U.S. Pharmacy Market Size Growth and Trends 2026 to 2035

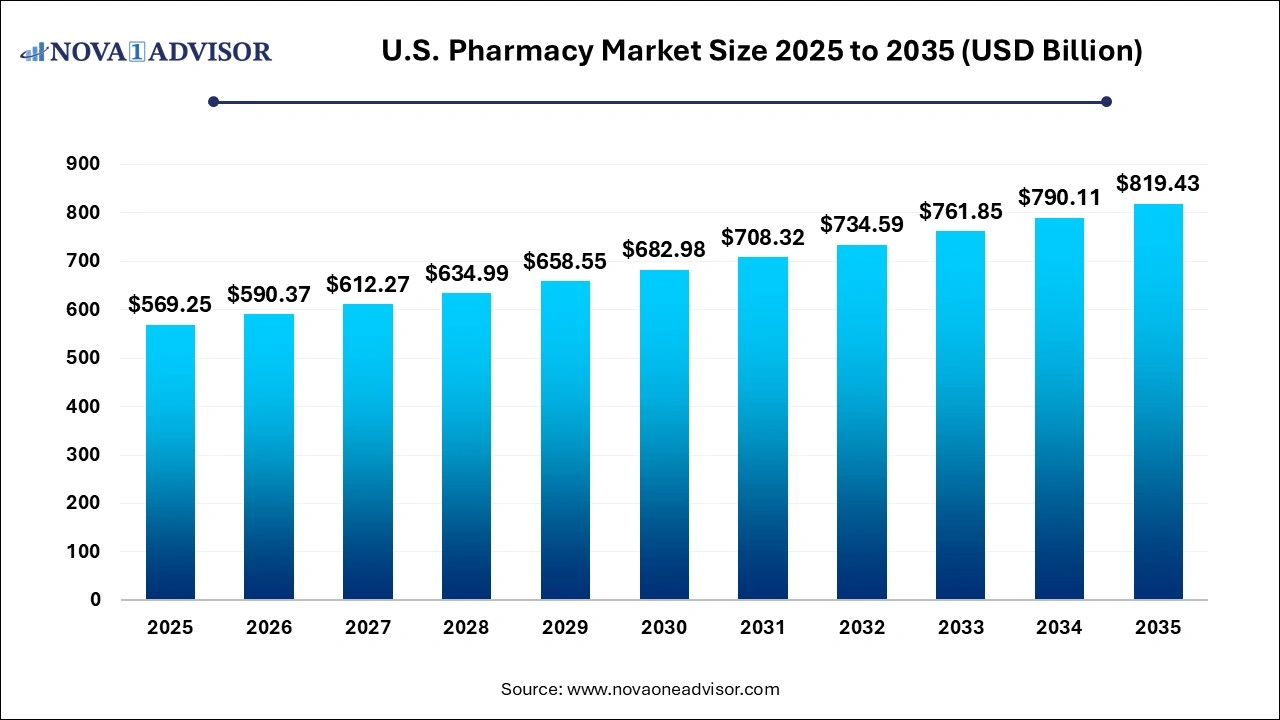

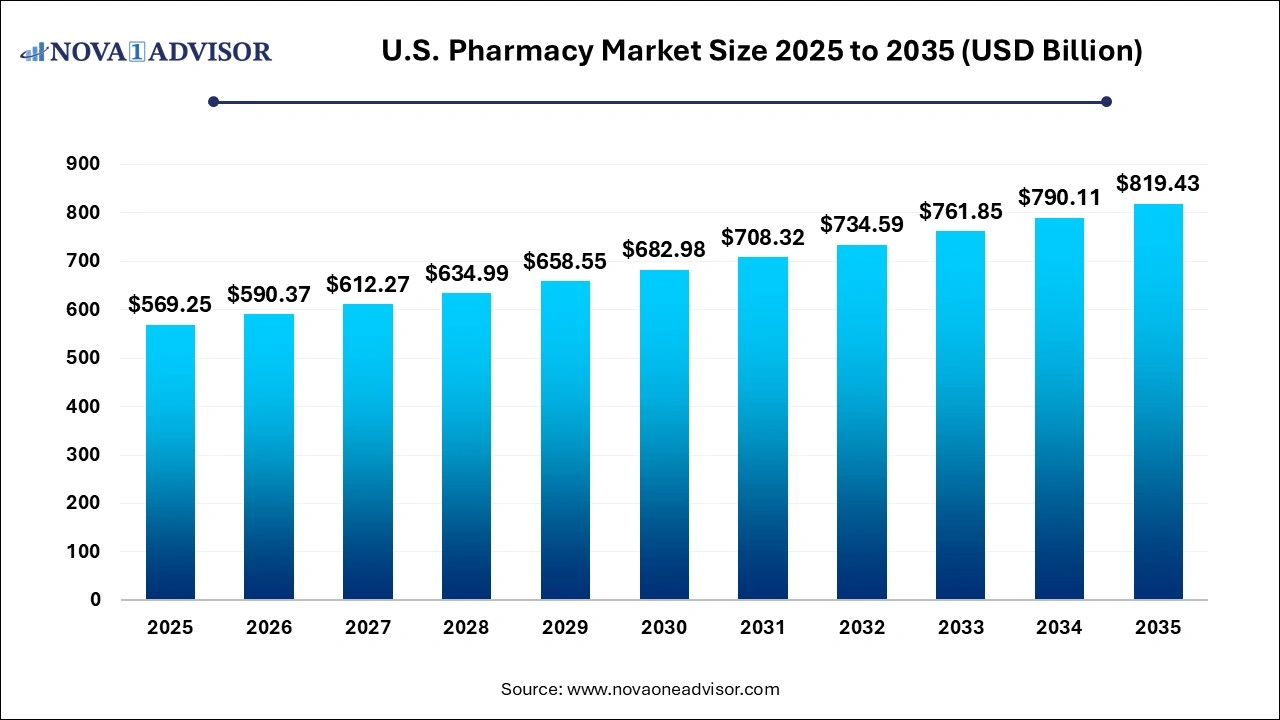

The U.S. Pharmacy market size was estimated at USD 569.25 billion in 2025 and is expected to surpass around USD 819.43 billion by 2035 and poised to grow at a compound annual growth rate (CAGR) of 3.71% during the forecast period 2026 to 2035.

Key Takeaways:

Key Takeaways:

- Based on type, the retail pharmacy segment held the largest market share in 2025 owing to easy accessibility and the presence of multiple retail pharmacy chains across the country

- Based on product type, the prescription segment held the largest revenue share in 2025, owing to the increasing burden of chronic diseases and the growing aging population

- Based on the ownership, the pharmacy chains segment held the largest market share in 2025 owing to the emergence of large hospital and corporation chains that offer convenient and cost-effective services, including specialty drugs, mail-order prescriptions, and other services

- The market has witnessed significant vertical and horizontal consolidations in recent years, which is expected to improve services

- The market potential is driving a number of service providers to strengthen their market presence by opening new centers and entering into partnerships. For instance, in October 2021, Walgreens Boots Alliance (WBA) announced an investment of USD 5.2 billion in VillageMD, a primary care provider. The investment allow VillageMD to open 600 new primary care practices in over 30 US markets by 2025, more than half of which will be located in underserved communities

U.S. Pharmacy Market Overview

The U.S. pharmacy market represents a critical component of the nation's healthcare ecosystem, serving as the primary point of access for medication, preventive services, and increasingly, clinical care. Traditionally focused on dispensing prescriptions, today’s pharmacy model has evolved into a multifaceted healthcare service provider offering immunizations, chronic disease management, wellness consultations, and digital prescription delivery. With the healthcare landscape undergoing rapid transformation driven by policy shifts, technological advancements, and changing consumer expectations pharmacies have emerged as pivotal players in improving population health and delivering convenient, cost-effective care.

