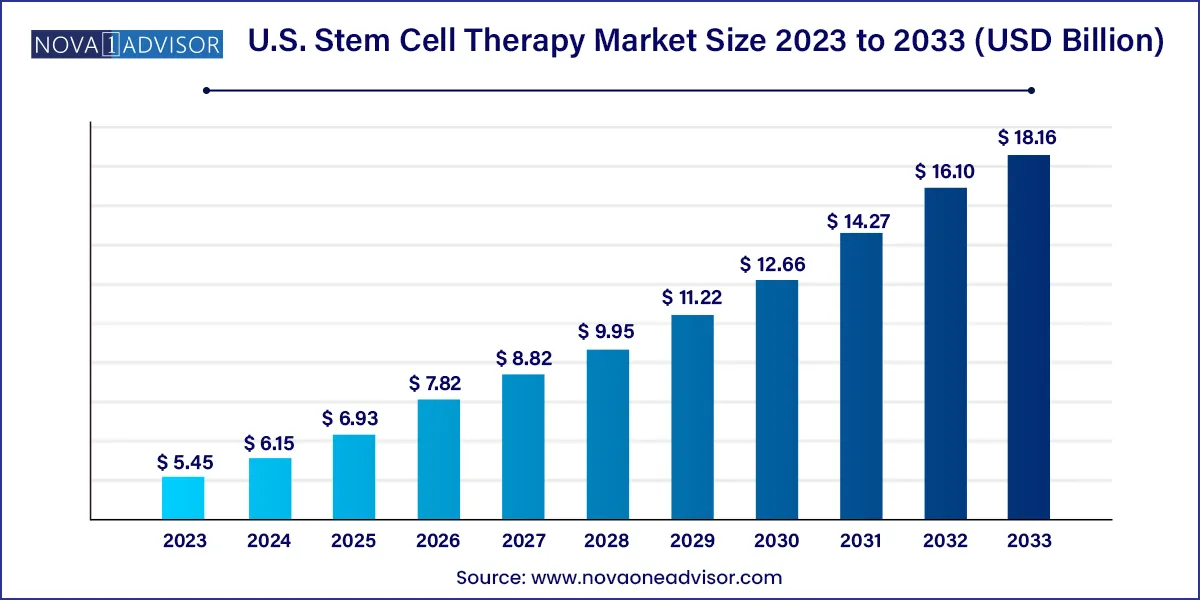

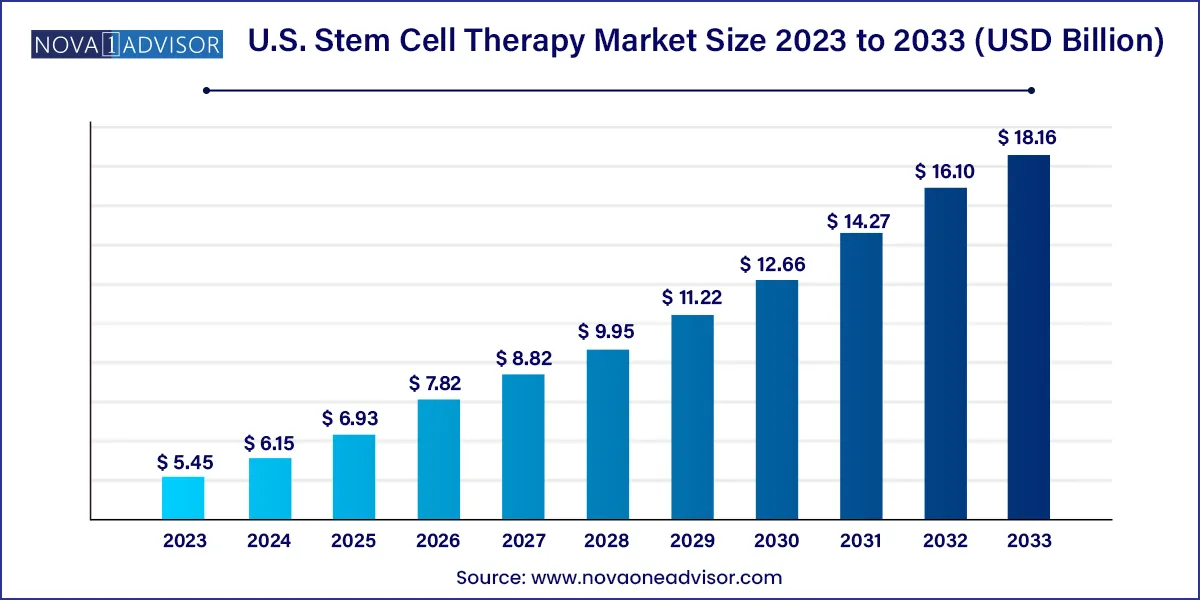

The U.S. stem cell therapy market size was estimated at USD 5.45 billion in 2023 and is projected to hit around USD 18.16 billion by 2033, growing at a CAGR of 12.79% during the forecast period from 2024 to 2033.

