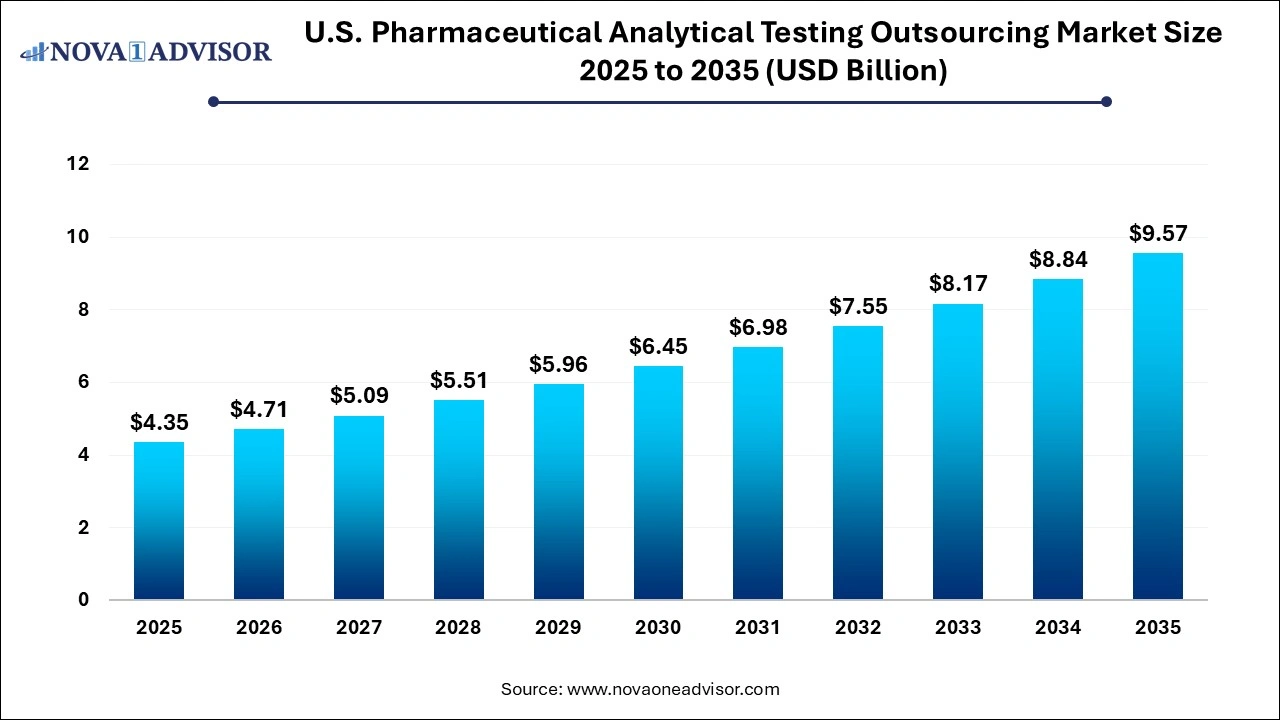

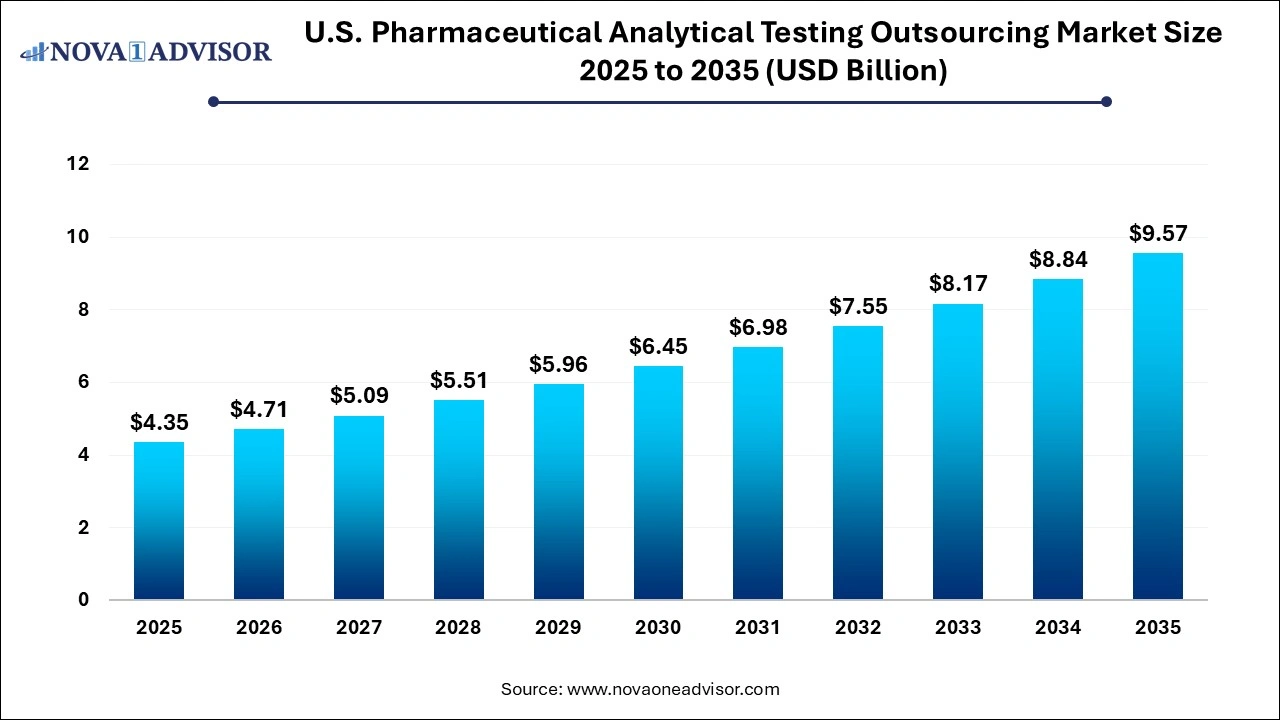

U.S. Pharmaceutical Analytical Testing Outsourcing market Size and Growth 2026 to 2035

The U.S. pharmaceutical analytical testing outsourcing market size was exhibited at USD 4.35 billion in 2025 and is projected to hit around USD 9.57 billion by 2035, growing at a CAGR of 8.2% during the forecast period 2026 to 2035.

U.S. Pharmaceutical Analytical Testing Outsourcing Market Key Takeaways:

- In 2025, the bioanalytical testing segment dominated the market, accounting for a revenue share of 52.2%.

- The method development and validation segment is expected to register the highest CAGR of 8.42% over the forecast period.

