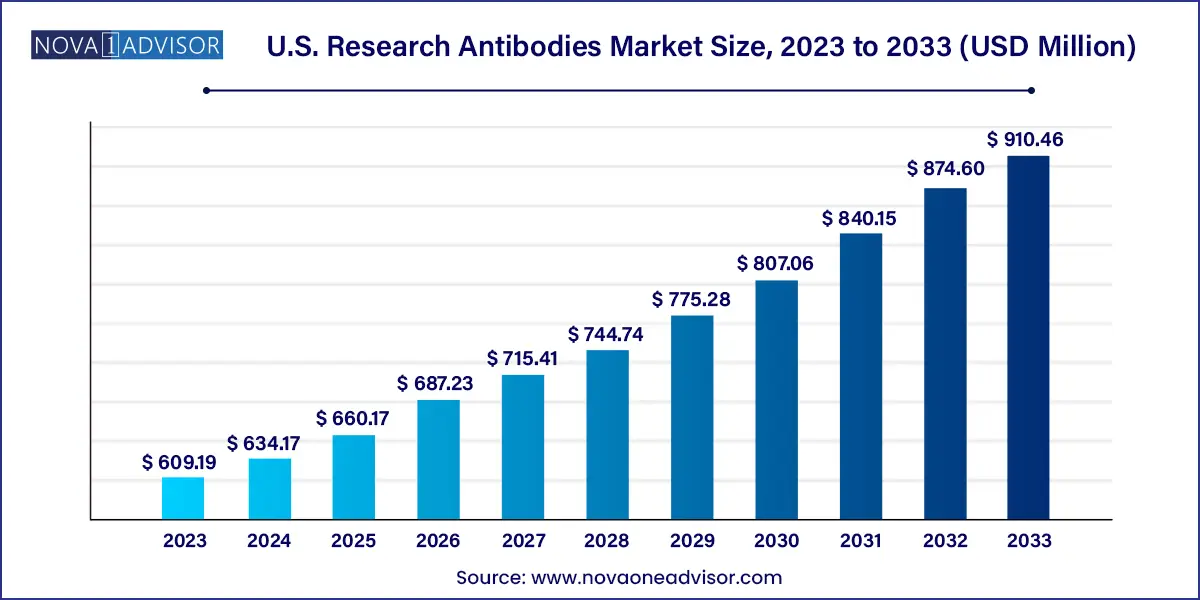

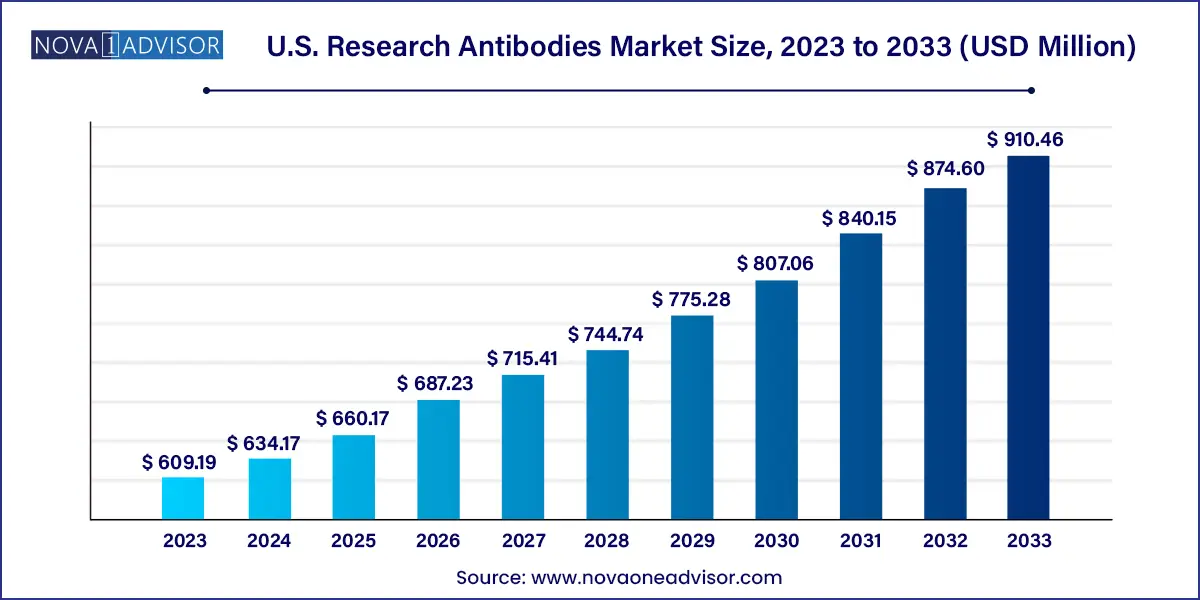

The U.S. research antibodies market size was estimated at USD 609.19 million in 2023 and is projected to hit around USD 910.46 million by 2033, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033.

