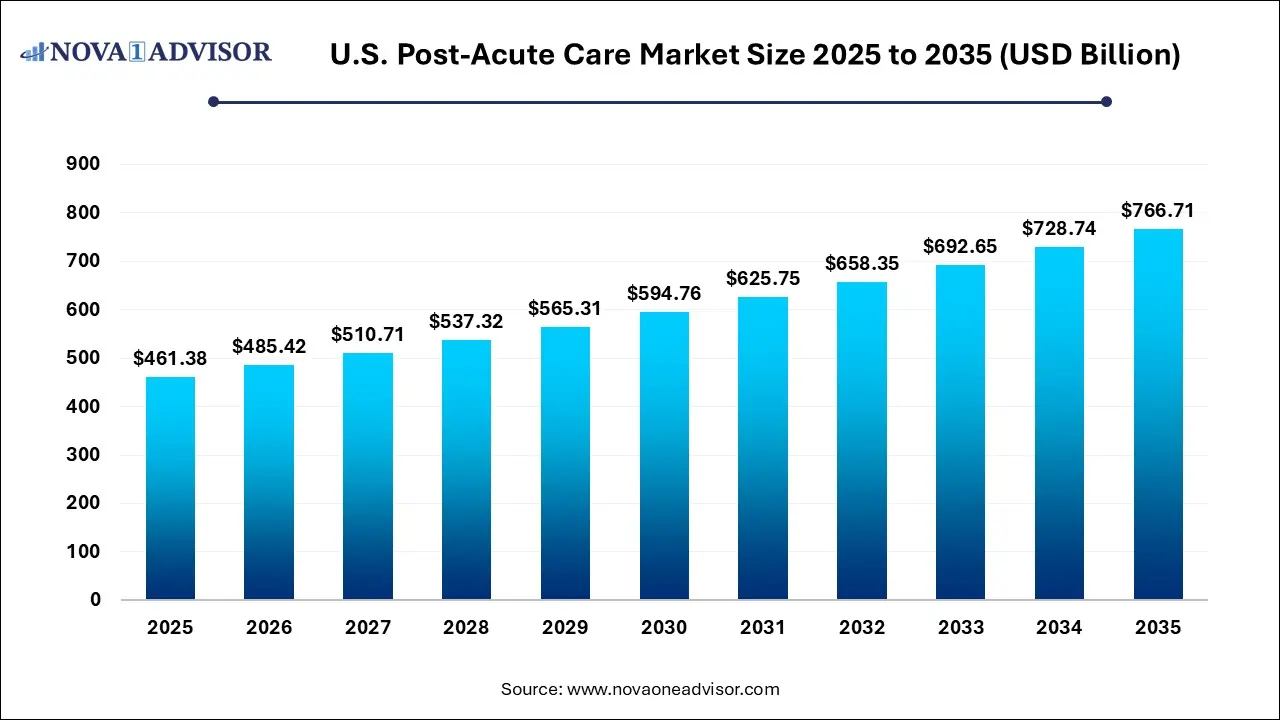

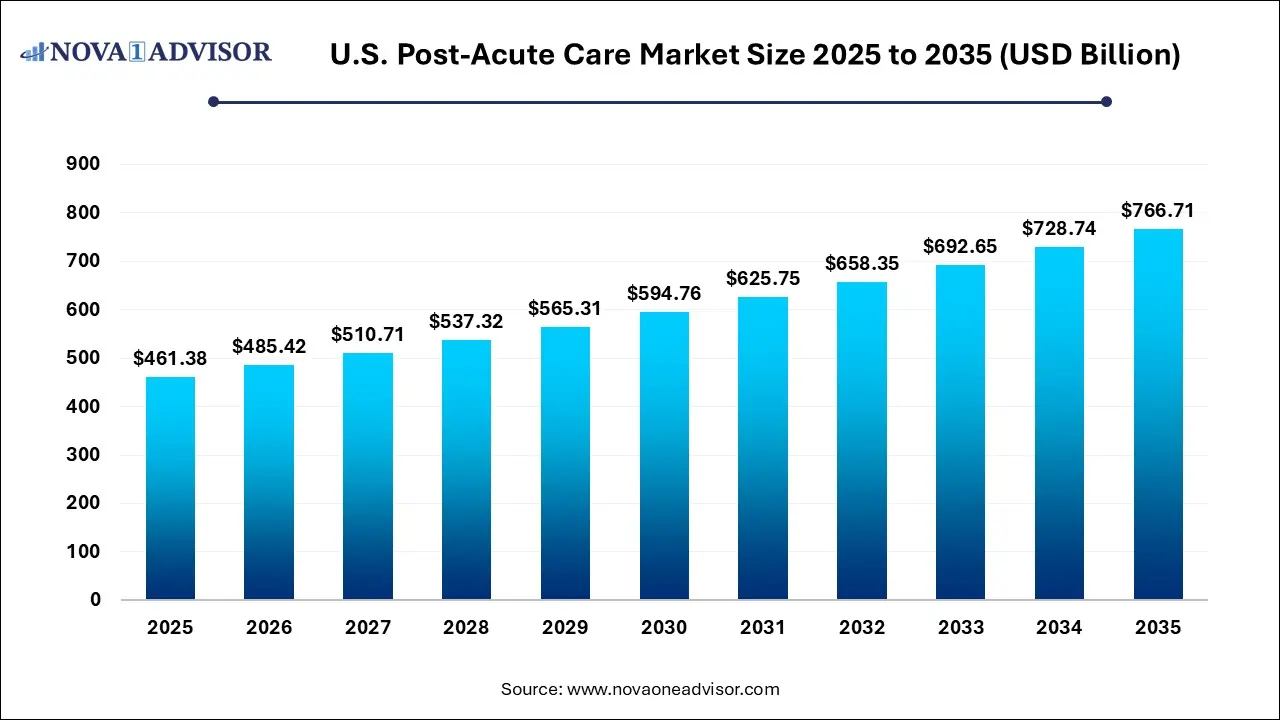

U.S. Post-Acute Care Market Size, Share, Growth, Report 2026 to 2035

The U.S. post-acute care market size was exhibited at USD 461.38 billion in 2025 and is projected to hit around USD 766.71 billion by 2035, growing at a CAGR of 5.21% during the forecast period 2026 to 2035.

Key Takeaways

- The skilled nursing facilities segment dominated the market for post-acute care in the U.S. and accounted for a revenue share of 2025.

- The home health agencies segment fastest growing in the market.

- The wound management segment led the market for post-acute care in the U.S. and accounted for a revenue share 2025.

- The elderly 65 years and older segment has the largest share of the market for post-acute care in the U.S. and accounted for a revenue share in 2025.

Market Overview:

The U.S. post-acute care (PAC) market provides a range of medical and rehabilitative services to patients after a hospitalization for an injury, illness, or surgery, with the goal of helping them recover and return to independent living. Key benefits of PAC in various applications include promoting functional recovery, preventing unnecessary hospital readmissions, and offering a cost-effective alternative to extended acute care stays. PAC services are applied across conditions like wound management, brain and spinal cord injuries, and neurological disorders, via settings such as skilled nursing facilities, inpatient rehabilitation facilities, long-term care hospitals, and home health agencies.

Market Outlook

- Market Growth Overview: The U.S. post-acute care market is expected to grow significantly between 2025 and 2034, driven by the rising chronic diseases, the rising shift to home and community-based care, and the increasing in aging population.

- Sustainability Trends: Sustainability trends involve a shift to value-based care, growth of care-at-home models, and a focus on operational efficiency and green practices.

- Major Investors: Major investors in the market include Elevance Health, Walgreens Boots Alliance, and Amedisys Inc.

Artificial Intelligence: The Next Growth Catalyst in U.S. Post-acute Care

AI is significantly impacting the U.S. post acute care (PAC) industry by driving a shift from reactive to proactive, data-driven, and patient-centered care. It leverages predictive analytics to identify high-risk patients for potential complications or readmissions, enabling timely and targeted interventions that improve health outcomes and reduce costs. AI also automates burdensome administrative and clinical documentation tasks through natural language processing, freeing up clinicians to focus on direct patient interaction and helping to mitigate staff burnout amidst labor shortages.

