U.S. Skin Lightening Products Market Size and Trends

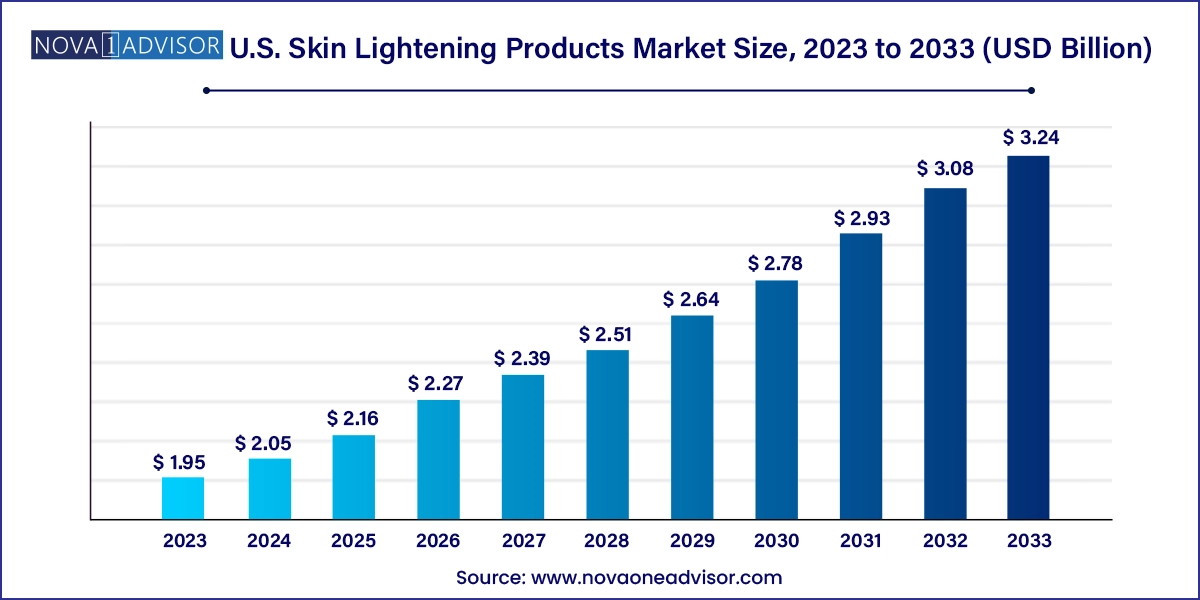

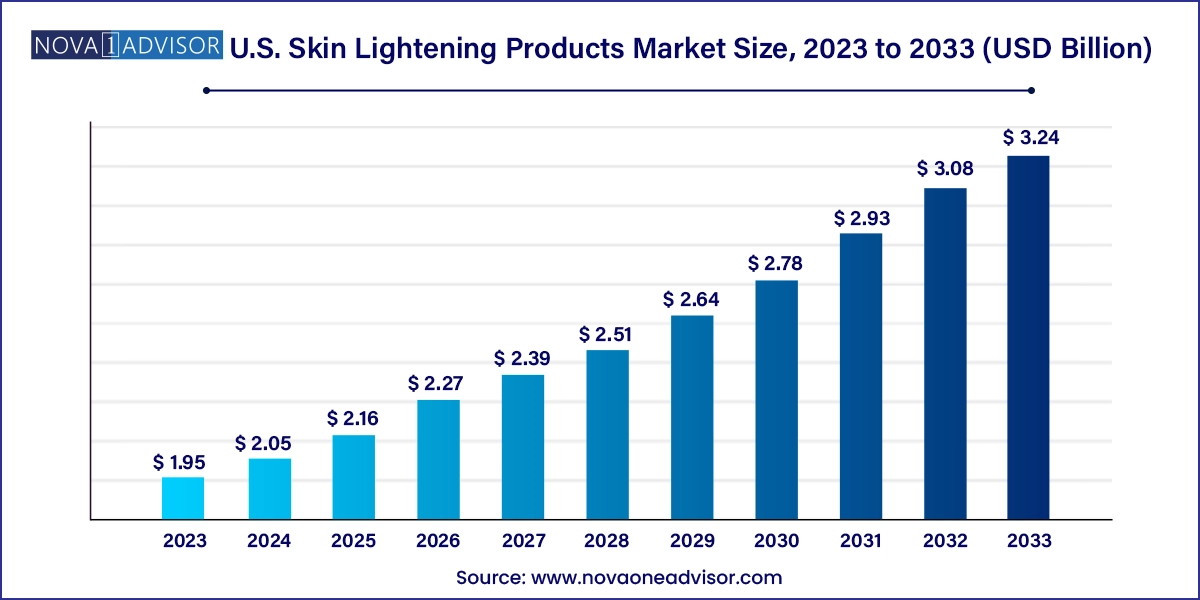

The U.S. skin lightening products market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 3.24 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

U.S. Skin Lightening Products Market Key Takeaways:

- The synthetic category accounted for a revenue share of over 88% in 2023.

- The natural skin lightening products market is anticipated to grow at a CAGR of 5.8% from 2024 to 2033.

- The skin lightening creams market accounted for a share of 54.0% in 2023.

- The skin lightening cleanser market is projected to grow at a CAGR of 5.6% from 2024 to 2033.

Market Overview

The U.S. skin lightening products market is undergoing a paradigm shift, moving away from conventional beauty ideals toward holistic skincare and inclusivity-driven narratives. While traditionally associated with complexion whitening, the contemporary interpretation of skin lightening in the U.S. has evolved to include skin brightening, tone correction, hyperpigmentation management, and overall skin health enhancement. Products marketed under the “skin lightening” label are now increasingly focused on delivering even skin tone, improving radiance, reducing age spots, and treating acne scars — appeals that resonate broadly across age, gender, and ethnic lines.

The U.S. market is driven by a multicultural consumer base with distinct skincare preferences, ranging from Asian and Hispanic communities seeking melanin management to African-American consumers combating post-inflammatory hyperpigmentation (PIH). Millennials and Gen Z populations are key demand drivers, given their growing awareness of skin health, comfort with online skincare communities, and preference for products backed by science. The rise of cosmeceuticals — products sitting between cosmetics and pharmaceuticals — has further propelled the demand for skin lightening formulations with potent actives like niacinamide, vitamin C, kojic acid, and alpha-arbutin.

