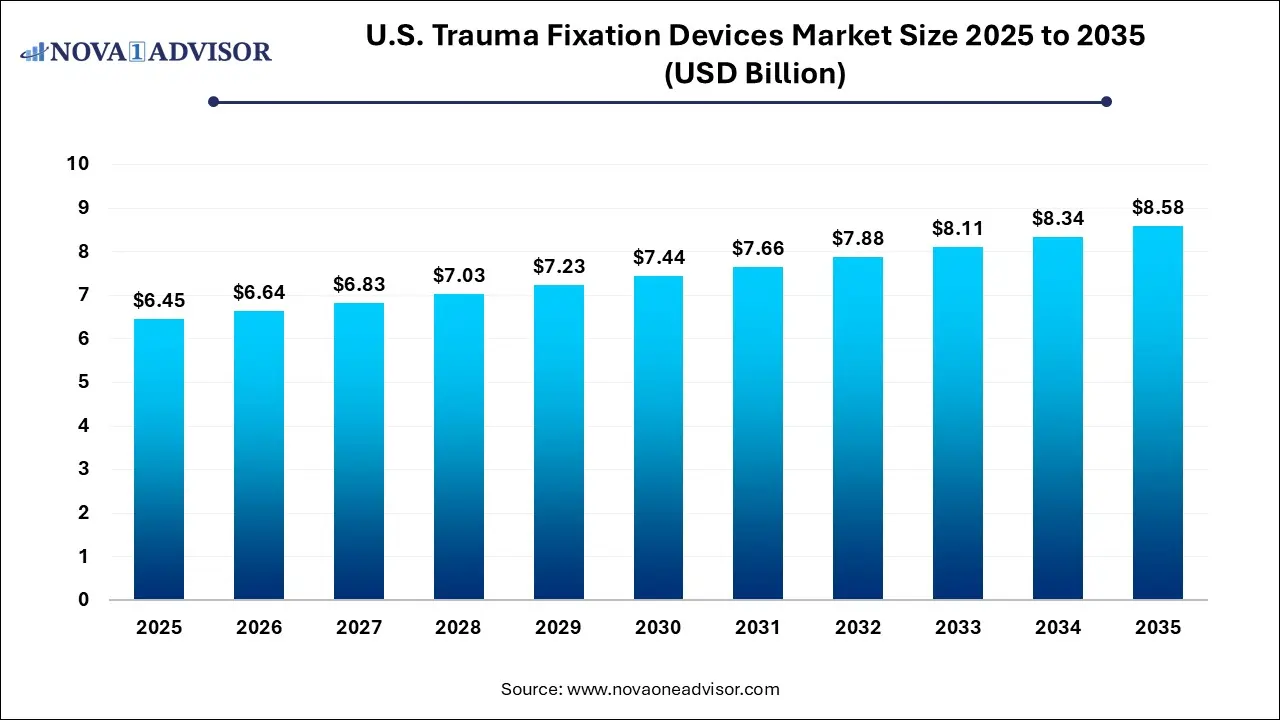

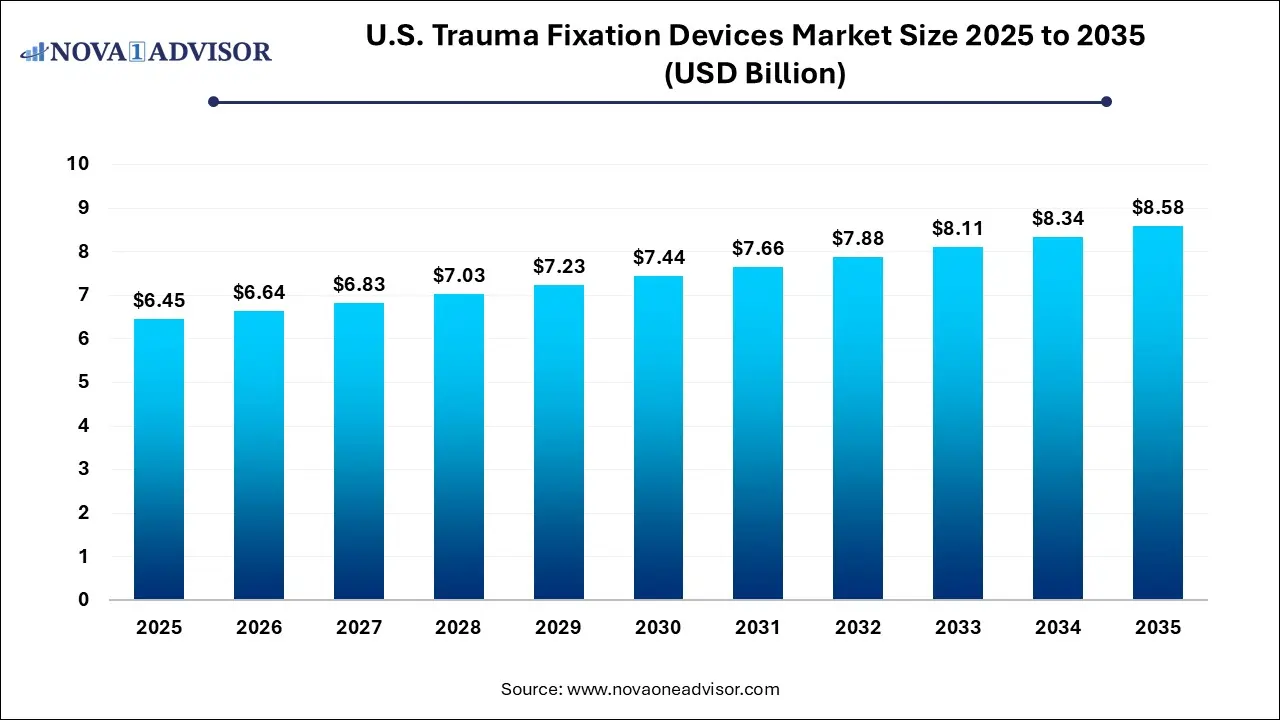

U.S. Trauma Fixation Devices Market Size and Growth 2026 to 2035

The U.S. trauma fixation devices market size was exhibited at USD 6.45 billion in 2025 and is projected to hit around USD 8.58 billion by 2035, growing at a CAGR of 2.9% during the forecast period 2026 to 2035.

Key Pointers:

- The Centers for Disease Control & Prevention (CDC), nearly 60.5 million individuals were diagnosed with arthritis in 2025.

- Titanium material segment held more than 35.19% share in the U.S. trauma fixation devices market in 2025.

- U.S. trauma fixation devices market from upper extremities segment is expected to surpass USD 2.9 billion by 2035.

- U.S. trauma fixation devices market from orthopedic centers is projected to exhibit a 3.9% CAGR from 2026-2035.

Market Outlook

- Market Growth Overview: The U.S. trauma fixation devices market is expected to grow significantly between 2025 and 2034, driven by the increased trauma cases, introduction of bioabsorbable implants, 3D-printed patient-specific devices, and growing minimally invasive services.

- Sustainability Trends: Sustainability trends involve bioabsorbable and biodegradable implants, circular economy and reusability, and waste management and recycling in operating rooms.

- Major Investors: Major investors in the market include Stryker, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), Smith & Nephew, B. Braun Melsungen AG, Orthofix, and Integra LifeSciences.

Artificial Intelligence: The Next Growth Catalyst in U.S. Trauma Fixation Devices

AI is significantly impacting the U.S. trauma fixation devices industry by enhancing diagnostic precision, surgical execution, and postoperative monitoring. In diagnostics, AI algorithms analyze vast datasets of medical images (X-rays, CT scans, MRIs) to identify fractures and bone lesions with high accuracy, often faster than human experts, which helps in timely intervention. During surgery, AI powers robotic-assisted systems that use real-time data and 3D modeling for highly precise implant placement, minimizing errors and enabling minimally invasive techniques.

