U.S. Sterilization Services Market Size and Trends

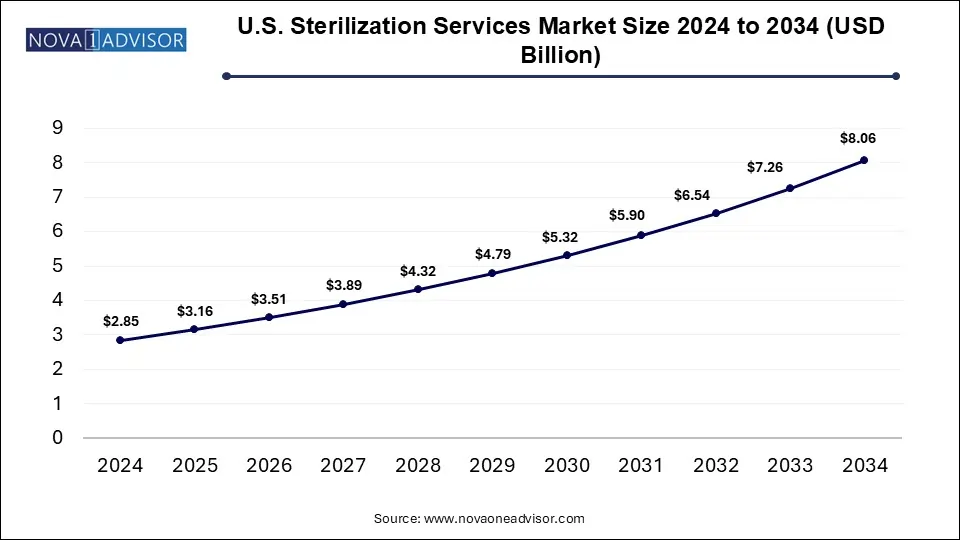

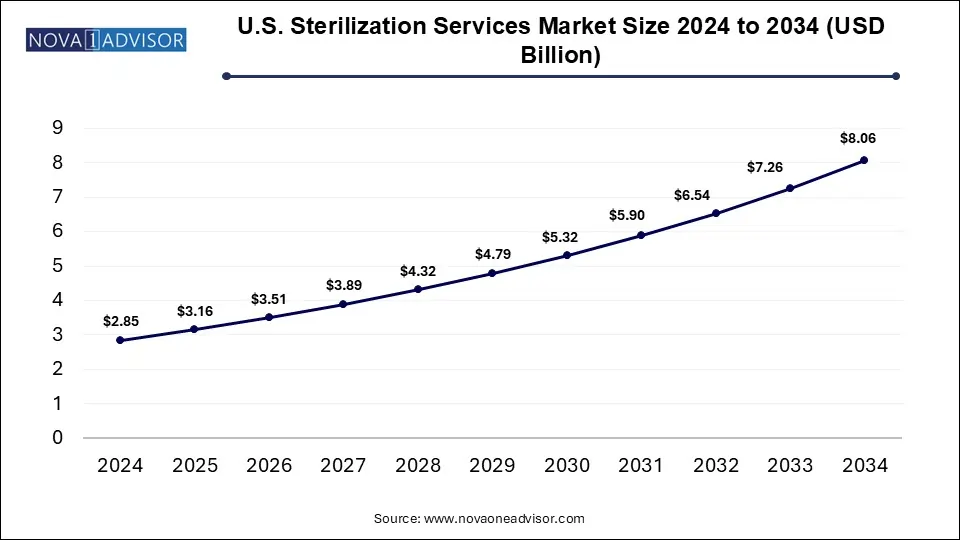

The U.S. sterilization services market size was exhibited at USD 2.85 billion in 2024 and is projected to hit around USD 8.06 billion by 2034, growing at a CAGR of 10.95% during the forecast period 2024 to 2033. The growth of the U.S. sterilization services market is driven by the increased awareness for infection control, advancements in sterilization technologies, rising trend of outsourcing sterilization services and surge in volume of surgical procedures.

