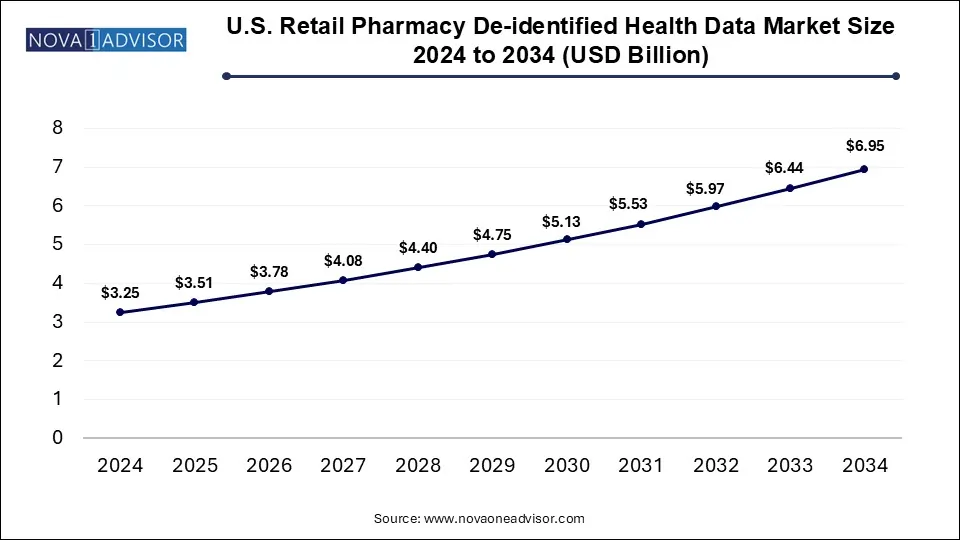

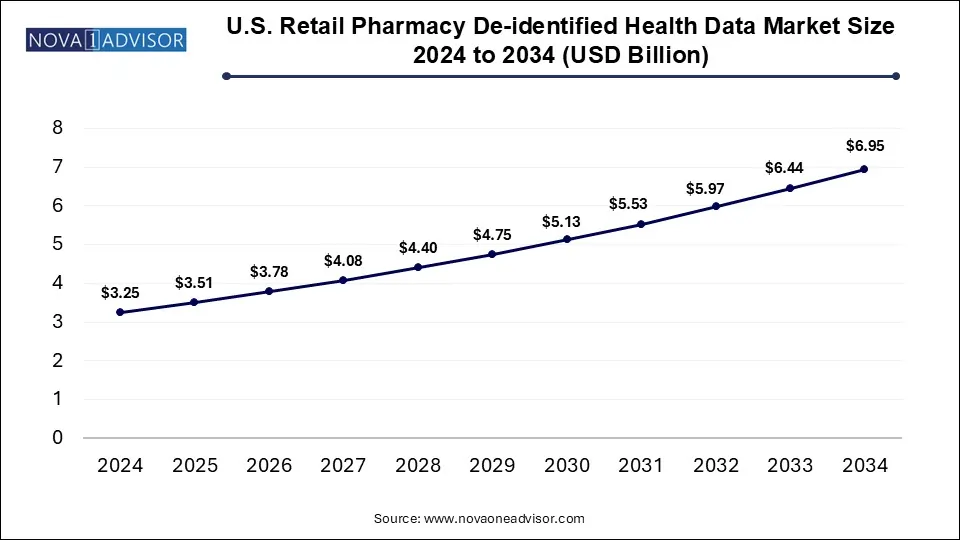

U.S. Retail Pharmacy De-identified Health Data Market Size and Growth

The U.S. retail pharmacy de-identified health data market size was exhibited at USD 3.25 billion in 2024 and is projected to hit around USD 6.95 billion by 2034, growing at a CAGR of 7.89% during the forecast period 2025 to 2034.

Market Overview

The U.S. Retail Pharmacy De-identified Health Data Market is emerging as a cornerstone in the data-driven transformation of the healthcare and life sciences industries. De-identified health data, stripped of personally identifiable information (PII), plays a crucial role in enabling research, regulatory compliance, market access strategies, and real-world evidence generation—without compromising patient privacy.