Report Scope of U.S. Post-Acute Care Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 485.42 Billion |

| Market Size by 2035 |

USD 766.71 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.21% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Services, By Conditions, Market Size |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Alden Network, PAC Leaders, CareCentrix, Inc., Amedisys Inc., LHC Group, Encompass Health Corporation, Kindred Healthcare, Lincoln Square Post-Acute Care, Mission Hills Post-Acute, Genesis Healthcare, Post-Acute Medical, Peninsula Post-Acute, Victoria Post-Acute Care, and AMITA Health. |

Segmentation:

By Services

U.S. post-acute market by serving as the essential clinical bridge for an aging population with increasingly complex chronic needs. As hospitals accelerate discharge timelines to control inpatient costs, SNFs provide the specialized wound care and intensive rehabilitation required to prevent expensive readmissions. The market's strength is centered in freestanding facilities, which leverage economies of scale to integrate advanced medical supervision at a lower price point than acute-care hospitals.

Home health agencies (HHAs) represent the fastest-growing segment of the U.S. post-acute care market, propelled by a strong consumer preference for "aging in place" and advanced remote monitoring technologies. This expansion is accelerated by supportive Medicare reimbursement models and the CMS "Hospital at Home" initiative, which makes high-acuity home care both clinically viable and more cost-effective than facility-based alternatives.

By Conditions

Wound management constitutes the largest revenue segment of the U.S. post-acute care market due to the high prevalence of chronic conditions like diabetic foot ulcers and the significant economic burden associated with their treatment. This dominance is driven by an aging population that requires ongoing, specialized care, which is increasingly delivered via advanced wound dressings, negative pressure wound therapy (NPWT) systems, and AI-driven remote monitoring technologies.

The neurological disorders segment is the fastest-growing in the U.S. post-acute care market, fueled by an aging population susceptible to chronic conditions like stroke, Parkinson’s, and traumatic brain injuries. This growth is accelerated by the adoption of cutting-edge technologies, such as VR-guided therapy, robotic exoskeletons, and IoT-enabled home monitoring, which deliver superior clinical outcomes for complex, long-term recoveries.

By Age

The elderly segment continues to hold the dominant share of the U.S. post-acute care market as the "Baby Boomer" generation drives an unprecedented demand for chronic disease management and specialized rehabilitation. This demographic shift has necessitated a surge in services tailored for complex needs, such as memory care for Alzheimer’s and intensive physical therapy to manage age-related mobility issues.

U.S. adult post-acute care (PAC) market is experiencing rapid growth as high-acuity workplace injuries, trauma, and chronic conditions necessitate specialized, value-based recovery pathways. The shift toward early hospital discharge and supportive insurance policies funnels a rising number of adults into PAC settings, where they leverage advanced tele-rehabilitation platforms and wearables to regain function.

U.S. Post-acute Care Market Companies

- Alden Network provides a comprehensive continuum of post-acute services, specializing in short-term rehabilitation and memory care across the Midwest to reduce hospital readmissions.

- PAC Leaders operates as a specialized physician group that provides on-site primary and post-acute care management within skilled nursing and assisted living facilities. By placing dedicated providers directly into these settings, they improve clinical outcomes and streamline the transition of care for high-acuity patients.

- CareCentrix, Inc. acts as a major coordinator of home-based post-acute care, using advanced analytics to manage transitions from hospitals to home settings for millions of patients.

- Amedisys Inc. is a leading provider of home health, hospice, and high-acuity "hospital-at-home" services, focusing on delivering clinically advanced care in the patient's preferred environment.

- LHC Group specializes in hospital-partnership models, collaborating with hundreds of healthcare systems to deliver integrated home health and facility-based post-acute care.

- Encompass Health Corporation is the largest owner and operator of inpatient rehabilitation hospitals in the U.S., providing intensive therapy for patients recovering from strokes, spinal cord injuries, and complex orthopedic conditions.

- Kindred Healthcare (now largely integrated under the Humana/CenterWell and LifePoint Health umbrellas) provides critical long-term acute care and rehabilitation services for the most medically complex patients.

- Lincoln Square (referring to Lincoln Square Post-Acute Care) serves as a localized example of a high-end skilled nursing and rehabilitation center that focuses on personalized recovery plans in urban environments.

U.S. U.S. Post-Acute Care Market Segmentation

By Services

- Inpatient Rehabilitation Facilities

- Skilled Nursing Facilities

- Home Health Agencies

- Hospice Care

- Long-term Care Hospitals

- Others

By Conditions

- Amputations

- Wound Management

- Brain Injury

- Spinal Cord Injury

- Neurological Disorders

- Others

Market Size

- Elderly (65 years & older)

- Adult (45-64 years)

- Others