U.S. Sterilization Services Market Key Takeaways:

- The contract sterilization services segment accounted for the largest revenue share of 71% in 2024

- Moreover, the contract sterilization services segment is anticipated to experience the fastest CAGR over the forecast period.

- The offsite segment dominated the market with a share of 69.0% in 2024

- The offsite model is expected to grow at the fastest CAGR over the forecast period.

Market Overview

The U.S. sterilization services market is a vital pillar in the nation's healthcare and medical manufacturing ecosystem, playing a critical role in ensuring product safety, infection control, and regulatory compliance. Sterilization services are essential across a range of industries including hospitals, pharmaceuticals, biotechnology, and medical device manufacturing, where eliminating microbial contamination is non-negotiable.

Sterilization services in the U.S. have evolved beyond traditional in-house autoclaving practices to sophisticated outsourced solutions using technologies such as ethylene oxide (EtO), gamma radiation, steam, and hydrogen peroxide gas plasma. These services cater to the sterilization of surgical instruments, pharmaceuticals, laboratory equipment, packaging, and single-use medical products. The demand for sterilization services in the U.S. is propelled by stringent regulations from the U.S. Food and Drug Administration (FDA), the Centers for Disease Control and Prevention (CDC), and the Association for the Advancement of Medical Instrumentation (AAMI), which mandate rigorous validation and documentation protocols.

In recent years, several trends have reshaped the U.S. sterilization services landscape. The COVID-19 pandemic highlighted the indispensable need for reliable sterilization infrastructure, leading to expanded capacity, emergency validation protocols, and the adoption of mobile or modular sterilization units. The ongoing rise in hospital-acquired infections (HAIs), increasing outsourcing by medical device companies, and growth of surgical procedures all contribute to robust market demand. As innovation in medical devices accelerates, especially for implantable and minimally invasive tools, the need for compatible, material-safe sterilization technologies becomes increasingly complex—creating opportunities for specialized sterilization providers and validation services.

Major Trends in the Market

-

Increasing Outsourcing of Sterilization by OEMs (Original Equipment Manufacturers) to Third-Party Providers

-

Growing Preference for Contract Sterilization to Optimize Facility Space and Cost

-

Expansion of Low-Temperature and Material-Compatible Sterilization Methods

-

Heightened Regulatory Scrutiny Around Ethylene Oxide (EtO) Sterilization Emissions

-

Rising Adoption of Sterilization-as-a-Service (SaaS) Models with Real-Time Monitoring

-

Integration of Digital Validation Platforms for Compliance and Traceability

-

Surge in Demand for Onsite Mobile Sterilization Units in Emergency and Rural Settings

-

Growth in Biopharmaceutical Sterilization for Complex Biologics and Drug Delivery Devices

-

Increased Focus on Green Sterilization Alternatives Amid Sustainability Pressures

-

Emergence of AI and Automation in Workflow Management and Validation Documentation

What is the Future of AI in U.S. Sterilization Services Market?

Artificial intelligence (AI) is transforming sterilization services market in U.S. by enhancing the safety and efficacy of processes. Real-time data from sterilization cycles can be analyzed by AI for adjusting parameters, leading to minimized errors, reduced waste, energy conservation and consistency in sterilization. AI-powered robots can potentially reduce manual intervention and increase throughput by automating tasks such as loading, unloading and instrument tracking in the sterilization process. AI algorithms can be applied for predicting potential equipment malfunctions by analyzing data from sensors, further providing proactive approach for ensuring sterility assurance and minimizing downtime.

How Are Regulatory Shifts Impacting the U.S. Sterilization Services Market?

The U.S. sterilization services market is experiencing significant regulatory shifts due to the stringent regulations imposed by U.S. government agencies such as the Environmental Protection Agency (EPA) and Food and Drug Administration (FDA). The FDA is focused on rigorous validation studies and documentation to ensure the consistency of sterilization processes, especially for complex medixal devices. Growing emphasis on environmental concerns for reducing chemical residues and pollution is driving the adoption of eco-friendly sterilization methods such as hydrogen peroxide and ozone sterilization. New requirements for Ethylene Oxide (EtO) sterilization facilities are being implemented by the EPA. Updated guidance on vaporized hydrogen peroxide (VH2O2) sterilization provided by the FDA is reducing regulatory burden for manufacturers.