U.S. Stem Cell Therapy Market Overview

The U.S. stem cell therapy market is a rapidly evolving sector within the healthcare industry, characterized by the use of stem cells to treat various medical conditions and diseases. Stem cells are unique cells with the ability to differentiate into different cell types, offering promising avenues for regenerative medicine and personalized healthcare solutions.

Key Takeaways

- By product, the adult stem cells (ASCs) segment dominated the market in 2023.

- By therapy type, the allogenic segment dominated the market in 2023.

- By technology, the cell production segment held the largest share of the market in 2023.

- By application, the regenerative medicine segment dominated the U.S. stem cell therapy market in 2023.

- By end user, the hospitals segment dominated the market in 2023.

U.S. Stem Cell Therapy Market Growth

the U.S. stem cell therapy market had been experiencing significant growth driven by factors such as increasing prevalence of chronic diseases, growing geriatric population, advancements in stem cell research, and favorable regulatory policies. However, specific growth figures beyond that point would require the latest market analysis or industry reports.

Generally, the U.S. stem cell therapy market was anticipated to continue expanding due to ongoing research and development efforts, along with increasing acceptance of stem cell-based treatments across various medical specialties. Moreover, the potential for stem cell therapies to address unmet medical needs in areas such as neurology, orthopedics, oncology, and cardiology could further propel market growth.

To get the most accurate and up-to-date information on the growth of the U.S. stem cell therapy market beyond 2022, I recommend consulting recent market research reports, industry analyses, or reaching out to relevant experts or organizations specializing in this field.

U.S. Stem Cell Therapy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 6.15 Billion |

| Market Size by 2033 |

USD 18.16 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.79% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Product, By Therapy Type, By Application, By Technology, and By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Caladrius, CELGENE CORPORATION, Opexa Therapeutics, Inc., Seneca Biopharmaceuticals, Inc., and Others. |

US Stem Cell Therapy Market Dynamics

Drivers

Discovery of new stem cell sources

The variety of illnesses and ailments that can be treated with stem cell treatment is expanded by new sources of stem cells. This extension of therapeutic possibilities increases the market potential for stem cell therapies. The therapeutic qualities of various types of stem cells may differ. Researchers can now identify stem cell types with improved efficacy for medical applications due to identifying new sources, which improves patient outcomes and increases demand for these therapies.

Growth and accessibility benefits from new stem cell sources could facilitate the production of therapeutic stem cells in large quantities for broad clinical applications. This scalability helps to expand the U.S. stem cell therapy market and improves the commercial viability of stem cell therapies.

Unmet needs in chronic and degenerative disease

Many degenerative and chronic illnesses provide symptomatic alleviation or have insufficient therapy alternatives. Stem cell therapy presents hope for patients who have tried every other kind of treatment and want to address the underlying cause of their problems. The regulatory environment has changed to reflect improvements in the field, even though regulatory monitoring is still in place to guarantee the security and effectiveness of stem cell therapies. The development and commercialization of stem cell therapies are made more accessible by this regulatory clarity and support, which further propels market expansion.

With their unique ability to develop into numerous cell types, stem cells can heal damaged tissues. Their capacity to regenerate makes them appealing for the treatment of ailments where tissue destruction is a defining feature, like diabetes, Parkinson's disease, Alzheimer's disease, and spinal cord injuries.

Restraint

Scientific and technological hurdles

There is still much to learn about the behavior and the uses of many types of stem cells, as stem cell research is still in its infancy. The research and approval of stem cell therapies are impeded by uncertainties around their efficacy, safety, and long-term impacts. Immune rejection is a common problem for stem cell therapies, in which the recipient's immune system assaults the transplanted cells because it perceives them as alien. Creating plans to reduce immunological rejection while maintaining the therapy's efficacy is still a significant challenge.

The regulatory environment surrounding stem cell therapy is intricate and dynamic. Stem cell therapies must pass costly, time-consuming clinical studies, regulatory approval processes, and safety evaluations.

