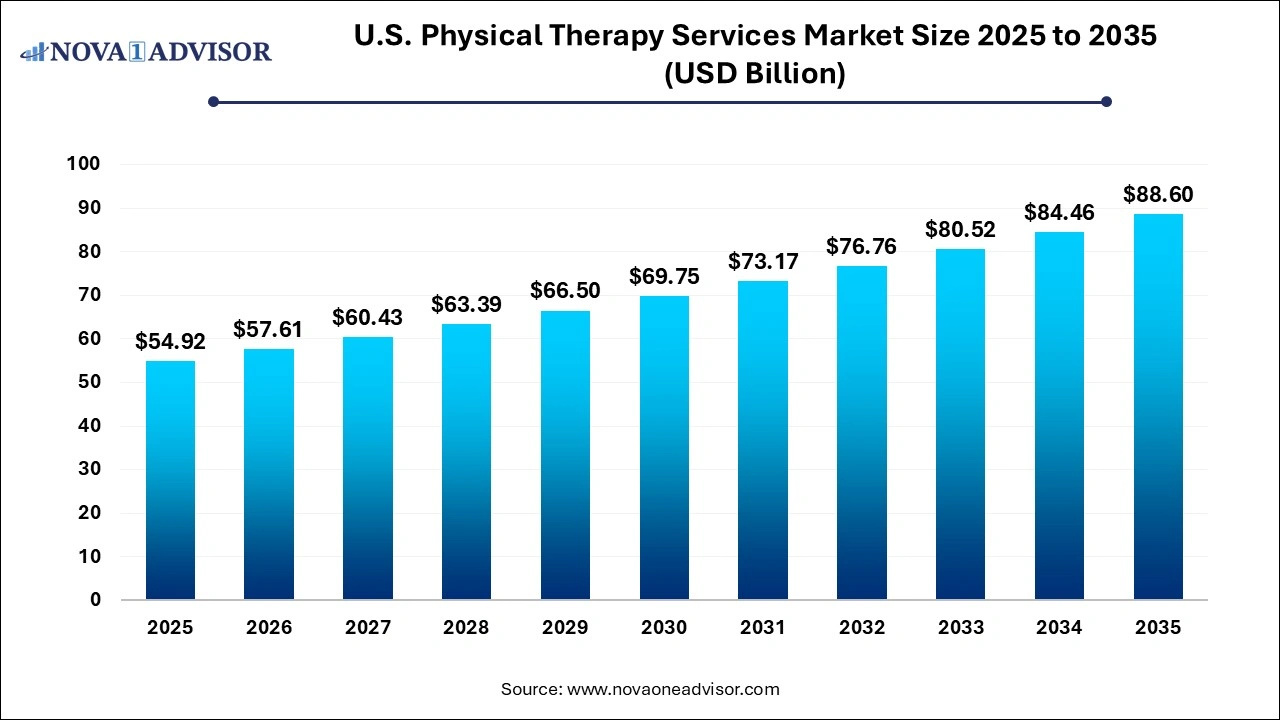

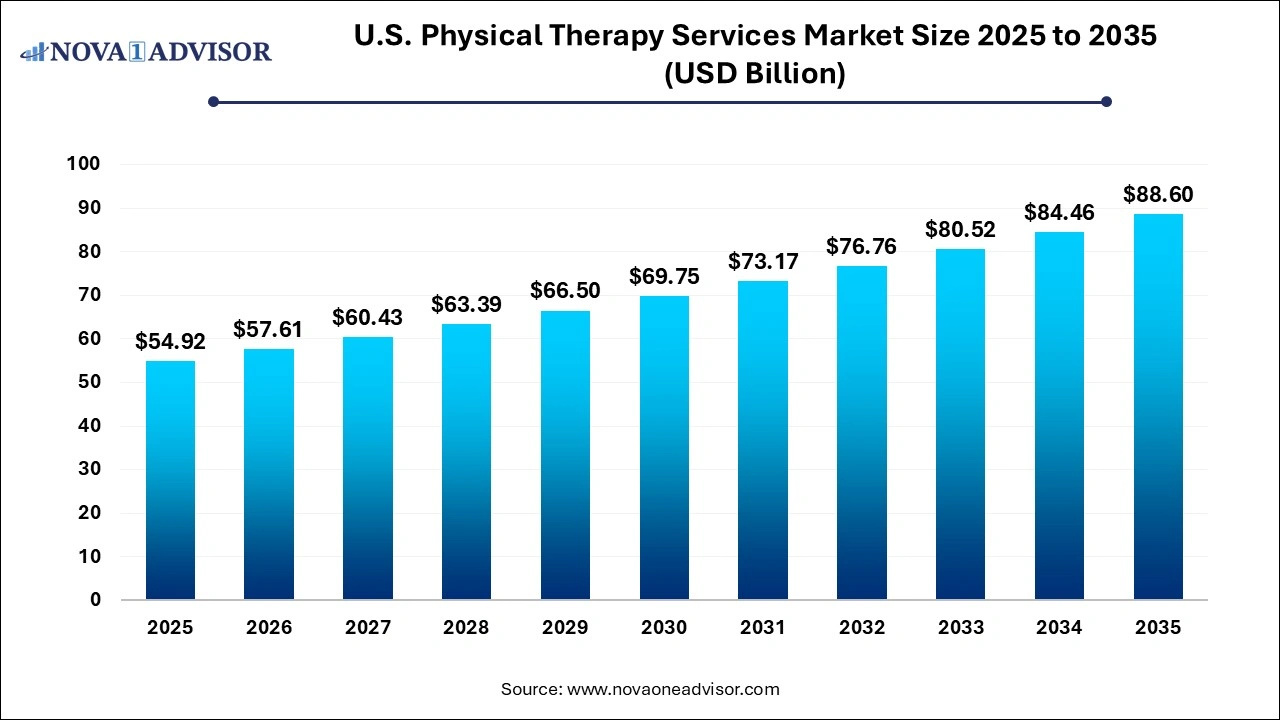

U.S. Physical Therapy Services Market Size and Growth 2026 to 2035

The U.S. physical therapy services market size was exhibited at USD 54.92 billion in 2025 and is projected to hit around USD 88.60

billion by 2035, growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

Key Takeaways:

- The orthopedic therapy segment dominated the industry with a share of more than 58.5% in 2025.

- The outpatient clinics segment accounted for the maximum share of more than 50.50% in 2025.

- In 2025, the private insurance segment accounted for the largest share of more than 58.0% of the overall revenue.

U.S. Physical Therapy Services Market Outlook

- Market Growth Overview: The U.S. physical therapy services market is expected to grow significantly between 2025 and 2034, driven by the growing demographic shift, widespread adoption of technological integration, and rising musculoskeletal disorders, chronic conditions, and sport-related injuries.

Sustainability Trends: Sustainability trends involve rapid adoption of digital transformation and telehealth, green clinic initiatives, and environmental physiotherapy and prevention.

Major Investors: Major investors in the market include BlackRock Inc., Vanguard Group, Morgan Stanley, and Houlihan Lokey.

U.S. Physical Therapy Services Market Overview

The U.S. physical therapy services market is a critical pillar within the country’s healthcare continuum, providing essential rehabilitative care to individuals across all age groups. Physical therapy (PT) services in the U.S. are delivered through various modalities and settings to address a wide range of health conditions including musculoskeletal, neurological, cardiovascular, and age-related disorders. The market is experiencing considerable growth, driven by a growing elderly population, a rising incidence of chronic diseases, and increasing awareness of preventive and rehabilitative healthcare.

