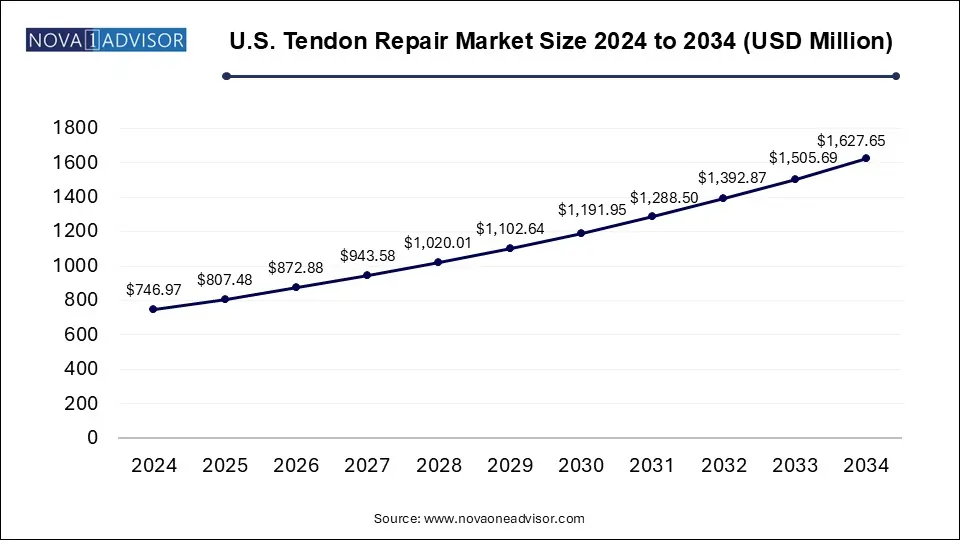

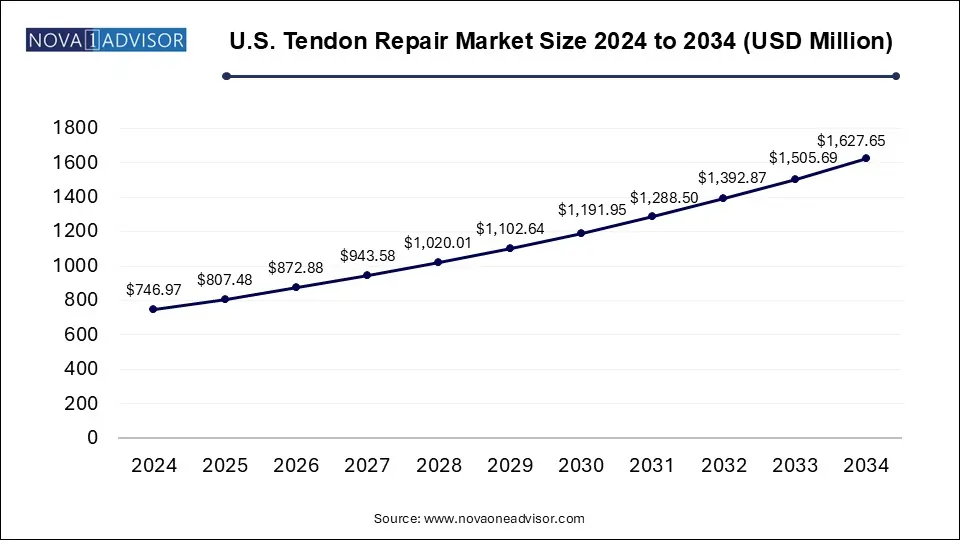

U.S. Tendon Repair Market Size and Growth

The U.S. tendon repair market size was exhibited at USD 746.97 million in 2024 and is projected to hit around USD 1,627.65 million by 2034, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

U.S. Tendon Repair Market Key Takeaways:

- Rotator cuff repair segment held the largest revenue share of 37.6% in U.S. tendon repair in 2024

- Achilles tendinosis repair segment is expected to witness the fastest growth rate over the forecast period.

- Suture anchor devices segment dominated the market regarding revenue share in the U.S. tendon repair market in 2024.

- Implants segment is expected to show the fastest growth rate over the forecast period.

Market Overview

The tendon repair market in the United States has evolved into a high-value, innovation-driven segment of the broader orthopedic and musculoskeletal therapeutics industry. Tendons are crucial connective tissues that link muscles to bones, enabling movement and joint stability. When tendons are injured due to trauma, overuse, or degenerative diseases, surgical intervention or minimally invasive repair is often necessary to restore function.

