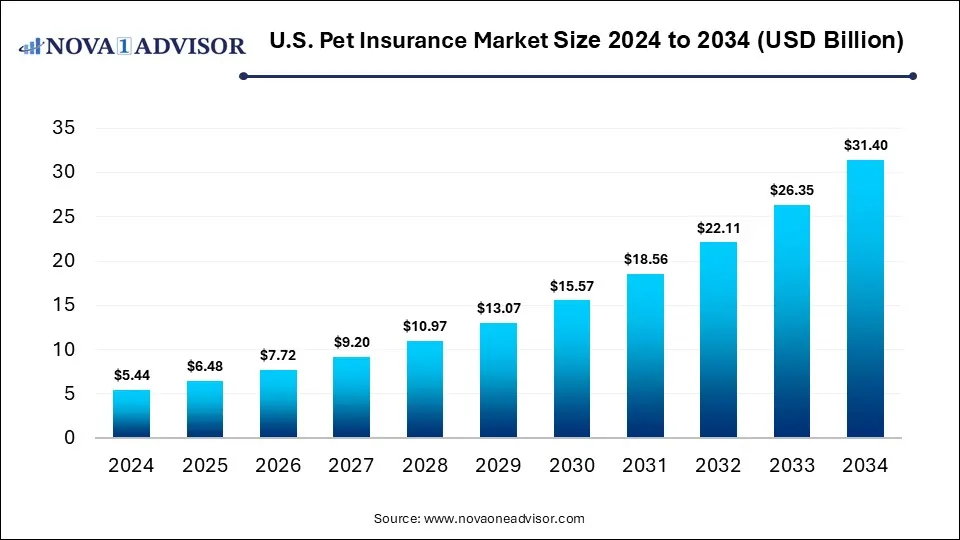

The U.S. pet insurance market was valued at USD 5.44 billion in 2024 and is projected to hit USD 31.40 billion by 2034, growing at a CAGR of 19.16% over the forecast period 2025 to 2034. The growth of the market is driven by rising pet adoption rates, increasing veterinary care costs, growing awareness of pet health and wellness, and the introduction of customized, AI-enabled insurance plans by major providers.

U.S. Pet Insurance Market Key Takeaways

- By state, California dominated the U.S. pet insurance market in 2024.

- By state, Florida is expected to grow rapidly between 2025 and 2034.

- By coverage type, the accident & illness segment held the largest market share in 2024.

- By animal type, the dogs segment dominated the market with the largest share in 2024.

- By animal type, the cats segment is expected to grow at a significant CAGR between 2025 and 2034.

- By distribution channel, the direct-to-consumer (DTC) segment captured the largest share of the market in 2024.

- By distribution channel, the broker segment is expected to grow at a significant CAGR during the forecast period.

Market Overview

The U.S. pet insurance market is rapidly expanding, driven by increasing pet adoption rates, the growing humanization of pets, and advancements in veterinary medicine that make treatments more costly but also more effective. Additionally, the availability of customizable insurance plans and digital claim processing platforms further drives market expansion. The U.S. pet insurance industry provides health coverage for pets to help owners manage rising veterinary costs, treatments, and medical emergencies. Pet insurance offers benefits such as financial protection against unexpected medical expenses, improved access to advanced veterinary services, and better overall pet health management. It covers a range of applications, including accident and illness coverage, wellness plans, and chronic disease management.

How AI is Reshaping the Pet Insurance Industry in the U.S.?

AI has the potential to greatly transform the pet insurance industry in the U.S. AI algorithms are advancing claims automation, risk evaluation, and personalized policy options. Insurers are using AI algorithms to analyze pet health data, forecast potential medical issues, and customize coverage plans to meet individual pet needs, boosting customer satisfaction. AI-powered chatbots and virtual assistants are improving customer support and claims processes, cutting down processing times and operational costs. Additionally, predictive analytics help insurers better assess risks and set accurate premiums, reducing fraud and inefficiencies.