In 2025, the physical therapy services market in the U.S. is witnessing robust expansion, primarily due to the nation’s proactive approach toward improving population health outcomes and reducing long-term healthcare costs. With a shift from reactive to proactive care models, the role of physical therapy has grown significantly. Technological integration, such as tele-rehabilitation and wearable motion-tracking devices, is further enhancing the accessibility and quality of care. Moreover, the increasing adoption of outpatient care and the emergence of value-based reimbursement models are redefining the physical therapy services landscape in the U.S.

Artificial Intelligence: The Next Growth Catalyst in U.S. Physical Therapy Services

AI is significantly transforming the U.S. physical therapy service industry by enhancing treatment personalization and enabling remote, data-driven rehabilitation. Through computer vision, AI-powered tools provide real-time, objective feedback on patient form and movement during home exercises, which has been shown to improve recovery outcomes and increase adherence. Furthermore, AI reduces administrative burdens on therapists by automating documentation, allowing them to focus more on patient care, which helps address industry shortages.

Major Trends in the U.S. Physical Therapy Services Market

-

Increased Adoption of Tele-rehabilitation Services: The COVID-19 pandemic accelerated the adoption of virtual care models, and tele-rehabilitation continues to see strong uptake among patients with mobility constraints and those living in rural areas.

-

Integration of AI and Wearable Technology: Wearables that track patient mobility, posture, and rehabilitation progress are increasingly integrated into therapy regimens, enhancing personalized care.

-

Rise of Direct Access Therapy: Legislative changes in several U.S. states have enabled patients to consult physical therapists without physician referrals, reducing treatment delays.

