U.S. Transdermal Drug Delivery System Market Size and Research

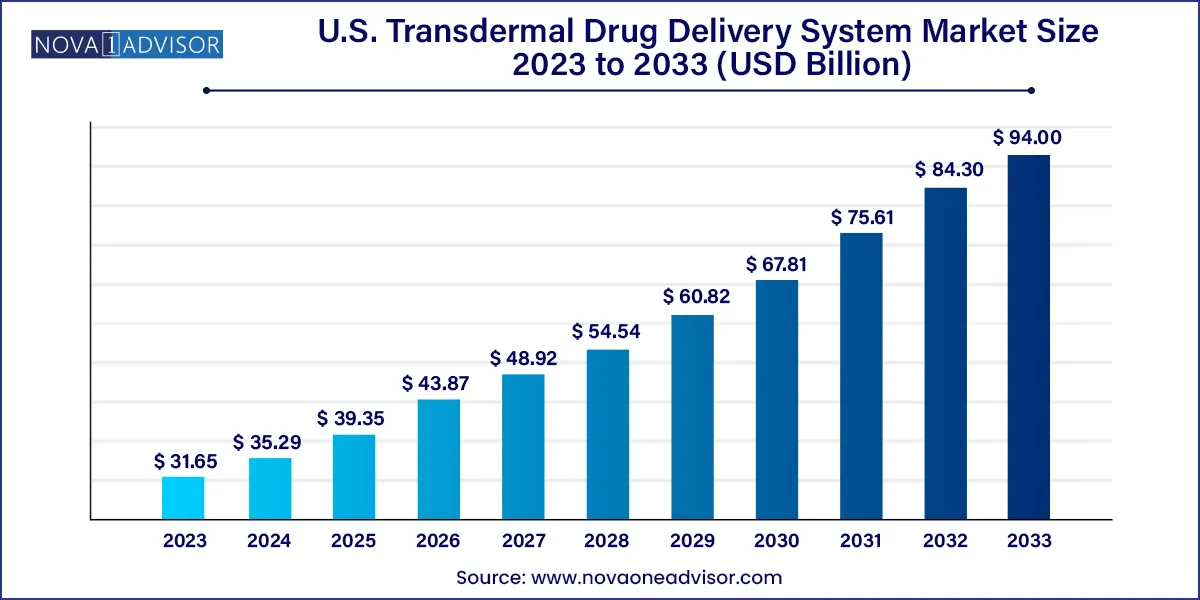

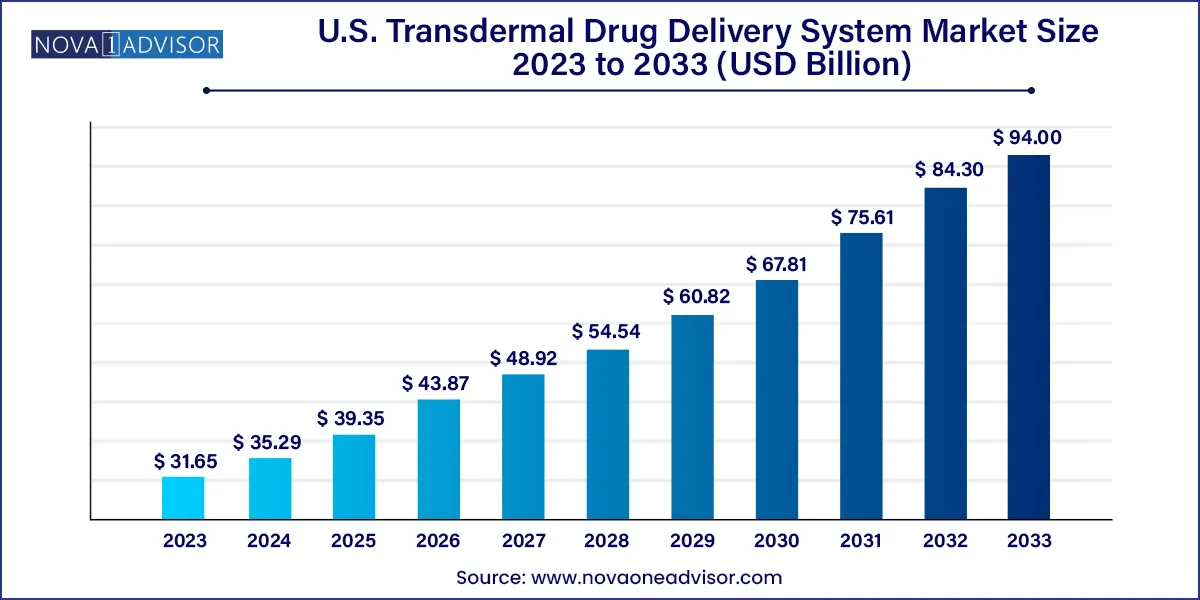

The U.S. transdermal drug delivery system market size was exhibited at USD 31.65 billion in 2023 and is projected to hit around USD 94.00 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2024 to 2033.

Key Takeaways:

- The iontophoresis segment dominated the market in 2023 owing to technological advancements.

- The mechanical arrays segment is anticipated to progress at a lucrative CAGR of over 12.7% throughout the forecast period.

- The pain management segment held the highest share of 22.7% in 2023.

- The cardiovascular segment is anticipated to undergo maximum growth over the forecast period.

U.S. Transdermal Drug Delivery System Market by Overview

The U.S. transdermal drug delivery system market is witnessing significant growth and evolution, driven by advancements in pharmaceutical technology and the increasing demand for non-invasive drug delivery methods. This comprehensive overview explores the dynamics, trends, and key factors shaping the landscape of transdermal drug delivery systems in the United States.

U.S. Transdermal Drug Delivery System Market Growth

The growth of the U.S. transdermal drug delivery system market is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and chronic pain conditions necessitates effective and convenient drug delivery methods, driving demand for transdermal delivery systems. Additionally, the growing aging population, coupled with a preference for non-invasive drug administration, further accelerates market growth. Moreover, technological advancements in transdermal delivery systems, including innovations in patch design, formulation techniques, and controlled release mechanisms, enhance drug permeation and bioavailability, fostering market expansion. Furthermore, favorable regulatory policies and guidelines support the development and commercialization of transdermal drug products, facilitating market penetration and adoption. Overall, these factors converge to propel the growth and evolution of the U.S. transdermal drug delivery system market, offering patients and healthcare providers convenient, effective, and safe treatment options.

