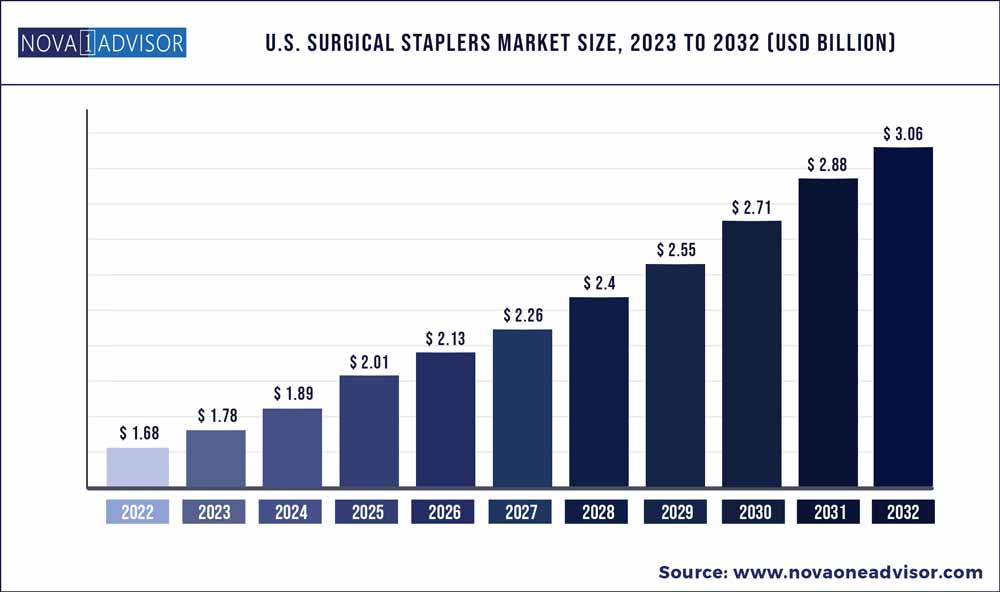

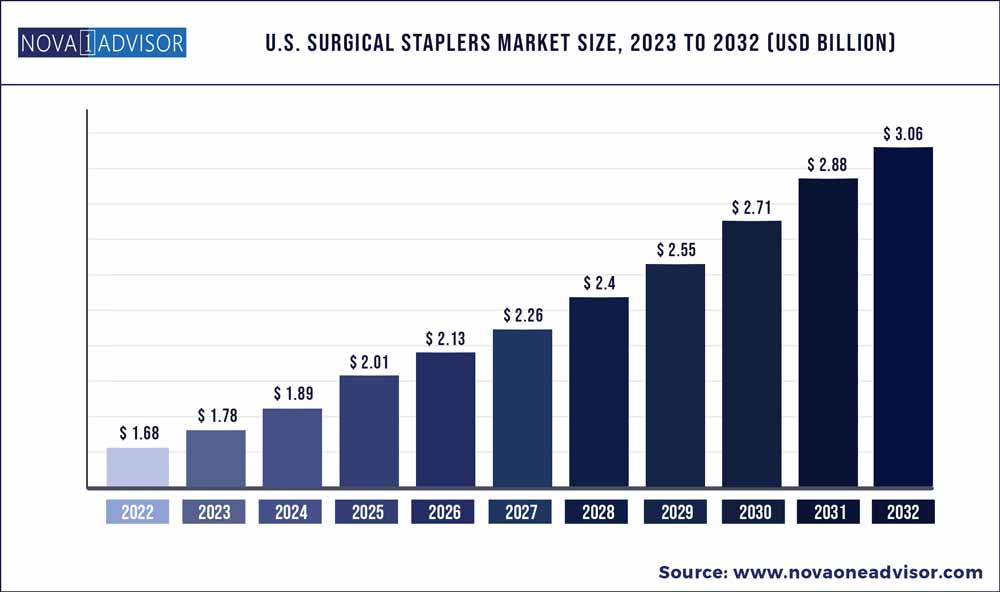

The U.S. surgical staplers market size was exhibited at USD 1.68 billion in 2022 and is projected to hit around USD 3.06 billion by 2032, growing at a CAGR of 6.19% during the forecast period 2023 to 2032.

Key Pointers:

- The linear staplers segment was valued at USD 685.1 million in 2022

- The manual staplers market is forecast to grow at a CAGR of 6.1% over the analysis period.