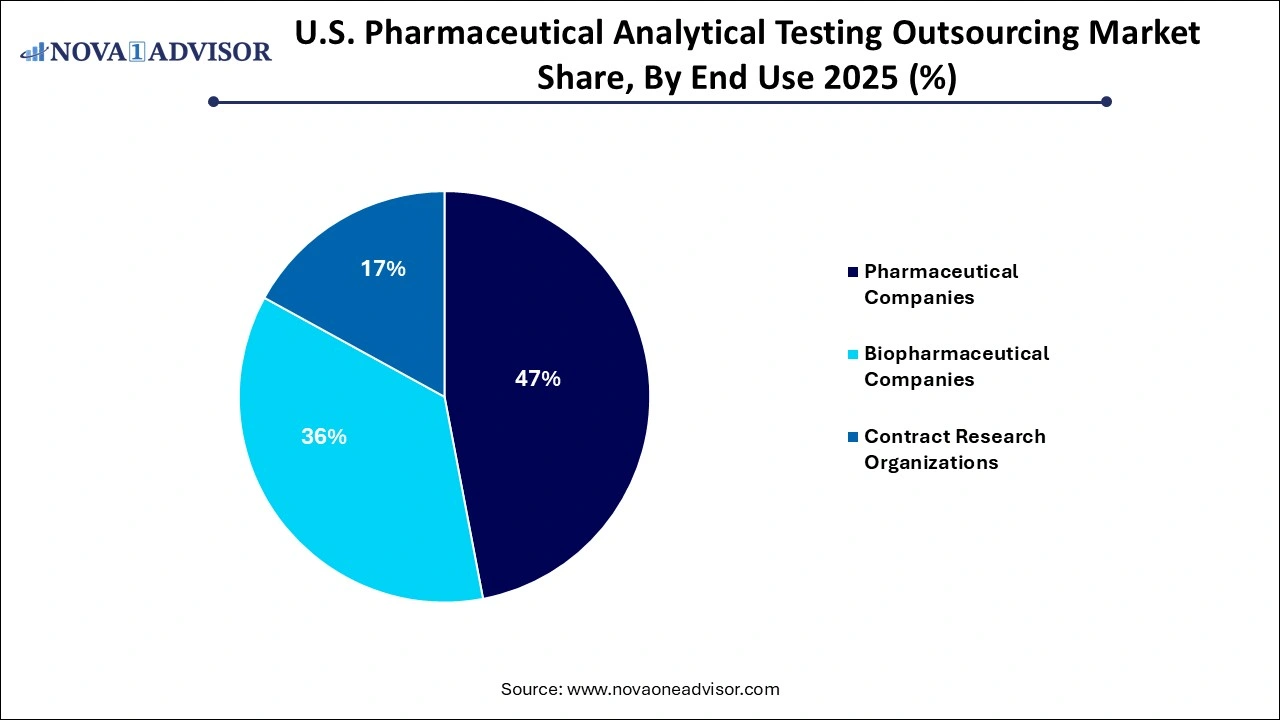

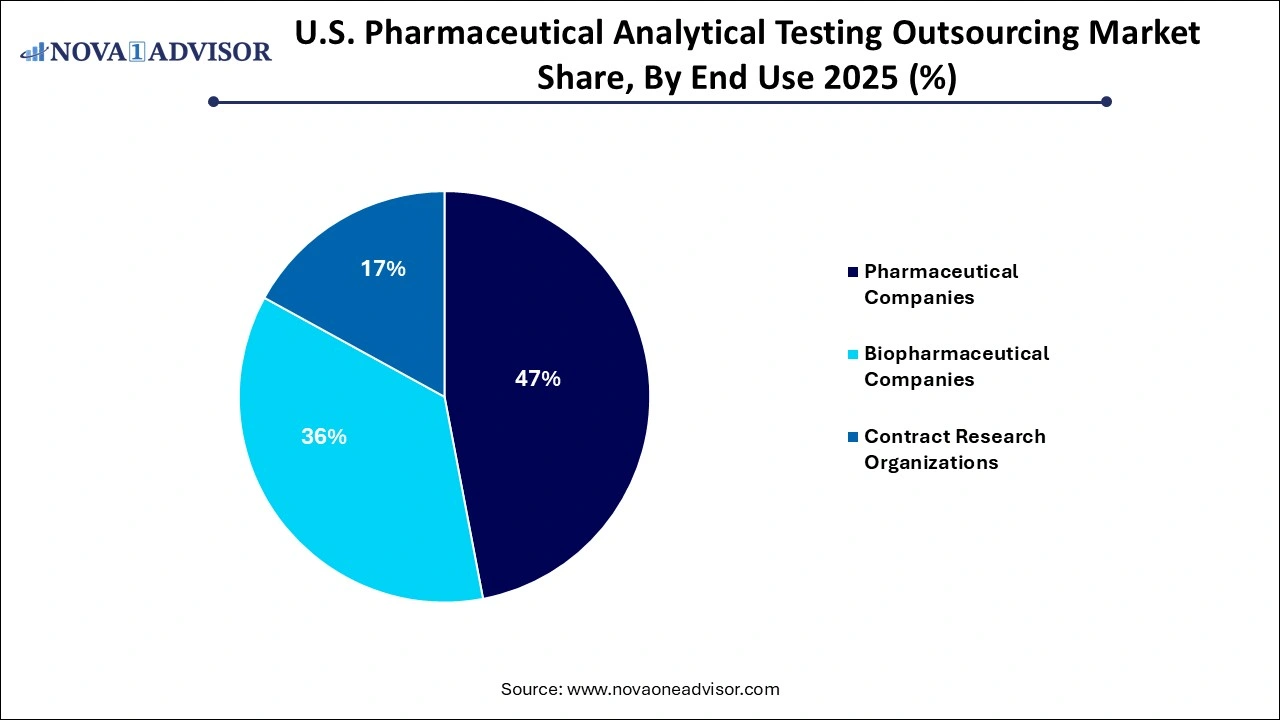

- In 2025, the pharmaceutical companies segment dominated the market, accounting for a revenue share of 46.0%.

- The biopharmaceutical companies segment is expected to register the highest CAGR of 8.8% over the forecast period.

U.S. Pharmaceutical Analytical Testing Outsourcing Market Overview

The U.S. pharmaceutical analytical testing outsourcing market is evolving as one of the most pivotal arms of the drug development and manufacturing ecosystem. It comprises services provided by third-party laboratories to pharmaceutical, biopharmaceutical, and contract research organizations (CROs) that need specialized testing, method validation, and regulatory support for drug products. With the expanding complexity of biologics and biosimilars, and the increasing regulatory stringency from agencies like the U.S. FDA, companies are turning to external service providers for cost-effective, timely, and expert support throughout the drug lifecycle.

Analytical testing spans a wide range of activities bioanalytical testing, method development and validation, stability testing, and various specialized assays all of which are critical in ensuring safety, efficacy, and regulatory compliance. Outsourcing these services allows pharmaceutical firms to focus on core R&D and commercialization while leveraging specialized expertise and advanced infrastructure from contract service providers.

A key driver behind the growth of this market is the increasing trend of virtual and lean pharmaceutical companies, which often lack in-house capabilities for extensive testing. In such cases, analytical testing labs act not only as service providers but also as strategic partners. From early-phase molecule profiling to post-approval stability testing, analytical service providers support companies throughout clinical and commercial stages.