Report Scope of The U.S. Transdermal Drug Delivery System Market

U.S. Transdermal Drug Delivery System Market Trends

Expansion Beyond Traditional Indications:

- Transdermal drug delivery systems are increasingly being explored for new therapeutic areas beyond their traditional applications, such as neurological disorders, oncology, and dermatology.

Personalized and Precision Medicine:

- Advancements in pharmacogenomics and personalized medicine are driving the development of transdermal drug delivery systems tailored to individual patient profiles.

Integration of Digital Health Technologies:

- The integration of digital health technologies, such as wearable sensors and smart patches, with transdermal drug delivery systems enables real-time monitoring of drug delivery and patient response.

Sustainability and Eco-Friendly Formulations:

- Increasing awareness of environmental sustainability is driving the demand for eco-friendly and biodegradable materials in transdermal drug delivery systems.

Regulatory Advances and Expedited Pathways:

- Regulatory agencies are adopting expedited pathways and streamlined approval processes for transdermal drug delivery systems, particularly for breakthrough therapies and orphan indications.

Telemedicine and Remote Healthcare Delivery:

- The rise of telemedicine and remote healthcare delivery models amid the COVID-19 pandemic has prompted increased interest in transdermal drug delivery systems for at-home and virtual care settings.

U.S. Transdermal Drug Delivery System Market By Technology Insights

Microporation technology dominated the U.S. transdermal drug delivery system market due to its superior ability to enhance drug permeation across the skin barrier. Microporation involves creating micro-channels in the skin to facilitate the entry of larger or poorly permeable molecules. This technology has shown significant promise in vaccine delivery, protein-based drugs, and hormonal therapies. Its minimally invasive nature, combined with high patient compliance, makes it ideal for chronic and preventive care applications. With continuous R&D and favorable regulatory reviews, microporation is expected to remain a cornerstone in next-generation transdermal systems.

