U.S. Registered Nurses Market Size, Share, Growth, Report 2026 to 2035

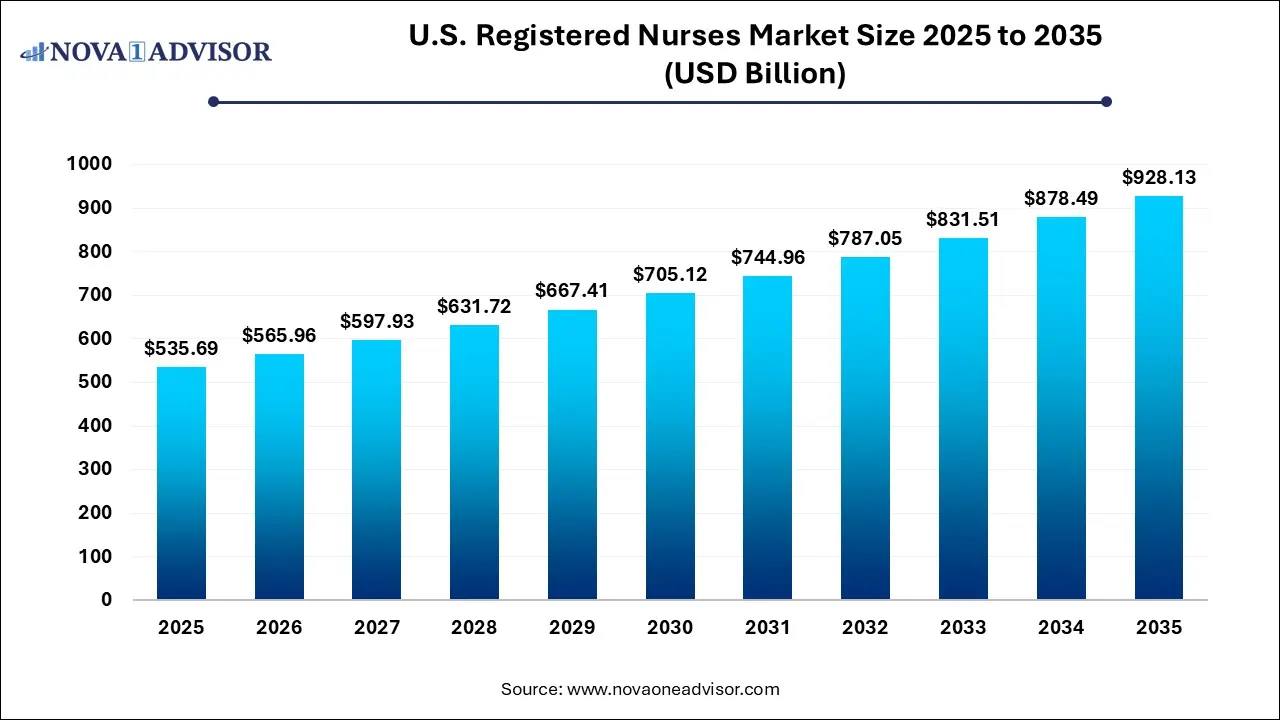

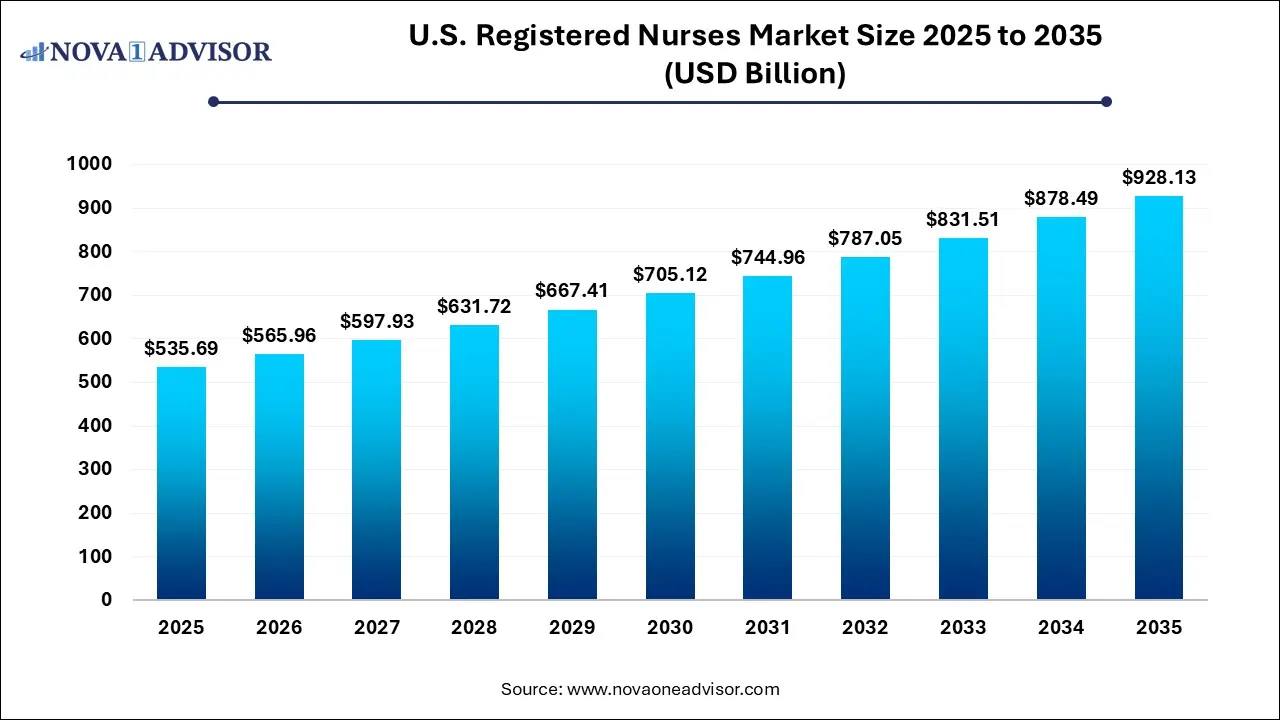

The U.S. registered nurses market size was exhibited at USD 535.69 billion in 2025 and is projected to hit around USD 928.13 billion by 2035, growing at a CAGR of 5.65% during the forecast period 2026 to 2035.

Key Takeaways:

- The U.S. registered nurses market is projected to grow at a significant rate due to the increasing demand for quality medical care

- Based on gender segmentation, the female was predicted to show the maximum market share in the year 2025

- Based on end-user segmentation, hospitals were the leading users in 2025

- On the basis of region, Midwest was the leading revenue generator in 2025

Market Overview

The U.S. registered nurses market is a vital component of the nation's healthcare infrastructure, playing an indispensable role in the delivery of medical services across various care settings. With healthcare systems under constant pressure from aging demographics, chronic diseases, and post-pandemic recovery, the demand for skilled registered nurses (RNs) has reached unprecedented levels. According to projections by the U.S. Bureau of Labor Statistics, the employment of RNs is expected to grow faster than the average for all occupations, driven by a combination of medical innovation, patient expectations, and care delivery reforms.