Additionally, with the U.S. market being home to a dense cluster of pharmaceutical companies and the world’s most robust biopharmaceutical pipeline, demand for third-party analytical services continues to soar. The presence of established outsourcing hubs in Massachusetts, California, and North Carolina further anchors market development.

Major Trends in the U.S. Pharmaceutical Analytical Testing Outsourcing Market

-

Rise in Biologics and Biosimilars Development: With the increase in complex large-molecule drugs, there is a growing demand for advanced bioanalytical services and method development tailored to biologics.

-

Integration of Automation and AI in Analytical Workflows: Labs are leveraging AI-driven data analysis, high-throughput screening systems, and lab automation to reduce turnaround time and improve accuracy.

-

Demand for Extractable and Leachable (E&L) Studies: The regulatory emphasis on packaging interactions has increased demand for comprehensive E&L testing in both injectable and inhalable products.

-

Expansion of Stability Testing Capabilities: Accelerated and photostability testing is gaining importance in product shelf-life prediction, particularly for vaccines and temperature-sensitive biologics.

-

Increased FDA Oversight and Quality-by-Design (QbD): The emphasis on QbD in method validation and lifecycle management of analytical procedures is shaping service protocols.

-

Outsourcing by Small and Mid-Sized Firms: Emerging pharma companies without internal infrastructure are forming long-term partnerships with CROs and testing labs.

-

Geographic Expansion by Global Testing Leaders: Companies such as Eurofins and Charles River are expanding their U.S. footprints through acquisitions and laboratory expansions to meet growing demand.