-

Growing Emphasis on Sports Rehabilitation: Rising sports participation, especially among youth and amateur athletes, has led to increased demand for specialized physical therapy services.

-

Expansion of Corporate Wellness Programs: Employers are integrating PT services into wellness programs to reduce employee downtime and healthcare costs.

-

Emergence of Multidisciplinary Rehabilitation Clinics: Clinics offering a blend of PT, occupational therapy, and chiropractic care are gaining popularity due to their holistic approach.

Report Scope of The U.S. Physical Therapy Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 57.61 Billion |

| Market Size by 2035 |

USD 88.60 Billion |

| Growth Rate From 2025 to 2035 |

CAGR of 4.9% |

| Base Year |

2025 |

| Forecast Period |

2025 to 2035 |

| Segments Covered |

By Application, By payer, By settings |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

U.S. Physical Therapy, Inc.; Select Physical Therapy; ATI Physical Therapy; Athletico Physical Therapy; Drayer Physical Therapy Institute; NovaCare Rehabilitation; Professional Physical Therapy; CORA Health Services, Inc.; PT SOLUTIONS; Boston Children’s Hospital |

Market Driver: Aging Population and Associated Mobility Issues

A major driver of the U.S. physical therapy services market is the rapidly aging population. According to the U.S. Census Bureau, by 2034, older adults will outnumber children for the first time in the nation's history. This demographic shift is resulting in a higher prevalence of age-related ailments such as arthritis, osteoporosis, and Parkinson’s disease, all of which necessitate long-term physical therapy. Older adults also face increased risks of falls, fractures, and surgeries, such as hip and knee replacements, which require extensive post-operative rehabilitation. The growing geriatric population thus represents a consistent and expanding customer base for physical therapy services.

Market Restraint: Reimbursement Limitations and Policy Fluctuations

Despite the expanding demand, reimbursement challenges continue to hinder the market’s full potential. Medicare and Medicaid, which cover a significant proportion of the elderly population, have strict limits on the number of therapy sessions that can be reimbursed annually. Moreover, fluctuating reimbursement rates and administrative complexities deter some providers from expanding their services or adopting innovative care delivery models. These limitations can lead to out-of-pocket expenses for patients, thereby reducing access to necessary therapy, especially among low-income populations.

Market Opportunity: Integration of PT Services in Value-Based Care Models

The shift from volume-based to value-based care is opening new opportunities for the physical therapy market. As healthcare providers and payers focus on improving patient outcomes while lowering costs, physical therapy is increasingly recognized for its role in reducing hospital readmissions, preventing surgeries, and managing chronic conditions. Integrating PT into bundled payment and accountable care organization (ACO) models allows for coordinated, outcome-driven care. This transition presents a significant opportunity for PT providers to demonstrate value, improve care quality, and secure better reimbursement.

U.S. Physical Therapy Services Market Segmental Insights

By Application Insights

Orthopedic Therapy dominated the application segment in 2025 and is expected to maintain its lead. Orthopedic therapy addresses conditions related to bones, joints, muscles, and ligaments. It plays a vital role in post-surgical rehabilitation, injury management, and musculoskeletal disorders, which are highly prevalent in the U.S. A report from the CDC indicates that over 50 million adults are diagnosed with arthritis—a key condition managed through orthopedic PT. The rise in joint replacement surgeries, such as total hip and knee replacements, has further driven the demand for orthopedic therapy. These procedures are often followed by long-term physical therapy programs to restore function and mobility.

Neurological Therapy is expected to grow at the fastest rate during the forecast period. This growth is fueled by increasing diagnoses of neurological disorders such as Parkinson’s disease, multiple sclerosis, and stroke. According to the American Stroke Association, nearly 800,000 strokes occur annually in the U.S., making post-stroke rehabilitation a major contributor to PT service needs. Neuro PT focuses on restoring balance, gait, and functional independence in affected individuals. Technological advancements like robotic gait training and virtual reality-based neuro-rehab solutions have made neurological therapy more effective and patient-friendly.

By Settings Insights

Outpatient Clinics continue to dominate the market due to their accessibility, affordability, and focus on diverse specialties. These settings offer flexible appointment options, access to specialized therapists, and are often conveniently located. Many outpatient clinics have expanded to include hydrotherapy, sports rehab, and balance training services. Chains like Athletico, BenchMark Physical Therapy, and ATI Physical Therapy have significantly expanded their national footprints through mergers and new openings.