Retail pharmacies, including giants such as CVS Health, Walgreens, and Rite Aid, are sitting atop massive repositories of health-related data generated through prescription dispensing, inventory systems, loyalty programs, and pharmacy benefit management (PBM) transactions. With evolving healthcare regulations, digital interoperability mandates, and rising demand for real-time insights, these organizations have turned toward structured monetization of de-identified datasets. The U.S. market, benefiting from robust data protection frameworks (like HIPAA and HITECH), has fostered an environment where the ethical commercial use of such data is not just viable but thriving.

Across various segments ranging from DSCSA traceability datasets to episodic pharmacy claims—data is now being licensed, syndicated, or integrated with broader platforms to support stakeholders including pharmaceutical manufacturers, payers, health tech firms, federal agencies, and marketing analytics companies. This market is increasingly underpinned by the convergence of retail health and digital transformation.

Major Trends in the Market

-

Surging interest in real-world evidence (RWE): Pharma and biotech companies are increasingly using retail pharmacy data to support RWE for regulatory filings and reimbursement models.

-

Rise of healthcare SaaS platforms: Software-as-a-Service providers specializing in recall compliance and inventory visibility are incorporating de-identified datasets into their tools.

-

Cross-sector data collaborations: AdTech, CPG brands, and insurers are forming cross-sector partnerships with pharmacies to tap into purchasing and prescription behavior.

-

AI/ML optimization models: Inventory datasets are being fed into AI engines for dynamic forecasting, reducing waste and enhancing shelf availability.

-

Growing prominence of DSCSA compliance tech: Regulatory pressure from the FDA’s Drug Supply Chain Security Act (DSCSA) has boosted demand for traceability data sharing.

-

Increased pharmacy-driven value-based care integration: Episodic prescription claims are being used by ACOs and value-based payers to inform medication adherence and care coordination.

-

Explosion in prior authorization analytics: PA data is becoming critical for pharma market access teams optimizing speed-to-therapy and payer negotiations.

Report Scope of U.S. Retail Pharmacy De-identified Health Data Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.51 Billion |

| Market Size by 2034 |

USD 6.95 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.89% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Dataset type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

CVS Health; Walgreens Boots Alliance, Inc.; Walmart Pharmacy; The Kroger Co.; Albertsons; UnitedHealth Group; Humana; BrightSpring Health Services; Costco Wholesale Corporation; Centene Corporation; Ahold Delhaize; Rite Aid Corp; H E B, LP; Aurora Health Care (a part of Advocate Health); Big Y Foods, Inc.; Brookshire Brothers; Wakefern Food Corp.; Publix; Cub (a subsidiary of United Natural Foods, Inc.). |

Market Driver: Demand for Data-Driven Decision Making in Life Sciences

A significant driver for this market is the life sciences industry’s accelerating demand for real-time, patient-level insights especially when traditional clinical trial data falls short in representing real-world populations. Retail pharmacy de-identified datasets fill this gap by offering large-scale, longitudinal views of patient behaviors across regions, demographics, and treatment plans.

For example, pharmaceutical manufacturers use pharmacy claims data to assess medication adherence post-launch, while outcomes teams harness it to evaluate real-world safety and efficacy. De-identified data from prescriptions especially in chronic conditions like diabetes or hypertension—enable granular segmentation, drug utilization reviews, and even predictive modeling for patient outreach. These insights are foundational for market access, value-based pricing, and payer engagement.

The strategic alignment between healthcare stakeholders and data-rich pharmacy chains has led to mutually beneficial data licensing arrangements. This symbiosis is further reinforced by analytics platforms and SaaS vendors that integrate these datasets into dashboards, supporting faster and more informed decision-making.

Market Restraint: Ethical and Regulatory Complexity in Data Monetization

One of the most pressing challenges in this market is the ethical and regulatory complexity associated with the de-identification and use of health data. Although HIPAA outlines safe harbor and expert determination methods for de-identification, concerns around re-identification risks continue to loom large.

Retail pharmacies must maintain a delicate balance between monetizing data and safeguarding patient trust. Any breach of ethical guidelines or overreach in data sharing can lead to significant reputational and financial consequences. For instance, the 2021 scrutiny over prescription data sold to analytics firms (even when de-identified) prompted consumer watchdogs and legislators to question the robustness of existing privacy frameworks.