Key Takeaways:

- Primary antibodies held the dominant share of the market in 2023, accounting for over 70.9% of the revenue generated, and are anticipated to grow at the fastest CAGR over the forecast period.

- Secondary antibodies are anticipated to register significant growth from 2024 to 2033.

- Monoclonal antibodies led the market in 2023 with 60.9% of the total revenue share

- On the contrary, polyclonal antibodies are anticipated to grow at a significant rate owing

- Western blotting was the dominant technology used in the market in 2023 with 30.5% of the total revenue share.

- The immunohistochemistry (IHC) segment is expected to register the fastest CAGR during the forecast period.

- Rabbits generated over 50.8% of the total revenue share in 2023

- Mice are expected to grow the fastest from 2024 to 2033

- Oncology held the most substantial share of the application segment in 2023, accounting for 34.9% of the total market revenue.

- Infectious diseases are expected to have the fastest CAGR over the forecast period.

- Academic & research applications occupied the largest revenue share in the market of nearly 61.7% in 2023 and are expected to grow at the fastest CAGR over the forecast period.

- The pharma and biotech companies segment is anticipated to grow significantly from 2024 to 2033

Market Overview

The U.S. research antibodies market has become a cornerstone of the country’s biomedical research ecosystem, underpinning a wide array of experimental and diagnostic applications. Research antibodies are specialized proteins used to detect, quantify, or isolate specific biomolecules such as proteins and antigens in research experiments. They are essential tools in areas such as immunology, oncology, stem cell biology, and neuroscience. In the U.S.—a global leader in biomedical innovation—antibodies are pivotal in advancing disease understanding, drug discovery, and translational medicine.

Antibodies are classified into two primary types: primary and secondary. Primary antibodies bind directly to the target antigen, whereas secondary antibodies are used to detect and amplify the signal from the primary antibody. Their broad applicability in laboratory-based techniques—such as ELISA, western blotting, immunohistochemistry, and flow cytometry—has made them indispensable in both academic and commercial research settings.

The U.S. market benefits from a well-established infrastructure of research institutions, biotechnology firms, and pharmaceutical companies, all of which require high-quality, reproducible antibodies. Institutions such as the National Institutes of Health (NIH), Harvard Medical School, and research divisions of pharmaceutical giants like Pfizer and Merck drive substantial demand. With increased emphasis on reproducibility, quality validation, and advanced imaging applications, the research antibodies market has evolved from being a mere consumables segment into a highly specialized, value-added market.

Technological advances, including recombinant antibody engineering, AI-based antibody validation, and high-throughput screening platforms, are propelling the market forward. Moreover, the emergence of personalized medicine, immunotherapy, and single-cell analysis techniques has broadened the market's horizon, introducing new challenges as well as exciting opportunities for growth and innovation.

Major Trends in the Market

-

Surge in Use of Recombinant Antibodies: Ongoing shift from traditional polyclonal and hybridoma-derived antibodies to recombinant and monoclonal formats for improved specificity and reproducibility.

-

Increasing Focus on Antibody Validation: Academic journals and funding agencies are emphasizing stringent validation standards to improve reproducibility in research.

-

Rising Demand for Multiplexing Technologies: Techniques like multiplex immunohistochemistry and flow cytometry are driving the demand for compatible antibody panels.

-

Growth of Custom Antibody Production Services: Tailored antibody solutions are increasingly in demand for novel or proprietary targets in pharma and biotech research.

-

Expansion of Single-cell and Spatial Biology Applications: Research in single-cell omics and tissue mapping is prompting new requirements for highly specific antibodies.

-

Integration of AI and Machine Learning: Companies are leveraging AI to predict antibody-antigen interactions, optimize development timelines, and reduce attrition rates.

-

Increased Outsourcing by Academic Institutions: Cost-conscious universities are increasingly sourcing ready-to-use, validated antibody kits to avoid in-house production costs.

-

Sustainability and Ethical Sourcing Initiatives: Rise in demand for ethically sourced antibodies, including recombinant antibodies that minimize animal use.

