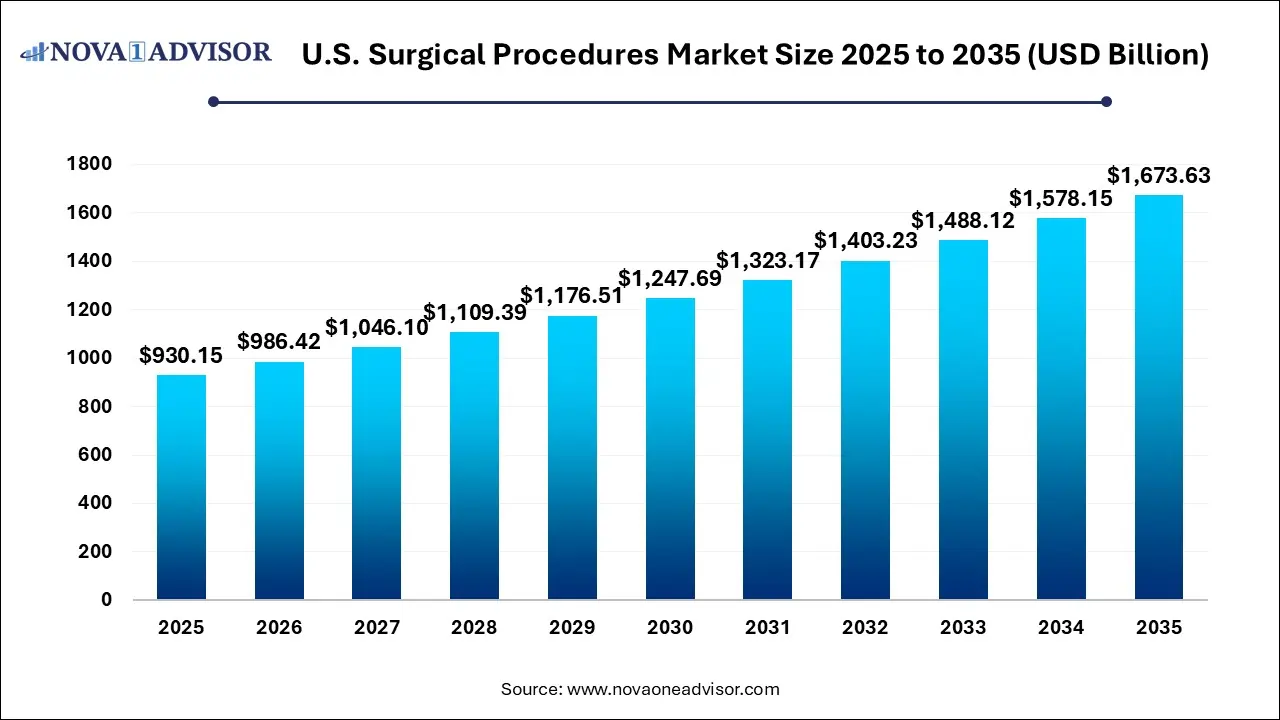

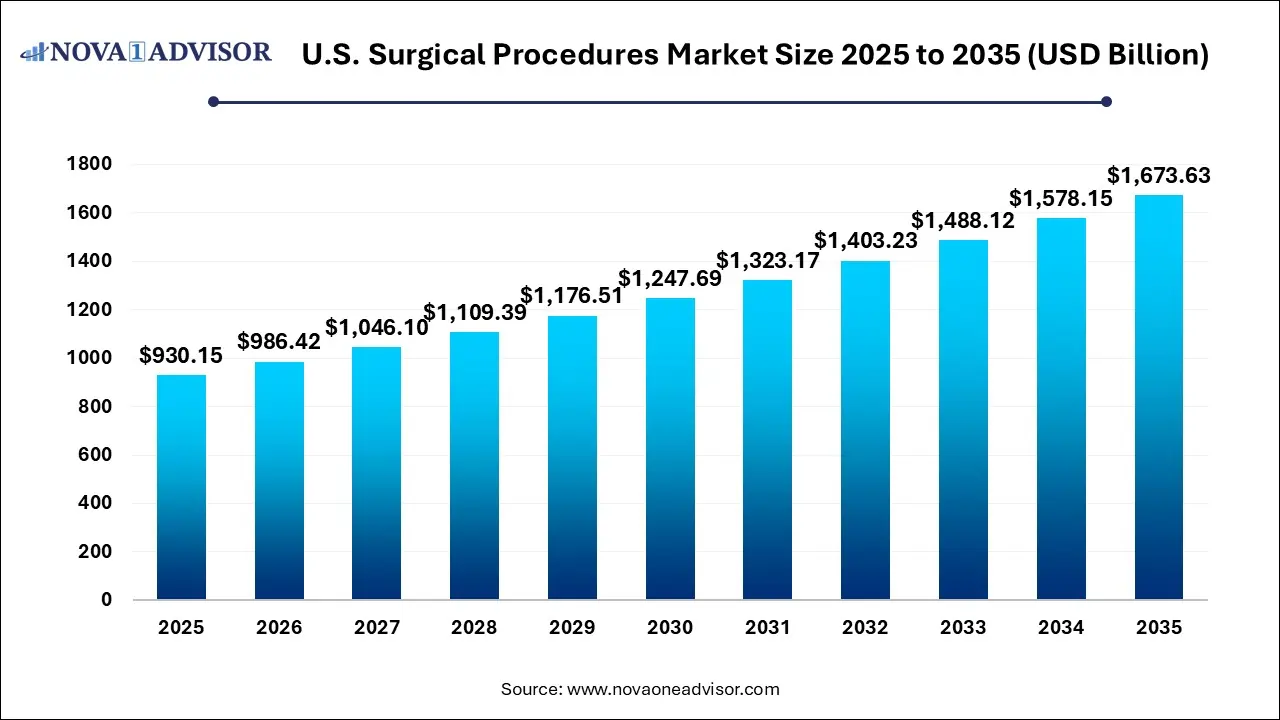

U.S. Surgical Procedures Market Size and Growth 2026 to 2035

The U.S. Surgical Procedures Market size was exhibited at USD 930.15 billion in 2025 and is projected to hit around USD 1,673.63 billion by 2035, growing at a CAGR of 6.05% during the forecast period 2026 to 2035.

Key Takeaways:

- Ophthalmic surgical procedures segment is projected to grow at the highest CAGR during the forecast period

- The ophthalmic surgical procedures segment is estimated to grow at the highest CAGR during the forecast period.

- Ambulatory surgery centers segment is estimated to witness fastest growth during the forecast period

- The ambulatory surgery centers segment is estimated to grow at the highest CAGR during the forecast period.

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of the US surgical procedures market is largely driven by the growing prevalence of chronic diseases, the rising geriatric population, advancements in surgical techniques, and increased investment in health facilities. On the other hand, stringent regulations and the high cost of medical devices are major restraints in the market.

Market Outlook

- Market Growth Overview: The US surgical procedures market is expected to grow significantly between 2025 and 2034, driven by the rising aging population, adoption of robotic surgery, advanced imaging, and rising cosmetic procedures and awareness.

- Sustainability Trends: Sustainability trends involve a shift from single-use to reusable devices, anesthetic gas management, and waste segmentation and reduction.