Report Scope of U.S. Sterilization Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.16 Billion |

| Market Size by 2034 |

USD 8.06 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.95% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Service Type, Delivery Mode |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

STERIS, MEDIVATORS Inc., Pall Corporation, Ecolab, BD, Thermo Fisher Scientific Inc., Merck & Co., Inc., 3M, E-BEAM Services, Inc., Stryker |

Market Driver: Rising Demand from the U.S. Medical Device Industry

A primary driver fueling the U.S. sterilization services market is the expansion of the domestic medical device manufacturing sector, which is one of the most technologically advanced and regulated industries in the country. The U.S. is home to over 6,000 medical device companies, many of which rely on sterilization to meet FDA requirements before devices can be sold or implanted.

Sterilization is a crucial step in the value chain for single-use instruments, implants, stents, catheters, and surgical kits. As the number of surgical interventions and hospital admissions increases, so does the demand for reliable, third-party sterilization solutions. The diversity of materials and designs in today’s medical devices necessitates tailored sterilization approaches, including EtO for heat-sensitive devices and gamma for dense packaging configurations. Contract sterilization services provide these manufacturers with scalability, validation expertise, and regulatory-compliant solutions without the need for capital-intensive sterilization infrastructure.

Furthermore, as more OEMs transition to just-in-time manufacturing, they increasingly rely on offsite, outsourced sterilization partners with quick turnaround capabilities, warehousing services, and integrated logistics. These trends are central to market growth and are reflected in the expansion plans of several major sterilization providers across the U.S.

Market Restraint: Environmental Concerns and Regulatory Scrutiny on EtO Sterilization

One significant restraint to the U.S. sterilization services market is the environmental and regulatory pressure associated with the use of ethylene oxide (EtO)—one of the most commonly used sterilization methods due to its efficacy and compatibility with complex, heat-sensitive devices.

EtO is classified as a carcinogen and has been associated with potential air quality issues in communities located near sterilization plants. In recent years, facilities in Illinois, Georgia, and other states faced temporary shutdowns or were required to implement enhanced emissions control systems following EPA and public health reviews. These events led to delays in device availability and raised concerns about the reliance on a single sterilization modality.

In response, the FDA launched initiatives to support alternative sterilization technologies and encouraged the development of lower-emission processes. Nevertheless, retrofitting facilities, achieving compliance, and transitioning to alternative technologies require time and capital, which poses a barrier to smaller sterilization providers and limits short-term scalability.

Market Opportunity: Technological Innovation in Onsite and Mobile Sterilization

A high-potential opportunity within the U.S. market lies in the growth of onsite and mobile sterilization units, particularly in ambulatory surgical centers (ASCs), emergency response units, and rural healthcare facilities. These solutions allow for decentralized sterilization at the point of care, reducing the need to transport instruments or products offsite—minimizing delays and contamination risks.

Mobile sterilization pods and trailers equipped with steam or hydrogen peroxide-based sterilizers are gaining traction in military, humanitarian, and disaster-response applications. Additionally, healthcare providers are showing interest in leasing modular, self-contained sterilization rooms that can be temporarily deployed during facility renovations or service overflow scenarios.

Startups and established vendors are innovating in this space by offering portable sterilization technologies with low energy and water consumption, built-in digital tracking, and compliance-ready documentation. These capabilities not only meet the operational needs of healthcare providers but also support contingency planning, infection control, and continuity of surgical services in crisis settings.

U.S. Sterilization Services Market By Service Type Insights

The contract sterilization services segment accounted for the largest revenue share of 71% in 2024. These services involve outsourcing sterilization to specialized third-party providers equipped with advanced facilities and multi-modality sterilization lines. OEMs, pharmaceutical companies, and hospitals prefer this model as it allows them to focus on core operations while ensuring regulatory compliance and cost savings through economies of scale.