Report Scope of U.S. Trauma Fixation Devices Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 6.64 Billion |

| Market Size by 2035 |

USD 8.58 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.11% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Material, Site, and End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Integra LifeSciences, Acumed LLC, Bioretec LTD, CONMED Corporation, Smith & Nephew, and Stryker Corporation are some of the leading producers of trauma fixation devices in the country. |

Segmental Analysis:

By Product:

External fixators dominate the U.S. trauma fixation devices market in 2025 due to their widespread use in managing complex fractures, polytrauma cases, and emergency orthopedic procedures. These devices are particularly preferred in high-impact trauma scenarios such as road accidents and open fractures, where rapid stabilization is critical. Their versatility across unilateral, bilateral, circular, and hybrid configurations enables surgeons to address diverse fracture patterns while minimizing soft tissue disruption. Additionally, external fixators are commonly used as temporary stabilization solutions prior to definitive internal fixation, further reinforcing their dominant adoption across trauma centers and hospitals nationwide.

Internal fixators represent the fastest-growing product segment, driven by advancements in minimally invasive surgical techniques and rising preference for definitive fracture management. Plates, screws, and intramedullary nails are increasingly favored for their ability to provide stable fixation, faster healing, and improved patient mobility. Technological innovations such as anatomically contoured plates and bio-compatible coatings have enhanced clinical outcomes. Growing volumes of elective trauma surgeries, coupled with shorter hospital stays and improved rehabilitation results, are accelerating the adoption of internal fixation devices across the U.S.