The U.S. is the global leader in tendon repair procedures, supported by advanced healthcare infrastructure, high rates of sports participation, rising incidence of musculoskeletal injuries, and an aging population with a growing burden of tendon degeneration. According to orthopedic statistics, over 300,000 rotator cuff surgeries are performed annually in the U.S., alongside increasing cases of Achilles tendon ruptures and ACL repairs.

The market comprises a diverse array of technologies and materials, including suture anchors, grafts, tendon scaffolds, screws, and implants. Clinical approaches range from arthroscopic tendon repair techniques to biologically enhanced solutions using regenerative matrices. Hospitals, ambulatory surgical centers, and specialized orthopedic clinics form the major points of care.

Major Trends in the Market

-

Minimally Invasive and Arthroscopic Techniques: Surgeons increasingly favor minimally invasive tendon repairs, reducing recovery times and hospital stays.

-

Biologics and Regenerative Medicine Integration: Growth in use of collagen matrices, platelet-rich plasma (PRP), and stem cells to enhance tendon healing.

-

Advanced Imaging and Navigation Tools: Real-time intraoperative imaging and robotic assistance are improving surgical accuracy and outcomes.

-

Rising Sports Injuries and Fitness Injuries: High sports participation, especially among youth and recreational athletes, is driving demand.

-

Patient-Specific Implants and 3D Printing: Custom-designed scaffolds and grafts tailored to individual anatomy are emerging in clinical practice.

-

Bundled Payment Models in Orthopedics: Health systems are adopting value-based care, emphasizing cost-effective tendon repair solutions.

-

Technological Convergence: Smart suture materials embedded with biosensors to monitor healing are in early-stage development.

Report Scope of U.S. Tendon Repair Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 807.48 Million |

| Market Size by 2034 |

USD 1,627.65 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 8.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Product Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Stryker, Arthrex, Inc.; CONMED Corporation; Integra LifeSciences; Smith+Nephew; TendoMend; Alafair Biosciences; MiMedx; DePuy Synthes, Inc.; BioPro, Inc.; Parcus Medical (Anika Therapeutics, Inc.); Aevumed, Inc.; Amniotics AB; BioTissue. |

The single most influential driver of the U.S. tendon repair market is the increasing incidence of sports injuries and degenerative tendon disorders, particularly among aging baby boomers and active populations. Sports such as football, basketball, tennis, and running exert repetitive stress on tendons, leading to conditions like tendinosis, partial tears, and full ruptures.

Additionally, with the growing popularity of fitness regimes, high-intensity interval training (HIIT), and endurance sports among adults over 40, age-related wear and tear in tendons is becoming more common. Rotator cuff injuries, Achilles tendon ruptures, and anterior cruciate ligament (ACL) tears are especially prevalent, resulting in over a million orthopedic procedures annually in the U.S. The increase in injury rates, combined with greater emphasis on maintaining mobility and quality of life, is fueling demand for effective tendon repair interventions.

Market Restraint: High Cost of Advanced Surgical Devices and Biological Products

Despite significant advancements in technology and clinical outcomes, high procedural and device costs remain a major restraint in the tendon repair market. Arthroscopic and minimally invasive surgeries often involve specialized implants, biologic matrices, and high-performance sutures, all of which add to the total procedural expense. These costs are further compounded by hospital facility fees, rehabilitation requirements, and post-operative imaging.

While commercial insurance covers most standard procedures, advanced biologics and regenerative therapies may fall outside reimbursement guidelines, placing financial burdens on patients. The lack of uniform pricing and inconsistent payer coverage for emerging products such as tendon scaffolds or tissue-engineered implants continues to limit widespread adoption, especially in smaller clinics or underinsured patient populations.

Market Opportunity: Emergence of Biologic and Tissue-Engineered Tendon Repair Solutions

A key opportunity in the U.S. tendon repair market lies in the integration of biologically active materials and tissue engineering techniques. These next-generation therapies aim not only to mechanically stabilize torn tendons but also to biologically stimulate healing at the cellular and molecular levels. Companies are developing bioabsorbable scaffolds, decellularized grafts, and collagen matrices that provide structural support while enhancing the body’s own regenerative processes.

In clinical trials and early commercial usage, such biologic constructs are showing promise in improving healing rates, reducing re-tear risk, and lowering rehabilitation time. This opportunity is especially strong in challenging tendon repairs such as chronic rotator cuff tears or revision surgeries, where conventional suturing has high failure rates. As regulatory approvals progress and clinical data becomes more robust, these biologic options are expected to become central to high-value orthopedic practices.