U.S. Research Antibodies Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 634.17 million |

| Market Size by 2033 |

USD 910.46 million |

| Growth Rate From 2024 to 2033 |

CAGR of 4.1% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, specificity, technology, source, application, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abcam Plc.; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; PerkinElmer, Inc.; Becton, Dickinson and Company; Bio-Techne Corporation; Proteintech Group, Inc.; Jackson ImmunoResearch Inc. |

Market Driver: Expanding Biomedical Research and Drug Discovery Initiatives

One of the strongest drivers for the U.S. research antibodies market is the country’s robust biomedical research ecosystem, supported by both public and private sector investments. Agencies such as the NIH allocate billions annually toward medical research grants. In 2023 alone, NIH funding exceeded $48 billion, with a considerable portion going toward immunology, oncology, neuroscience, and infectious diseases—all areas where research antibodies are fundamental.

Simultaneously, pharmaceutical and biotech companies are investing heavily in drug discovery and preclinical studies, where research antibodies play a central role in target identification, validation, and pathway mapping. The success of immunotherapy drugs like pembrolizumab (Keytruda) has spotlighted the importance of immune checkpoint proteins, which are detected and quantified using antibodies. Thus, both basic and translational research initiatives are fueling a continuous demand for novel, high-specificity antibodies, reinforcing the market’s long-term growth trajectory.

Market Restraint: Reproducibility Crisis and Quality Concerns

Despite widespread adoption, the research antibodies market faces a significant challenge in the form of product variability and reproducibility issues. Numerous studies have highlighted the inconsistent performance of antibodies across batches or suppliers, leading to unreliable research outcomes. According to a Nature survey, over 70% of researchers have failed to reproduce results due to variability in reagents antibodies being one of the major culprits.

This challenge has prompted concern from regulatory agencies, journal publishers, and funding bodies, which now require greater transparency and validation data. However, many smaller suppliers lack the infrastructure to conduct rigorous specificity, sensitivity, and cross-reactivity testing. Consequently, poor-quality antibodies can delay research timelines, waste resources, and contribute to the broader reproducibility crisis in science. Addressing these concerns through better standardization and validation remains a top priority but also a limiting factor for less-established suppliers.

Market Opportunity: Rise of Personalized Medicine and Biomarker Discovery

The rise of personalized and precision medicine offers a massive opportunity for the U.S. research antibodies market. These emerging treatment models rely on detailed patient profiling—often involving the use of antibodies to detect and quantify disease-specific biomarkers. In oncology, for instance, the expression levels of proteins like HER2, PD-L1, and EGFR are critical in determining therapeutic strategy and predicting patient response. Research antibodies enable the discovery and validation of such biomarkers in preclinical models and human samples.

Additionally, antibody-based assays are essential for developing companion diagnostics, which are used alongside targeted therapies. As pharmaceutical companies continue to invest in personalized therapeutics, the need for research-grade and diagnostic-grade antibodies will only increase. This provides a lucrative growth avenue for companies capable of producing high-affinity, highly specific antibodies tailored for biomarker exploration and patient stratification.

Segmental Analysis

By Product

Primary antibodies dominate the U.S. research antibodies market. These antibodies are used directly to detect specific antigens and are integral to nearly every immunoassay protocol. Their high specificity, affinity, and broad applicability across research domains—from western blotting and ELISA to immunohistochemistry—make them indispensable. In academic labs, primary antibodies are often sourced for newly discovered or less-characterized targets, reinforcing their critical role in hypothesis-driven research.

Secondary antibodies are the fastest-growing segment, as their role in signal amplification, cost efficiency, and versatility becomes more appreciated. A single secondary antibody can be used across different primary antibodies if sourced from the same species, making them a staple for multi-assay workflows. Fluorophore- or enzyme-conjugated secondary antibodies also simplify detection and visualization, further enhancing their appeal in both high-throughput screening and educational lab settings.

By Specificity

Monoclonal antibodies held the dominant share in the specificity segment, owing to their high degree of antigen specificity, batch-to-batch consistency, and suitability for clinical-grade validation. These are increasingly favored in pharmaceutical research, where reproducibility and target precision are non-negotiable. Their application in oncology and immunology research has seen a particularly strong uptick, especially in developing biosimilars and studying immune checkpoint pathways.

Conversely, polyclonal antibodies are growing rapidly due to their superior ability to bind to multiple epitopes, enhancing signal detection. While they are less specific, their robustness in detecting low-abundance proteins and their cost-effectiveness make them popular in academia. Polyclonals are especially useful for targets with post-translational modifications or in preliminary screening assays where broad reactivity is beneficial.

By Technology

Western blotting remains the most widely used technology in the U.S. research antibodies market. This technique’s ability to detect specific proteins in complex samples using antibodies has made it a gold standard for protein validation. Academic institutions frequently rely on western blotting for confirming gene knockdown or verifying the success of protein overexpression. Suppliers that offer validated, western blot-ready antibodies often enjoy significant market loyalty.

