U.S. Stethoscope Market Size and Research 2026 to 2035

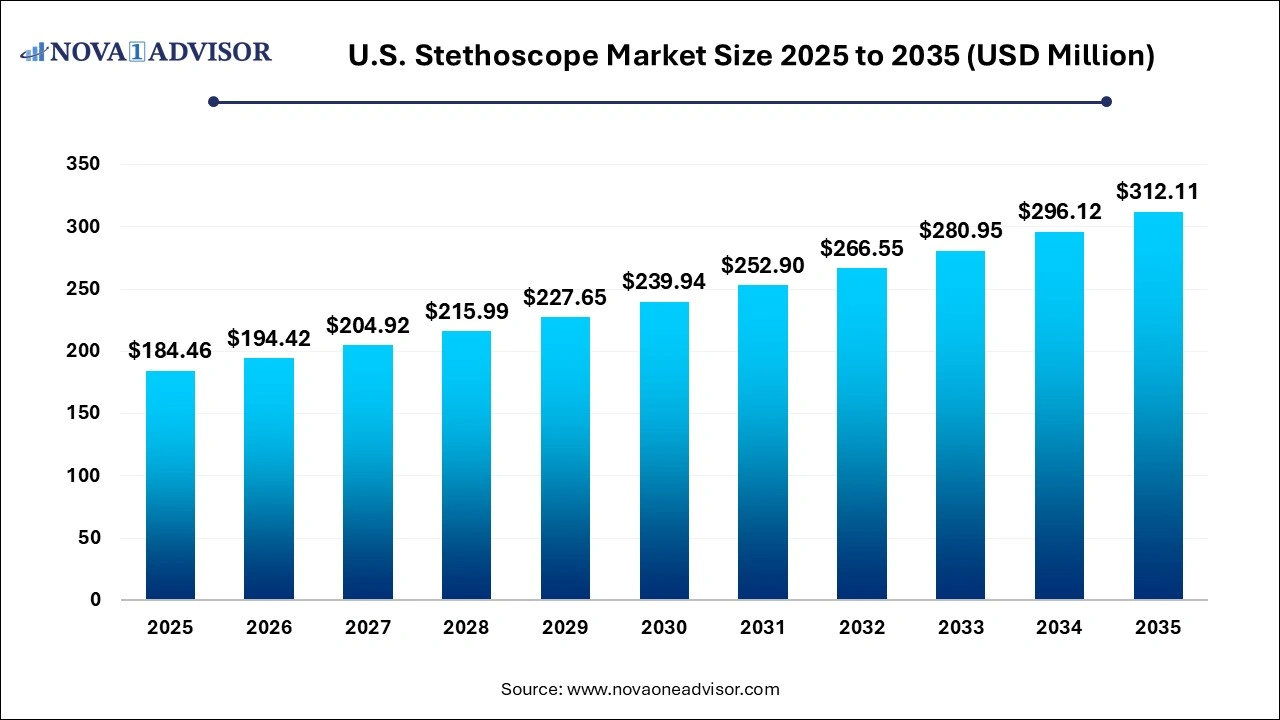

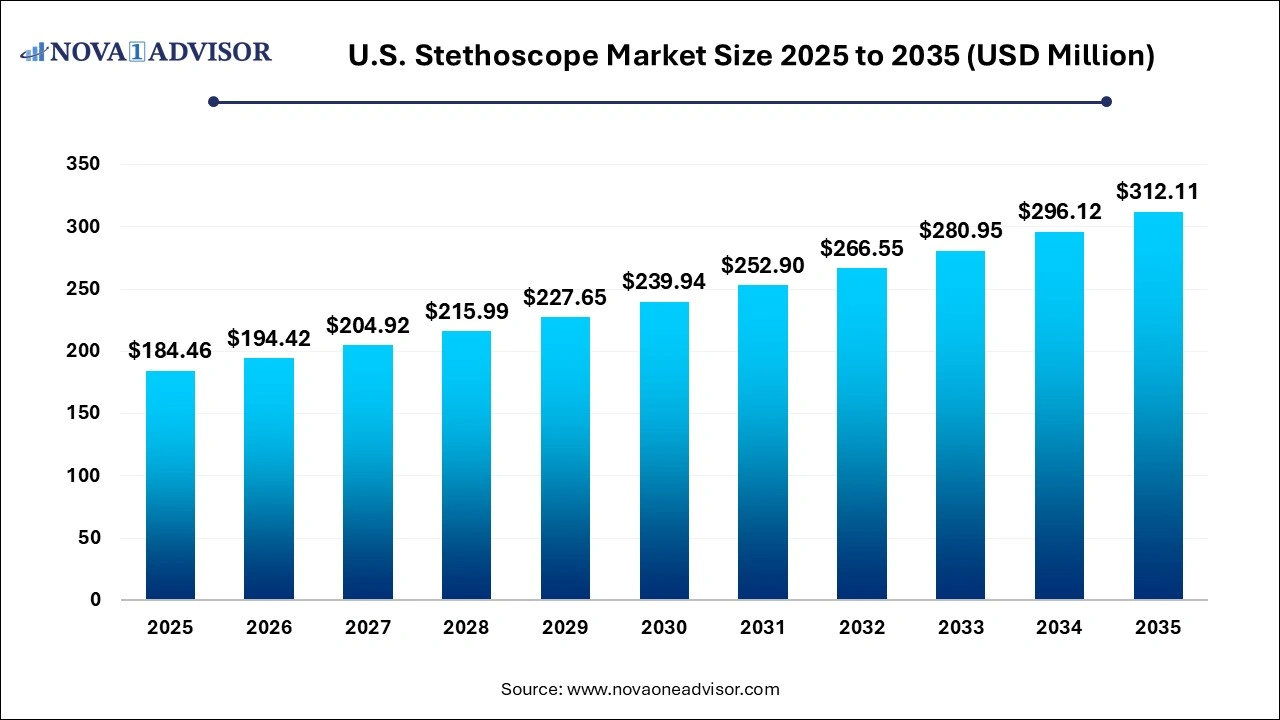

The U.S. stethoscope market size was exhibited at USD 184.46 million in 2025 and is projected to hit around USD 312.11 million by 2035, growing at a CAGR of 5.4% during the forecast period 2026 to 2035.

U.S. Stethoscope Market Key Takeaways:

- In 2025, the traditional acoustic stethoscope segment dominated the market with a revenue share of 72.79%.

- The smart stethoscopes segment is expected to expand at the highest revenue-based CAGR of 5.8% from 2026 to 2035.

- In 2025, the distributors' segment dominated the market with a revenue share of 43.03%.

- The e-commerce segment is expected to expand at the highest revenue-based CAGR of 5.8% from 2026 to 2035.

- In 2024, the hospitals' segment dominated the market with a revenue share of 42.0% and is expected to expand at the highest CAGR in terms of revenue from 2026 to 2035.

U.S. Stethoscope Market Overview

The U.S. stethoscope market, a vital component of the broader medical diagnostics industry, continues to evolve with the integration of cutting-edge technologies and shifting healthcare dynamics. Stethoscopes—long considered an iconic and indispensable tool in medical diagnostics—are now being reengineered to align with digital transformation trends, the expansion of telemedicine, and the rising demand for point-of-care diagnostics. The market encompasses traditional acoustic stethoscopes, electronic/digital variants, and smart stethoscopes integrated with AI and mobile applications.

In the United States, healthcare infrastructure is well-established and technologically progressive, creating fertile ground for the adoption of advanced stethoscope solutions. The increasing burden of chronic diseases, such as cardiovascular and respiratory disorders, has led to a surge in patient monitoring demands. Simultaneously, the growth in nurse practitioners, EMT professionals, and home healthcare services contributes to the demand for both basic and high-performance stethoscopes across a broad user base.

