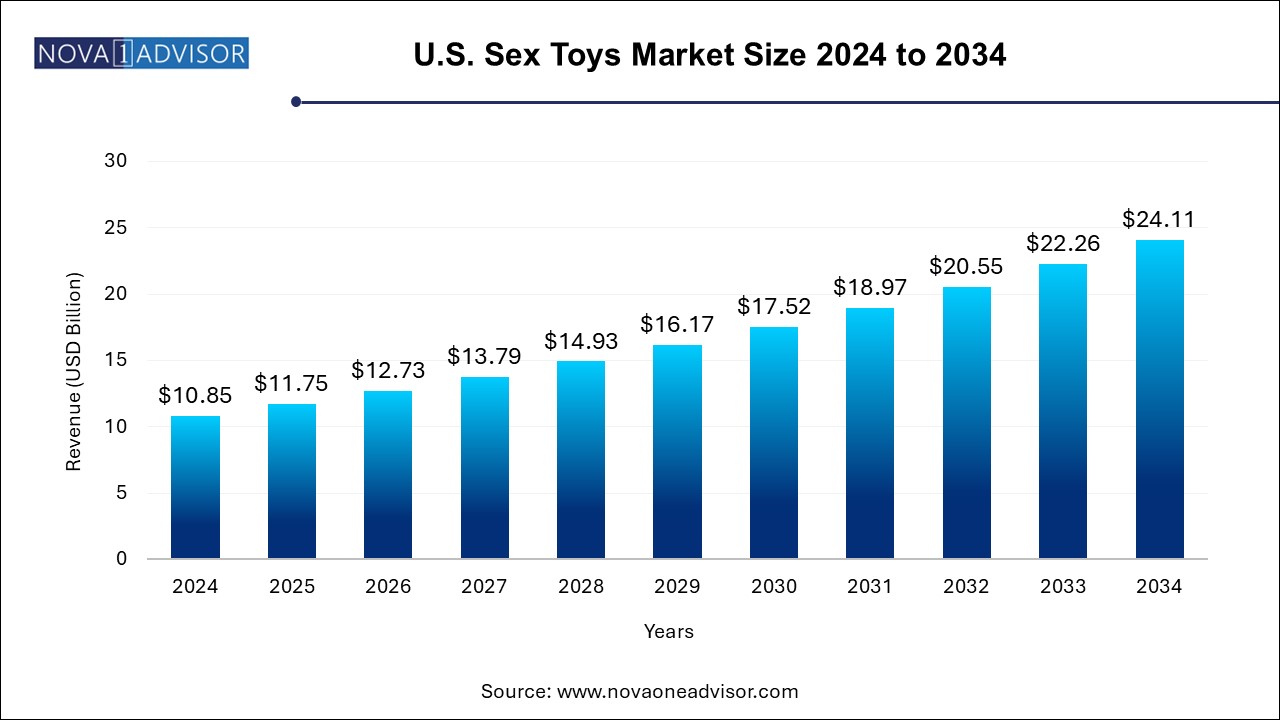

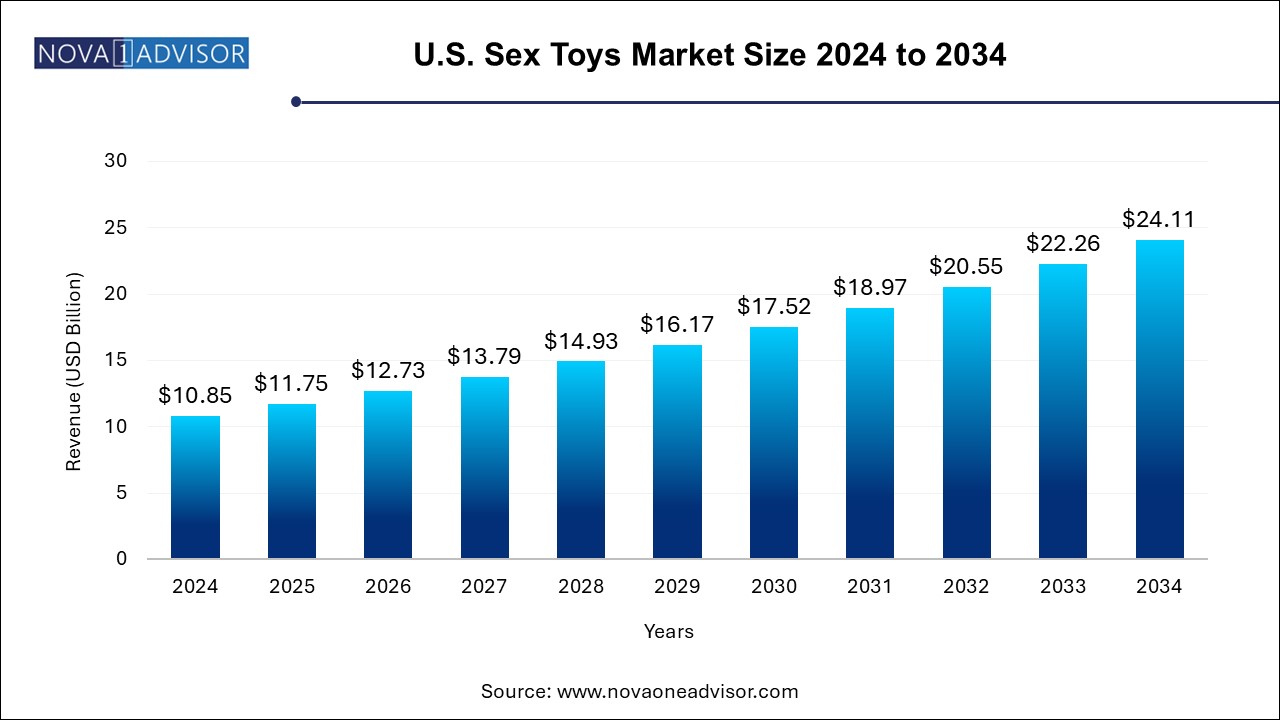

U.S. Sex Toys Market Size and Growth

The U.S. sex toys market size was exhibited at USD 10.85 billion in 2024 and is projected to hit around USD 24.11 billion by 2034, growing at a CAGR of 8.31% during the forecast period 2024 to 2034.

U.S. Sex Toys Market Key Takeaways:

- The vibrators segment dominated the market with a revenue share of 22.84% in 2024 and expected to witness fastest CAGR during the forecast period.

- The e-commerce segment dominated the market with a revenue share of 58.00% in 2024 and is expected to grow at the fastest CAGR during the forecast period.

- The West region dominated the market with a revenue share of 24.21% in 2024 and is expected to have the fastest CAGR during the forecast period.

- The Northeast region is expected to experience significant growth from 2024 to 2034.

Market Overview

The U.S. sex toys market has evolved significantly over the past two decades, transitioning from a niche, often stigmatized segment into a mainstream and rapidly growing industry. This transformation is driven by changing consumer perceptions, technological innovations, and a broader cultural shift toward sexual wellness, self-exploration, and gender inclusivity. From simple vibrators to app-controlled, AI-integrated devices, the product landscape has expanded in complexity and diversity, reflecting the growing sophistication of consumer preferences.