Importantly, the shift towards transparency and clean beauty has dramatically influenced product innovation. Modern consumers are rejecting hydroquinone and mercury-based formulations in favor of natural and organic alternatives. This has compelled established brands like Neutrogena and Olay to reformulate legacy products, while also making room for indie skincare brands that promote safer and more inclusive skincare.

Additionally, digital beauty influencers, dermatologist-backed brands, and platforms like TikTok and YouTube have democratized skincare education. Consumers are more informed than ever and seek targeted solutions — whether it’s reducing melasma, sunspots, or dullness. Dermatologists and estheticians in the U.S. are increasingly recommending over-the-counter (OTC) skin lightening serums and creams as adjuncts to clinical treatments such as chemical peels or laser therapy, boosting the legitimacy of the market.

Major Trends in the Market

-

Transition from Whitening to Brightening and Tone-Correcting Products: Consumer narratives have evolved from fairness-centric ideals to healthy, radiant, and even-toned skin.

-

Boom in Dermatologist-Backed Skincare Brands: Brands like The Ordinary, CeraVe, and Paula’s Choice have gained popularity by emphasizing science-driven, skin-safe ingredients.

-

Surge in Natural and Organic Product Demand: Consumers are actively avoiding hydroquinone and opting for botanical actives such as licorice root extract, mulberry, turmeric, and bearberry.

-

Increased Male Participation in Skincare: The emergence of unisex and male-focused skincare brands has contributed to broader acceptance and consumption of skin lightening and brightening products among men.

-

Celebrity-Endorsed and Influencer-Driven Product Launches: Personal brands by public figures like Rihanna (Fenty Skin) and Alicia Keys (Keys Soulcare) are redefining beauty inclusivity and promoting skin tone positivity.

-

Rise of Clinical and At-Home Treatments: Skin lightening products are now being used in conjunction with at-home dermarollers, peels, and devices for more intense treatment routines.

