U.S. Surgical Microscopes Market Size, Growth, Trends

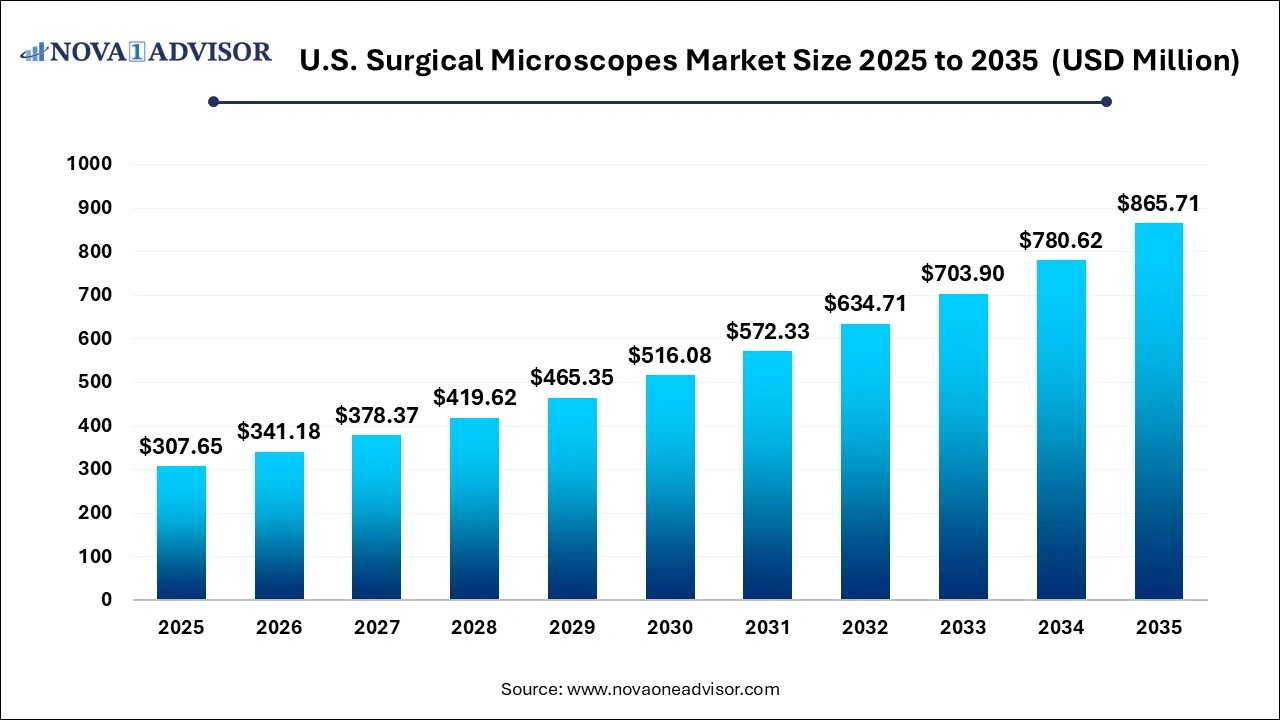

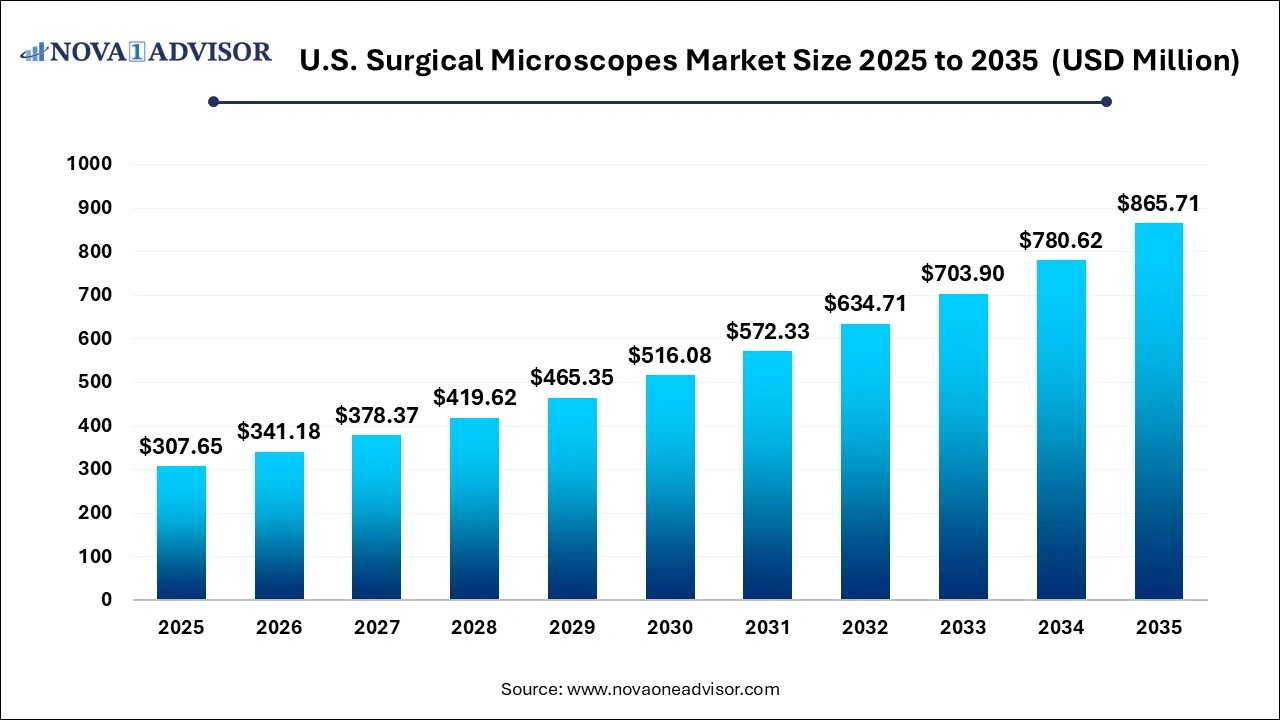

The U.S. surgical microscopes market size was estimated at USD 307.65 million in 2025 and is expected to hit around USD 865.71 million by 2035, poised to reach at a notable CAGR of 10.9% during the forecast period 2026 to 2035.

Key Takeaways:

- In terms of revenue, on caster was the leading type segment in the market in 2025 and is anticipated to hold a large share throughout the forecast period, exhibiting a CAGR of 11.6% over the forecast period

- On the basis of application, oncology is likely to account for the largest share in terms of revenue, while the neurosurgery and spine surgery segments are estimated to register the highest CAGR over the forecast period

- Based on end-use, hospitals were the leading revenue contributors in 2025. The trend is estimated to continue throughout the forecast period.

U.S. Surgical Microscopes Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 341.18 million |

| Market Size by 2035 |

USD 865.71 million |

| Growth Rate From 2026 to 2035 |

CAGR of 10.9% |

| Base Year |

2025 |

| Forecast Period |

2025 to 2035 |

| Segments Covered |

Type, Application, End-use, and Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Seiler Precision Microscopes; Alcon Laboratories; Alltion (Wuzhou) Co. Ltd.; Carl Zeiss; Leica Microsystems; Takagi Seiko Co Ltd.; Topcon Corporation Inc. |

The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders, which need surgical intervention, is anticipated to be one of the key trends stimulating the U.S. operating microscopes market growth. The number of cases related to chronic diseases such as cancer, CVDs, and diabetes is increasing every year.

For instance, according to the American Cancer Society, the number of new cases of cancer in 2017 and 2022 were found to be 1,638,910 and 1,688,780, respectively. In the same years, deaths registered due to the same were 577,190 and 600,920, respectively. Treatment of these disorders requires surgical procedures and microsurgery at certain times, thus, increasing the demand for surgical microscopes.