The market has benefited from greater openness in public discourse surrounding sexual health, fueled in part by media, influencers, and the wellness movement. Millennials and Gen Z consumers have been particularly instrumental in destigmatizing the use of sex toys, embracing them not only for pleasure but also for emotional and physical well-being. As sex education initiatives shift from abstinence-focused programs to comprehensive sexual health curricula, awareness around self-pleasure and mutual satisfaction has grown further boosting demand.

Moreover, the COVID-19 pandemic introduced a unique catalyst for market expansion. As social distancing measures limited physical intimacy for many, consumers turned to solo play and remote-controlled devices to maintain intimacy. This period saw an uptick in first-time purchases, especially through e-commerce channels. With the growing popularity of body-safe materials, gender-neutral designs, and smart features, the U.S. sex toys market continues to demonstrate strong growth potential across both urban and suburban areas.

Major Trends in the Market

-

App-Controlled and Bluetooth-Enabled Devices: Smart sex toys that sync with apps offer remote-controlled intimacy, long-distance play, and even interactive features with audio/video content.

-

Sustainable and Eco-Friendly Products: Manufacturers are increasingly using recyclable packaging and body-safe, biodegradable silicone in response to environmentally conscious consumers.

-

Gender-Inclusive and Non-Binary Designs: Products are being designed with inclusive language and non-gendered functionality to appeal to LGBTQ+ and non-binary users.

-

Integration with Virtual Reality (VR): High-end masturbators and sex dolls now integrate with VR content for immersive adult entertainment experiences.

-

Luxury and Designer Sex Toys: Brands like Lelo and Dame are creating elegant, luxury-focused toys that double as aesthetic lifestyle products.

