The U.S. practice management system market size was exhibited at USD 5.55 billion in 2023 and is projected to hit around USD 13.64 billion by 2033, growing at a CAGR of 9.41% during the forecast period 2024 to 2033.

Key Takeaways:

- The integrated segment dominated the market with a revenue share of over 74% in 2023 and is expected to witness the fastest CAGR from 2024 to 2033.

- The software segment dominated the market with a revenue share of over 66% in 2023

- The services segment is expected to experience the fastest CAGR during the forecast period.

- The web-based practice management systems segment accounted for the largest revenue share of over 47% in 2023

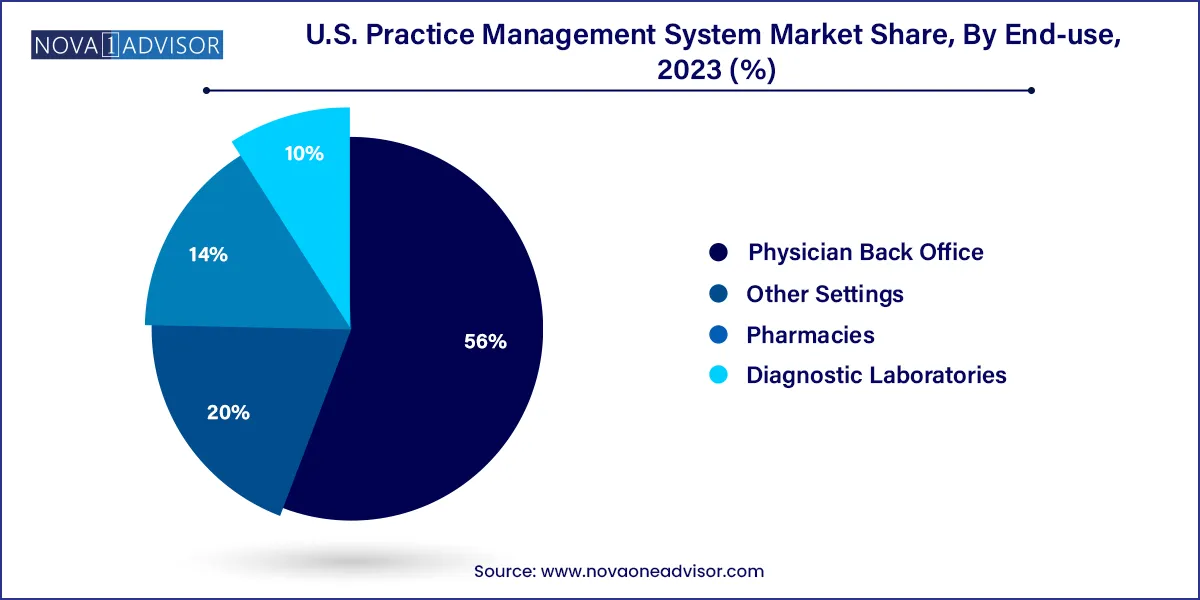

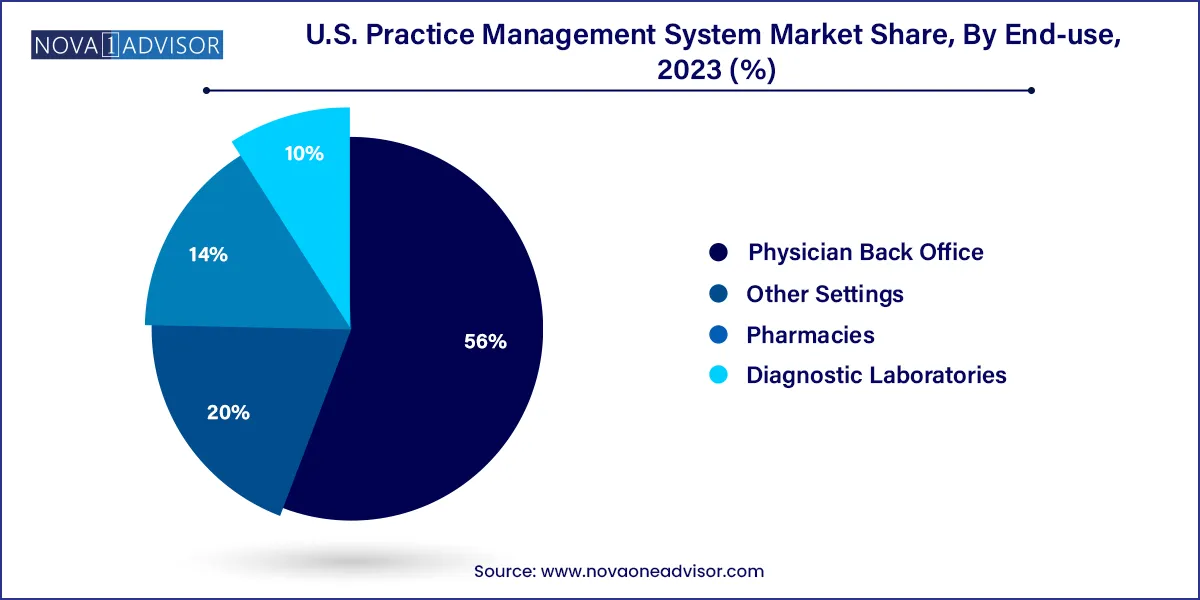

- The physician back office segment held the largest revenue share of over 56% in 2023 and is projected to witness remunerative growth during the forecast period.

Market Overview

The U.S. Practice Management Systems (PMS) market is an integral part of the country's evolving healthcare IT landscape, representing a foundational layer in the digital transformation of medical practice operations. As the American healthcare system becomes increasingly complex, with stringent regulatory requirements, growing patient expectations, and a heightened focus on cost-efficiency, healthcare providers ranging from solo practitioners to large multispecialty groups are turning to sophisticated practice management systems to streamline administrative and clinical workflows.

Practice management systems are designed to automate a wide array of non-clinical tasks such as patient registration, appointment scheduling, billing, claims processing, and revenue cycle management. Over time, these systems have matured from basic standalone modules to comprehensive, integrated platforms that work in tandem with Electronic Health Records (EHR), e-prescription tools, patient engagement interfaces, and insurance clearinghouses. The U.S. market, being technologically advanced and regulation-driven, has seen rapid adoption of such systems, particularly in light of federal mandates like the Health Information Technology for Economic and Clinical Health (HITECH) Act and the transition to value-based care models.

Today, PMS solutions are no longer a luxury but a necessity. Rising healthcare costs, staffing shortages, and the administrative burden on clinical teams have made automation critical. Moreover, with increasing patient demand for convenience—such as online appointments, digital payments, and transparent billing practice management systems are evolving into a key driver of patient experience and operational sustainability. The U.S. PMS market is therefore witnessing significant innovation, competition, and investment from both established healthcare IT companies and nimble digital health startups.