Major Trends in the U.S. Pet Insurance Market:

- Rising Adoption of Digital and AI-Powered Platforms

Insurance providers are increasingly using AI and digital tools for claim automation, underwriting, and customer engagement. This trend improves efficiency, reduces fraud, and enables faster claim settlements and personalized policies.

- Growth of Customized and Flexible Insurance Plans

Pet owners are demanding customized insurance plans that address specific breeds, ages, and health conditions. Insurers are responding with flexible coverage options and add-on benefits for wellness, dental care, and chronic disease management.

- Strategic Partnerships Between Insurers and Veterinary Networks

Pet insurance companies are forming alliances with veterinary hospitals, telehealth providers, and pet wellness platforms to improve customer experience. These partnerships help streamline claims and enhance access to integrated pet healthcare services.

- Increasing Popularity of Online and App-Based Policy Management

The use of mobile apps and digital portals is on the rise in the country for policy management, claim filing, and renewals.

Report Scope of U.S. Pet Insurance Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.48 Billion |

| Market Size by 2034 |

USD 31.40 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 19.16% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Coverage Type, By Animal Type, By Distribution Channel, By State |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

Market Dynamics

Drivers

Rising Veterinary Care Costs

The rising cost of veterinary care is a significant driver of growth in the U.S. pet insurance market. as pet owners seek financial protection against expensive medical treatments. Advances in veterinary medicine, such as specialized surgeries, diagnostics, and chronic disease management, have significantly increased healthcare expenses for pets. As a result, more owners are turning to insurance to manage these unpredictable costs and ensure access to quality care. Pet insurance provides peace of mind by covering a substantial portion of medical bills, encouraging owners to pursue timely and advanced treatments.

Rising Pet Ownership

Rising pet ownership in the U.S. is another major driver of the market because more pets mean greater demand for veterinary care and financial protection. As pet owners increasingly view pets as family members, they are more willing to invest in insurance to cover unexpected medical costs. The growth in adoption rates, particularly among millennials and urban households, expands insurers' potential customer base. Higher pet populations also increase awareness of preventive care and wellness plans, further fueling market expansion. Overall, the combination of emotional attachment and financial prudence is driving the nationwide adoption of pet insurance.

- Pet ownership in the U.S. has risen sharply, with 66% of households (86.9 million) owning a pet in 2024, up from 56% in 1988. Pets play a vital role in owners’ lives, with 97% considering them part of the family.

Restraint

High Premium Costs and Limited Coverage Options

The high premium costs and limited coverage options significantly hinder the market growth. Many insurance plans come with expensive monthly premiums, especially for older pets or breeds prone to hereditary conditions, making them unaffordable for some owners. Additionally, limited coverage for routine care, dental treatments, or pre-existing conditions reduces the perceived value of these policies. Such financial and coverage barriers discourage broader adoption, particularly among first-time pet owners or those in lower-income households.

Opportunity

Rising Demand for Preventive and Wellness Coverage

The rising demand for preventive and wellness coverage creates significant opportunities in the U.S. pet insurance market. Pet owners are increasingly prioritizing routine check-ups, vaccinations, dental care, and nutrition management to prevent costly medical conditions in the future. Insurance providers are responding by introducing wellness-focused plans that cover preventive treatments and early diagnostics, appealing to proactive pet owners. This shift not only enhances pet health outcomes but also boosts long-term customer retention for insurers.

- In September 2024, a U.S.-based company, Pumpkin, launched the Pumpkin Wellness Club, a preventive care membership for pets. Available standalone, it offers savings on routine care and special perks, starting at $14.95/month for cats and $19.95/month for dogs, helping pets live healthier, longer lives.

U.S. Pet Insurance Market Segment Outlook

By Coverage Type

Why Did the Accident & Illness Segment Dominate the Market in 2024?