-

Shift to Subscription-Based E-commerce Models: Brands like Curology and Apostrophe offer customized skin lightening solutions through subscription models, improving user retention.

-

Increased Scrutiny from FDA and Advocacy Groups: Regulatory monitoring has intensified against mercury-laced or hydroquinone-heavy imports, pushing brands toward safer compliance.

Report Scope of U.S. Skin Lightening Products Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.05 Billion |

| Market Size by 2033 |

USD 3.24 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Nature |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

L’Oréal S.A.; Beiersdorf AG; Shiseido Co., Ltd.; Procter & Gamble; Unilever; Himalaya Global Holdings Ltd.; Avon Products, Inc.; Oriflame Cosmetics S.A.; Revlon, Inc.; The Estee Lauder Companies Inc |

Key Market Driver

Rising Prevalence of Hyperpigmentation and Uneven Skin Tone Across Demographics

One of the primary drivers of the U.S. skin lightening products market is the increasing demand for solutions that address skin tone irregularities caused by hyperpigmentation, melasma, sun exposure, and hormonal changes. According to the American Academy of Dermatology, hyperpigmentation affects nearly 5 million Americans annually, with higher incidence among people of color. This has prompted the development of targeted lightening products that are safe, effective, and tailored to diverse skin types. Brands have responded by incorporating clinically proven agents such as alpha-arbutin, niacinamide, and azelaic acid to fade dark spots without irritation. Notably, younger consumers seek preventive care as much as curative treatment, boosting long-term product adoption. This growing awareness and medical validation continue to fuel market expansion.

Key Market Restraint

Regulatory Restrictions and Health Concerns over Harmful Ingredients

The industry has long battled criticism over the inclusion of harmful chemicals in skin lightening formulations. Ingredients such as mercury and hydroquinone — once mainstays in bleaching creams — have been associated with skin damage, kidney toxicity, and other serious health concerns. In 2020, the U.S. FDA issued stronger guidelines banning OTC hydroquinone products without a prescription, disrupting several brand portfolios. Additionally, import seizures of non-compliant products from international markets have further constrained supply chains. These regulatory crackdowns, while essential for consumer safety, pose a significant restraint for legacy brands that now need to invest in R&D for safer, compliant substitutes. The resultant reformulation costs, certification requirements, and reputational risks make market entry and innovation more complex.

Key Market Opportunity

Expansion of Personalized and AI-Driven Skincare Solutions

The intersection of artificial intelligence and skincare is creating a new frontier for personalized skin lightening products in the U.S. Leveraging data from consumer quizzes, facial scans, and dermatological assessments, brands can now formulate products tailored to individual skin tones, concerns, and goals. Companies like Curology and Proven Skincare have successfully implemented AI algorithms to deliver custom formulations that target pigmentation, sensitivity, or acne-related discoloration. As personalization becomes a key purchasing factor for millennial and Gen Z consumers, this tech-enabled skincare model offers a strong opportunity for growth. Furthermore, the ability to integrate these products into app-based routines enhances brand loyalty and consumer confidence.

U.S. Skin Lightening Products Market By Nature Insights

The synthetic category accounted for a revenue share of over 88% in 2023. longer shelf life, and mass-market appeal. Ingredients such as retinoids, glycolic acid, and lab-synthesized niacinamide deliver visible results and are widely used in dermatologist-recommended brands. Products under this category often include multi-functional solutions that combine whitening agents with moisturizers, sunscreens, and anti-aging properties. These are commonly found in drugstores and mass-retail chains like Walgreens, CVS, and Target, ensuring easy consumer access and affordability.

Meanwhile, the organic category is the fastest-growing segment, driven by the clean beauty movement and increasing ingredient scrutiny. Consumers today are actively reading labels and choosing products free of parabens, sulfates, and synthetic dyes. Brands like True Botanicals, Tata Harper, and Juice Beauty are at the forefront of this organic revolution, promoting transparency and eco-certification. Ingredients such as aloe vera, rosehip oil, saffron, and vitamin E-rich botanicals are being used in formulations that promise brightening without compromising skin health. Although priced at a premium, these products are experiencing heightened demand among affluent urban consumers who are investing in skin wellness over instant results.