Major Trends in the Market

-

Integration with EHR/EMR Systems: There is a strong trend towards all-in-one platforms that integrate practice management with electronic health records, enabling seamless data exchange and coordinated care.

-

Shift Toward Cloud-Based Solutions: Cloud adoption is accelerating due to benefits like scalability, cost-efficiency, remote access, and automatic updates.

-

AI-Powered Revenue Cycle Management: AI is being used to optimize billing, detect claim errors, and predict reimbursement trends, significantly reducing administrative errors and improving cash flow.

-

Rise of Patient-Centric Features: Modern PMS platforms are incorporating patient portals, self-scheduling, and mobile communication tools to enhance engagement and satisfaction.

-

Specialty-Specific Customization: Vendors are increasingly developing customizable templates and workflows tailored to the unique needs of specialties like orthopedics, dermatology, or behavioral health.

-

Growth in SaaS-Based Offerings: Subscription models (SaaS) are replacing legacy licensing, offering flexibility to small and mid-sized practices.

-

Cybersecurity and Compliance Focus: With HIPAA violations and data breaches on the rise, PMS vendors are emphasizing robust encryption, audit trails, and compliance tools.

-

Voice and NLP-Based Interfaces: Natural Language Processing (NLP) and voice-enabled commands are enhancing administrative efficiency by reducing manual data entry.

Report Scope of The U.S. Practice Management System Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.07 Billion |

| Market Size by 2033 |

USD 13.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.41% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Component, Delivery Mode, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Henry Schein, Inc., Veradigm LLC (Allscripts Healthcare, LLC), AdvantEdge Healthcare Solutions, Athenahealth, Inc., Cerner Corporation (Oracle), GE Healthcare, McKesson Corporation, EPIC Systems Corporation, NXGN Management, LLC. (Thoma Bravo), eClinicalWorks, CareCloud, Inc., Kareo, Inc., AdvancedMD, Inc. (Global Payments Inc.), DrChrono, Inc., CollaborateMD Inc., OfficeAlly Inc., Accumedic Computer Systems, Inc. |

Market Driver: Increasing Administrative Burden in U.S. Healthcare

One of the most compelling drivers of the U.S. Practice Management Systems market is the escalating administrative burden on healthcare providers. According to studies by the American Medical Association (AMA), physicians spend nearly 50% of their time on administrative tasks, significantly detracting from direct patient care. Tasks such as billing, claims reconciliation, appointment coordination, and documentation often require manual intervention, are prone to error, and result in delayed payments or denied claims.

