U.S. Smart Lock Market Size and Trends 2024-2033

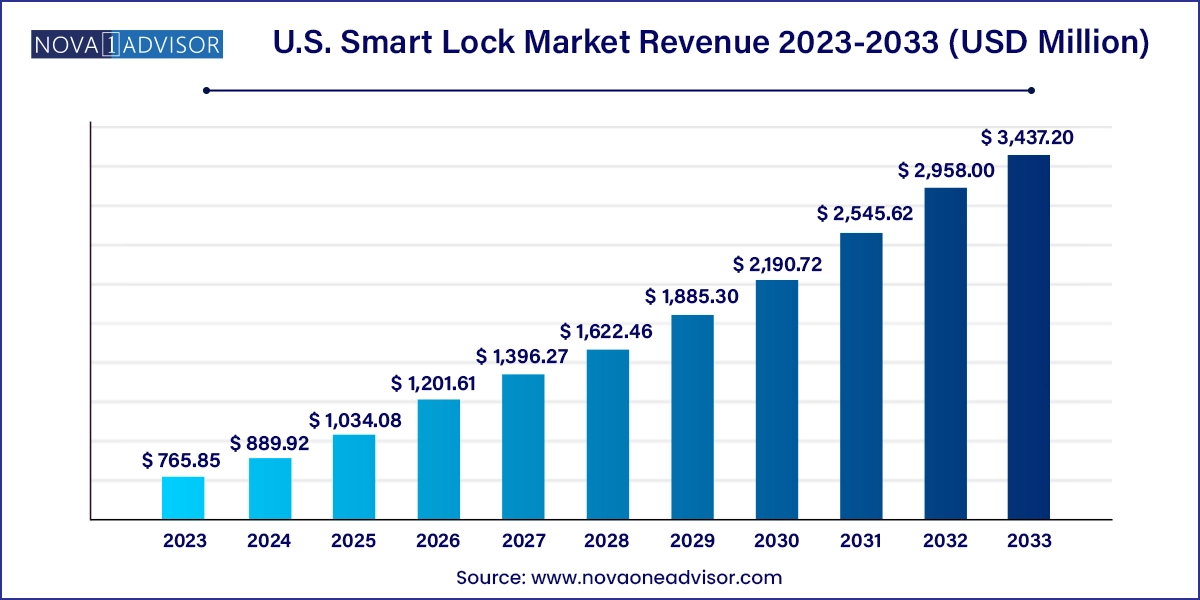

The U.S. smart lock market size was exhibited at USD 765.85 million in 2023 and is projected to hit around USD 3,437.20 million by 2033, growing at a CAGR of 16.2% during the forecast period 2024 to 2033.

U.S. Smart Lock Market Key Takeaways:

- The residential segment accounted for a revenue share of 61.9% in 2023.

- The hospitality segment is anticipated to grow at a CAGR of over 20.1% from 2024 to 2033.

- Based on type, the deadbolt segment accounted for the largest revenue share of 45.0% in 2023.

- The lever handles segment is projected to grow at a CAGR of 18.8% from 2024 to 2033.

Market Overview

The U.S. smart lock market is at the forefront of the country’s rapidly evolving smart home ecosystem, acting as a foundational security component across residential, commercial, and infrastructure sectors. A smart lock, which replaces or augments traditional mechanical locking mechanisms with electronically controlled systems, enables users to manage access using smartphones, voice assistants, keypads, and biometric inputs.

Driven by the surge in home automation, increasing concerns around safety, and growing awareness of connected living solutions, smart locks have transitioned from early adopter technology to mainstream household essentials. In the United States, tech-savvy consumers are rapidly adopting smart locks not only for convenience but also for enhanced security, real-time monitoring, and remote access management.

The COVID-19 pandemic accelerated interest in touchless entry, remote verification, and secure delivery systems—further stimulating demand across urban households, property managers, and shared access businesses like Airbnbs and coworking spaces. This momentum continues, with smart locks increasingly integrating with broader smart home platforms like Amazon Alexa, Google Home, and Apple HomeKit, offering seamless interoperability and centralized control.

The market is shaped by a competitive landscape of legacy hardware brands evolving into smart device manufacturers (e.g., Yale, Schlage, Kwikset), as well as tech-driven disruptors like Level, Lockly, and Wyze offering minimalist, app-centric, or retrofit-friendly devices. With growing investment in IoT security, cloud infrastructure, and AI-driven user management, the U.S. smart lock market is poised for sustained innovation and expansion.