- Major Investors: Major investors in the market include Johnson & Johnson, Medtronic, Stryker, Intuitive Surgical, Surgery Partners, and SCA Health.

- Startup Economy: The startup economy is focused on efficiency and cost reduction, specialized solutions, and technological innovations.

Strategic Overview of the US Surgical Procedures Industry

U.S. surgical procedures market functions as a high-growth vertical within the healthcare economy, encompassing a comprehensive portfolio of diagnostic and therapeutic interventions across key specialties such as cardiology, orthopedics, and ophthalmology. Market expansion is currently accelerated by significant demographic tailwinds, specifically an aging population with a rising index of chronic morbidity, which has sustained high demand for both elective and life-sustaining operations. Strategic leadership in this sector is increasingly defined by the integration of high-precision technologies, including Robotic-Assisted Surgery (RAS) and Minimally Invasive Surgery (MIS) platforms, which serve as critical drivers for clinical differentiation.

Artificial Intelligence: The Next Growth Catalyst in US Surgical Procedures

AI is profoundly impacting the U.S. surgical procedures industry by enhancing precision, efficiency, and patient outcomes throughout the entire surgical process. AI-powered systems assist in detailed preoperative planning by creating patient-specific 3D anatomical models from imaging data, allowing surgeons to simulate and refine their approaches.