The accident & illness segment dominated the U.S. pet insurance market with the largest share in 2024 and is expected to continue its growth trajectory in the coming years. This is mainly due to its comprehensive coverage, addressing the widest range of pet health issues, from injuries and infections to chronic and hereditary conditions. Pet owners prefer these policies because they provide financial protection against unpredictable, often expensive veterinary care, ensuring better access to quality care. Most leading insurers, such as Tropaion, Nationwide, and Embrace, prioritize this segment and offer customizable plans that combine accident and illness protection under a single policy. The growing awareness of pet health, coupled with the rising cost of advanced veterinary procedures, has further strengthened the demand for these all-inclusive insurance products.

U.S. Pet Insurance Market By Coverage Type, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Accident & Illness |

4.24 |

5.07 |

6.06 |

7.23 |

8.64 |

10.32 |

12.33 |

14.73 |

17.60 |

21.03 |

25.12 |

| Accident only |

0.54 |

0.63 |

0.73 |

0.84 |

0.97 |

1.11 |

1.28 |

1.47 |

1.68 |

1.92 |

2.20 |

| Wellness Plans |

0.44 |

0.53 |

0.65 |

0.79 |

0.97 |

1.18 |

1.43 |

1.74 |

2.12 |

2.58 |

3.14 |

| Others |

0.22 |

0.25 |

0.29 |

0.34 |

0.39 |

0.46 |

0.53 |

0.61 |

0.71 |

0.82 |

0.94 |

By Animal Type

What Made Dogs the Dominant Segment in the Market?

The dogs segment dominated the U.S. pet insurance market, accounting for a major share in 2024. This is mainly due to the fact that dogs are the most commonly owned pets and typically require higher veterinary care costs than other animals. Pet owners are more inclined to insure dogs due to their greater susceptibility to accidents, hereditary conditions, and lifestyle-related health issues. Insurers such as Trupanion, Healthy Paws, and Nationwide focus heavily on dog insurance, offering tailored plans based on breed, age, and activity level. The emotional bond between dog owners and their pets, coupled with rising awareness of preventive healthcare, has further fueled insurance adoption.

The cats segment is expected to grow at a significant CAGR over the coming period, driven by rising cat adoption rates and greater awareness of feline health needs. Traditionally, cats were perceived as low-maintenance pets, but owners are now recognizing the importance of regular vet visits and preventive care for chronic conditions like diabetes and kidney disease. Insurance providers are increasingly offering affordable, cat-specific plans with tailored coverage options, making policies more attractive to owners. Moreover, the surge in urban living, where cats are more popular due to space constraints, has expanded the potential customer base.

U.S. Pet Insurance Market By Animal Type, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Dogs |

4.46 |

5.30 |

6.29 |

7.46 |

8.86 |

10.52 |

12.49 |

14.83 |

17.60 |

20.90 |

24.80 |

| Cats |

0.87 |

1.05 |

1.27 |

1.53 |

1.84 |

2.22 |

2.68 |

3.23 |

3.89 |

4.69 |

5.65 |

| Others |

0.11 |

0.14 |

0.17 |

0.21 |

0.26 |

0.33 |

0.40 |

0.50 |

0.62 |

0.76 |

0.94 |

By Distribution Channel

How Does the DTC Segment Dominate the U.S. Pet Insurance Market in 2024?

The direct-to-consumer (DTC) segment dominated the market while holding the largest share in 2024. This leadership is driven by pet owners’ preference for convenience and transparency, allowing them to research, compare, and purchase policies online or via mobile apps without intermediaries. The DTC model also helps insurers reduce operational costs, enabling them to offer more competitive premiums and attractive offerings. Additionally, its digital-first approach appeals to younger, tech-savvy pet owners, supporting continued growth in this segment.