The post-pandemic healthcare landscape in the U.S. further reinforced the need for precision, hygiene, and tele-enabled tools in clinical environments. Consequently, manufacturers have responded with electronic stethoscopes offering noise-cancellation, digital amplification, Bluetooth integration, and tele-auscultation capabilities. Meanwhile, traditional stethoscopes maintain strong demand among practitioners favoring tactile accuracy and affordability.

Market growth is also stimulated by educational institutions, hospital expansions, rural healthcare investments, and the proliferation of e-commerce as a distribution channel. The U.S. market remains a global innovation hub for stethoscope design and functionality, with key players headquartered domestically and constantly developing competitive, ergonomic, and AI-ready devices.

Major Trends in the U.S. Stethoscope Market

-

Integration of AI in Smart Stethoscopes: AI-enabled stethoscopes can detect abnormal heart and lung sounds, supporting clinical decision-making, especially for primary care and telemedicine.

-

Rising Adoption of Electronic Stethoscopes in Cardiology and Pulmonology: Specialists increasingly prefer amplified stethoscopes for more accurate auscultation, particularly in high-noise environments like emergency departments.

-

Growth of E-commerce Channels for Medical Devices: Online platforms like Amazon, Medline, and company-owned portals are increasingly used by healthcare professionals and students for direct purchases.

-

Emergence of Tele-auscultation in Remote Care: Smart and digital stethoscopes are supporting remote diagnostics in telemedicine, especially for rural and underserved areas.