Home Healthcare is projected to experience the fastest growth. Patients recovering from orthopedic surgeries or living with mobility limitations prefer in-home therapy services to avoid hospital visits. The aging population and increased incidence of chronic conditions make home-based PT an attractive option. Providers such as Amedisys and BAYADA Home Health Care have invested heavily in scaling their home health PT teams. Furthermore, technological enablers like remote monitoring devices and app-based therapy exercises support this trend.

By Payer Insights

Private Insurance emerged as the dominant payer in the U.S. market. Due to a high percentage of Americans under employer-sponsored insurance plans and increasing preference for comprehensive private insurance policies, most patients utilize private coverage for PT services. These plans often offer greater flexibility in provider choice and higher reimbursement rates. Moreover, private insurers are increasingly supporting digital and hybrid therapy models, recognizing their cost-effectiveness.

Out of Pocket payments are anticipated to be the fastest-growing segment. This trend is driven by high-deductible insurance plans, limited session approvals, and increasing consumer preference for personalized care not covered under traditional plans. Additionally, a rise in direct access PT services has empowered patients to seek therapy without waiting for insurance approvals, especially in urgent post-injury situations. Boutique practices offering sports rehabilitation and wellness PT are witnessing increased out-of-pocket clients.

Country-Level Insights: United States

In the U.S., the physical therapy landscape is largely shaped by state-level policies, reimbursement structures, and demographic patterns. States like California, Texas, and Florida have seen significant growth in physical therapy centers owing to their large aging populations and higher incidence of orthopedic and lifestyle-related conditions. California leads in adoption of tele-PT services due to its advanced digital infrastructure and regulatory flexibility around direct access.

Rural regions, however, still struggle with access to physical therapy due to a shortage of practitioners and facilities. Programs such as the Medicare Rural Health Clinic program are attempting to bridge this gap. Furthermore, legislative efforts such as the Medicare Access to Rehabilitation Services Act aim to remove therapy caps and improve access for underserved populations.

Urban centers, on the other hand, are increasingly incorporating physical therapy into integrated healthcare systems and multidisciplinary pain management programs. States like New York and Illinois have supported innovative pilot programs integrating physical therapy with mental health and occupational therapy in community settings.

Some of the prominent players in the U.S. physical therapy services market include:

- U.S. Physical Therapy, Inc.: As a large publicly-traded operator, U.S. Physical Therapy, Inc. operates hundreds of clinics providing pre- and post-operative care, while also managing third-party facilities and offering industrial injury prevention services.

- Select Physical Therapy: Select Physical Therapy (part of Select Medical) delivers comprehensive outpatient physical and occupational therapy, focusing on restoring function through personalized treatment plans.

- ATI Physical Therapy: ATI Physical Therapy is a national leader known for a large footprint of outpatient clinics, offering specialized services like pelvic health alongside traditional physical therapy.

- Athletico Physical Therapy: Athletico Physical Therapy provides personalized, patient-centric physical therapy and rehabilitation services across numerous states, often offering free assessments to improve patient access.

- Drayer Physical Therapy Institute: (Now part of Upstream Rehabilitation/Select Medical) focuses on outpatient physical therapy, placing a strong emphasis on evidence-based treatment and high patient satisfaction.

- NovaCare Rehabilitation: As part of Select Medical, Select Physical Therapy (operating as NovaCare) provides comprehensive orthopedic and sports medicine services to a wide range of patients.

Recent Developments

-

ATI Physical Therapy (January 2025) announced a strategic partnership with Luna, a leading in-home physical therapy platform, to expand hybrid care services in 12 additional states. The collaboration aims to combine outpatient quality with the convenience of home care.

-

Hinge Health (March 2025) launched a new AI-powered digital physical therapy assistant named “Hinge Motion+” to assist patients with real-time motion feedback, enhancing adherence and outcomes for musculoskeletal conditions.

-

Select Medical (February 2025) completed the acquisition of two outpatient rehabilitation centers in Pennsylvania, continuing its expansion strategy in the northeastern U.S.

-

Kindred Healthcare (December 2024) entered into a joint venture with a large physician group in Florida to offer integrated rehabilitation services, including home-based physical therapy.

-

Fyzical Therapy & Balance Centers (November 2024) announced its 500th clinic opening, signifying the brand’s rapid franchise growth focused on vestibular and balance therapy.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. physical therapy services market

Application

- Orthopedic Therapy

- Geriatric Therapy

- Cardiopulmonary Therapy

- Pediatric Therapy

- Neurological Therapy

- Women’s Health

- Others

Payer

- Public Insurance

- Private Insurance

- Out of Pocket

Settings

- Hospitals

- Outpatient Clinics

- Home Healthcare

- Others