Major Trends in the Market

-

Biometric and Fingerprint-Based Access Gaining Traction: As security becomes more personal, fingerprint recognition and facial unlocking are becoming increasingly common in new smart lock models.

-

Retrofit Smart Locks for Rental and Multifamily Units: Landlords and tenants are turning to solutions that don't require replacing existing deadbolts but still enable smart access.

-

Integration with Voice Assistants and Ecosystems: Compatibility with Amazon Alexa, Google Assistant, Apple Siri, and smart home hubs is now a key purchasing factor.

-

App-Centric User Management and Temporary Access Codes: Apps now allow users to grant, schedule, and revoke access in real-time, ideal for home deliveries, cleaners, and guests.

-

Battery-Optimized and Low-Power Bluetooth Locks: Power efficiency is improving, and many smart locks now offer over 6–12 months of battery life with low-battery alerts.

-

Adoption in Small Businesses and Co-Working Spaces: Beyond homes, smart locks are now being used in modern office spaces for secure, scalable access control.

-

Cybersecurity Becoming a Competitive Differentiator: With hacking concerns rising, companies are emphasizing end-to-end encryption, two-factor authentication, and tamper alerts.

-

Growing Use of Cloud-Based Lock Monitoring: Cloud dashboards and real-time activity logs are essential for property managers and enterprise users overseeing multiple units.

Report Scope of U.S. Smart Lock Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 889.92 Million |

| Market Size by 2033 |

USD 3,437.20 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 16.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

August Home, Inc. (ASSA ABLOY); HavenLock, Inc.; Kwikset (Spectrum Brands Holdings, Inc.); Schlage (Allegion Plc; Sentrilock, LLC; UniKey Technologies, Inc.; Yale Locks (ASSA ABLOY); Goji; Onity Inc. (Carrier Global Corp.); Honeywell International Inc. |

Market Driver: Rising Adoption of Smart Homes Across the U.S.

One of the strongest drivers for the U.S. smart lock market is the increasing penetration of smart home technologies across the country. According to recent data, over 60% of U.S. households now own at least one smart home device, with smart locks consistently ranked among the top five most desirable categories.

As homeowners invest in devices like smart thermostats, video doorbells, security cameras, and home assistants, integrating entry point control has become a logical extension of the connected home. Smart locks allow residents to lock/unlock doors remotely, receive notifications when someone enters or exits, and set custom access routines that align with daily habits.

Moreover, partnerships with home automation platforms like Amazon Alexa, Google Nest, Apple HomeKit, and Samsung SmartThings have made it easier than ever to control smart locks using voice commands or triggers from other smart devices (e.g., unlocking the door when the smoke detector activates).

In suburban and urban settings alike, this technology is especially valued for its role in managing home deliveries, dog walkers, cleaning services, and family members with varying schedules—all without the need for physical keys.

Market Restraint: Cybersecurity and Privacy Concerns

While smart locks offer unmatched convenience and security benefits, one of the primary concerns restraining adoption is the potential risk of cyberattacks and digital breaches. Unlike traditional locks that are physically manipulated, smart locks introduce digital vulnerabilities due to their reliance on Wi-Fi, Bluetooth, cloud services, and mobile apps.

Hackers exploiting weak encryption, outdated firmware, or unsecured networks can potentially override access controls or monitor user activity. Concerns around device spoofing, keyless replay attacks, and unauthorized third-party integrations have created skepticism, particularly among older homeowners or those unfamiliar with IoT security protocols.

In response, leading manufacturers are enhancing product security by including two-factor authentication (2FA), AES-256 encryption, biometric failsafes, and real-time tamper alerts. Nonetheless, the perception of vulnerability continues to impact consumer confidence, especially when widely publicized cases of compromised smart home devices make headlines.

To overcome this, education around best practices, certification standards (e.g., UL 294 for access control), and manufacturer transparency will be crucial in reassuring customers and unlocking the next wave of growth.

Market Opportunity: Rising Demand from Multi-Family Housing and Rental Markets

A major emerging opportunity in the U.S. smart lock market lies in the rapid growth of rental properties, co-living spaces, and multifamily housing units. As millennial and Gen Z populations increasingly choose to rent in cities rather than own homes, property owners and managers are seeking scalable, tech-enabled security solutions that offer convenience without compromising control.