-

Ergonomic and Hygienic Design Innovations: Demand for lightweight, antimicrobial-coated, and easily cleanable stethoscopes has surged post-COVID-19.

-

Customization for Specific Roles: Manufacturers are offering profession-specific models for pediatricians, cardiologists, EMTs, and veterinary professionals.

-

Sustainability and Recycling Programs: Environmentally conscious procurement policies have led to increased interest in stethoscopes with recyclable materials and corporate recycling initiatives.

Report Scope of U.S. Stethoscope Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 194.42 Million |

| Market Size by 2035 |

USD 312.11 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 5.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology Type, Sales Channel, End use, State |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

3M; Medline Industries Inc.; Welch Allyn (Hill-Rom Holdings, Inc.);Eko Devices Inc.; GF Health Products, Inc.; Rudolf Riester GmbH (HalmaPlc); American Diagnostics Corporation; Cardionics; Heine Optotechnik GmbH & Co. KG |

Market Driver – Expanding Role of Non-Physician Healthcare Providers

A compelling driver in the U.S. stethoscope market is the expanding role of non-physician healthcare providers such as nurse practitioners (NPs), physician assistants (PAs), and EMTs. These professionals are increasingly serving as frontline caregivers across primary care, urgent care, emergency services, and home-based healthcare settings. With the U.S. facing a physician shortage, particularly in rural regions, nurse practitioners and EMTs are taking on expanded diagnostic responsibilities, often requiring reliable stethoscopes as part of their essential toolkit.

According to the American Association of Nurse Practitioners (AANP), the number of licensed NPs exceeded 355,000 in 2024, reflecting a nearly 10% year-on-year increase. EMT and paramedic personnel are also rising in number as part of the broader emergency response strategy. These professionals need durable, precise, and versatile stethoscopes suitable for diverse environments, including ambulatory settings and fieldwork. Manufacturers have responded with lightweight, robust models featuring dual-lumen tubing, tunable diaphragms, and noise-isolating capabilities enabling diagnostic accuracy on-the-go.

Market Restraint – High Cost of Smart and Electronic Stethoscopes

While digital and smart stethoscopes are revolutionizing diagnostic practices, their high cost remains a limiting factor for widespread adoption. Entry-level electronic stethoscopes may cost over $300, and high-end smart stethoscopes embedded with AI and Bluetooth connectivity can exceed $500–$600, making them unaffordable for many individual practitioners, small clinics, and EMT units operating on tight budgets.

Insurance typically does not reimburse stethoscope purchases, placing the financial burden on individual users or institutions. This cost barrier is particularly significant for early-career professionals, students, and healthcare providers in underserved regions. Moreover, electronic models require ongoing maintenance, including battery replacements, software updates, and potential repairs. These factors discourage bulk purchases and slow down penetration in primary and public health settings.

Market Opportunity – Rise in Home Healthcare and Remote Patient Monitoring

The growth of home healthcare and remote patient monitoring presents a significant opportunity in the U.S. stethoscope market. As aging populations seek in-home care and chronic disease management becomes more proactive, healthcare professionals and caregivers are increasingly using medical devices including stethoscopes in non-hospital settings.

Smart stethoscopes integrated with mobile apps allow real-time auscultation data to be shared with remote physicians, enabling effective virtual assessments of cardiac or respiratory issues. These devices are essential in providing continuity of care, especially for heart failure patients, COPD patients, or those recovering post-surgery. The rise of home-based care organizations and a surge in personal health tech adoption among older adults are encouraging innovation and accessibility in this space.

Companies that develop intuitive, cost-effective, and telehealth-compatible stethoscopes stand to benefit substantially as patient-centric care models become standard in the U.S. Additionally, caregiver training programs and hospital-at-home initiatives provide further momentum for at-home diagnostic toolkits.

U.S. Stethoscope Market By Technology Type Insights

Traditional acoustic stethoscopes dominated the U.S. market, driven by their affordability, reliability, and ease of use. Widely adopted by hospitals, clinics, and educational institutions, these stethoscopes remain a trusted choice for many general practitioners, medical students, and nurses. Brands like 3M Littmann continue to lead in this segment with innovations in sound clarity, lightweight materials, and dual-frequency diaphragms. Traditional stethoscopes also appeal due to their low maintenance needs and lack of electronic components, making them ideal for fast-paced or resource-limited settings.

Smart stethoscopes are the fastest-growing segment, fueled by the integration of AI and IoT features. These devices enable real-time digital auscultation, data storage, and Bluetooth transmission to connected platforms, often linking with electronic health records (EHRs). In the U.S., smart stethoscopes are gaining adoption among telehealth providers, pediatricians, and primary care networks aiming for remote diagnostics. For example, digital models from companies like Eko Health allow clinicians to visualize waveforms and detect murmurs using machine learning algorithms, revolutionizing frontline diagnostics.