During surgery, AI-integrated robotic systems and computer vision provide real-time guidance and navigation, enhancing accuracy, minimizing invasiveness, and reducing human error and surgeon fatigue. In the postoperative phase, AI uses predictive analytics and continuous monitoring to detect potential complications early and tailor recovery plans, leading to shorter hospital stays and improved recovery times.

US Surgical Procedures Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 986.42 Billion |

| Market Size by 2035 |

USD 1,673.63 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.05% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Type, By Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

AMSURG, T.H.Medical, Surgery Partners, SurgCenter, Surgical Care Affiliates, HCA Healthcare, Physicians Endoscopy, Covenant Physician Partners Inc, Constitution Surgery Alliance, ASD Management, and Medical Facilities Corporation. |

Driver: Technological advancements in surgical procedures

US is considered a leader in medical technology innovation; most advanced surgical products and devices are developed and manufactured by US-based companies. The rapid growth of surgeries has been possible due to significant advancements in medical technology, which partly solved some of the technical and clinical challenges associated with surgical procedures. Hospitals and healthcare systems invest heavily in the latest technologies to provide the best possible care for their patients.

Of note is a six-year partnership between the National Aeronautics and Space Administration (NASA) (US) and the Skull Base Institute (US), which resulted in a 3D high-definition endoscope with a rotating tip: MARVEL (Multi-Angle Rear-Viewing Endoscopic tool). The small camera helps surgeons get a 3D view of a tumor during surgery. Due to its sub-4mm size, the camera requires a small incision; it can rotate 160 degrees to provide a better view.

Additionally, robotics has enabled surgeons to perform delicate or complex procedures that are extremely difficult or even impossible with other methods. Further, augmented reality (AR) technology has greatly enhanced surgical procedures by providing surgeons with real-time, interactive visual information and guidance during operations. For instance, AR-backed spinal fusion surgery, first conducted in 2020 in the US, helped surgeons to visualize the 3D spinal anatomy of a patient during surgery. The team at the Johns Hopkins Hospital praised the tool for its accuracy, safety, and operating efficiency. Thus, the launch of advanced technology products in this region has driven the surgical procedure market.

Opportunity: Increasing Adoption Of Outpatient Surgeries

Ambulatory surgery centers (ASCs) are freestanding facilities specializing in surgical, diagnostic, and preventive procedures that do not require hospital admission. Medical procedures are moving into these outpatient facilities due to technological advances such as minimally invasive surgical procedures and value-based care incentives. Health systems have also been acquiring or partnering with physicians and physician practices, further driving the volume of services performed in outpatient settings. The cost-effectiveness of ASCs provides significant savings for governments, third-party payers, and patients. A study conducted by Healthcare BlueBook (a provider of data for healthcare services) and HealthSmart (a provider of health plans for self-funded employers) concluded that ASCs decreased the cost of outpatient surgery by USD 38 billion annually since these facilities offer a lower-cost site of care in comparison with hospital outpatient departments.

Challenge: Complications associated with surgical procedures

A few complications are associated with surgical procedures, resulting in additional healthcare costs. Most complications associated with surgeries are minor, but some can be quite serious. The patient’s discomfort after surgery depends on many things, including the type of surgery. Typical discomforts may include nausea and vomiting from general anesthesia, sore throat caused by the tube placed in the windpipe for breathing during surgery, soreness, pain, & swelling around the incision site or minor pain around the IV site and restlessness & sleeplessness among others. However, certain surgeries can also be high risk owing to patient-specific factors or operation-specific factors. Certain health factors can increase surgery risks. Some major patient-specific risks associated with surgical procedures may include obesity, postoperative delirium, postoperative cognitive dysfunction (POCD) and sleep apnea among others.

By Segment

By Type Insights

How did the Ophthalmic Surgical Procedures fastest grow in the U.S. Surgical Procedures Market?

The U.S. ophthalmic surgery market is expanding rapidly as an aging demographic and modern digital lifestyles drive record volumes of age-related and screen-induced eye conditions. Cataract surgeries remain the primary volume driver, supported by a robust reimbursement environment and a shift toward high-margin premium intraocular lenses. Strategic growth is further accelerated by the integration of AI-enhanced diagnostics and ultra-widefield imaging, which significantly improve procedural precision and clinic throughput.