As of 2025, the U.S. pharmacy sector operates at the intersection of retail and clinical health, supported by a diverse mix of hospital pharmacies, community retailers, independent stores, and fast-growing ePharmacy platforms. According to industry estimates, over 60,000 pharmacies operate across the United States, catering to an aging population, a growing prevalence of chronic diseases, and expanding pharmaceutical innovation. The COVID-19 pandemic significantly accelerated the expansion of pharmacy services, with pharmacists administering millions of vaccine doses and offering point-of-care testing services thereby solidifying their role as frontline healthcare providers.

Market participants are also redefining value delivery through vertical integration, personalized medicine, and the adoption of digital health solutions. With the increasing adoption of pharmacy benefit management (PBM) services, the lines between pharmacy, insurer, and provider are blurring. Meanwhile, disruptive players such as Amazon Pharmacy are challenging traditional business models, compelling incumbents to invest in e-commerce, logistics, and patient experience. These dynamic shifts are reshaping the U.S. pharmacy landscape, making it a rapidly evolving and competitive market with significant growth potential.

Major Trends in the U.S. Pharmacy Market

-

Rise of Digital and Mail-Order Pharmacies: Consumers increasingly prefer the convenience of ordering prescriptions online, fueled by growing trust in ePharmacy services and greater internet penetration.

-

Pharmacy-as-a-Healthcare-Hub: Pharmacies are expanding their service portfolios to include immunizations, health screenings, and even telehealth consultations, reducing pressure on clinics and emergency departments.

-

Vertical Integration and Consolidation: Major players are acquiring or merging with insurers, providers, and PBMs to create end-to-end healthcare ecosystems.

-

Artificial Intelligence and Automation in Dispensing: AI-powered inventory management, robotic dispensing systems, and predictive analytics are optimizing operations and reducing errors.

-

Retail Clinics and Walk-in Services: Pharmacies like CVS and Walgreens have integrated urgent care clinics to enhance access to minor illness treatment and chronic disease support.

-

Personalized and Specialty Medication Growth: An increase in specialty drugs, gene therapies, and personalized treatment plans is driving demand for advanced pharmacy capabilities.

-

Legislative Reforms and Provider Status for Pharmacists: States are passing laws to expand pharmacists’ clinical roles, especially in prescribing certain medications and delivering clinical services.

U.S. Pharmacy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 590.37 Billion |

| Market Size by 2035 |

USD 819.43 Billion

|

|

Growth Rate From 2026 to 2035

|

CAGR of 3.71% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Ownership, Product type, Pharmacy type |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

CVS Health; Walgreens Boots Alliance, Inc.; Walmart Stores, Inc; Cigna Healthcare; Rite Aid Corp; The Kroger Company; Albertsons Companies, Inc; UnitedHealth Group (OptumRx); Cardinal Health, Inc; Humana pharmacy solution. |

Market Driver: Increasing Burden of Chronic Diseases

A key driver for the U.S. pharmacy market is the increasing prevalence of chronic diseases such as diabetes, hypertension, cardiovascular conditions, and respiratory ailments. These conditions require ongoing medication management and consistent patient engagement, placing pharmacies at the center of long-term care delivery. According to the CDC, 6 in 10 U.S. adults have at least one chronic condition, and 4 in 10 have two or more. Pharmacies play an essential role in ensuring medication adherence, providing education, and offering point-of-care services to manage these illnesses effectively.

As the healthcare system emphasizes value-based care, pharmacies are leveraging their accessibility and frequent patient touchpoints to improve health outcomes. For example, programs involving medication therapy management (MTM) have shown measurable improvements in adherence and reduced hospital readmissions. In states like California and Ohio, pharmacies are also initiating pilot programs to manage blood pressure and cholesterol under collaborative practice agreements. This shift positions pharmacies as active contributors to chronic disease prevention and management, significantly enhancing their relevance in the healthcare continuum.

Market Restraint: Complex Reimbursement Structures

Despite their growing responsibilities, pharmacies often struggle with opaque and unfavorable reimbursement structures, especially those dictated by pharmacy benefit managers (PBMs). PBMs act as intermediaries between insurers, pharmacies, and drug manufacturers, negotiating prices and determining reimbursement rates. However, the lack of pricing transparency and prevalence of "clawbacks" where PBMs recoup part of the reimbursement post-dispensing has led to financial uncertainty, particularly for independent pharmacies.

