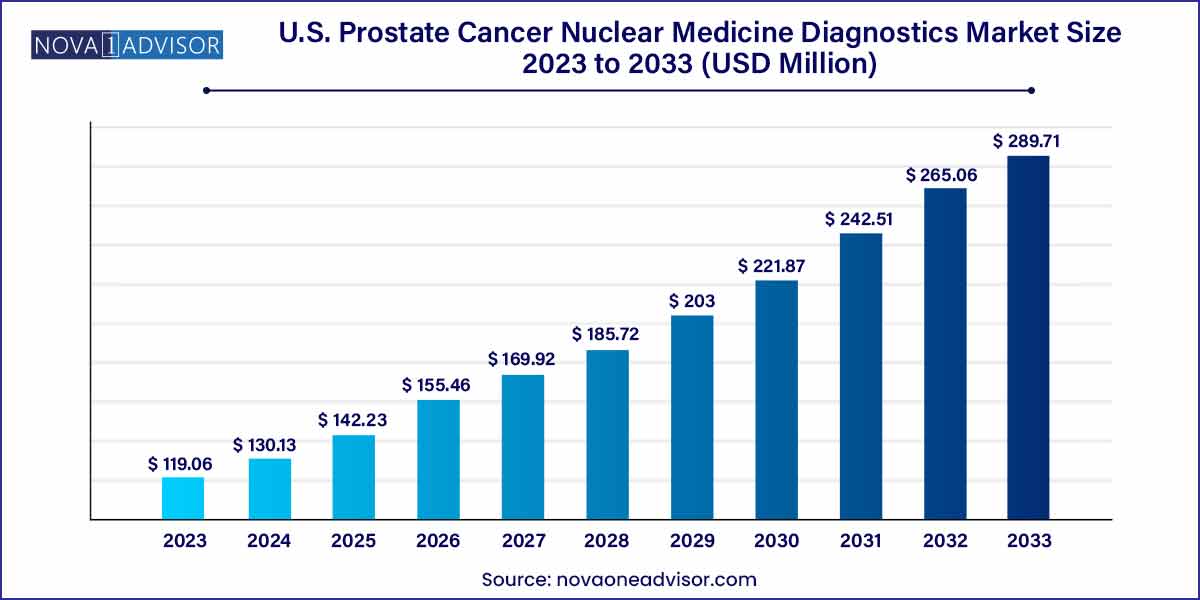

The U.S. prostate cancer nuclear medicine diagnostics market size reached USD 119.06 million in 2023 and is projected to hit around USD 289.71 million by 2033, expanding at a CAGR of 9.2% during the forecast period from 2024 to 2033.

Key Takeaways:

- The SPECT segment held the largest market share of 61.15% in terms of revenue in 2023

- The PET segment is expected to witness a lucrative growth rate of 9.5% over the forecast period

- The PET diagnostics market is segmented in terms of products into F-18 and SR-82/RB-82. F-18 held the largest market share of 75% in terms of revenue in 2023

- The SR-82/RB-82 segment is expected to expand at a CAGR of 9.9% over the forecast period

Market Overview

The U.S. Prostate Cancer Nuclear Medicine Diagnostics Market is experiencing significant transformation fueled by innovations in radiotracer development, early detection initiatives, and rising adoption of molecular imaging. Prostate cancer is the second most common cancer in American men, with over 288,000 new cases expected in 2025 according to national estimates. Accurate diagnosis is critical to manage disease progression, guide treatment decisions, and reduce mortality.

Nuclear medicine offers a functional imaging approach that goes beyond anatomical scanning. Techniques such as Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT) allow clinicians to detect cancerous cells at a molecular level. These imaging modalities, often enhanced by radiotracers like PSMA-targeted agents, F-18, and RB-82, help identify localized and metastatic lesions with high sensitivity.

The U.S. healthcare system is uniquely positioned to adopt nuclear diagnostic tools due to strong infrastructure, regulatory support from the FDA, widespread use of Medicare and private insurance, and increasing investment in oncology imaging centers. Academic institutions, clinical trial networks, and radiopharmaceutical companies are also actively pushing innovation, contributing to rapid growth.