Contract sterilization facilities offer a range of modalities under one roof—EtO, gamma, electron beam (e-beam), and steam—along with ancillary services like packaging, logistics, and environmental testing. Leading providers such as STERIS and Sotera Health have built expansive networks of such facilities, capable of servicing high volumes and complex product portfolios. Their experience with FDA and ISO standards also ensures that clients meet compliance requirements efficiently.

Validation sterilization services, while smaller in market share, are the fastest-growing segment. These services are essential in the product development and pre-commercialization phase. They include sterility assurance testing, bioburden studies, dose mapping, and protocol development. As regulatory bodies tighten sterilization documentation requirements and product complexity increases, the demand for validation expertise is growing rapidly. Emerging biotech and medtech firms particularly rely on validation partners to conduct feasibility assessments and ensure successful audits.

U.S. Sterilization Services Market By Delivery Mode Insights

The offsite segment dominated the market with a share of 69.0% in 2024, These centralized facilities offer economies of scale and advanced safety protocols for handling hazardous gases and radioactive sources. Offsite delivery also facilitates centralized documentation, quality control, and logistics, making it the model of choice for large-scale production and nationwide distribution.

However, onsite sterilization services are gaining popularity, particularly among large hospital systems, ASCs, and specialty device producers that require faster turnaround or have high customization needs. Onsite models offer greater control over scheduling, inventory, and workflow, and can be especially useful in sterile processing departments (SPDs) of major hospitals. In many cases, sterilization equipment is leased and managed by service providers who maintain compliance and perform regular audits, enabling hospitals to benefit from advanced capabilities without full ownership responsibilities.

Country-Level Analysis

The U.S. remains the largest and most sophisticated sterilization services market globally, driven by its mature medical device sector, extensive hospital network, and strict regulatory landscape. The FDA’s oversight ensures that sterilization practices adhere to high standards, pushing service providers to continually invest in facility upgrades, training, and innovation.

High procedure volumes, aging demographics, and strong public-private investment in healthcare infrastructure further stimulate demand. Additionally, the U.S. is at the forefront of digital transformation in healthcare, fostering the growth of data-integrated sterilization platforms that support traceability, audit readiness, and real-time reporting.

In states such as California, Texas, Florida, and New York, where healthcare systems are highly consolidated and procedure-intensive, sterilization outsourcing is deeply embedded into operations. The Midwest, meanwhile, serves as a manufacturing hub with major sterilization and packaging facilities serving national and global supply chains.

Recent U.S. regulatory developments around EtO emissions, however, have prompted both challenges and innovation. The push toward lower-emission sterilization, including vaporized hydrogen peroxide (VHP) and nitrogen dioxide (NO2) systems, is expected to create new growth niches within the national market.

U.S. Sterilization Services Market Recent Developments

- In June 2025, Instrumentum, LLC, a fast-growing leader in surgical instrument sterilization services, acquired Sterile Processing Express (SPDx), a portfolio company of cultivate(MD), a leading medical device venture capital company.

- In May 2025, Angels for Change selected Fagron Sterile Services US (FSS) for the 2025 Project PROTECT grant to manufacture sterile water for injection (SWFI) which is a crucial element for preparing injectable medications.

- In October 2024, Nutek Corp. announced expansion of its electron beam (E-beam) contract sterilization business with the inclusion of SmartEO ethylene oxide (EO) sterilization services offering an integrative approach for delivering ethylene oxide sterility solutions throughout the entire product lifecycle – from concept, design, and testing to packaging, validation, and high-volume production.

- In March 2024, STERIS launched Verafit Sterilization Bags and Covers featuring an innovative, patent-pending viewing window for visually inspecting and confirming the dryness of a sterilized part. The special design assists biopharmaceutical manufacturers match up to the latest EU GMP Annex 1 requirements for confirming dryness as part of the sterilization cycle acceptance.

Some of the prominent players in the U.S. sterilization services market include:

- STERIS

- MEDIVATORS Inc.

- Pall Corporation

- Ecolab

- BD

- Thermo Fisher Scientific Inc.

- Merck & Co., Inc.

- 3M

- E-BEAM Services, Inc.

- Stryker

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. sterilization services market

Service Type

- Contract Sterilization Services

- Validation Sterilization Services

Delivery Mode