Smart locks provide a game-changing value proposition for these stakeholders. Property managers can issue and revoke digital keys instantly, track entry logs, and manage access remotely—eliminating the cost and hassle of physical key duplication or lock changes after tenants vacate. This capability also supports temporary access for maintenance staff, cleaners, and guests.

Platforms like Airbnb and Vrbo have further fueled smart lock adoption by normalizing keyless entry in short-term rentals. Many hosts now consider smart locks a baseline requirement for convenience and contactless check-ins. Companies like August, Yale, and Level have released specific product lines tailored to rental property applications, including integrations with booking platforms, audit logs, and multi-unit dashboards.

As urban housing demand continues to rise, this segment presents a high-growth pathway with long-term value for both hardware vendors and platform providers.

U.S. Smart Lock Market By Application Insights

Residential usage dominates the U.S. smart lock market, accounting for the majority of unit sales and revenue. The use of smart locks in homes aligns with broader trends in home automation, personal safety, and lifestyle convenience. Homeowners are investing in integrated security ecosystems where smart locks work in tandem with video doorbells, motion sensors, and smart lighting. Single-family homes and suburban households are especially likely to invest in these systems, often influenced by smart home bundles from providers like Amazon, Google, or Comcast.

Hospitality is the fastest-growing application segment, driven by the rise of short-term rentals, boutique hotels, and vacation property management platforms. Hotel chains and Airbnb hosts alike are adopting smart locks to streamline guest entry, automate check-in/check-out, and reduce staffing costs. Solutions such as August’s Airbnb integration, Yale’s keyless entry locks, and Schlage’s Encode series have made digital guest access seamless and secure. As travelers increasingly expect contactless experiences, smart locks are becoming essential infrastructure in modern hospitality environments.

U.S. Smart Lock Market By Type Insights

Deadbolts remain the dominant type of smart lock in the U.S. market, primarily because they offer a familiar and secure mechanical base that integrates well with smart modules. Smart deadbolts are commonly retrofitted over existing lock systems or offered as full replacement kits. Brands like August, Yale Assure, and Kwikset Halo have capitalized on this segment, offering deadbolts with features such as fingerprint sensors, app-based unlocking, and guest passcodes. Consumers favor deadbolts for their reliability, ease of installation, and wide compatibility with residential door types.

.webp)

Padlocks are the fastest-growing segment, thanks to their flexibility in both residential and enterprise settings. Smart padlocks offer secure access to garages, sheds, lockers, bikes, and even storage units without needing physical keys. Bluetooth-based padlocks are popular among gym-goers, small businesses, and logistics providers. Brands like Master Lock and eufy Security have introduced weatherproof, biometric-enabled padlocks that are gaining popularity in both consumer and commercial verticals. As outdoor and mobile security needs increase, this segment is expected to surge further.

Country-Level Analysis

The United States represents the largest and most mature smart lock market globally, fueled by high rates of technology adoption, smart home investment, and consumer spending. Urban centers like San Francisco, New York, Los Angeles, and Austin lead the market due to dense tech ecosystems and digitally inclined residents. However, suburban expansion and home renovation trends have made smart locks a staple across many middle-class households nationwide.

Federal and state policies promoting energy efficiency and home security (such as tax credits or insurance incentives) have supported smart device installation. Additionally, U.S. consumers are increasingly influenced by privacy and data protection regulations, prompting hardware vendors to include stronger security and compliance protocols.

DIY-friendly products available through Home Depot, Lowe’s, Amazon, and Best Buy have also made smart lock adoption more accessible. Integration with popular ecosystems—like Amazon Alexa, Google Nest, and Apple HomeKit—has positioned smart locks not just as standalone devices, but as essential nodes within a connected lifestyle.

The convergence of consumer convenience, digital literacy, and security consciousness continues to shape the U.S. smart lock market, making it a benchmark region for global product rollouts and innovation pilots.

Some of the prominent players in the U.S. smart lock market include:

- August Home, Inc. (ASSA ABLOY)

- HavenLock, Inc.

- Kwikset (Spectrum Brands Holdings, Inc.)

- Schlage (Allegion Plc

- Sentrilock, LLC

- UniKey Technologies, Inc.

- Yale Locks (ASSA ABLOY)

- Goji

- Onity Inc. (Carrier Global Corporation)

- Honeywell International Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. smart lock market

Type

- Deadbolt

- Level Handlers

- Padlock

- Others

Application

- Residential

- Hospitality

- Enterprise

- Critical Infrastructure

- Others

.webp)