The reimbursement landscape becomes even more complex for services like medication therapy management, point-of-care testing, or vaccinations, where state-by-state variation exists in pharmacist compensation. Without a consistent federal framework recognizing pharmacists as reimbursable providers for clinical services, many pharmacies face barriers in expanding their service offerings. This financial unpredictability affects investment decisions, staffing, and operational sustainability, especially for smaller market participants.

Market Opportunity: Expansion of ePharmacy and Home Delivery Models

The rapid growth of ePharmacy platforms represents one of the most promising opportunities in the U.S. pharmacy market. As consumers become more digitally engaged and value convenience, the demand for mail-order prescriptions, telepharmacy services, and automated refills has surged. Companies like Amazon Pharmacy, Capsule, and NowRx have revolutionized how prescriptions are ordered, filled, and delivered introducing transparency, speed, and competitive pricing.

In parallel, traditional players like CVS and Walgreens are expanding their home delivery capabilities and investing in app-based services that allow real-time prescription tracking, chat-based pharmacist consultations, and integrated chronic care management. With increased internet access, changing patient demographics, and advancements in digital health infrastructure, the ePharmacy model is becoming a viable long-term care delivery channel, particularly for the elderly, rural populations, and those managing multiple chronic conditions. The integration of AI and logistics tracking is expected to further enhance user experience and operational efficiency in this segment.

Segmental Analysis

By Pharmacy Type

Retail pharmacy dominated the pharmacy type segment, accounting for the highest share of market activity due to its widespread presence, accessibility, and expanded service capabilities. Retail pharmacies, including giants like Walgreens, CVS Health, and Rite Aid, are the first point of contact for millions of Americans seeking prescription refills, over-the-counter medications, and clinical services. These outlets are increasingly functioning as mini health hubs, offering flu shots, COVID-19 vaccines, health screenings, and consultations. Their strong physical footprint particularly in suburban and urban neighborhoods ensures high foot traffic and customer loyalty. Additionally, partnerships with health systems and payers are strengthening the clinical capabilities of retail pharmacy chains, making them indispensable in care coordination models.

ePharmacy emerged as the fastest-growing segment, driven by evolving consumer expectations, pandemic-induced digital adoption, and technological innovations. Online pharmacies offer unparalleled convenience, especially for maintenance medications and chronic care patients who prefer doorstep delivery. Players like Amazon Pharmacy and PillPack have disrupted traditional retail models by offering price comparisons, subscription services, and digital interfaces for seamless user experiences. Furthermore, ePharmacies are increasingly integrating AI-powered chatbots and virtual pharmacists to enhance customer support and medication adherence. As regulations catch up and consumers become more comfortable with digital healthcare, the ePharmacy segment is poised for sustained growth.

By Product Type

Prescription drugs dominated the product type segment owing to their indispensable role in treating acute and chronic illnesses. With increasing incidences of conditions such as diabetes, cancer, and autoimmune disorders, the demand for prescription medications continues to rise. Retail and hospital pharmacies are the primary channels through which prescription drugs are dispensed, and many now provide value-added services such as dosage monitoring, side-effect management, and synchronization of medication schedules. Specialty prescriptions, including biologics and gene therapies, are also contributing significantly to this segment’s growth, often requiring sophisticated storage, handling, and counseling—capabilities that pharmacies are expanding to accommodate.

OTC (over-the-counter) products represent the fastest-growing segment, fueled by consumer self-care trends, greater product awareness, and the convenience of non-prescription availability. Consumers increasingly rely on OTC medications for minor ailments such as cold, flu, allergies, digestive issues, and pain relief. The growing demand for vitamins, nutraceuticals, and immune booster sespecially post-pandemic has further energized this segment. Pharmacies are optimizing shelf space, promotional strategies, and private-label branding to maximize revenue from OTC products. Moreover, digital tools like symptom checkers are encouraging consumers to seek OTC options before consulting a physician, expanding the scope of self-medication.

