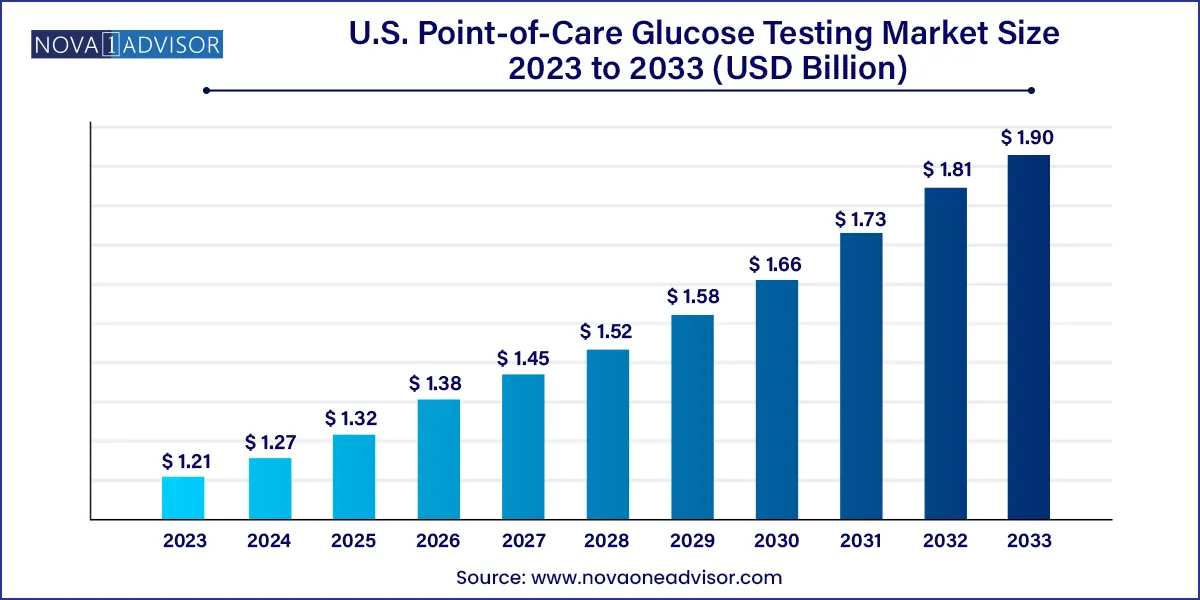

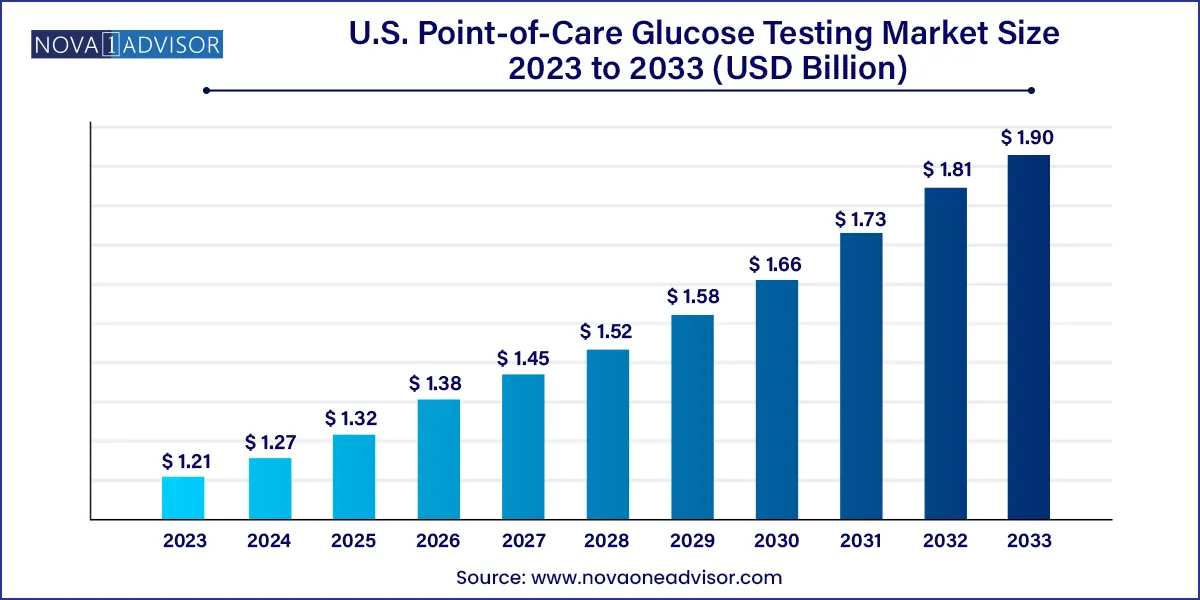

The U.S. point-of-care glucose testing market size was estimated at USD 1.21 billion in 2023 and is projected to hit around USD 1.90 billion by 2033, growing at a CAGR of 4.6% during the forecast period from 2024 to 2033.

Key Takeaways:

- Accu-Chek Inform II accounted for the largest market share of 18.9% in 2023.

- Freestyle lite is expected to witness the fastest growth over the forecast period.

Market Overview

The U.S. Point-of-Care (POC) Glucose Testing Market plays a critical role in the nation’s chronic disease management ecosystem, with diabetes being one of the most prevalent and costly conditions in the country. With over 37 million Americans living with diabetes and an additional 96 million classified as prediabetic, the demand for fast, accurate, and accessible blood glucose testing is surging. Point-of-care testing (POCT) devices enable real-time blood sugar monitoring in clinics, hospitals, ambulatory settings, and increasingly, at home.

POC glucose testing devices provide immediate results, facilitating timely therapeutic decisions and improving outcomes. Unlike traditional laboratory testing, which may take hours or even days for results, POC systems offer diagnostic support within minutes. This rapid turnaround is crucial for both inpatient glycemic control and outpatient diabetes management.

The market is driven by a growing diabetic population, the emphasis on decentralized diagnostics, the integration of digital technologies, and the increasing focus on preventive care. Insurance coverage, government healthcare initiatives like Medicare’s support for diabetic supplies, and public awareness programs also contribute to market growth.