The broker segment is expected to grow at a significant rate in the coming years due to several key factors. As insurance products become more complex, brokers offer personalized guidance, helping pet owners navigate various coverage options and select plans that best meet their needs. This expertise is particularly valuable for individuals seeking tailored solutions amidst a wide array of policies. Additionally, brokers often have access to multiple insurance providers, allowing them to compare plans and secure competitive premiums for their clients. Their role in simplifying the decision-making process and providing customized support contributes to the increasing demand for broker services in the pet insurance industry.

U.S. Pet Insurance Market By Distribution Channel, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Agency |

1.52 |

1.79 |

2.10 |

2.47 |

2.90 |

3.40 |

3.99 |

4.68 |

5.48 |

6.43 |

7.54 |

| Broker |

1.20 |

1.41 |

1.65 |

1.94 |

2.28 |

2.68 |

3.15 |

3.69 |

4.33 |

5.09 |

5.97 |

| Direct-to-Consumer (DTC) |

2.07 |

2.51 |

3.04 |

3.69 |

4.47 |

5.42 |

6.57 |

7.96 |

9.64 |

11.67 |

14.13 |

| Bancassurance |

0.27 |

0.33 |

0.41 |

0.50 |

0.61 |

0.75 |

0.92 |

1.12 |

1.37 |

1.67 |

2.04 |

| Others |

0.38 |

0.44 |

0.52 |

0.60 |

0.70 |

0.82 |

0.95 |

1.10 |

1.28 |

1.49 |

1.73 |

By State

Why Did California Contribute the Most Revenue Share in 2024?

California led the U.S. pet insurance market, holding the largest share in 2024. This is mainly because of its large pet-owning population, high disposable incomes, and strong awareness of pet healthcare. California’s residents are known for prioritizing pet wellness, which drives demand for comprehensive insurance plans that cover preventive care, chronic conditions, and emergency treatments. The state’s concentration of advanced veterinary clinics and specialty hospitals further supports pet insurance adoption as treatment costs continue to rise. Additionally, several leading insurers, like Nationwide and Healthy Paws, have a strong presence in the state, offering tailored plans to meet regional needs.

Florida is expected to experience the fastest growth in the coming years, driven by its large and expanding pet population, fueled by many pet-owning households and retirees who often make significant investments in pet care. Increasing awareness about comprehensive veterinary services and the rising costs of advanced treatments are prompting pet owners to seek insurance for financial security. Additionally, the presence of numerous veterinary clinics, animal hospitals, and wellness centers offering partnership-based insurance promotions boosts adoption rates.

U.S. Pet Insurance Market By State 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| California |

0.98 |

1.17 |

1.41 |

1.68 |

2.02 |

2.42 |

2.90 |

3.47 |

4.16 |

4.98 |

5.97 |

| New York |

0.65 |

0.77 |

0.92 |

1.09 |

1.29 |

1.54 |

1.82 |

2.16 |

2.57 |

3.04 |

3.61 |

| Florida |

0.57 |

0.68 |

0.82 |

0.98 |

1.17 |

1.40 |

1.68 |

2.01 |

2.41 |

2.89 |

3.45 |

| Texas |

0.49 |

0.59 |

0.70 |

0.84 |

1.01 |

1.21 |

1.45 |

1.74 |

2.08 |

2.49 |

2.98 |

| New Jersey |

0.30 |

0.36 |

0.42 |

0.50 |

0.59 |

0.71 |

0.84 |

0.99 |

1.18 |

1.40 |

1.66 |

| Pennsylvania |

0.33 |

0.39 |

0.46 |

0.55 |

0.65 |

0.77 |

0.92 |

1.09 |

1.29 |

1.53 |

1.82 |

| Massachusetts |

0.22 |

0.26 |

0.31 |

0.37 |

0.44 |

0.53 |

0.63 |

0.76 |

0.90 |

1.08 |

1.29 |

| Washington |

0.19 |

0.23 |

0.27 |

0.32 |

0.39 |

0.46 |

0.55 |

0.66 |

0.79 |

0.95 |

1.13 |

| Illinois |

0.19 |

0.23 |

0.27 |

0.32 |

0.38 |

0.45 |

0.54 |

0.64 |

0.76 |

0.90 |

1.07 |

| Other States |

1.52 |

1.81 |

2.14 |

2.54 |

3.02 |

3.58 |

4.25 |

5.04 |

5.98 |

7.09 |

8.41 |

Country Level Analysis: Why the U.S. is a Global Leader in the Pet Insurance Industry?