Electroporation is emerging as the fastest-growing segment. This technique uses electrical pulses to temporarily disrupt the lipid bilayers of the skin, enhancing permeability. It is particularly valuable in delivering hydrophilic and large molecular weight drugs that traditional patches cannot handle. Electroporation-based systems are gaining traction in CNS and cancer therapies, where precision and penetration depth are critical. The development of wearable electroporation devices is also accelerating its adoption in home-based care models, a trend highly favored in the post-pandemic healthcare landscape.

U.S. Transdermal Drug Delivery System Market By Application Insights

Pain management dominated the application segment in the U.S. transdermal drug delivery market. This is attributed to the high burden of chronic pain disorders and the favorable pharmacokinetics of transdermal analgesics. Buprenorphine and fentanyl patches are among the most prescribed solutions for moderate to severe pain, particularly in cancer patients and the elderly. The ease of use, reduced dosing frequency, and minimal gastrointestinal burden make transdermal systems highly attractive for long-term pain management. Additionally, these systems help clinicians monitor adherence and adjust dosages without invasive interventions.

CNS applications are the fastest-growing segment, driven by advancements in drug formulations and delivery technology. Transdermal patches for ADHD, Parkinson's disease, and Alzheimer’s are increasingly entering clinical pipelines. Companies are focusing on developing controlled-release systems that can deliver neuroactive agents over 24 to 72 hours, reducing the risk of dosage fluctuations. The non-invasive nature of these systems is especially valuable in pediatric and geriatric care, where swallowing difficulties or cognitive impairment can hinder oral medication adherence.

Country-Level Analysis: United States

In the U.S., the transdermal drug delivery market is driven by a sophisticated healthcare ecosystem that encourages innovation and rapid adoption. With high consumer awareness, robust reimbursement models, and regulatory pathways such as the FDA's 505(b)(2) route, companies find the U.S. market conducive for launching advanced transdermal systems. The growing number of outpatient procedures and home-based chronic disease management is also contributing to the rise in demand.

The U.S. is witnessing increased penetration of wearable transdermal devices that offer controlled release and integration with mobile health platforms. This synergy between pharmaceutical and digital technology sectors is uniquely prominent in the U.S., giving rise to smart patches that can monitor vitals while delivering drugs. States with aging populations like Florida and California represent high-demand zones, while urban health systems are integrating transdermal care models for efficiency and cost control.

Some of the prominent players in the U.S. Transdermal Drug Delivery System Market include:

- Novartis AG

- Johnson & Johnson

- Viatris Inc.

- Boehringer Ingelheim GmbH

- Biogel Technology, Inc.

- 3M Company

- Noven Pharmaceuticals, Inc.

- Nutriband Inc.

- Transdermal Corporation

- Echo Therapeutics, Inc.

Recent Developments

-

In March 2025, Avery Dennison Medical announced the expansion of its transdermal adhesive platform designed for multi-day wear, targeting hormone and pain relief therapies.

-

In January 2025, Teva Pharmaceuticals received FDA clearance for a new buprenorphine transdermal patch indicated for opioid-experienced cancer patients.

-

In November 2024, Zosano Pharma partnered with a leading CNS drug developer to co-develop a microneedle-based transdermal system for Alzheimer's therapeutics.

-

In August 2024, Corium Inc. launched its ADHD transdermal patch under the brand name AZSTARYS, receiving positive reviews for once-daily delivery in pediatric patients.

-

In June 2024, Medherant Ltd., in partnership with a U.S. distributor, began clinical trials for a testosterone transdermal patch designed for aging males with hypogonadism.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. transdermal drug delivery system market

Technology

- Electroporation

- Radio Frequency

- Iontophoresis

- Microporation

- Thermal

- Mechanical arrays

- Ultrasound

- Others

Application

- CNS

- Pain Management

- Cardiovascular

- Hormone

- Immunological

- Metabolic

- Gastrointestinal

- Infection

- Cancer

- Others

-

- Urological

- Blood disorders

- Respiratory

- Musculoskeletal

Country