U.S. Urgent Care Centers Market Size and Trends

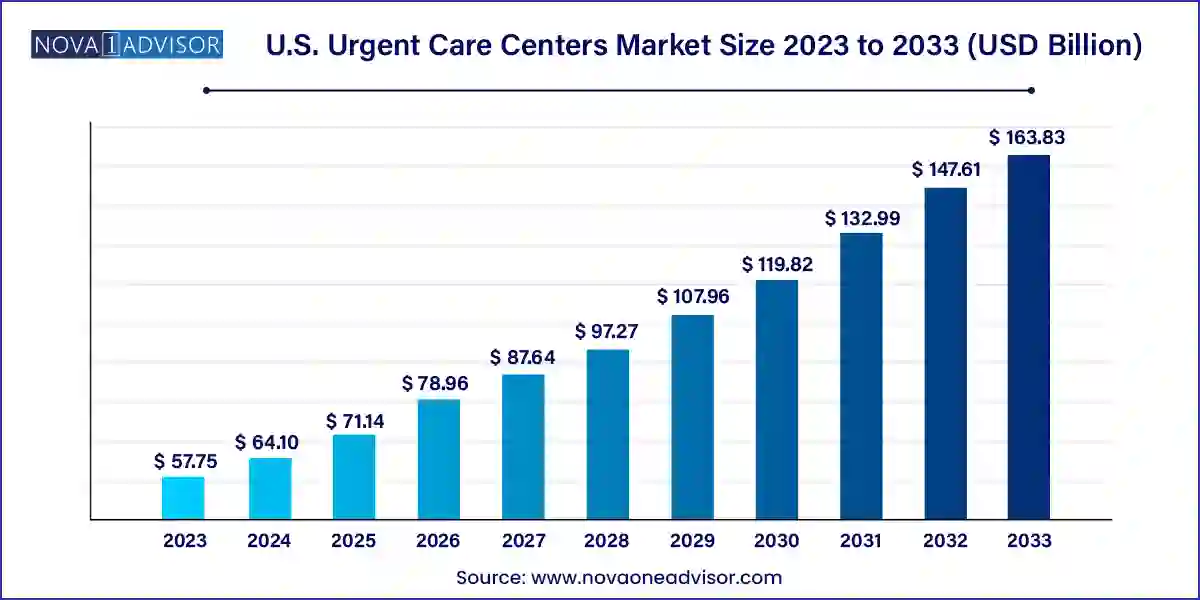

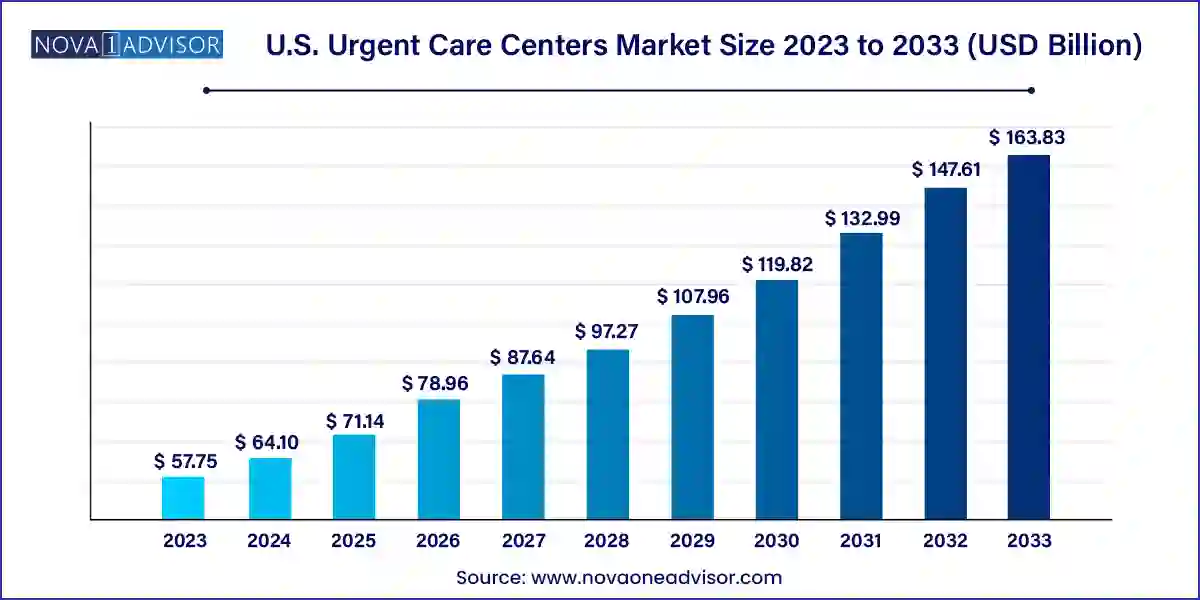

The U.S. urgent care centers market size was exhibited at USD 57.75 billion in 2023 and is projected to hit around USD 163.83 billion by 2033, growing at a CAGR of 10.99% during the forecast period 2024 to 2033.

Key Takeaways:

- The acute respiratory infection segment dominated the market in 2023 with a 28% revenue share and is expected to continue its lead during the forecast period.