Flow cytometry is emerging as the fastest-growing technology, driven by advances in single-cell analysis, immunophenotyping, and immune monitoring. Antibodies used in flow cytometry must meet stringent quality criteria, including high signal-to-noise ratio and minimal cross-reactivity. As immunotherapy and vaccine research expand, flow cytometry's role in characterizing immune cell populations is becoming more pronounced, and demand for fluorochrome-labeled antibodies is surging.

By Source

Mice-derived antibodies dominate the source segment due to their well-established hybridoma production platforms, high specificity, and cost-effective production. Most commercially available monoclonal antibodies today are mouse-derived, and they remain the default choice in many experimental workflows, particularly in western blotting and immunohistochemistry.

Rabbit-derived antibodies, however, are gaining momentum as the fastest-growing segment. Rabbits produce antibodies with higher affinity and better recognition of small epitopes compared to mice. This makes them particularly valuable in applications where signal strength and specificity are crucial, such as immunofluorescence or when detecting proteins with low immunogenicity. Recombinant rabbit monoclonals, which combine the benefits of rabbit immune response and monoclonal reproducibility, are also driving interest in this category.

By Application

Immunology is the dominant application area within the U.S. research antibodies market. The demand is fueled by research into autoimmune diseases, allergies, vaccine responses, and inflammation. Antibodies are used to detect cytokines, chemokines, and immune checkpoint proteins—key players in immune system regulation. The success of therapies targeting PD-1 and CTLA-4 has brought even greater attention to the immunological mechanisms, with antibodies serving as investigative and diagnostic tools.

Oncology is the fastest-growing application, reflecting the rapid advancement of cancer research and immuno-oncology. Antibodies are used in tumor profiling, biomarker discovery, and in developing targeted therapies. Multiplex immunohistochemistry panels using tumor-specific antibodies are now routinely employed in cancer diagnostics and translational research. As new targets such as TIGIT, LAG-3, and TIM-3 enter the research arena, the need for reliable, high-performance antibodies continues to rise.

By End-use

Academic and research institutes are the primary end-users of research antibodies in the U.S., benefiting from a consistent stream of NIH grants and institutional funding. These institutes conduct fundamental research into disease mechanisms, genetics, and therapeutics, all of which heavily rely on antibody-based assays. Many universities also collaborate with biotech startups and pharmaceutical firms, further amplifying demand for customized and validated antibodies.

Pharma and biotech companies represent the fastest-growing end-user segment, driven by the expansion of preclinical R&D pipelines and biomarker-driven drug discovery efforts. These firms require antibodies not only for basic research but also for regulatory-grade assays and clinical development. Increasingly, these companies are partnering with antibody developers for co-branded reagents and antibody panels tailored to their proprietary technologies.

Country-Level Analysis: United States

The United States is a global hub for biomedical research and biotechnology innovation, making it the most lucrative market for research antibodies. With the presence of over 6,000 biotech firms, dozens of top-ranked academic medical centers, and well-funded government agencies, the U.S. ecosystem supports continuous antibody demand. The NIH, National Cancer Institute (NCI), and Defense Advanced Research Projects Agency (DARPA) routinely fund studies that depend on antibody-based detection methods.

Additionally, the U.S. houses major pharmaceutical players and contract research organizations (CROs) that drive outsourcing and product development. Regions such as Boston, San Diego, San Francisco, and New York are hotbeds for translational research and personalized medicine initiatives. Policies encouraging biotech growth, such as tax credits and fast-track approvals, further support the growth of high-quality antibody manufacturing and distribution networks.

Recent Developments

-

January 2024: Bio-Techne Corporation announced the expansion of its antibody validation program, introducing AI-based specificity verification for all newly launched antibodies.

-

November 2023: Abcam plc launched a next-generation recombinant antibody portfolio targeting novel immune checkpoints, enhancing their oncology and immunology research support.

-

August 2023: Thermo Fisher Scientific introduced a new range of fluorophore-conjugated antibodies compatible with advanced spectral flow cytometry platforms.

-

May 2023: Cell Signaling Technology unveiled a partnership with the Dana-Farber Cancer Institute to co-develop antibody panels for use in tumor microenvironment analysis.

-

March 2023: Proteintech Group opened a new U.S.-based manufacturing facility to improve supply chain efficiency and expand its recombinant antibody portfolio.

Key U.S. Research Antibodies Companies:

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson ImmunoResearch Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Research Antibodies market.

By Product

By Specificity

- Monoclonal Antibodies

- Polyclonal Antibodies

By Technology

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Other Technologies

By Source

- Mice

- Rabbit

- Goat

- Other Sources

By Application

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Other Applications

By End-use

- Academic & Research Institutes

- Contract Research Organizations

- Pharma & Biotech Companies