-

Specialization in Niche Analytical Services: Providers are carving niches in areas like nitrosamine testing, cell and gene therapy analytics, and bioavailability studies for complex drug delivery systems.

Report Scope of U.S. Pharmaceutical Analytical Testing Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.71 Billion |

| Market Size by 2035 |

USD 9.5 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.2% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Service, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

U.S. |

| Key Companies Profiled |

West Pharmaceutical Services, Inc.; SGS SA; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; Pharmaceutical Product Development, LLC.; Wuxi AppTec, Inc.; Boston Analytical; and Charles River Laboratories among others |

Key Market Driver

Increasing Complexity of Drug Molecules Necessitating Specialized Analytical Capabilities

As pharmaceutical innovations move toward biologics, personalized therapies, and complex dosage forms like liposomal drugs and nanoparticle formulations, the demand for sophisticated analytical methodologies is increasing exponentially. Traditional in-house QC labs are often not equipped with the technology or expertise to handle such complexity. For instance, high-sensitivity techniques such as LC-MS/MS and hybrid LC methods for biologics require specialized knowledge and instrumentation, which are readily available in established CROs and analytical labs. The outsourcing model enables pharmaceutical companies to tap into these advanced capabilities without incurring heavy capital expenditure. This shift is especially pronounced in the U.S., where a significant share of new drug approvals includes biologics and combination products.

Key Market Restraint

Concerns Around Data Security and Regulatory Compliance in Outsourced Environments

Despite the operational advantages, pharmaceutical companies remain cautious about data confidentiality and compliance risks associated with outsourcing. The analytical data generated during drug development is proprietary and subject to strict regulatory scrutiny. Any breach or error in documentation can have severe implications, including drug recalls, clinical hold, or loss of intellectual property. Ensuring that outsourcing partners adhere to cGMP guidelines, 21 CFR Part 11 compliance, and data integrity protocols requires constant vigilance and regulatory audits. Smaller analytical service providers, despite technical capabilities, sometimes lack the robust data security frameworks needed to gain trust from large pharma clients, thus limiting their market share.

Key Market Opportunity

Growth in Cell and Gene Therapy Pipeline Requiring Specialized Analytical Support

Cell and gene therapies (CGTs) represent the future of precision medicine, and the U.S. leads the world in the number of CGT clinical trials. These therapies require unique analytical testing protocols, such as viral vector characterization, genetic integrity assays, potency assays, and contamination detection. Most pharmaceutical firms entering this space do not have in-house capacity or regulatory expertise for these complex procedures. Specialized analytical providers are now tailoring services for CGT sponsors, creating a rapidly growing niche. This opens opportunities for labs to expand service portfolios and invest in novel platforms like next-generation sequencing (NGS), droplet digital PCR, and cell-based assays.

Segmental Insights

By Services Insights

Bioanalytical Testing dominated the services segment. With the rise in biologics, biosimilars, and advanced therapeutics, bioanalytical testing services have become the cornerstone of drug development in the U.S. Bioanalytical labs assist with clinical and non-clinical studies by evaluating pharmacokinetics (PK), pharmacodynamics (PD), bioequivalence, and immunogenicity profiles. Clinical bioanalytical testing, in particular, is critical during Phase I-III trials, ensuring that drug exposure and therapeutic effects are accurately quantified. Non-clinical bioanalytical studies, meanwhile, support toxicology and preclinical assessments. Large service providers such as Charles River and Labcorp Drug Development are consistently expanding their mass spectrometry capabilities to accommodate large molecule testing.

Method Development and Validation is the fastest-growing service category. As regulatory agencies tighten quality expectations, pharmaceutical companies are investing in robust method development strategies aligned with ICH Q14 guidelines. Services such as impurity profiling, extractable and leachable studies, and complex chromatographic method validations are increasingly outsourced due to their technical intricacies. Extractable and leachable services, particularly for parenteral products, are in high demand following the U.S. FDA's recent focus on nitrosamine contamination and packaging safety. Technical consulting within method validation services is also gaining prominence as companies seek strategic input during regulatory filings.