1. Large Pet Ownership Base

The U.S. has one of the world’s highest pet ownership rates, with millions of households owning at least one pet. This broad consumer base creates consistent demand for insurance products covering dogs, cats, and exotic animals.

2. High Pet Care Expenditure

American pet owners spend heavily on healthcare, grooming, and wellness services, often comparable to human healthcare costs. Rising veterinary bills and advanced treatments drive the need for insurance to manage these growing expenses.

3. Strong Culture of Pet Humanization

Pets are increasingly seen as family members, motivating owners to seek comprehensive medical protection. This emotional bond fuels spending on preventive and wellness services, boosting the adoption of insurance coverage.

4. Advanced Veterinary Infrastructure

The U.S. has a well-developed network of veterinary hospitals, clinics, and specialty centers offering modern diagnostics and treatments. Insurance plays a key role in making these high-quality medical services financially accessible to pet owners.

U.S. Pet Insurance Market Value Chain Analysis

1. Product Development & Underwriting

This stage involves designing comprehensive insurance policies that cover accidents, illnesses, and wellness care. Companies perform actuarial analysis, evaluate pet health risk factors, and establish premium pricing structures. Key players like Nationwide and Trupanion focus on creating customizable plans and expanding coverage options to meet the diverse needs of pet owners, thus boosting product innovation and competitiveness.

Key Players:

2. Marketing & Distribution

At this stage, insurers use multi-channel marketing strategies, including online platforms, social media, veterinary partnerships, and pet stores, to reach potential customers. Companies such as Fetch and Figo rely on digital marketing campaigns and mobile applications to improve accessibility and user experience, thereby expanding market reach and increasing customer acquisition rates.

Key Players:

3. Policy Administration & Customer Service

This phase includes managing policy issuance, renewals, and claim processing. Efficient customer support systems and technology-driven claim portals help reduce turnaround time and improve customer satisfaction. Players like Lemonade leverage AI-based claim management to streamline operations and enhance transparency, fostering stronger client relationships.

Key Players:

4. Claims Management & Risk Assessment

Claims management is crucial for maintaining trust and controlling loss ratios. Companies verify medical claims through vet partnerships and digital documentation systems to ensure accuracy and timely reimbursements. Trupanion, for instance, integrates directly with veterinary billing systems for real-time claim settlements, improving operational efficiency and customer confidence.

Key Players:

5. After-Sales Support & Retention

This final stage focuses on maintaining customer loyalty through renewal offers, wellness program upgrades, and 24/7 support. Companies like Embrace and Healthy Paws engage in proactive communication and offer flexible plan adjustments, ensuring long-term policyholder satisfaction and retention. Strong after-sales service strengthens brand credibility and promotes repeat business.

Key Players:

Competitive Landscape

1. Nationwide Mutual Insurance Company

Nationwide is one of the largest and most established providers, offering a wide range of pet insurance plans covering accidents, illnesses, and wellness care. The company’s extensive customer base and strong brand trust drive significant market penetration and product innovation in the U.S. pet insurance sector.

2. Trupanion Inc.

Trupanion stands out for its direct-to-vet payment system, which enables real-time claim reimbursements and enhances customer satisfaction. Its strong partnerships with veterinary clinics and focus on technology-driven services strengthen its leadership position in the accident and illness segment.

3. Embrace Pet Insurance

Embrace offers customizable, flexible insurance plans that appeal to pet owners seeking comprehensive coverage. The company emphasizes customer-centric services and wellness rewards programs, boosting retention and expanding its U.S. market share.