By Material:

Stainless steel remains the dominant material segment in 2025 due to its cost-effectiveness, mechanical strength, and long-standing clinical reliability. These devices are widely used in trauma fixation procedures where affordability and durability are key considerations, especially in high-volume hospital settings. Stainless steel fixation systems offer excellent load-bearing capacity and corrosion resistance, making them suitable for a wide range of fracture types. Their established manufacturing processes and surgeon familiarity continue to support their dominant market presence.

Titanium is the fastest-growing material segment, owing to its superior biocompatibility, lightweight properties, and enhanced osseointegration. Titanium-based fixation devices are increasingly preferred for complex and long-term implants, as they reduce inflammatory responses and improve patient comfort. The material’s compatibility with advanced imaging techniques and lower risk of allergic reactions further contributes to its growing adoption. Rising demand for premium orthopedic solutions and improved patient outcomes is driving the rapid growth of titanium fixation devices in the U.S. market.

By Site:

Lower extremities dominate the trauma fixation devices market in 2025, primarily due to the high incidence of fractures involving hips, knees, lower legs, and ankles. Traffic accidents, sports injuries, and age-related falls contribute significantly to trauma cases affecting the lower body. Fixation procedures in these regions often require robust and durable devices to support weight-bearing functions. The large procedural volume associated with hip, pelvic, and knee fractures ensures sustained demand for fixation devices targeting lower extremities.

Upper extremities are the fastest-growing site segment, driven by increasing cases of hand, wrist, and shoulder injuries from sports, occupational hazards, and recreational activities. Advances in surgical techniques and the availability of smaller, anatomically precise fixation devices have improved outcomes for upper limb trauma. Faster recovery times and improved functional restoration are encouraging greater surgical intervention. As outpatient orthopedic procedures rise, demand for fixation devices in upper extremity applications continues to accelerate.

By End Use

Hospitals dominate the end-use segment in 2025 due to their role as primary centers for trauma care and emergency orthopedic surgeries. Equipped with advanced surgical infrastructure and multidisciplinary trauma teams, hospitals handle the majority of complex fracture cases requiring fixation devices. High patient inflow, availability of advanced imaging, and reimbursement support further strengthen hospital dominance. Additionally, teaching hospitals and Level I trauma centers contribute significantly to procedural volumes across the U.S.

Orthopedic centers are the fastest-growing end-use segment, fueled by the shift toward specialized, high-efficiency care settings. These centers offer focused expertise in fracture management, advanced fixation techniques, and post-surgical rehabilitation. Shorter procedure times, lower costs, and improved patient satisfaction are driving preference for orthopedic specialty centers. The increasing number of standalone orthopedic facilities and growing demand for elective trauma surgeries are accelerating growth in this segment.

Value Chain Analysis of the U.S. Trauma Fixation Devices Market

- Research and Development (R&D) and Product Design

This foundational stage involves innovating new materials (e.g., bioabsorbable metals), smart implants, and minimally invasive techniques to improve patient outcomes and reduce recovery times.

Key Players: DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Smith & Nephew, Arthrex, Integra LifeSciences.

- Raw Material Procurement and Supply

This stage focuses on sourcing high-quality, biocompatible materials like titanium, stainless steel, and specialized polymers for device manufacturing.

Key Players: DePuy Synthes, Stryker, and Zimmer Biomet.

- Manufacturing and Production

Devices are manufactured with high precision, including processes like 3D printing for patient-specific hardware and applying antimicrobial coatings.

Key Players: Stryker, Zimmer Biomet, DePuy Synthes, Smith & Nephew, B. Braun Melsungen AG, Acumed.

Some of the prominent players in the U.S. trauma fixation devices Market include:

- Integra LifeSciences

- Acumed LLC

- B Braun Melsungen AG

- Bioretec LTD

- CONMED Corporation

- Depuy Synthes (Johnson & Johnson)

- Smith & Nephew

- Wright Medical Group N V

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

Recent Developments:

- In March 2025, Johnson & Johnson MedTech launched the VOLT™ Plating System, which features variable-angle optimized locking technology to provide enhanced stability and improved fracture management.

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor has segmented the U.S. trauma fixation devices market.

By Product

- External Fixators

- Unilateral and Bilateral

- Circular

- Hybrid

- Internal Fixators

- Plates

- Screws

- Nails

- Others

- Others

By Material

- Stainless Steel

- Titanium

- Others

By Site

- Lower Extremities

- Hip and Pelvic

- Lower Leg

- Knee

- Foot & Ankle

- Thigh

- Upper Extremities

- Hand & Wrist

- Shoulder

- Elbow

- Arm

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Centers

- Others

- Frequently Asked Questions