U.S. Skin Lightening Products Market By Product Insights

The skin lightening creams market accounted for a share of 54.0% in 2023. These include day creams with SPF, night creams for overnight depigmentation, and treatment-specific products addressing melasma and age spots. Well-known brands such as Ambi, Olay, and Neutrogena have built robust consumer trust through years of consistent performance in the cream segment. Clinical-grade brands like PCA Skin and Murad have also introduced brightening creams with stabilized vitamin C and peptides, catering to dermatological requirements.

In contrast, the mask segment is gaining rapid traction, particularly due to the popularity of self-care rituals and spa-like experiences at home. Charcoal, turmeric, pearl extract, and kojic acid-based masks are frequently sought by younger demographics. These products are often marketed as weekly detox routines that refresh and illuminate the skin. Sheet masks, clay masks, and peel-off masks infused with brightening agents are promoted via influencers on Instagram and TikTok, contributing to their popularity among beauty-conscious users. This segment, while smaller in size, is growing faster than creams and cleansers, signaling evolving consumer preferences toward hybrid skincare rituals.

Country-Level Analysis

In the United States, the skin lightening products market exhibits diverse demand patterns influenced by geographic, demographic, and cultural factors. Major urban areas like New York, Los Angeles, Miami, and Houston serve as high-consumption zones due to their multi-ethnic populations and exposure to global beauty trends. Within these regions, demand is particularly strong among Asian-American, African-American, and Hispanic populations, who seek products to manage pigmentation, sun damage, and uneven skin tone.

Dermatology clinics and medspas across the country are also playing a pivotal role by recommending OTC skin lightening products as post-treatment care. With increasing access to professional consultations, even suburban and semi-urban populations are exploring targeted skincare solutions. Additionally, the rise in online shopping has enabled small-town consumers to access niche organic and international skin lightening brands. U.S.-based e-commerce platforms like Dermstore, Skinstore, and Amazon dominate distribution, often running promotions for trending brands and seasonal launches.

Consumer awareness is further strengthened by localized influencer marketing, with dermatologists and skincare coaches on TikTok, Instagram, and YouTube shaping product preferences. In regions with intense sun exposure — such as Florida, Arizona, and California — there is a parallel rise in products that combine UV protection with skin tone enhancement. As societal perceptions shift towards embracing diverse skin tones, the demand for safe and ethical brightening products remains on an upward trajectory.

Some of the prominent players in the U.S. skin lightening products market include:

- L’Oréal S.A.

- Beiersdorf AG

- Shiseido Co., Ltd.

- Procter & Gamble

- Unilever

- Himalaya Global Holdings Ltd.

- Oriflame Cosmetics S.A.

- Avon Products, Inc.

- Revlon, Inc.

- The Estee Lauder Companies Inc

U.S. Skin Lightening Products Market Recent Developments

-

CeraVe (February 2024): CeraVe announced the expansion of its Brightening Vitamin C Serum line with an added ferulic acid complex, designed to combat dullness and uneven skin tone. The launch targets consumers seeking dermatologist-developed brightening options.

-

Ambi Skincare (March 2024): Ambi launched its new Advanced Even & Clear Fade Cream, specifically formulated for ethnic skin tones. The product has received favorable reviews on retail platforms and is backed by melanin science research.

-

Curology (January 2024): Curology introduced a new AI-led skincare subscription plan that includes customized brightening serums for users with hyperpigmentation, backed by online dermatologist consultations.

-

Paula’s Choice (December 2023): Paula’s Choice unveiled a reformulated Radiance Renewal Mask, replacing synthetic agents with a plant-based complex, aligning with clean beauty demands while targeting dull skin.

-

Neutrogena (November 2023): Neutrogena entered a strategic partnership with Target to launch a “Tone & Radiance” campaign, promoting its Bright Boost line through pop-up skincare labs in select U.S. cities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. skin lightening products market

Product

- Creams

- Cleanser

- Mask

- Others

Nature

- Synthetic

- Natural

- Organic