-

Retail Normalization: Sex toys are appearing in mainstream retail outlets like Target, CVS, and Walmart, signaling societal acceptance and accessibility.

-

Celebrity and Influencer Collaborations: High-profile endorsements are helping to normalize the use of pleasure products and reach new customer segments.

-

Educational Platforms and Sex-Positive Content: Companies are investing in education to empower consumers and promote healthy sexual exploration.

Report Scope of U.S. Sex Toys Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 11.75 Billion |

| Market Size by 2034 |

USD 24.11 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 8.31% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Reckitt Benckiser Group plc; Church & Dwight Co., Inc.; Lovehoney Group Ltd.; LifeStyles Healthcare Pte Ltd.; LELO; Doc Johnson Enterprises; Unbound; Tenga Co., Ltd.; Fun Factory; BMS Factory; PHE, Inc. (Adam & Eve); California Exotic Novelties; Pipedream Products; Dame Products, Inc; ILF, LLC |

Key Market Driver – Changing Cultural Attitudes Toward Sexual Wellness

One of the most significant drivers of the U.S. sex toys market is the growing societal acceptance of sexual wellness and pleasure as integral components of overall health. What was once whispered in hushed tones or confined to the back of adult novelty shops has now found its place in health-focused conversations and even wellness routines. A significant portion of this cultural shift can be attributed to feminist and sex-positive movements that emphasize autonomy, body confidence, and the destigmatization of masturbation.

Media, podcasts, and educational platforms have contributed to shifting public discourse around pleasure. TV shows like Sex Education, online platforms like O.school, and influencers openly discussing intimacy have helped consumers—especially women—feel more comfortable exploring sex toys. Surveys now indicate that more than 50% of American women have used a vibrator, and nearly 30% of men report using some form of a sex toy. This normalization has opened the door to mainstream commercial success and ongoing product innovation.

Market Restraint – Legal Restrictions and Content Moderation Policies

Despite growth and progress, the market faces ongoing challenges due to regulatory and legal ambiguities, particularly around advertising and product classification. While sex toys are legal in the U.S., online platforms such as Facebook, Instagram, and TikTok restrict or ban adult content and advertising, making it difficult for companies to reach potential customers through conventional digital marketing strategies. These moderation policies limit exposure and require brands to adopt indirect or coded language, often impacting SEO and visibility.

Additionally, certain states and jurisdictions still impose legal restrictions on the sale of specific types of sex toys or devices considered "obscene." While enforcement is generally minimal, these lingering laws reflect cultural conservatism that still affects portions of the market. This results in fragmented marketing strategies and increased costs for brands navigating a patchwork of legal compliance.

Market Opportunity – Integration of Technology and SexTech Innovation

An exciting growth opportunity lies in the continued integration of technology with sex toys, creating a burgeoning category referred to as SexTech. This includes devices that are app-connected, voice-responsive, AI-enabled, and even capable of syncing with wearable health devices. Companies like Lovense and We-Vibe have pioneered this space by introducing remote-controlled devices that can be operated via smartphone apps, making them popular among long-distance couples and tech-savvy users.

Emerging startups are also developing haptic feedback systems, mood-responsive vibrators, and augmented reality (AR) interfaces to simulate real-time intimacy. Some companies are even exploring the intersection between pleasure and mental health, integrating biofeedback sensors that adapt stimulation to relaxation or arousal levels. As consumer interest in personalized and interactive products grows, the marriage of sexual wellness and digital innovation presents vast untapped potential in the U.S. market.

U.S. Sex Toys Market By Product Insights

Vibrators dominate the U.S. sex toys market, accounting for the largest share of sales across demographics and distribution channels. Available in numerous formats including bullet, wand, rabbit, and wearable styles vibrators appeal to a broad audience, including individuals and couples of all orientations. Their mainstream acceptance, ease of use, and wide price range (from $10 to $250+) contribute to their widespread popularity. Many consumers begin their sex toy journey with vibrators, which are often marketed as essential tools for both solo and partnered pleasure. Innovations like app-control, magnetic charging, and waterproofing have only added to their appeal.

Sex dolls are the fastest-growing product segment, driven by technological innovation and increasing consumer openness. High-end silicone dolls with lifelike features and AI-based responses are attracting attention in niche markets, including disability communities and virtual companionship seekers. Companies like RealDoll and AI-AITech have introduced dolls that integrate with smart assistants and respond to user inputs. Furthermore, male sex dolls and gender-neutral models are expanding the appeal of this segment. Although sex dolls remain expensive and niche compared to vibrators, demand is accelerating due to customization options and increased online privacy in purchasing.