By Ownership

Chain pharmacies dominated the ownership segment due to their economies of scale, standardized service protocols, and robust supply chain infrastructure. Chains like CVS Health, Walgreens Boots Alliance, and Walmart Pharmacy operate thousands of locations nationwide, supported by centralized logistics, integrated IT systems, and strong payer relationships. These advantages enable chain pharmacies to offer competitive pricing, loyalty programs, and broader service portfolios, including vaccination drives, diagnostics, and chronic care programs. Their brand recognition and convenience continue to attract a loyal customer base, particularly in densely populated areas.

Independent pharmacies, while smaller in footprint, are the fastest-growing segment in terms of community engagement and service personalization. These local businesses often operate in rural or underserved areas, playing a crucial role in filling care gaps left by larger players. Independent pharmacists typically have more flexibility in adopting patient-centric models, building long-term relationships, and offering customized counseling. With growing support from pharmacy buying groups, health-tech startups, and state-level grants, many independent pharmacies are upgrading their digital infrastructure, offering delivery, and integrating telepharmacy services. Their agility and deep community ties give them a competitive edge in specialized and patient-trust-driven markets.

Country-Level Analysis: United States

The U.S. pharmacy market is characterized by diversity in pharmacy models, advanced drug development, a high prevalence of chronic illnesses, and rapid digitalization. With healthcare spending exceeding $4.5 trillion annually, a significant portion of it flows through pharmacies in the form of drug sales, clinical services, and preventive care. Federal healthcare programs like Medicare and Medicaid play a pivotal role in shaping reimbursement and access policies, directly influencing pharmacy operations and service scope.

State legislatures are also expanding pharmacists' scope of practice, granting prescribing authority for minor ailments and promoting collaborative care models. For example, states like California and Idaho allow pharmacists to initiate therapy for birth control, tobacco cessation, and even travel medications. The expansion of pharmacist provider status is gaining momentum nationwide, which will have a transformative impact on service delivery models in both chain and independent pharmacies.

The U.S. is also a hotbed for pharmaceutical innovation, with over 20,000 drugs currently in the pipeline. Specialty pharmacies are expanding rapidly to support complex drug regimens, and pharmacy technicians are assuming more clinical roles. The integration of pharmacogenomics and real-time data sharing is setting the stage for personalized medication plans and improved outcomes.

Key Companies & Market Share Insights

The market is highly competitive. Some of the major players are CVS Pharmacy, Walgreens, Health Mart, and Rite Aid. There are more than 29,881 pharmacies across 8 pharmacy chains in the US. Market players adopt this strategy to expand the outreach of their service in the market and increase the availability of their service in diverse geographical areas.

For instance, in December 2021, CVS Health collaborated with Microsoft on its Omni channel pharmacy capabilities and provide personalized, customized care recommendations for consumers. As part of this strategy, CVS is expected to utilize Microsoft's Azure cloud platform and data science. Some prominent players in the U.S. pharmacy market include:

Recent Developments

-

April 2025 – Amazon Pharmacy launched real-time prescription price comparison tools for Prime members, aiming to improve affordability and transparency for U.S. customers.

-

February 2025 – CVS Health announced the expansion of its HealthHUB concept stores into 500 new locations, enhancing its clinical services portfolio, including diabetes management and mental health screening.

-

January 2025 – Walgreens Boots Alliance partnered with Pear Therapeutics to integrate digital therapeutics into its pharmacy platforms, offering app-based mental health treatment alongside medication management.

-

October 2024 – Capsule Pharmacy rolled out its one-hour delivery service across six additional states, reinforcing its logistics and ePharmacy network.

-

August 2024 – GoodRx unveiled a partnership with independent pharmacies to boost foot traffic through online discount coupon distribution and in-store redemption programs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Pharmacy market.

By Pharmacy Type

- Hospital Pharmacy

- Retail Pharmacy

- ePharmacy

- Others

By Product Type

By Ownership

Key Takeaways:

Key Takeaways: