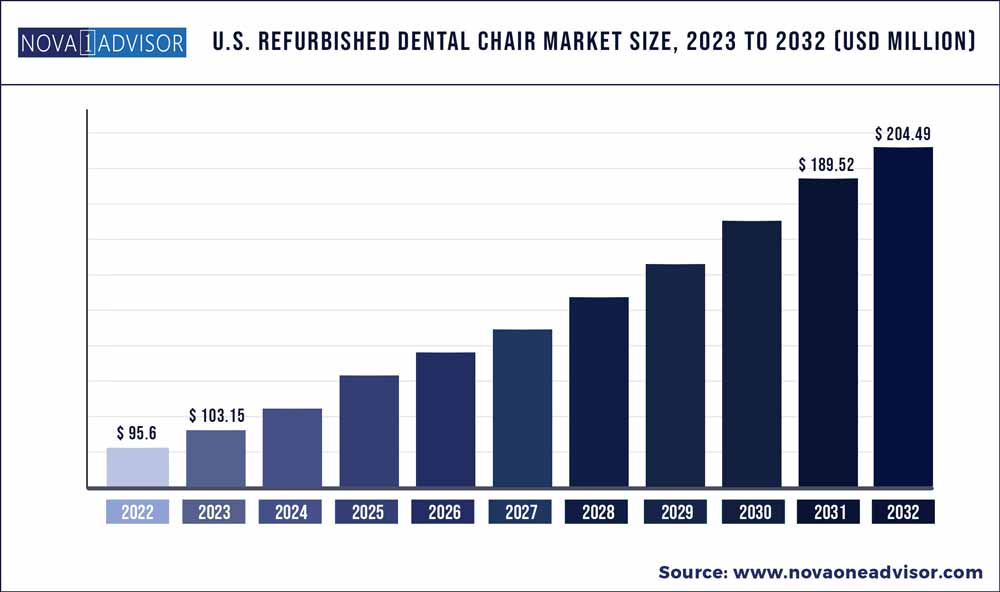

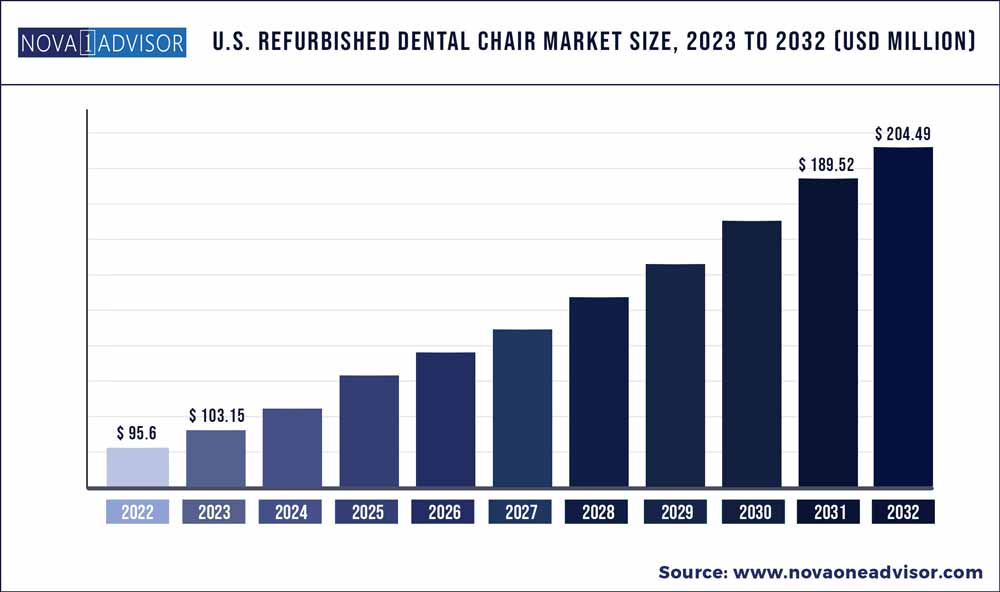

The U.S. refurbished dental chair market size was estimated at USD 95.6 million in 2022 and is expected to hit around USD 204.49 million by 2032, poised to reach at a notable CAGR of 7.9% during the forecast period 2023 to 2032.