U.S. Sex Toys Market By Distribution Channel Insights

E-commerce is the dominant distribution channel, led by specialty platforms such as Adam & Eve, Lovehoney, and direct-to-consumer (DTC) brands like Dame and Maude. Online shopping provides the discretion, product variety, and educational content that many consumers seek. The ease of browsing categories, comparing features, and reading reviews has fueled the growth of e-commerce, which has only accelerated post-pandemic. Specialty platforms, in particular, offer curated collections, discreet shipping, and targeted marketing, making them preferred portals for both first-time buyers and returning customers.

Online portals of mass merchandisers are the fastest-growing sub-segment within e-commerce. Retailers such as Amazon, Walmart, and Target have expanded their adult wellness sections, often integrating them under broader health or beauty categories. This has exposed mainstream audiences to sex toys while leveraging the logistical advantages of trusted marketplaces. In 2024, Amazon reported a 40% year-on-year increase in adult wellness product sales, with vibrators, lubes, and wearable toys leading the charge. As brand partnerships and search engine optimization improve, this segment is expected to continue growing rapidly.

U.S. Sex Toys Market By Region Insights

The Western U.S. dominates the sex toys market, driven by progressive social attitudes, a strong presence of direct-to-consumer brands, and high e-commerce penetration. California alone accounts for a significant share of the market, thanks to cities like Los Angeles and San Francisco that host sex tech startups, feminist wellness brands, and LGBTQ+-inclusive retailers. The region's liberal stance on sexual wellness, combined with high average disposable income, contributes to its leadership position in both online and offline sales.

The Southeast is the fastest-growing region, defying stereotypes and showcasing shifting cultural dynamics. States like Florida, Georgia, and North Carolina have witnessed increased demand for sex toys, particularly through e-commerce platforms. This growth is attributed to younger, digitally savvy populations, changing religious conservatism, and the expansion of sexual health education. Companies have noted increased web traffic, subscription box signups, and customer engagement from the Southeast, suggesting a long-term market opportunity despite historical resistance.

Country-Level Analysis: United States

The United States presents one of the most diverse and dynamic sex toys markets globally, characterized by rapid innovation, competitive DTC branding, and growing institutional support for sexual health and wellness. Unlike other countries where social norms may suppress demand, the U.S. market benefits from both individual freedom and a cultural embrace of lifestyle experimentation. A broad range of consumers from urban millennial women to married suburban couples and LGBTQ+ individuals actively participate in the market.

The rise of telehealth services and online therapy platforms has also played a role in normalizing sex toys as part of mental and emotional well-being. Therapists often recommend vibrators and other devices to treat sexual dysfunctions, postpartum recovery, and relationship intimacy. With increasing insurance coverage for sexual therapy and FDA approval of some sexual wellness devices (such as pelvic floor stimulators), the policy environment is becoming more supportive. Furthermore, local sex-positive education initiatives and university programs are empowering young adults with information, encouraging early adoption and destigmatization of pleasure devices.

Some of the prominent players in the U.S. sex toys market include:

U.S. Sex Toys Market By Recent Developments

-

March 2025 – Dame Products launched a new line of wearable, AI-enhanced vibrators that use machine learning to adjust intensity based on user feedback, targeting couples and long-distance relationships.

-

January 2025 – Maude received $10 million in Series B funding, signaling investor confidence in sex-positive wellness brands targeting Gen Z and millennials with minimalist, gender-inclusive designs.

-

November 2024 – Lora DiCarlo reintroduced its flagship robotic massager after FDA scrutiny, now marketed under wellness therapy and medical-grade categories.

-

October 2024 – Lovehoney and WOW Tech merged under the newly formed Lovehoney Group, creating one of the largest global adult toy conglomerates with significant U.S. operations.

-

July 2024 – Amazon added an “Intimacy & Wellness” filter to its adult category, increasing product visibility and searchability for sexual wellness items without triggering algorithm restrictions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. sex toys market

Product

- Vibrators

- Sex Dolls

- Dildos

- Bondage

- Penis Rings

- Anal Toys

- Masturbation Sleeve

- Others

Distribution Channel

-

- Specialty Platforms

- Online Portals of Mass Merchandizers

- Specialty Stores

- Mass Merchandizers

Region

- West

- Midwest

- Southeast

- Northeast

- Southwest