As of 2025, the U.S. registered nurses market is marked by both significant opportunities and pressing challenges. On one hand, increasing patient load, the expansion of outpatient care facilities, and growing awareness around preventive care have created a need for skilled nursing personnel. On the other hand, the market is constrained by staffing shortages, burnout, and regional disparities in supply and demand. Technological integration—ranging from electronic health records (EHRs) to remote monitoring and AI-supported diagnostics—has transformed nursing practice, demanding continual skill upgradation.

Healthcare providers in hospitals, ambulatory centers, nursing homes, and home care are not only focusing on hiring qualified nurses but also investing in retention strategies like flexible work hours, mental health programs, and career development opportunities. A visible shift is also seen in gender demographics and specialty certifications, reflecting a diversified and evolving nursing workforce. The market is also becoming more digitized and decentralized, with nurses increasingly performing advanced care roles, including nurse practitioners and care coordinators.

Major Trends in the Market

-

Telehealth Integration: Nurses are increasingly being trained and employed in telemedicine services, especially for chronic disease management and mental health care.

-

Rise in Male Nursing Professionals: Traditionally dominated by females, the nursing profession in the U.S. is witnessing a gradual increase in male participation, contributing to workforce diversification.

-

Demand for Specialized Nursing Roles: Certified Nurse Practitioners (CNPs), Oncology Nurses, and Geriatric Nurses are in high demand due to increasing specialization in healthcare delivery.

-

Burnout Management Initiatives: Hospitals are rolling out mental health and wellness programs for nurses to combat burnout and improve retention.