Refurbished dental equipment is used for the treatment of oral diseases. Simple oral care can significantly lower the risk of various oral conditions. Frequent flossing, brushing teeth, and visiting the dentist regularly are good oral practices. Refurbished dental equipment include chairs, lights, and delivery systems that are reconditioned or repaired. The usage of refurbished dental equipment helps reduce the operational cost of dental clinics and laboratories. Maintenance of refurbished dental equipment helps keep them in working condition, thereby improving their reliability.

U.S. Refurbished Dental Chair Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 103.15 million |

| Market Size by 2032 |

USD 204.49 million |

| Growth Rate From 2023 to 2032 |

CAGR of 7.9% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Equipment Maintenance |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Dental Equipment Liquidators, Inc., Collins Dental Equipment, Inc., Independent Dental, Inc., Capital Dental Equipment, American Dental Refurbishment, Atlas Resell Management, A & K Dental Equipment, Henry Schein, Inc., DuraPro Health, and Pre-Owned Dental, Inc. |

Rise in Prevalence of Oral Diseases Augmenting U.S. Refurbished Dental Chair Market

Oral diseases are a health burden, causing pain, discomfort, and disfigurement in patients. Tooth decay and gum disease are the most prevalent oral conditions. According to the National Institute of Dental and Craniofacial Research (NIDCR), tooth decay affects 90% of adults aged 20 years to 64 years, while gum disease affects almost 50% of adults aged 45 years to 64 years. More than US$ 45 Bn is lost in productivity in the U.S. annually due to untreated oral diseases. Periodontitis is a major cause of tooth loss in adults in the country. Furthermore, oral cancer is the eighth most common and expensive cancer to treat. According to NIDCR, more than two in five adults between 45 years of age and 64 years of age suffer from periodontal disease, which is linked to almost 60 other health issues such as diabetes, heart disorders, and Alzheimer's disease.

Increase in Demand for Low-cost Equipment Fueling Refurbished Dental Equipment Market Size

Budget constraints in the healthcare sector are prompting public hospitals and dental professionals to adopt low-cost and quality refurbished dental equipment and maintenance services. The usage of refurbished dental equipment also reduces treatment costs. Refurbished dental equipment and parts are available at 40% to 60% of the cost of new devices. Refurbished dental equipment companies assure timely delivery and services. This makes refurbished dental equipment a preferred choice among hospitals and private practitioners

Growth in Geriatric Population Propelling Dental Chairs Segment

In terms of equipment, the U.S. refurbished dental chair market has been classified into dental lights, dental chairs, and dental delivery systems. The dental chairs segment is projected to dominate the market during the forecast period. Growth of the segment can be ascribed to the increase in geriatric population, surge in usage of and awareness about refurbished dental products, and rise in number of refurbished dental chair manufacturers in the U.S.

Analysis of Key Players in U.S. Refurbished Dental Chair Market

The U.S. refurbished dental chair market is fragmented, with the presence of many small players. Investment in R&D activities is a key marketing strategy of market players. Expansion of product portfolios and mergers and acquisitions are other major strategies adopted by players. Prominent players operating in the market are Dental Equipment Liquidators, Inc., Collins Dental Equipment, Inc., Independent Dental, Inc., Capital Dental Equipment, American Dental Refurbishment, Atlas Resell Management, A & K Dental Equipment, Henry Schein, Inc., DuraPro Health, and Pre-Owned Dental, Inc.

Some of the prominent players in the U.S. Refurbished Dental Chair Market include:

- Capital Dental Equipment

- Dental Equipment Liquidators, Inc.

- A & K Dental Equipment

- DuraPro Health

- Independent Dental Inc.

- Collins Dental Equipment

- American Dental Refurbishment

- Atlas Resell Management

- Henry Schein, Inc.

- Pre-Owned Dental, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Refurbished Dental Chair market.

By Equipment

- Dental Lights

- Dental Chairs

- Dental Delivery Systems

By Maintenance

- Dental Lights

- Dental Chairs

- Dental Delivery Systems