The need for efficient systems that automate and streamline these workflows has become paramount, especially for small to medium-sized practices that lack dedicated administrative staff. PMS platforms alleviate this burden by offering end-to-end solutions—from scheduling and charting to revenue cycle and compliance tracking. For example, practices that adopt integrated systems report up to 30% improvement in claim approval rates and faster patient check-ins. As healthcare continues to move toward value-based reimbursement, the role of PMS in enhancing administrative efficiency and clinical productivity becomes more critical than ever.

Market Restraint: Data Interoperability and System Integration Challenges

Despite the numerous advantages, one of the biggest challenges facing the U.S. PMS market is data interoperability. Many healthcare providers use a patchwork of software systems ranging from legacy billing platforms to newer EHR modules which often do not communicate seamlessly. This lack of integration leads to data silos, redundant entries, inconsistent records, and ultimately, diminished operational efficiency.

Moreover, transitioning from an old system to a new PMS can be disruptive. Data migration, training, and workflow customization often come with substantial costs and learning curves. In some cases, providers are hesitant to switch vendors even if their current systems are outdated, fearing operational downtime or loss of critical data. Additionally, the lack of standardized APIs and the proprietary nature of some vendor platforms exacerbate integration issues. As a result, even technologically capable providers may delay adopting newer or more advanced practice management systems.

Market Opportunity: Growing Demand for Cloud-Based and Mobile-First Solutions

The most significant opportunity in the U.S. PMS market lies in the growing demand for cloud-based and mobile-first platforms. The traditional on-premise deployment model, while secure and customizable, is costly, rigid, and ill-suited for the evolving needs of modern practices that require flexibility, remote access, and real-time data sharing. Cloud-based solutions address these concerns by offering scalable, subscription-based platforms that require minimal IT infrastructure and allow instant access from any device with internet connectivity.

This model is especially appealing to small and mid-sized practices, rural health centers, and new healthcare startups that seek cost-efficient, plug-and-play solutions. Additionally, mobile-friendly PMS platforms are becoming essential in a post-pandemic world where remote work and telehealth are normalized. Mobile access to scheduling, billing dashboards, and patient records enables on-the-go decision-making and faster response times. Vendors investing in mobile UX, offline sync capabilities, and app-based portals are well-positioned to capitalize on this opportunity.

U.S. Practice Management System Market By Product Insights

Integrated practice management systems dominated the product segment, primarily because of their ability to unify diverse functions such as billing, scheduling, EHR, e-prescriptions, and patient engagement under a single platform. This all-in-one approach reduces the need for multiple software licenses, minimizes errors due to system incompatibility, and improves data accuracy across departments. Health systems and large practices are increasingly investing in integrated PMS solutions from vendors like Epic, Cerner, and athenahealth, which allow seamless communication between clinical and administrative teams.

Among the sub-segments, EHR/EMR integration stands out as the cornerstone of modern PMS systems. Having patient records, medical histories, and administrative data accessible through one interface reduces charting time, enhances patient care coordination, and supports population health initiatives. Moreover, integrated systems are better positioned to support regulatory compliance under MACRA and MIPS frameworks, making them attractive to practices focused on quality improvement and value-based care reporting.

Standalone PMS platforms are gaining momentum among solo practices and budget-conscious providers, making them the fastest-growing sub-segment within this category. These systems focus on specific functions like billing or scheduling and are often simpler, more affordable, and easier to deploy. For example, a pediatric practice may choose a standalone scheduling platform with pediatric-specific templates instead of investing in a full-fledged integrated suite. As SaaS-based microservices become more refined, the standalone market is expected to attract more buyers seeking customization and simplicity.

U.S. Practice Management System Market By Component Insights

Software dominated the component segment, as it represents the core infrastructure driving all practice management functionalities. PMS software solutions come with dashboards, analytics, alerts, task automation, and user-role-based interfaces that optimize efficiency and user experience. Modern software tools are also integrating artificial intelligence (AI) to predict no-shows, suggest optimal appointment slots, and reduce claim denials by flagging coding errors in real-time.

Services are the fastest-growing component, fueled by increasing demand for onboarding support, training, software updates, system customization, and managed IT services. Many practices prefer outsourcing PMS setup and maintenance to third-party vendors who provide end-to-end support. Additionally, value-added services like analytics consulting, cybersecurity audits, and compliance monitoring are now bundled with PMS contracts, creating a recurring revenue stream for providers and enhancing client stickiness.