-

Technological Upskilling: Continuous education programs focusing on the use of digital tools and EHRs are being widely implemented.

-

Increased Federal Funding: The U.S. government has increased funding for nursing education and rural healthcare staffing under the Health Resources and Services Administration (HRSA).

-

Expanding Roles in Community Health: Nurses are being increasingly deployed in community health and school settings to support public health initiatives.

U.S. Registered Nurses Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 565.96 Billion |

| Market Size by 2035 |

USD 928.13 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.65% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By End-User, By Gender, and By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Johns Hopkins Medicine, HCA Healthcare, Kaiser Permanente, Tenet Healthcare, Cleveland Clinic, Ascension Health, Ohio State University Wexner Medical Center, Community Health Systems, Rush University Medical Center, Universal Health Services, Cedars-Sinai Medical Center, Mayo Clinic, Vanderbilt University Medical Center, Massachusetts General Hospital, Duke University Health System, New York-Presbyterian Hospital, University of Michigan Health System, Stanford Health Care, UAB Medicine, Emory Healthcare, Banner Health, Houston Methodist, Yale New Haven Health, Northwell Health, and AdventHealth. |

Key Market Driver: Aging Population and Chronic Illness Management

One of the most critical drivers in the U.S. registered nurses market is the aging population, which creates a sustained and growing demand for healthcare services. According to the U.S. Census Bureau, by 2030, all baby boomers will be over the age of 65, resulting in one in five Americans being at retirement age. This demographic shift is significantly increasing the incidence of chronic conditions such as diabetes, arthritis, heart diseases, and dementia—all of which require long-term care and regular medical attention.

Registered nurses are essential in managing these conditions, providing not just direct care but also education, emotional support, and coordination with multidisciplinary teams. The role of nurses has also expanded to preventive healthcare, early diagnosis, and long-term monitoring, making them central to the efficient functioning of primary and geriatric care systems. Their ability to perform clinical assessments, administer medications, and guide patients through treatment regimens is invaluable in a healthcare landscape that is becoming increasingly stretched and complex.

Key Market Restraint: Workforce Shortage and High Burnout Rates

While the demand for registered nurses is growing rapidly, the supply is not keeping pace, primarily due to workforce shortages and high burnout rates. A 2024 report by the American Association of Colleges of Nursing (AACN) noted that U.S. nursing schools turned away over 90,000 qualified applicants due to faculty shortages and limited clinical training sites. Moreover, the impact of the COVID-19 pandemic exacerbated nurse exhaustion, leading to early retirements, career changes, and part-time shifts.

Burnout in nursing is largely attributed to high patient-nurse ratios, long work hours, emotionally taxing environments, and insufficient support from management. This not only impacts job satisfaction and performance but also affects patient outcomes. Hospitals and healthcare organizations are increasingly struggling with turnover, which adds recruitment and training costs while also hampering service continuity. Despite various federal and state-level initiatives, the retention of experienced nursing professionals remains a significant hurdle to the market’s stability.

Market Opportunity: Expansion of Home Healthcare and Ambulatory Services

An evolving healthcare delivery model emphasizing outpatient care and home healthcare presents a significant opportunity for the U.S. registered nurses market. With patients preferring recovery in home environments and insurance providers advocating cost-effective care outside traditional hospital settings, the need for registered nurses in these segments is growing rapidly. Home healthcare, in particular, has expanded as a preferred option for post-operative care, chronic disease management, and elderly support.

Nurses operating in ambulatory settings and home care often enjoy more flexible hours, personalized patient interaction, and reduced work stress compared to those in acute care hospitals. This trend is also supported by advancements in remote monitoring technologies and mobile EHR systems, allowing nurses to deliver high-quality care outside hospital walls. In rural and underserved areas, ambulatory healthcare services facilitated by traveling nurses are closing care gaps. This shift is not only optimizing healthcare delivery but also creating new roles and career trajectories for registered nurses across the country.

Segmental Analysis

By End-User

Hospitals dominated the end-user segment of the U.S. registered nurses market. Hospitals remain the primary employers of registered nurses, offering a wide spectrum of job roles across emergency care, surgery, intensive care, and maternity services. Due to the critical and round-the-clock nature of hospital operations, a significant number of RNs are hired for bedside care, monitoring, administration, and discharge planning. These settings offer robust career progression, specialized training, and a broad skillset, making hospitals the hub for experienced as well as newly graduated nurses. The constant inflow of patients and the need for interdisciplinary collaboration underscore the critical role of RNs in this environment.