By End Use Insights

Pharmaceutical Companies remained the largest consumers of analytical outsourcing services. The traditional small-molecule pharma sector in the U.S. has long relied on external testing support, especially during scale-up, NDA submissions, and post-market stability testing. Both legacy players and new entrants in generic drug manufacturing heavily outsource impurity and dissolution profiling services. Additionally, pharma companies outsourcing their manufacturing processes to CDMOs (Contract Development and Manufacturing Organizations) often loop in analytical testing providers to independently validate batches and ensure cGMP adherence.

Biopharmaceutical Companies are the fastest-growing end-user segment. The U.S. biopharma industry is experiencing unprecedented innovation, with a robust pipeline of

monoclonal antibodies, gene therapies, and RNA-based drugs. These novel modalities demand high-precision analytics and custom assay development—services that are seldom available in-house for early-stage biotechs. Analytical service providers are responding by building high-containment suites, enhancing biosafety certifications, and acquiring niche testing capabilities. Biopharma clients also require long-term partnerships that go beyond testing to include analytical method lifecycle management and regulatory submission support.

Country-Level Insights United States

The U.S. pharmaceutical analytical testing outsourcing market is the most advanced and mature globally, driven by the presence of major pharmaceutical hubs, regulatory agencies, and contract service providers. With over 70% of new drug applications (NDAs) and biologics license applications (BLAs) originating in the U.S., demand for high-quality analytical services is insatiable. States like Massachusetts (Boston-Cambridge), California (San Diego, San Francisco Bay Area), and North Carolina (Research Triangle Park) serve as epicenters for biotech innovation, further driving regional demand for analytical testing.

Moreover, the U.S. Food and Drug Administration (FDA) enforces rigorous compliance standards that necessitate comprehensive method validation and continuous stability testing, thereby promoting third-party lab involvement. In response to market needs, companies are expanding their laboratory footprints across the Midwest and Southeast to increase turnaround times and cater to smaller biopharma players. Government funding for pandemic preparedness, antibiotic resistance research, and orphan drug development is further fueling analytical service requirements.

Some of the prominent players in the U.S. pharmaceutical analytical testing outsourcing market include:

U.S. Pharmaceutical Analytical Testing Outsourcing Market Recent Developments

-

March 2025 – Eurofins Scientific announced a major expansion of its bioanalytical testing laboratory in Lancaster, Pennsylvania, doubling its capacity to support the growing demand for large-molecule pharmacokinetic and immunogenicity testing

-

January 2025 – Charles River Laboratories launched its next-generation viral clearance testing suite tailored to cell and gene therapy sponsors in the U.S., improving safety validation during regulatory filings.

-

November 2024 – SGS North America expanded its extractable and leachable testing services at its Lincolnshire, Illinois, facility to address rising demand in sterile injectables and combination products.

-

October 2024 – Intertek Group opened a new stability testing facility in Allentown, Pennsylvania, with advanced capabilities for accelerated and photostability studies aligned with ICH guidelines.

-

August 2024 – Labcorp Drug Development introduced AI-powered automation in its method validation protocols, reducing result delivery times by 25% and enhancing data integrity for NDA submissions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. pharmaceutical analytical testing outsourcing market

Services

- Method Development and Validation

-

- Extractable and Leachable

- Impurity Method

- Technical Consulting

- Other Method Validation Services

-

- Drug Substance

- Stability Indicating Method Validation

- Accelerated Stability Testing

- Photostability Testing

- Other Stability Testing Methods

End Use

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Research Organizations

Biopharmaceutical Companies are the fastest-growing end-user segment. The U.S. biopharma industry is experiencing unprecedented innovation, with a robust pipeline of

Biopharmaceutical Companies are the fastest-growing end-user segment. The U.S. biopharma industry is experiencing unprecedented innovation, with a robust pipeline of