In a rapidly evolving regulatory climate, the burden of compliance is heavy. Firms are required to continuously audit data pipelines, update governance models, and ensure partners adhere to data protection standards raising operational costs and elongating go-to-market timelines for data products.

Market Opportunity: Integration of Data Ecosystems Across Retail, Pharma, and Payers

A major opportunity lies in the integration of data ecosystems across retail pharmacy chains, pharmaceutical companies, and payer organizations, creating a unified platform for longitudinal patient insights. This data interoperability can unlock efficiencies in drug development, care coordination, and policy-making.

For instance, consider a scenario where a payer integrates episodic pharmacy claims data with PA approval records and basket-level retail purchase data. Such a fusion could enable the creation of risk models that predict non-adherence based on socioeconomic variables, trigger outreach campaigns, or even tailor copay programs.

Pharmacy inventory data combined with AI-driven optimization platforms can enhance supply chain visibility, ensuring drug availability during public health emergencies or recalls. Moreover, retail pharmacies' role as healthcare access points (especially in underserved areas) makes them strategic data hubs for future public health surveillance initiatives. This convergence is expected to expand as Health Information Exchanges (HIEs) and cloud data lakes become more mainstream.

Segmental Analysis

By Dataset Type

The DSCSA Data segment holds the largest share of the market, driven by mandatory compliance under the Drug Supply Chain Security Act (DSCSA). With the FDA mandating traceability of pharmaceuticals from manufacturer to dispenser, retail pharmacies are required to generate and share serialized product transaction data with a range of stakeholders. This includes product identifiers, transaction history, and pedigree details.

Pharmaceutical manufacturers and regulatory technology vendors like TraceLink and LSPedia are the dominant buyers of this data. These firms use it to ensure end-to-end traceability, detect counterfeit products, and enhance recall efficiency. In 2023, the FDA reiterated its full enforcement timeline for DSCSA implementation in 2024, prompting a surge in demand for compliant data exchange infrastructure. Healthcare SaaS vendors are also increasingly integrating this data into compliance dashboards and track-and-trace applications.

In contrast, Prior Authorization (PA) Data is the fastest-growing dataset type, owing to the complexity and cost associated with access to specialty medications. Pharma market access teams are leveraging PA data to identify payer rejection patterns, refine coverage strategy, and streamline speed-to-therapy workflows. Consulting firms and health IT vendors are integrating PA metrics into payer engagement tools, signaling broader adoption. Given the push for transparency in coverage decisions and the shift toward personalized therapy, PA data will likely remain a high-growth area.

Market Basket Data: Dominated by CPG & Pharma Brands

The Market Basket Data segment is dominated by CPG and pharmaceutical brands aiming to understand the intersection of prescription fills and over-the-counter (OTC) purchases. This dataset captures SKU-level information tied to loyalty cards or anonymized tokens, helping marketers analyze health-related buying behavior and build targeted promotional strategies.

For instance, a brand promoting a smoking cessation drug might study whether patients also purchase nicotine patches or stress-relief supplements. Marketing and AdTech firms also license this data to run closed-loop campaigns that assess ROI based on pharmacy aisle conversions. With rising consumer interest in wellness products, basket-level insights are becoming vital for cross-category optimization.

Meanwhile, Retail Analytics Platforms represent the fastest-growing buyer type in this segment. These platforms use de-identified basket data to benchmark sales performance, detect regional trends, and predict inventory needs. Platforms like SymphonyAI, Numerator, and NielsenIQ are increasingly adding pharmacy data feeds to their retail dashboards, responding to rising demand for health-aligned retail intelligence.

Episodic Data / Pharmacy Rx Claims Data: Driven by Value-Based Payers

Among episodic datasets, Pharmacy Rx Claims Data is most widely consumed by value-based payers and Accountable Care Organizations (ACOs). These organizations use de-identified claims data to evaluate adherence rates, understand therapy drop-offs, and build population health models. The longitudinal nature of these datasets allows for outcome tracking over time, which is essential for performance-based reimbursement contracts.

Real-world evidence vendors also rely heavily on these datasets to support observational research and inform regulatory filings. In fact, several FDA 506B post-market studies have increasingly included pharmacy claims data as part of their methodology.

However, AI/ML healthtech firms represent the fastest-growing buyer type. These startups develop predictive models that flag patients at risk of non-compliance, potential opioid abuse, or adverse drug reactions. For example, an AI tool may use historical claims to alert a physician when a patient fails to refill critical medications. The proliferation of such tools is expanding the market’s tech footprint.