By Channel Insights

How did the Ambulatory Surgery Centre fastest growing in the U.S. Surgical Procedures Market?

The U.S. Ambulatory Surgery Center (ASC) market is benefiting from a massive migration of complex procedures, such as total joint replacements, facilitated by advanced anesthesia and minimally invasive techniques. This shift is driven by a value-based care ecosystem where insurers and Medicare/Medicaid incentivize lower-cost settings that offer significant savings over traditional hospital stays.

Value Chain Analysis: U.S. Surgical Procedures Market

Research & Development (R&D) and Product Innovation

This stage involves the ideation, clinical research, and development of new surgical techniques, devices, and technologies, such as robotic-assisted systems and advanced imaging.

- Key Players: Medtronic plc, Johnson & Johnson (Ethicon, DePuy Synthes), Stryker Corporation, Intuitive Surgical, Inc., and Zimmer Biomet Holdings, Inc.

Manufacturing and Supply Chain Management

Following R&D, this stage focuses on the mass production of surgical equipment, instruments, and related supplies, and managing their efficient flow to healthcare facilities.

- Key Players: Medtronic, Johnson & Johnson, Stryker, Becton, Dickinson and Company (BD)

Distribution and Sales

Products are distributed from manufacturers to healthcare providers, which involves logistics, sales, and marketing efforts to ensure availability and promote new technologies to surgeons and hospital administrators.

- Key Players: Medline Industries and Cardinal Health

U.S. Surgical Procedures Market Companies

AMSURG is a leading operator of more than 250 ambulatory surgery centers across the U.S., specializing in high-volume, high-efficiency gastrointestinal and ophthalmology procedures.

- T.H.Medical (Tenet Healthcare)

Through its United Surgical Partners International (USPI) subsidiary, Tenet operates the largest ASC network in the nation, performing millions of surgeries annually across nearly 500 facilities.

Surgery Partners focuses on a diversified clinical model, managing over 180 locations that provide complex orthopedic and cardiovascular procedures in a cost-effective outpatient environment.

SurgCenter Development specializes in the design and management of physician-owned ASCs, having successfully developed hundreds of facilities that focus on high-acuity procedures like total joint replacements.

- Surgical Care Affiliates (SCA Health)

Part of Optum (UnitedHealth Group), SCA Health manages more than 320 surgical facilities and provides comprehensive support services to over 8,000 partner physicians.

HCA Healthcare is one of the largest providers of surgical services in the U.S., operating an extensive network of 186 hospitals and approximately 124 freestanding surgery centers.

- Physicians Endoscopy (PE GI Solutions)

Specializing exclusively in gastroenterology, PE GI Solutions partners with GI physicians to develop and manage specialized centers for endoscopies and colonoscopies.

- Covenant Physician Partners Inc.

Covenant utilizes a physician-services organization model to support multi-specialty surgical practices, particularly in the fields of ophthalmology, gastroenterology, and anesthesia.

- Constitution Surgery Alliance (CSA)

CSA is a leading developer and operator of high-acuity ASCs, focusing on complex surgical programs that include spine, orthopedics, and cardiovascular health.

ASD Management provides comprehensive operational oversight for ASCs, focusing on maximizing profitability and clinical compliance through rigorous financial and administrative management.

- Medical Facilities Corporation

This corporation holds controlling interests in diverse surgical hospitals and ASCs, primarily in the U.S. Midwest and South, offering a unique "surgical hospital" model that bridges the gap between traditional hospitals and ASCs.

Recent Developments:

- In March 2025, Stryker launched the next generation of its Mako SmartRobotics™ platform, expanding into shoulder and spine indications, while Zimmer Biomet secured FDA clearance for an updated ROSA knee robot with enhanced data integration.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the US Surgical Procedures market.

By Type

- Gastrointestinal Surgical Procedures

- Cardiovascular Surgical Procedures

- Dental Surgical Procedures

- Cosmetic Surgical Procedures

- Urologic Surgical Procedures

- Ophthalmic Surgical Procedures

- Orthopedic Surgical Procedures

- ENT Surgical Procedures

- Obstetric/Gynecologic Surgical Procedures

- Other Surgical Procedures

By Channel

- Physician Offices

- Hospitals

- Inpatient Surgeries

- Outpatient Surgeries

- Ambulatory Surgery Centre