4. ASPCA Pet Health Insurance (Crummey Insurance Group)

ASPCA Pet Health Insurance leverages its strong brand association with animal welfare to build trust among pet owners. The company contributes to market growth through affordable plans and broad coverage, making insurance more accessible across the U.S.

5. Fetch by The Dodo (formerly Petplan)

Fetch by The Dodo combines advanced digital marketing strategies with strong media partnerships to target tech-savvy pet owners. Its data-driven policy customization and easy-to-use app enhance convenience, helping expand coverage among younger demographics.

6. Healthy Paws Pet Insurance

Healthy Paws offers simple, transparent, and comprehensive accident and illness plans with no annual or lifetime caps. Its commitment to charitable giving through the Healthy Paws Foundation also strengthens customer loyalty and brand reputation.

7. Figo Pet Insurance

Figo integrates advanced cloud technology through its Pet Cloud app, offering policy management, claim submission, and health reminders in one platform. Its digital-first approach appeals to millennials, accelerating the market’s shift toward tech-enabled insurance services.

8. Lemonade Pet Insurance

Lemonade leverages artificial intelligence to simplify policy management, pricing, and claims processing, ensuring fast and efficient service. Its innovative approach and transparent business model attract a growing customer base in the digital pet insurance segment.

9. Spot Pet Insurance

Spot offers flexible and customizable coverage options with wellness add-ons that cater to diverse customer needs. Supported by strong marketing campaigns and celebrity endorsements, it is rapidly expanding its presence in the U.S. market.

10. Pumpkin Pet Insurance

Pumpkin emphasizes preventive care by including wellness coverage for routine checkups and vaccinations. Its data-driven insights and partnerships with veterinary professionals help promote proactive pet healthcare, supporting market expansion.

Recent Developments

- In April 2025, Pumpkin Insurance Services introduced "PumpkinNow," a service allowing qualifying customers to get an upfront payment for up to 90% of eligible veterinary expenses within 15 minutes.

- In June 2025, Healthy Paws partnered with Combined Insurance to add pet insurance to its portfolio of supplemental benefits for employers. This makes pet insurance available through voluntary employee benefit programs.

- In January 2024, Five Sigma partnered with Odie Pet Insurance to modernize claims management, aiming to make pet insurance more flexible and affordable. The collaboration enhances operational efficiency and reimagines the claims process across the industry.

Exclusive Analysis on the U.S. Pet Insurance Market

The U.S. pet insurance market is experiencing a paradigm shift, propelled by multifaceted dynamics that present substantial opportunities for stakeholders. The surge in pet ownership, coupled with the humanization of pets, has led to an increased demand for comprehensive healthcare solutions. As pet owners increasingly view their animals as family members, the need for financial protection against escalating veterinary costs becomes paramount. This evolving sentiment underscores a lucrative avenue for insurers to tailor products that resonate with the emotional and financial considerations of pet parents.

Technological advancements are further revolutionizing the landscape, offering avenues to enhance operational efficiencies and customer engagement. The integration of artificial intelligence (AI) and data analytics facilitates precise underwriting, personalized policy offerings, and expedited claims processing. Such innovations not only streamline operations but also foster trust and satisfaction among consumers. Insurers leveraging these technologies position themselves as forward-thinking entities, capable of delivering value through enhanced service delivery and responsiveness.

Moreover, regulatory developments are shaping the market's trajectory, necessitating adaptability and compliance from industry players. Legislative measures aimed at increasing transparency and protecting consumer interests are becoming more prevalent. Insurers that proactively align their practices with these regulations not only mitigate legal risks but also build credibility and consumer confidence. This regulatory alignment can serve as a competitive differentiator in a market where trust and reliability are paramount.