POC glucose meters have evolved from basic handheld devices to smart, Bluetooth-enabled analyzers, often integrated with health records and smartphone apps. Hospitals are increasingly adopting connectivity-ready meters for better integration with electronic health records (EHR), ensuring compliance and clinical efficiency. At the same time, consumer-driven innovation continues to fuel growth in compact, user-friendly meters suited for at-home and travel use.

Major Trends in the Market

-

Shift Toward Connected Devices: Bluetooth-enabled and app-integrated meters support real-time data tracking and remote monitoring.

-

Expansion of Continuous Glucose Monitoring (CGM) and Integration with POC: Though traditionally distinct, CGM and POC meters are beginning to be used complementarily.

-

Emphasis on Accuracy and ISO Compliance: Devices with high precision and adherence to ISO 15197:2013 standards are increasingly preferred in hospitals.

-

Rising Adoption in Emergency and Critical Care Settings: Rapid glucose testing is becoming standard in ICUs and ERs to manage glycemic variability.

-

Pediatric and Geriatric Device Customization: User-friendly interfaces and small sample volumes are improving accessibility for vulnerable age groups.

-

Retail and Pharmacy-Based Screening Services: Pharmacies like CVS and Walgreens are leveraging POC glucose meters for community-based testing.

-

Bundling with Insulin Management Platforms: Devices are being bundled with insulin pumps and diabetes management apps.

-

Increased Regulatory Scrutiny: FDA and CMS have emphasized accuracy, especially in critical care usage, pushing manufacturers toward higher-performance systems.