U.S. Tendon Repair Market By Application Insights

Rotator cuff repair continues to dominate the tendon repair application segment in the U.S., driven by its high incidence, especially among adults over 40. The rotator cuff comprising four tendons that stabilize the shoulder joint is highly vulnerable to degeneration and tears due to repetitive overhead activities, trauma, or age-related changes. With over 300,000 rotator cuff repairs performed annually, this segment has the largest share of procedure volume and revenue.

Surgical interventions include arthroscopic debridement, anchor fixation, and augmentation using patches or scaffolds. The demand for biologic grafts and collagen-based patches is also rising in rotator cuff repairs with poor tissue quality. The availability of post-surgery physical therapy, high reimbursement rates, and strong clinical outcomes further solidify this segment’s dominance.

Bicep tenodesis is the fastest-growing segment, owing to increased recognition of the procedure as a preferred treatment for biceps tendonitis and SLAP lesions. This procedure involves reattaching the biceps tendon to the humerus to relieve pain and improve shoulder function. It is commonly performed alongside rotator cuff repairs, especially in middle-aged patients or athletes with overuse injuries. Minimally invasive approaches and dual-row fixation techniques are enhancing outcomes, driving adoption.

U.S. Tendon Repair Market By Product Type Insights

Suture anchor devices are the most widely used products, accounting for the majority of procedural kits in tendon repairs. These devices are used to affix tendons back to bone and are available in absorbable and non-absorbable forms. Suture anchors are crucial in procedures such as rotator cuff and Achilles tendon repairs, offering strong fixation and minimal tissue disruption. Technological innovation in anchor design—including knotless anchors and all-suture anchors—is further expanding their usage across arthroscopic surgeries.

On the other hand, matrix/scaffolds are the fastest-growing product category, especially within biologic and regenerative surgery practices. These products provide a bioactive or synthetic framework that supports tissue ingrowth and remodeling. Tendon-specific matrices enhance collagen alignment and vascularization, crucial for successful long-term healing. Companies are developing scaffold-based tendon repair patches that reduce the risk of re-tear and enhance mechanical load distribution. Their adoption is particularly high in revision surgeries and elderly patients with poor tendon quality.

Country-Level Analysis

The U.S. stands as the global epicenter of tendon repair innovation and procedure volume. With a well-established healthcare system, extensive sports culture, and aging demographics, the demand for tendon repair procedures continues to rise. The U.S. orthopedic sector includes a dense network of academic hospitals, ambulatory surgery centers, and private practices equipped with state-of-the-art surgical technologies.

Government agencies like the NIH and DoD are funding research into tendon regeneration, while the FDA is approving new biologic implants at an accelerating pace. Additionally, the adoption of bundled payment models in orthopedic surgery is encouraging providers to choose cost-effective, outcome-optimized devices and materials. High insurance penetration, early adoption of robotic surgery platforms, and growing patient preference for minimally invasive interventions position the U.S. tendon repair market for sustained growth in the coming decade.

Some of the prominent players in the U.S. tendon repair market include:

U.S. Tendon Repair Market Recent Developments

-

March 2025: Smith+Nephew launched its new "REGENMEND BioPatch", a collagen-based biologic scaffold for rotator cuff augmentation in the U.S., targeting patients with large or chronic tendon tears.

-

January 2025: Stryker Corporation expanded its tendon repair portfolio with the acquisition of a startup specializing in customizable, 3D-printed tendon scaffolds designed for complex shoulder and knee repairs.

-

November 2024: Arthrex Inc. received FDA clearance for its next-generation "AlloPatch P" tendon matrix designed to enhance healing in Achilles and biceps repairs. The company reported successful pilot outcomes in ambulatory surgical centers across Florida and Texas.

-

September 2024: ConMed Corporation introduced a sutureless tendon anchor system, “AnchorFree Fix,” featuring bioresorbable wings for enhanced tendon-to-bone contact, aimed at simplifying arthroscopic workflows.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. tendon repair market

By Application

- Rotator Cuff Repair

- Achilles Tendinosis Repair

- Cruciate Ligament Repair

- Bicep Tenodesis

- Others

By Product Type

- Implants

- Suture Anchor Devices

- Grafts

- Matrix/Scaffolds

-

- Tendon Repair

- Tendon Protection Matrix/Scaffolds