- The disposable surgical staplers held a market share of around 75.6% in 2022.

- The gynecology segment was valued at USD 300.2 million in 2022

Report Scope of the U.S. Surgical Staplers Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 1.78 Billion

|

|

Market Size by 2032

|

USD 3.06 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 6.19%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Product, By Technology, By Usability, By Surgery

|

|

Key companies profiled

|

3M Company, B. Braun Melsungen AG, CONMED Corporation, Ethicon (Johnson & Johnson), Integra Life Sciences, Intuitive Surgical, CooperSurgical and Medtronic among others.

|

Surgical staplers are used for external and internal closure of wounds under high tension. These wounds include wounds on the scalp or trunk of the body. Surgical staplers majorly find applications in the surgeries such as gynecological, gastrointestinal, thoracic and many more. These staplers help in removing part of an organ, creating connections between sutures and for cutting through organs and tissues.

Rapidly growing number of surgical operations and procedures across the country will positively influence the market growth. Moreover, increasing preference of healthcare professionals towards the adoption of surgical staplers over sutures will boost the market growth in the upcoming years. In addition to that, the introduction of new technologies by the market players related to the skin closure will further contribute to the growth of surgical staplers market in the U.S.

Rise in the number of patients suffering from chronic disorders that require invasive surgical operations will propel the market growth in the coming years. For instance, as per the recently published statistics by the Texas Heart Institute, around 200,000 bypass surgeries are performed on an annual basis in the U.S. Hence, such large patient pool requiring invasive surgical procedures will boost the growth of surgical staplers market. Moreover, increasing prevalence of wound related complications leading to mortality of patients will augment the market growth over the analysis timeframe.

Increase in number of surgeons opting for surgical staplers in the U.S. will augment the industry growth. Additionally, technological advancements in the surgical staplers has made the surgical interventions safer and more feasible. Thus, such benefits of surgical staplers will attract the medical professionals and surgeons across the U.S. healthcare industry, thereby fostering the growth of surgical staplers market.

The linear staplers segment was valued at USD 685.1 million in 2022 and is projected to expand at a significant growth rate over the forecast period. The segmental growth is attributed to the factors such as increasing use of linear staplers in abdominal, thoracic, gynecological surgeries and advent of new functions and abilities related to linear staplers. Linear staplers provide benefits such as adjustability, ease of use, consistency and easy accessibility to narrow anatomic sites. These benefits will contribute to the segmental growth thereby, supporting the market growth.

Furthermore, linear surgical staplers minimize the post-operative complications including bleeding and other infections. Hence, aforementioned factors will contribute to the segmental growth and will further enhance the market demand.

The manual staplers market is forecast to grow at a CAGR of 6.1% over the analysis period. Easy availability and cost-effectiveness of manual staplers are some of the major factors impelling the segmental growth. Moreover, rising focus of market players towards the manufacturing of manual surgical staplers will increase the product demand and will ultimately lead to industry expansion. Hence, healthcare facilities in the U.S. are focusing on the adoption of manual staplers thereby, fueling the market growth.

The disposable surgical staplers held a market share of around 75.6% in 2022. Disposable staplers are highly preferred during the chronic surgeries such as heart surgeries. In addition to that, disposable staplers are ideal for post-operative wound closures. Thus, this will increase the acceptance of disposable staplers thereby, supporting the industry growth. Additionally, increasing prevalence of complicated surgeries such as cancer and cardiovascular surgeries will lead to the increase in adoption of disposable staplers thereby, fostering the market growth.

The gynecology segment was valued at USD 300.2 million in 2022 and is expected to witness significant market growth over 2020 to 2026. Rising proportion of caesarean deliveries as compared to normal deliveries will positively impact the segmental growth thereby, enhancing the product demand. For instance, according to a recently published data by the Centers for Disease Control and Prevention (CDC), in 2021, the total number of cesarean deliveries in the U.S. was around 1,2 million, i.e. around 40% of the total normal deliveries. These caesarian sections will require surgical staplers for the skin closure and will ultimately boost the market growth.

U.S. Surgical Staplers Market Segmentation

| By Product |

By Technology |

By Usability |

By Surgery |

|

Linear stapler

Circular stapler

Skin Stapler

Endoscopic Stapler

Others

|

Manual

Powered

|

Reusable

Disposable

|

Gynecology

Cardiac

Bariatric

Colorectal

Others

|