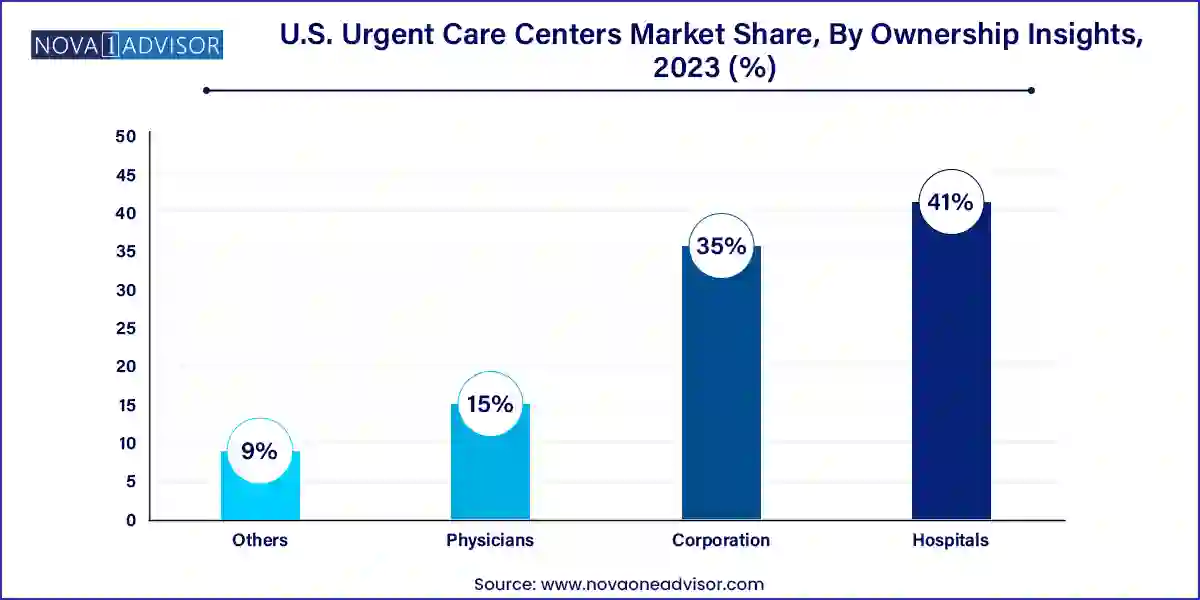

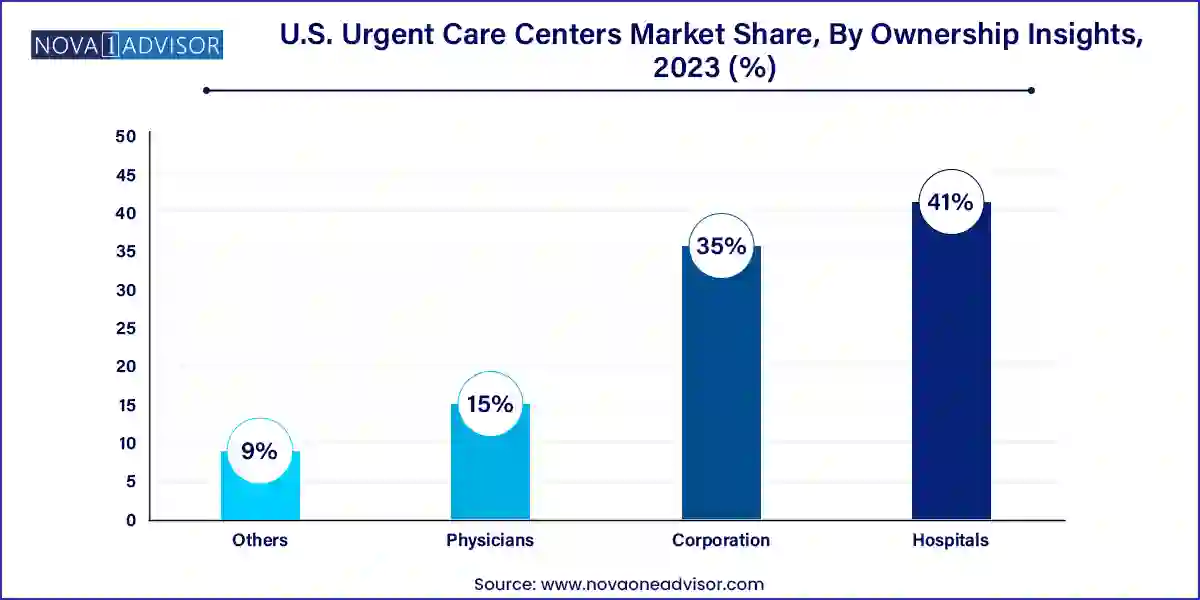

- The hospital-owned segment held the largest share of 41% in 2023 and is expected to grow at the fastest CAGR of 11.38% during the forecast period.

Market Overview

The U.S. Urgent Care Centers Market has emerged as a key player in the American healthcare delivery landscape, offering timely, affordable, and accessible medical services for non-life-threatening conditions. Urgent care centers serve as a critical bridge between primary care and emergency departments, providing walk-in treatment for illnesses and injuries that require prompt attention but are not severe enough for the ER. These facilities are equipped to handle a wide range of medical conditions from flu symptoms and fractures to skin infections and minor surgeries and are often open beyond typical business hours, including weekends.

Several factors have fueled the rapid growth of urgent care centers (UCCs) across the United States. Rising emergency room overcrowding, physician shortages, extended wait times in hospitals, and the escalating cost of ER services have pushed patients and payers toward more efficient care delivery models. UCCs provide a cost-effective alternative, often offering services at one-tenth the cost of an ER visit, while delivering treatment with similar clinical outcomes for minor injuries and illnesses.

The convenience-driven nature of American consumer behavior has also played a vital role in shaping this market. Patients are increasingly opting for facilities that provide on-demand care, extended hours, no-appointment-needed access, and minimal waiting times. In urban, suburban, and even rural areas, urgent care clinics have proliferated, often strategically co-located with retail spaces, pharmacies, and diagnostic labs to ensure one-stop service delivery. Moreover, insurers and employers are actively supporting the use of urgent care to reduce healthcare expenditures and absenteeism, particularly for minor but time-sensitive health issues.

As a result, the U.S. urgent care centers market continues to thrive, both in terms of physical expansion and service diversification. Many centers now offer services such as occupational health screenings, vaccinations, diagnostic imaging, and even limited chronic disease management. With a changing regulatory landscape, increasing investment from private equity, and digital integration (including tele-urgent care), the sector is poised for sustained and dynamic growth.

Major Trends in the Market

-

Retail and Hybrid Care Expansion: Big retail chains like CVS, Walmart, and Walgreens are integrating urgent care services into their health strategies, creating hybrid models that blend retail, primary care, and urgent care under one roof.

-

Increased Scope of Services: Many urgent care centers are expanding into preventive services, travel medicine, and chronic condition screenings to diversify offerings and capture broader patient demographics.