Technological advancements have widened the scope of application of these devices across a variety of fields. For instance, the new surgical microscope ORBEYE developed by Olympus, is equipped with 4K resolution and 3D imaging. This microscope can also be connected to a television, which can allow family members of the patient to observe the surgery from a surgical suite. In addition, these high definition 3D video clips can also be viewed by med students and they can observe complex spinal and neurosurgeries. This device is being tested in hospitals in Northern Carolina, Manhattan, and Massachusetts.

Heightened awareness regarding the advantages of minimally invasive surgeries (MIS) is creating an upswing in the demand for MIS. These advantages include lesser trauma to patients and lesser recovery time than invasive procedures. Surgical microscopes are required for these procedures as they help in better visualization, especially for spinal and neurosurgeries. Hence, due to the rising preference and penetration of minimally invasive procedures, the demand for these operating microscopes is expected to increase in the coming years.

Type Insights

The market, based on type, is divided into on casters, wall-mounted, tabletop, and ceiling mounted. The on casters microscopes are designed to be portable, which helps in cleaning and maintenance of the product. In addition, they are available in product variants such as single mounted, double mounted, or compound wheels. These factors are estimated to support the dominance of the segment in the market over the forecast period. The segment is also projected to exhibit a remarkable growth rate over the same period. Several prominent players including market leaders such as Zeiss and Leica Microsystems are providing the option of portability in all surgical microscopes.