Inventory Data: Pharma Manufacturers Lead but Optimization Vendors Are Rising

Inventory datasets are currently dominated by pharmaceutical manufacturers, who use this data to assess pharmacy stock levels, optimize supply chain cycles, and forecast production needs. With inflation impacting drug production and distribution, real-time inventory visibility has become crucial for demand planning and minimizing stockouts.

However, AI/ML inventory optimization vendors are the fastest-growing segment. These firms apply predictive analytics to inventory flows, helping retail pharmacies automate reorders, identify slow movers, and prevent waste. During the COVID-19 pandemic, inventory modeling became essential in forecasting demand for antivirals and over-the-counter therapeutics, and that trend has continued into broader disease categories.

Country-Level Analysis: United States

As the sole geography for this market, the United States stands as both the pioneer and global leader in the monetization of retail pharmacy de-identified health data. With one of the most digitized retail pharmacy networks globally, the U.S. benefits from vast volumes of prescription and consumer health data, strong analytics ecosystems, and advanced regulatory frameworks supporting safe data usage.

Regulatory milestones such as HIPAA (Health Insurance Portability and Accountability Act) and HITECH (Health Information Technology for Economic and Clinical Health Act) provide foundational guidelines for data protection and ethical sharing. Moreover, U.S. pharmacies often double as primary care access points, especially in rural and underserved communities, thereby increasing the richness and granularity of datasets collected.

Several health tech innovations and public-private partnerships in the U.S. including initiatives from the ONC (Office of the National Coordinator for Health IT) and CMS further catalyze the integration of retail pharmacy data into broader healthcare strategies.

Some of The Prominent Players in The U.S. Retail Pharmacy De-identified Health Data Market Include:

- CVS

- Cub (subsidiary of UHealth

- Walgreens Boots Alliance, Inc.

- Walmart Pharmacy

- The Kroger Co.

- Albertsons

- UnitedHealth Group

- Humana

- BrightSpring Health Services

- Costco Wholesale Corporation

- Centene Corporation

- Ahold Delhaize

- Rite Aid Corp

- H E B, LP

- Aurora Health Care (a part of Advocate Health)

- Big Y Foods, Inc.

- Brookshire Brothers

- Wakefern Food Corp.

- Publixnited Natural Foods, Inc.)

Recent Developments

-

April 2025: CVS Health announced the launch of a data collaboration platform in partnership with Snowflake, enabling real-time access to de-identified retail health data for pharma clients.

-

February 2025: Walgreens Boots Alliance expanded its relationship with Komodo Health to integrate prescription-level data into longitudinal patient journeys for real-world evidence use cases.

-

January 2025: Amazon Pharmacy partnered with Datavant to de-identify and commercialize prescription claims for use in payer-provider value-based care arrangements.

-

December 2024: LSPedia introduced DSCSA EdgeTrace™, a serialization analytics suite that uses pharmacy traceability data for advanced compliance visualization.

-

October 2024: TraceLink acquired a health data interoperability startup to enhance its DSCSA compliance platform with AI-powered pharmacy trace analytics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Dataset Type

-

-

- Pharmaceutical Manufacturers

- Drug Distributors

- Regulatory Tech Vendors (e.g., TraceLink, LSPedia)

- Healthcare SaaS Vendors (compliance and recall management tools)

- Others (Federal Agencies e.g., FDA, etc.)

-

-

- CPG & Pharma Brands

- Marketing & AdTech Firms

- Health Insurers & PBMs

- Retail Analytics Platforms

- Others (Data Aggregators (e.g., NielsenIQ, IRI), etc.)

-

-

- Payers & PBMs

- Pharma Market Access Teams

- Health IT Providers

- Consulting & Policy Firms

- Others (Advocacy Groups, etc.)

-

-

- Pharma Manufacturers

- Distributors/Wholesalers

- AI/ML Inventory Optimization Vendors

- Others (Clinical Supply Vendors, etc.)

- Episodic Data / Pharmacy Rx Claims Data

-

-

- Value-based Payers & ACOs

- Pharma Outcomes Teams

- Real-world Evidence Vendors

- CMS & Government Organizations

- Others (AI/ML Healthtech Firms, etc.)