The fastest-growing segment is ambulatory healthcare services. With increasing emphasis on outpatient care, same-day surgeries, and preventive checkups, ambulatory services have seen exponential growth. Nurses in these settings typically assist with diagnostics, vaccinations, wound care, and chronic disease follow-ups. These roles are becoming increasingly attractive due to lower stress levels and more predictable work schedules. The development of urgent care centers and retail clinics is accelerating this trend, especially in urban and semi-urban areas. RNs in ambulatory settings are also receiving training in telemedicine and electronic documentation, further broadening their responsibilities.

By Gender

Female registered nurses dominate the gender segment of the market. Historically and currently, women constitute the majority of the nursing workforce in the U.S., accounting for over 85% of registered nurses. This dominance is influenced by long-standing societal norms and education trends. Female nurses are widely represented across all specialties, age groups, and geographic locations. Healthcare education institutions report significantly higher female enrollment, which is reflected in the workforce demographics. Furthermore, career support systems such as maternity leave policies, child care assistance, and female mentorship programs have contributed to sustained female participation in this profession.

Male registered nurses represent the fastest-growing gender segment. Though still a minority, the number of male nurses in the U.S. has been steadily rising. This shift is being encouraged through diversity hiring initiatives, scholarships targeting underrepresented groups, and awareness campaigns aimed at changing outdated stereotypes. Male RNs are increasingly found in high-intensity environments such as emergency departments, operating rooms, and trauma units. Their presence is also notable in administrative roles and health informatics. As societal perceptions evolve, the gender gap is expected to narrow, bringing a more balanced workforce that enhances care outcomes through diverse perspectives.

Country-Level Analysis

In the U.S., the distribution of registered nurses varies significantly by state due to differences in population density, healthcare infrastructure, and regulatory frameworks. States such as California, Texas, Florida, and New York employ the highest number of RNs, driven by large urban populations and a high concentration of healthcare facilities. However, rural areas in states like Wyoming, Montana, and the Dakotas continue to face acute nurse shortages. This has led to increased deployment of traveling nurses and telehealth programs to bridge gaps in service.

Licensing regulations also vary, with the Nurse Licensure Compact (NLC) allowing nurses in participating states to practice across state lines without needing additional licenses. States with NLC adoption are witnessing smoother recruitment processes and higher nurse mobility. The federal government, along with state healthcare departments, is offering incentives for nurses to serve in medically underserved regions, including loan forgiveness, housing stipends, and sign-on bonuses. The rise in educational institutions offering online nursing degrees is also democratizing access to the profession across the U.S.

Some of the prominent players in the U.S. Registered Nurses Market include:

- Johns Hopkins Medicine

- HCA Healthcare

- Kaiser Permanente

- Tenet Healthcare

- Cleveland Clinic

- Ascension Health

- Ohio State University Wexner Medical Center

- Community Health Systems

- Rush University Medical Center

- Universal Health Services

- Cedars-Sinai Medical Center

- Mayo Clinic

- Vanderbilt University Medical Center

- Massachusetts General Hospital

- Duke University Health System

- New York-Presbyterian Hospital

- University of Michigan Health System

- Stanford Health Care

- UAB Medicine

- Emory Healthcare

- Banner Health

- Houston Methodist

- Yale New Haven Health

- Northwell Health

- AdventHealth.

Recent Developments

-

In March 2025, UnitedHealth Group launched a $100 million fund to support the education and training of nurses in rural areas, aiming to improve access to quality care in underserved regions.

-

In February 2025, CommonSpirit Health announced a partnership with academic institutions to create nursing residency programs that provide structured mentorship and advanced clinical training for new graduates.

-

In January 2025, HCA Healthcare revealed its plan to hire over 10,000 nurses over the next two years, backed by an internal scholarship and upskilling program aimed at mitigating burnout and retaining talent.

-

In December 2024, Ascension Health initiated a digital nursing documentation platform across all its hospitals to reduce administrative workload and improve time spent in patient care.

-

In November 2024, Kaiser Permanente rolled out a hybrid work model for its nurse case managers, combining in-clinic and remote care to increase job flexibility.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Registered Nurses market.

By End-User

- Ambulatory Healthcare Services

- Hospitals

- Nursing Homes

- Others

By Gender