With a heightened focus on precision oncology and personalized medicine, nuclear medicine diagnostics are becoming a cornerstone in prostate cancer detection and monitoring. This creates a high-growth environment for equipment manufacturers, radiopharmaceutical developers, and diagnostic imaging service providers.

Major Trends in the Market

-

Surging Utilization of PSMA-Targeted PET Imaging for Metastasis Detection

-

Integration of AI Tools for Image Interpretation and Treatment Planning

-

Rising Demand for Theranostics (Therapy + Diagnostics) in Advanced Prostate Cancer

-

Favorable FDA Approvals of Novel Radiotracers (e.g., Ga-68 PSMA-11, F-18 DCFPyL)

-

Expansion of Hybrid PET/CT and PET/MRI Installations in Leading Cancer Centers

-

Increased Government and Private Funding for Prostate Cancer Research

-

Growth of Outpatient Nuclear Imaging Centers with Specialized Oncology Units

-

Partnerships Between Radiopharmaceutical Suppliers and Healthcare Networks

U.S. Prostate Cancer Nuclear Medicine Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 130.13 million |

| Market Size by 2033 |

USD 289.71 million |

| Growth Rate From 2024 to 2033 |

CAGR of 9.2% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, PET product |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Blue Earth Diagnostics; Siemens Healthcare Private Limited; Cardinal Health; CURIUM PHARMA; Lantheus; Jubilant Draximage Radiopharmacies, Inc.; NCM-USA LLC; Telix Pharmaceuticals Limited; ARICEUM THERAPEUTICS; Novartis AG; Life Molecular Imaging |

U.S. Prostate Cancer Nuclear Medicine Diagnostics Market Dynamics

Drivers

- Increasing Incidence Rates: The market is driven by a rising prevalence of prostate cancer cases, emphasizing the need for advanced diagnostic tools for effective disease management.

- Technological Advancements: Ongoing innovations in nuclear medicine technologies, including the development of novel radiopharmaceuticals and enhanced imaging techniques, contribute significantly to the market's growth by improving diagnostic accuracy and efficiency.

Restraints

- High Costs: The U.S. Prostate Cancer Nuclear Medicine Diagnostics Market faces a challenge in terms of high associated costs, encompassing expenses related to equipment, radiopharmaceuticals, and specialized personnel training. These elevated costs may act as a barrier to widespread adoption, particularly in smaller healthcare facilities.

- Safety Concerns: Concerns regarding radiation exposure and safety associated with nuclear imaging techniques represent a potential restraint. These apprehensions may influence both patient and clinician acceptance, hindering the broader market penetration of nuclear medicine diagnostics for prostate cancer.

Opportunities

- Rising Research and Development: Increasing investments in research and development activities open avenues for novel diagnostic solutions. Collaborative efforts between industry stakeholders, research institutions, and government bodies can foster the creation of advanced nuclear medicine technologies tailored for efficient prostate cancer diagnosis.

- Growing Emphasis on Early Detection: With a heightened emphasis on early detection of prostate cancer, there is a substantial opportunity for nuclear medicine diagnostics to play a pivotal role. These diagnostics can provide valuable insights at earlier stages, enabling timely intervention and improving patient outcomes.

Challenges

- Regulatory Compliance: Navigating and complying with regulatory requirements poses a significant challenge in the U.S. Prostate Cancer Nuclear Medicine Diagnostics Market. Stringent regulations related to the approval and use of radiopharmaceuticals and nuclear imaging technologies may create barriers for market players, impacting the speed of innovation and market access.

- High Initial Investment: The high initial investment required for establishing nuclear medicine facilities and acquiring specialized equipment can be a substantial challenge. This financial barrier may limit the adoption of nuclear medicine diagnostics, particularly in smaller healthcare facilities with constrained budgets.