-

Integration with Telehealth and RPM Models: Home glucose meters are now key tools in remote patient monitoring programs.

-

Sustainability and Device Reusability: Eco-friendly and rechargeable meters are gaining consumer interest.

U.S. Point-of-Care Glucose Testing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 1.27 Billion |

| Market Size by 2033 |

USD 1.90 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.6% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Abbott; Nipro; Platinum Equity Advisors, LLC (Lifescan, Inc.); Nova Biomedical; ACON Laboratories; Trividia Health, Inc.; Prodigy Diabetes Care, LLC; Bayer AG/Ascensia Diabetes Care Holdings AG; EKF Diagnostics |

Market Driver: Rising Diabetes Burden and Need for Real-Time Glycemic Management

One of the strongest market drivers is the increasing prevalence of diabetes and the need for real-time glucose monitoring to manage acute and chronic complications. Diabetes is a leading cause of morbidity in the U.S., contributing to kidney failure, vision loss, cardiovascular diseases, and lower-limb amputations. In this context, early detection of hyperglycemia or hypoglycemia through point-of-care glucose monitoring is a vital preventive strategy.

In hospital settings, tight glycemic control is essential for both diabetic and non-diabetic patients, particularly post-operatively and in critical care. Rapid glucose results allow for immediate insulin adjustments, reducing risks such as hypoglycemia or infection-related complications. Outside of hospitals, POC glucose meters empower patients with self-monitoring capabilities, enhancing treatment adherence and lifestyle modification.

Government-funded health initiatives such as the National Diabetes Prevention Program (NDPP), Medicare Part B coverage for diabetic testing supplies, and state-level wellness programs have also increased accessibility to POC devices. Together, these forces are expanding device penetration into both clinical and home environments.

Market Restraint: Data Inaccuracy and Device Calibration Issues

Despite advancements, a persistent challenge in the POC glucose testing market is the potential for inaccurate readings due to device variability, user error, and calibration inconsistencies. Inaccurate results can lead to inappropriate insulin dosing, resulting in severe complications such as hypoglycemia or hyperosmolar states.

This is particularly critical in hospital settings, where POC readings may be used for decision-making in unstable patients. Factors like hematocrit variability, interfering substances (e.g., maltose, galactose), and sample contamination can distort results. Furthermore, not all devices are approved for use in critical care environments, adding another layer of regulatory and operational complexity.

To address these concerns, hospitals often mandate devices that are FDA-cleared for hospital use and compliant with CLIA-waived standards. Nevertheless, smaller clinics or home users may still rely on lower-cost models with limited accuracy, which impacts overall quality of care.

Market Opportunity: Integration with Remote Patient Monitoring and Telehealth

An emerging and powerful opportunity lies in the integration of POC glucose meters with telehealth and remote patient monitoring (RPM) ecosystems. The COVID-19 pandemic greatly accelerated the adoption of virtual care, and now, managing chronic conditions like diabetes remotely has become a sustainable model.

Connected glucose meters with Bluetooth and cellular capabilities enable automatic transmission of glucose readings to healthcare providers. This allows clinicians to detect trends, adjust medications, and intervene early—without the patient needing to visit a facility. These devices are increasingly being prescribed along with RPM service bundles reimbursed under Medicare and private payers.

Startups and device manufacturers are developing cloud platforms that collect, store, and visualize blood glucose data from POC devices, creating a seamless virtual loop for chronic disease management. This opportunity is especially relevant in rural areas or among elderly populations with limited access to specialists. As CMS continues to expand reimbursement for RPM, POC glucose meters are poised to become core tools in a decentralized, tech-enabled healthcare environment.

U.S. Point-of-Care Glucose Testing Market By Product Insights

The Accu-Chek Aviva Meter has long dominated the U.S. point-of-care glucose testing market, particularly in home use due to its brand reliability, accuracy, and ease of handling. The meter's large display, minimal sample requirement, and fast results make it a consumer favorite. Roche’s strong distribution network and insurance collaborations have ensured widespread availability. Moreover, Accu-Chek’s inclusion in Medicare Part B has bolstered its adoption among elderly populations.