Opportunities

Developing advanced technologies and delivery systems

Improved stem cell manipulation, growth, and differentiation are made possible by advanced technologies, which may result in more potent treatments for various illnesses. Advances in delivery technologies allow stem cells to be precisely targeted and released under controlled conditions, enhancing their therapeutic potential and reducing negative effects. By investing in state-of-the-art technologies and delivery methods, businesses can obtain a competitive advantage by providing superior products with enhanced patient experiences and outcomes. Thereby, such developments are observed to act as an opportunity for the U.S. stem cell therapy market.

Developing cost-effective manufacturing processes

Although expensive, stem cell therapies have not yet been widely used to treat various medical diseases. Streamlining and optimizing the manufacturing process can help organizations lower the cost of producing stem cell treatment. This could entail automation, scalability, and cell culture improvements, ultimately making these treatments more available and reasonably priced for patients.

Product Insights

The adult stem cells (ASCs) segment dominated the U.S. stem cell therapy market in 2023. In comparison to embryonic stem cells, adult stem cells (ASCs) have several benefits, including being more readily available, being simpler to remove from tissues like bone marrow and adipose tissue, and having a decreased chance of immunological rejection. Furthermore, improvements in science and technology have made it possible to create more effective techniques for isolating and culturing ASCs, which has increased their potential for therapeutic use. Patients and healthcare providers widely adopt ASC-based therapies due to their promising results in treating neurological disorders, cardiovascular diseases, and orthopedic injuries.

Therapy Type Insights

The allogenic segment dominated the U.S. stem cell therapy market in 2023. Using donor stem cells instead of the patient's own is known as allogenic stem cell treatment. Compared to autologous stem cell therapy, which involves removing the patient's cells for therapy, this method has many benefits, including shorter treatment times, more cells available for therapy, and possibly lower costs.

Allogenic stem cell therapy also gets around some of the drawbacks of autologous therapy, like how the patient's age and health state affect the quantity and quality of available stem cells. Furthermore, allogenic therapy makes it possible to produce standardized cell products that can go through stringent quality control procedures to guarantee treatment safety and uniformity.

Technology Insights

The cell production segment dominated the U.S. stem cell therapy market in 2023. Advances have greatly improved the scalability and efficiency of manufacturing stem cells in cell production technologies, making it easier to supply the growing demand for these therapies. Furthermore, this sector is growing because regulatory frameworks now support cell production procedures more.

Furthermore, partnerships between universities, research centers, and biotech firms have sparked creativity in cell culture methods, leading to cutting-edge and more potent stem cell treatments.

Application Insights

The regenerative medicine segment dominated the U.S. stem cell therapy market in 2023. Since its primary goal is to use the body's innate capacity to repair and replace damaged organs and tissues, this method includes replacing or repairing damaged or diseased tissues utilizing stem cells, which can differentiate into various cell types. Techniques in regenerative medicine have promised for treating multiple illnesses, such as autoimmune diseases, neurological problems, orthopedic injuries, and cardiovascular ailments. A critical aspect of regenerative medicine that has gained popularity is stem cell therapy, which can offer individualized, minimally invasive treatments.

End User Insights

The hospitals segment dominated the U.S. stem cell therapy market in 2023. Hospitals often have well-established infrastructures with cutting-edge medical technology and facilities that enable them to provide various medical treatments, including stem cell therapy. Typically, it possesses extensive knowledge of regulatory compliance, guaranteeing adherence to stringent criteria and standards established by regulatory bodies. As a result, patients gain faith and confidence in the safety and effectiveness of stem cell treatments provided by hospitals.

Numerous healthcare facilities participate in stem cell therapy research and development initiatives, which result in advancements in treatment protocols and methodologies. This boosts their reputation and draws in patients looking for innovative treatments. Highly qualified medical workers, such as doctors and stem cell treatment researchers, are frequently employed by hospitals. Patients looking for cutting-edge treatment alternatives are drawn to this expertise.

Recent Developments

- In June 2023, A formal agreement was announced by Sigilon Therapeutics, Inc. and Eli Lilly & Company for Lilly to buy Sigilon. This biopharmaceutical business aims to create effective treatments for acute and chronic illnesses.

- In January 2022, the specific purpose of the acquisition firm of Chamath Palihapitiya is to support Pro Kidney. Pro Kidney will get $825 million from the merger to support the phase 3 trial of a cell therapy intended to halt and reverse the deterioration of kidney function.

Some of the prominent players in the U.S. Stem Cell Therapy Market include:

- Caladrius

- CELGENE CORPORATION

- Opexa Therapeutics, Inc.

- Seneca Biopharmaceuticals, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Stem Cell Therapy market.

By Product

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

By Therapy Type

By Application

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

By Technology

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood Cord

- Apheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

By End User

- Hospitals

- Research Institutes

- Surgical Institutes

- Orders