Segments Insights

By Type

PET Imaging Dominated the Market

PET imaging has emerged as the dominant segment in the U.S. prostate cancer nuclear diagnostics market, primarily driven by the widespread adoption of PSMA PET scans. These scans offer superior resolution and sensitivity for both primary tumor staging and recurrent disease evaluation, outperforming conventional CT or MRI in many clinical settings.

With FDA approvals of F-18-labeled tracers like Pylarify, PET imaging has gained momentum in academic medical centers, private oncology networks, and standalone imaging clinics. PET’s ability to provide quantifiable, functional data makes it a critical decision-making tool for oncologists, radiation therapists, and urologists.

SPECT is the Fastest-Growing Complementary Modality

While PET leads, SPECT imaging is experiencing a resurgence, especially as hybrid systems and technetium-labeled tracers are being refined. SPECT remains a cost-effective and widely available tool, especially in community hospitals and smaller diagnostic centers.

SPECT imaging is also being utilized to complement PSMA PET in bone metastasis detection, a key area in prostate cancer where skeletal involvement is common. Its role is expanding through advancements in collimator design and image reconstruction software, making it more competitive as a secondary or adjunct modality.

By PET Product Insights

F-18 PET Products Dominate the Segment

Among PET products, F-18-based agents such as Pylarify dominate the market due to their longer half-life (110 minutes), which enables centralized manufacturing and wider distribution compared to Ga-68 (with a 68-minute half-life). F-18-labeled tracers offer high-resolution images and broader clinical utility, facilitating use in both large academic centers and independent imaging facilities.

Products like F-18 DCFPyL have set the benchmark in PSMA imaging and are now included in NCCN guidelines for prostate cancer, validating their clinical importance. Their stability and superior logistics make them ideal for regional or national diagnostic service networks.

.jpg)

SR-82/RB-82 Products are the Fastest-Growing Subtype

Although traditionally used for myocardial perfusion imaging, SR-82/RB-82 generators are gaining attention in nuclear oncology due to their applicability in novel theranostic approaches. Research is ongoing into combining short-lived isotopes like RB-82 with prostate-specific imaging to support ultrafast dynamic PET imaging, enabling real-time tumor perfusion assessment.

Their use in prostate cancer is still emerging but holds promise, especially in academic research centers exploring dynamic imaging for treatment response monitoring and dual-isotope scanning. This niche but fast-growing segment is expected to attract R&D investments in the coming years.

Country-Level Analysis

In the United States, the prostate cancer nuclear medicine diagnostics market is supported by advanced regulatory systems, high imaging infrastructure penetration, and robust payer support for prostate cancer care. The FDA’s fast-track approvals of diagnostic radiotracers have significantly catalyzed adoption, while Medicare coverage for PSMA PET scans ensures accessibility in high-risk patients.

Centers such as Mayo Clinic, Dana-Farber, MD Anderson, and Memorial Sloan Kettering are leading innovation in PSMA imaging, and are actively participating in multicenter trials evaluating imaging’s role in therapy guidance. Meanwhile, regional diagnostic companies and outpatient imaging providers are increasingly integrating PET/CT systems to meet the demand.

Furthermore, partnerships between radiopharmaceutical manufacturers and U.S. radiology networks are enabling just-in-time radiotracer delivery. As prostate cancer incidence grows and diagnostic pathways become more nuanced, the U.S. remains the largest and most technologically advanced market for nuclear medicine imaging in prostate oncology.

Key U.S. Prostate Cancer Nuclear Medicine Diagnostics Companies:

- Blue Earth Diagnostics

- Siemens Healthcare Private Limited

- Cardinal Health

- CURIUM PHARMA

- Lantheus

- Jubilant Draximage Radiopharmacies, Inc.

- NCM-USA LLC

- Telix Pharmaceuticals Limited

- ARICEUM THERAPEUTICS

- Novartis AG

- Life Molecular Imaging

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Prostate Cancer Nuclear Medicine Diagnostics market.

By Type

By PET Product

.jpg)