The fastest-growing segment is the StatStrip glucose meter, particularly in hospitals and critical care environments. Manufactured by Nova Biomedical, StatStrip is one of the few glucose meters cleared by the FDA for use in critically ill patients. Its ability to eliminate interference from hematocrit, oxygen, and other factors makes it highly accurate in ICU and emergency room settings. Hospitals are increasingly standardizing on StatStrip to comply with CMS and FDA mandates for high-risk patient testing, contributing to its accelerated uptake.

Other popular meters like OneTouch Verio Flex and Freestyle Lite continue to find a firm foothold in both retail and pharmacy-based settings due to their compact size, app integration, and affordability. i-STAT, Abbott’s handheld blood analyzer that includes glucose among other analytes, remains widely used in ERs and paramedical units for multi-parameter testing.

Country-Level Analysis

The United States remains the global leader in POC glucose testing, owing to its large diabetic population, advanced healthcare infrastructure, and strong reimbursement ecosystem. Medicare, Medicaid, and most private insurance providers cover POC glucose testing supplies for both inpatient and outpatient settings. This coverage has contributed to wide accessibility and routine use across all care levels.

U.S. hospitals are early adopters of advanced POC technologies, often driven by Joint Commission standards, FDA approvals, and the need to align with evidence-based glycemic control protocols. In critical care, tight glucose control remains a cornerstone of patient safety, and U.S. institutions prioritize FDA-cleared, high-accuracy meters for this purpose.

Retail pharmacies and community health programs also play a vital role in promoting routine glucose testing. National drugstore chains offer testing stations and often provide POC devices bundled with mobile health management programs. Additionally, digital health platforms such as Livongo and Dexcom are integrating POC meter data into broader diabetes management platforms, extending the utility of glucose testing beyond just diagnosis to behavior-driven outcomes.

U.S. Point-of-Care Glucose Testing Market Recent Developments

-

March 2025: Nova Biomedical announced expanded FDA approval for its StatStrip Glucose Hospital Meter System for use in multiple critical care settings, including neonatal and surgical units, making it the most widely approved POC glucose meter for hospital use in the U.S.

-

February 2025: Roche Diabetes Care launched an updated mobile application for Accu-Chek Guide, offering real-time alerts and seamless integration with insulin tracking platforms, enhancing home-based diabetes management.

-

January 2025: Abbott Laboratories revealed a partnership with Walgreens to integrate Freestyle Lite data into a new in-store diabetes counseling service, aiming to improve adherence and real-time education for prediabetic customers.

-

December 2024: Lifescan (OneTouch) expanded its telehealth collaboration with Teladoc Health, allowing real-time glucose tracking with the OneTouch Verio Flex, enhancing its utility in virtual diabetes care models.

-

November 2024: Trividia Health, the maker of True Metrix, received FDA clearance for a next-gen version with improved accuracy algorithms and voice-assist technology, aiming to enhance usability for elderly and visually impaired users.

U.S. Point-of-Care Glucose Testing Market Top Key Companies:

- F. Hoffmann-La Roche Ltd.

- Abbott

- Nipro

- Platinum Equity Advisors, LLC (Lifescan, Inc.)

- Nova Biomedical

- ACON Laboratories

- Trividia Health, Inc.

- Prodigy Diabetes Care, LLC

- Bayer AG/Ascensia Diabetes Care Holdings AG

- EKF Diagnostics

U.S. Point-of-Care Glucose Testing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Point-of-Care Glucose Testing market.

By Product

- Accu Check Aviva Meter

- Onetouch Verio Flex

- i-STAT

- Freestyle Lite

- Bayer CONTOUR Blood Glucose Monitoring System

- True Metrix

- Accu-Chek Inform II

- StatStrip

- Others