Application Insights

The key application segments include ENT surgery, dentistry, oncology, gynecology, urology, ophthalmology, plastic & reconstructive surgery, neurosurgeries, and spine surgeries. Oncology was the leading revenue contributor in the U.S. operating microscopes market in 2022. As mentioned, rising prevalence and complexity of chronic conditions facilitate the use of advanced techniques including operational microscopes.

According to the Center for Disease Control and Prevention (CDC) in 2015, the cancer prevalence rate in the U.S. was in the range of 380.4-510.7 incidents per 100,000 people. States with the highest cancer incidence rates were Kentucky, Delaware, Pennsylvania, Maine, New Hampshire, Louisiana, Connecticut, New York, Iowa, and Michigan. This gives an opportunity to market players to invest in this region. Surgical removal of tumors is an important method of treatment and surgical microscopes are known to assist in the better removal of tumors.

End-use Insights

Based on end-use, the market is segmented into hospitals, physician/dentist’s clinics, and other outpatient settings. Hospitals have the highest number of operating rooms in the U.S., thus, the adoption of the product is highest in hospitals. Hospitals will remain the most prominent end-use segment in the country in terms of revenue throughout the forecast period.

However, the physician/dentist’s clinic segment is likely to register the highest CAGR during the forecast period. Soaring demand for cosmetic dentistry and procedures such as root canal therapy, dental trauma therapy, and dental cracking is poised to rev up the adoption rate of operating microscopes.

Regional Insights

From a geographical standpoint, the market is classified into California, Texas, Ohio, Massachusetts, Pennsylvania, New York, New Jersey, Michigan, Illinois, and Florida. New York dominated the market in terms of revenue in 2022. There are an estimated 134 Ambulatory Surgical Centers (ASC) in New York. The most common procedures conducted in these facilities are cataract surgeries, upper GI procedures, and colonoscopies. Rapid growth in the geriatric population in the region is also escalating the need for surgical intervention. Rising awareness regarding the benefits of minimally invasive surgery and a high number of ASCs are anticipated to keep the demand for the product high over the forecast period.

Key Companies & Market Share Insights

Due to the oligopolistic nature of the market, a few top players dominate the market. Companies are focused on the development of technologically advanced products having greater accuracy and efficiency. Discounts and affordable service contracts are the key strategies of players for market penetration. The dominance of a few market players with a few new entrants keeps the industry rivalry on a moderate level. Some of the key companies present in the industry are Seiler Precision Microscopes; Alcon Laboratories; Alltion (Wuzhou) Co. Ltd.; Carl Zeiss; Leica Microsystems; Takagi Seiko Co Ltd.; and Topcon Corporation Inc.

Recent Developments

- In March 2022, ACCU-SCOPE, one of the world's elite microscope manufacturers based in America launched ACCU-fluor LED Fluorescence Illuminator. These illuminators are attached to compatible microscopes' viewing heads and frames, provide a good alternative to typical fluorescence accessories

- In December 2021, SurgicalOne, the premier surgical specialty distribution company from the Midwest to the Midsouth announced a partnership with Leica Microsystems. This strategic partnership will emphasize increasing the market representation of SurgicalOne for its neurosurgical, spine, ophthalmic, otolaryngologic, dental, and plastic reconstructive microscope sales

- In November 2021, JOHNSON & JOHNSON, an American multinational corporation that develops medical devices, and pharmaceuticals announced the collaboration with NATIONAL UNIVERSITY HOSPITAL (NUH) of Singapore. This collaboration is planning to launch the first 3D printing point-of-care in the hospital

Some of the prominent players in the U.S. Surgical Microscopes Market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Surgical Microscopes market.

By Type

- On Casters

- Wall Mounted

- Table Top

- Ceiling Mounted

By Application

- Neurosurgery and Spine Surgery

- ENT Surgery

- Dentistry

- Oncology

- Gynecology

- Urology

- Ophthalmology

- Plastic & Reconstructive Surgeries

- Other Surgeries

By End-use

- Hospitals

- Physician's/Dentists Clinic

- Other Outpatient Settings

By Regional

- The U.S.

- California

- Texas

- Ohio

- Massachusetts

- New York

- Pennsylvania

- Illinois

- Florida

- New Jersey

- Michigan

- Rest of the U.S.