In conclusion, the U.S. pet insurance market is at the cusp of significant transformation, driven by demographic shifts, technological innovations, and evolving regulatory frameworks. Stakeholders who can adeptly navigate these dynamics, offering tailored solutions that address the nuanced needs of pet owners, are poised to capitalize on the burgeoning opportunities within this sector.

Segments Covered in the Report

By Coverage Type

- Accident & Illness

- Accident only

- Wellness Plans

- Others

By Animal Type

By Distribution Channel

- Agency

- Broker

- Direct-to-Consumer (DTC)

- Bancassurance

- Others

By State

- California

- New York

- Florida

- Texas

- New Jersey

- Pennsylvania

- Massachusetts

- Washington

- Illinois

- Other States

List of Tables

- U.S. Pet Insurance Market Size (USD Billion), 2024–2034

- U.S. Market Share by Coverage Type, 2024 & 2034

- U.S. Market Share by Animal Type, 2024 & 2034

- U.S. Market Share by Distribution Channel, 2024 & 2034

- U.S. Pet Insurance Market Size, by State, 2024–2034

By Coverage Type

- California Market Size, by Coverage Type, 2024–2034

- New York Market Size, by Coverage Type, 2024–2034

- Florida Market Size, by Coverage Type, 2024–2034

- Texas Market Size, by Coverage Type, 2024–2034

- New Jersey Market Size, by Coverage Type, 2024–2034

- Pennsylvania Market Size, by Coverage Type, 2024–2034

- Massachusetts Market Size, by Coverage Type, 2024–2034

- Washington Market Size, by Coverage Type, 2024–2034

- Illinois Market Size, by Coverage Type, 2024–2034

- Other States Market Size, by Coverage Type, 2024–2034

By Animal Type

- California Market Size, by Animal Type, 2024–2034

- New York Market Size, by Animal Type, 2024–2034

- Florida Market Size, by Animal Type, 2024–2034

- Texas Market Size, by Animal Type, 2024–2034

- New Jersey Market Size, by Animal Type, 2024–2034

- Pennsylvania Market Size, by Animal Type, 2024–2034

- Massachusetts Market Size, by Animal Type, 2024–2034

- Washington Market Size, by Animal Type, 2024–2034

- Illinois Market Size, by Animal Type, 2024–2034

- Other States Market Size, by Animal Type, 2024–2034

By Distribution Channel

- California Market Size, by Distribution Channel, 2024–2034

- New York Market Size, by Distribution Channel, 2024–2034

- Florida Market Size, by Distribution Channel, 2024–2034

- Texas Market Size, by Distribution Channel, 2024–2034

- New Jersey Market Size, by Distribution Channel, 2024–2034

- Pennsylvania Market Size, by Distribution Channel, 2024–2034

- Massachusetts Market Size, by Distribution Channel, 2024–2034

- Washington Market Size, by Distribution Channel, 2024–2034

- Illinois Market Size, by Distribution Channel, 2024–2034

- Other States Market Size, by Distribution Channel, 2024–2034

List of Figures

- U.S. Pet Insurance Market Outlook, 2024–2034 (USD Billion)

- U.S. Market Share, by Coverage Type, 2024

- U.S. Market Share, by Animal Type, 2024

- U.S. Market Share, by Distribution Channel, 2024

- U.S. Market Share, by Coverage Type, 2034

- U.S. Market Share, by Animal Type, 2034

- U.S. Market Share, by Distribution Channel, 2034

- U.S. Market Share, by State, 2024

- California Market Share, by Coverage Type, 2024

- New York Market Share, by Coverage Type, 2024

- Florida Market Share, by Coverage Type, 2024

- Texas Market Share, by Coverage Type, 2024

- New Jersey Market Share, by Coverage Type, 2024

- Pennsylvania Market Share, by Coverage Type, 2024

- Massachusetts Market Share, by Coverage Type, 2024

- Washington Market Share, by Coverage Type, 2024

- Illinois Market Share, by Coverage Type, 2024

- Comparative Growth Rate of Pet Insurance Market across States, 2024–2034