U.S. Practice Management System Market By Delivery Mode Insights

Web-based delivery dominated the PMS landscape, particularly due to its balance between accessibility and data control. Unlike traditional on-premise models, web-based PMS systems can be accessed remotely via a secure browser login without the complexities of cloud architecture. This model is particularly popular among mid-sized practices and physician groups that want centralized data with customizable server control and fewer cybersecurity concerns compared to cloud-hosted platforms.

Cloud-based platforms are witnessing the fastest growth, as healthcare providers increasingly seek scalability, interoperability, and affordability. Cloud-based PMS solutions allow for automatic updates, scalable storage, remote access, and minimal IT support. Vendors like Kareo, DrChrono, and AdvancedMD offer robust cloud-native platforms with embedded AI tools, mobile integration, and telehealth modules. Given their cost-effectiveness and enhanced data-sharing capabilities, cloud-based systems are becoming the preferred choice for emerging practices and telemedicine clinics.

U.S. Practice Management System Market By End-use Insights

Physician back offices dominate the PMS market by end-use, as physicians are the primary users of these systems for scheduling, documentation, and billing. Back offices handle the lion’s share of administrative work in medical practices, and PMS tools significantly reduce workload by automating patient eligibility checks, appointment reminders, co-pay collection, and insurance claim submission. Integration with lab results, imaging systems, and patient communication portals ensures physicians can focus more on care delivery than paperwork.

Pharmacies and diagnostic laboratories are emerging as the fastest-growing end-users of PMS systems. These stakeholders are increasingly incorporating PMS to manage patient queues, prescription histories, insurance billing, and stock control. Pharmacies, particularly those inside health systems, now rely on PMS platforms to interface with EHRs and PBMs for faster dispensing and reimbursement. Similarly, diagnostic labs are investing in PMS features that integrate with Laboratory Information Management Systems (LIMS) for unified operations. This expansion of PMS usage beyond traditional physician offices reflects a broader trend of healthcare digitization across all care delivery points.

Country-Level Analysis: United States

The United States holds the most mature and competitive market for practice management systems globally, driven by high healthcare spending, technological innovation, and policy support. The American healthcare ecosystem is characterized by a complex payer-provider structure, necessitating efficient administrative systems to navigate billing, insurance coding, HIPAA compliance, and electronic documentation.

Federal regulations like the HITECH Act and the Medicare Access and CHIP Reauthorization Act (MACRA) have incentivized the adoption of digital health infrastructure, including PMS. Furthermore, the shift toward value-based care, accountable care organizations (ACOs), and alternative payment models has created demand for systems that can track performance metrics, generate quality reports, and support risk stratification.

The U.S. also benefits from a robust vendor ecosystem ranging from tech giants like Oracle (Cerner) and Epic to agile cloud-native firms such as Kareo and AdvancedMD. The presence of major health systems, private practices, outpatient centers, and urgent care networks ensures a diverse demand base for both comprehensive and modular PMS solutions. Additionally, the increasing role of consumer-driven healthcare is influencing vendors to develop patient-facing features like mobile scheduling, price transparency, and digital bill pay.

Recent Developments

-

March 2025 – athenahealth announced the launch of a next-generation integrated PMS-EHR solution powered by generative AI to assist physicians in administrative documentation and predictive analytics.

-

January 2025 – DrChrono, an EverHealth company, introduced a mobile-first PMS module focused on behavioral health practices, including teletherapy scheduling and insurance verification.

-

November 2024 – AdvancedMD partnered with Stripe to integrate frictionless billing and payment processing into its PMS platform, improving revenue cycle speed for small practices.

-

September 2024 – Kareo launched a cloud-native PMS suite tailored for independent primary care clinics with plug-and-play EHR integration and compliance tracking dashboards.

-

July 2024 – Epic Systems expanded its AI capabilities with a new "AutoChart" feature designed to assist with real-time note-taking and workflow automation during patient visits.

Some of the prominent players in the U.S. practice management system market include:

- Henry Schein, Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- AdvantEdge Healthcare Solutions

- Athenahealth, Inc.

- Cerner Corporation (Oracle)

- GE Healthcare

- McKesson Corporation

- EPIC Systems Corporation

- NXGN Management, LLC.

- eClinicalWorks

- CareCloud, Inc.

- Kareo, Inc.

- AdvancedMD, Inc.

- DrChrono, Inc. (EverCommerce)

- CollaborateMD Inc. (EverCommerce)

- OfficeAlly Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. practice management system market.

Product

-

- Integrating Software

- EHR/EMR

- e-Rx

- Patient Engagement

- Others

Component

Delivery Mode

- On Premise

- Web-Based

- Cloud-Based

End-use

- Physician Back Office

- Pharmacies

- Diagnostic Laboratories

- Other Settings