U.S. Stethoscope Market By Sales Channel Insights

Distributors held the largest share of the U.S. stethoscope sales, given their long-standing relationships with hospitals, universities, clinics, and government procurement agencies. Medical distributors offer bulk purchasing, bundled discounts, and after-sales service contracts that make them indispensable in the healthcare supply chain. Especially for traditional and electronic stethoscopes, distributors serve as the primary bridge between manufacturers and institutional buyers.

E-commerce is witnessing the fastest growth, reshaping how medical professionals procure diagnostic equipment. Platforms such as Amazon, Medline, and manufacturer websites now offer personalized recommendations, user reviews, financing options, and quick shipping. The convenience of online comparisons, combined with rising trust in direct-to-consumer healthcare platforms, makes e-commerce an increasingly preferred choice for EMTs, students, and home healthcare professionals.

U.S. Stethoscope Market By End-use Insights

Hospitals continue to dominate the end-use segment, owing to their large-scale and recurring need for diagnostic tools. From emergency rooms to outpatient clinics, hospitals require stethoscopes tailored for cardiology, pediatrics, general medicine, and critical care. Institutional purchasing through GPOs (Group Purchasing Organizations) ensures hospitals maintain consistent inventory, replacing worn devices and equipping new staff as needed. Additionally, training hospitals serve as significant procurement centers for student kits and staff onboarding packages.

Home healthcare is emerging as the fastest-growing end-use, driven by aging populations, chronic care needs, and the growing shift toward decentralization of healthcare delivery. Remote patient monitoring services and in-home caregiver teams increasingly rely on digital or Bluetooth stethoscopes for on-site evaluations. As home-based care transitions from convenience to necessity in the U.S., the market is poised to benefit from innovations in patient-friendly stethoscope designs.

Country-Level Analysis

Within the U.S., the stethoscope market reflects a high degree of technological adoption, product diversity, and user segmentation. States like California, Texas, New York, and Florida are major contributors, driven by dense healthcare infrastructure, medical education hubs, and a higher concentration of specialist clinics. California, for instance, has been a frontrunner in integrating smart medical devices in outpatient care, whereas Texas sees substantial usage among emergency medical services due to its expansive geography and disaster response programs.

Massachusetts and New Jersey—home to numerous medical device companies and research institutions—also serve as innovation and procurement centers. Meanwhile, the rise of home-based care, supported by Medicare programs and private home health agencies, is creating demand in less urbanized states. The U.S. also has a growing number of community colleges and vocational schools offering nursing and medical assistant programs, creating recurring demand for beginner-level acoustic stethoscopes in states like Ohio and Illinois.

Some of the prominent players in the U.S. stethoscope market include:

- 3M

- Medline Industries Inc.

- WelchAllyn (Hill-Rom Holdings, Inc.)

- Eko Devices Inc.

- GF Health Products, Inc.

- Rudolf Riester GmbH (HalmaPlc)

- American Diagnostics Corporation

- Cardionics

- Heine Optotechnik GmbH & Co. KG.

Recent Developments

-

April 2025 – 3M Littmann announced the launch of its new Cardiology V stethoscope in the U.S. market, featuring dual-lumen tubing, improved ergonomics, and next-generation acoustic performance.

-

March 2025 – Eko Health partnered with Mayo Clinic to enhance AI-based murmur detection algorithms in their digital stethoscope models, improving diagnostic accuracy for heart valve disorders.

-

January 2025 – Thinklabs Medical introduced a USB-C powered digital stethoscope compatible with telehealth platforms, targeting remote care providers and mobile clinics in the U.S.

-

December 2024 – ADC (American Diagnostic Corporation) rolled out antimicrobial tubing variants for their most popular stethoscope lines, responding to post-pandemic infection control demands.

-

October 2024 – Welch Allyn (Hillrom) released a smart auscultation system for its Spot Vital Signs platform, integrating real-time data streaming with cloud-based diagnostics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. stethoscope market

By Technology Type

- Electronic/Digital Stethoscope

- Smart Stethoscope

- Traditional Acoustic Stethoscope

By Sales Channel

- Distributors

- E-commerce

- Direct Purchase

By End-use

- Home Healthcare

- Hospitals

- Clinics

- Nurse Practitioners

- EMT/ First Responders

- Veterinary

By State

- California

- New York

- Texas

- Florida

- Pennsylvania

- Illinois

- Ohio

- Michigan

- Massachusetts

- New Jersey

- Rest of USA