-

Digital Check-ins and Tele-urgent Care: The use of mobile apps, virtual queues, and telemedicine consultations is enhancing patient convenience and reducing wait times.

-

Private Equity Investment and Consolidation: The market is witnessing consolidation with major players acquiring independent UCCs, creating large regional and national networks.

-

On-site Diagnostic Capabilities: Point-of-care testing, X-ray, EKG, and even lab draws are becoming standard, enabling centers to provide comprehensive episodic care in one visit.

-

Rising Patient Education and Brand Loyalty: Urgent care operators are investing in marketing, loyalty programs, and patient engagement platforms to increase retention and brand awareness.

-

Employer-Sponsored Urgent Care Programs: Corporations are contracting directly with UCCs for workforce health initiatives, injury management, and wellness programs.

-

Quality and Accreditation Standards: Accreditation from organizations like the Urgent Care Association (UCA) is becoming a standard for compliance, credibility, and payer alignment.

-

Operational Efficiencies via AI and Automation: Workflow tools, AI-enabled diagnostics, and patient management platforms are improving the profitability and scalability of urgent care networks.

Report Scope of The U.S. Urgent Care Centers Market

Market Driver: Rising Demand for Convenient, Cost-effective Healthcare Access

The primary driver fueling the U.S. urgent care centers market is the growing demand for fast, affordable, and accessible healthcare services, especially in a climate where emergency rooms are overburdened and primary care appointments are often delayed for weeks. As patients increasingly prioritize time and convenience, urgent care centers offer a practical solution. These clinics typically operate during evenings and weekends, do not require appointments, and deliver care within a shorter timeframe compared to ERs or traditional clinics.

Healthcare payers are also advocating the use of urgent care for minor illnesses and injuries due to the substantial cost savings. For instance, treating a simple urinary tract infection or minor laceration in an ER can cost up to 10 times more than in a UCC. Additionally, younger generations like Millennials and Gen Z are more likely to seek healthcare on-demand, often avoiding traditional primary care relationships. The convergence of consumer behavior, payer incentives, and rising healthcare awareness is pushing the urgent care model into mainstream acceptance.

Market Restraint: Variability in Quality and Scope of Services

Despite strong growth, the market is hindered by a lack of uniformity in service quality, diagnostic accuracy, and provider qualifications across different urgent care centers. Unlike hospitals or accredited clinics, many urgent care facilities operate with varying clinical protocols, depending on ownership structure, state regulations, and business goals. This lack of standardization can lead to misdiagnosis, treatment delays, or inappropriate referrals, especially in more complex cases.

Some centers are staffed primarily by physician assistants or nurse practitioners without oversight from board-certified physicians, raising concerns among regulators and patients. Furthermore, scope of care can differ significantly while some centers offer full diagnostic imaging and lab services, others provide only basic evaluations. This variability may erode patient trust and hinder long-term brand loyalty unless quality standards and accreditation become mandatory and widely adopted.

Market Opportunity: Expansion into Underserved Areas and Rural Markets

A significant opportunity lies in the penetration of urgent care services into rural and underserved areas, where access to timely and affordable healthcare is still a challenge. Many regions across the U.S., especially in the Midwest and South, face physician shortages, hospital closures, and long travel times to emergency departments. Urgent care centers can help fill this critical access gap by offering essential medical services close to home.

Moreover, with advancements in telemedicine and mobile diagnostic tools, UCCs can now be established with lower overhead and fewer staff while still providing a broad scope of care. Public-private partnerships and incentive programs from the federal government to improve rural healthcare infrastructure further bolster this expansion potential. Operators who customize their business models to local needs—such as combining urgent care with primary care or wellness education—are likely to gain a competitive edge while delivering substantial public health value.

U.S. Urgent Care Centers Market By Application Insights

General symptoms dominated the application segment of the U.S. urgent care centers market, largely due to their non-specific nature and high frequency among patients seeking quick medical evaluations. Conditions like fever, fatigue, headaches, sore throat, and dizziness are common reasons for UCC visits. These symptoms often represent the initial signs of infections or systemic conditions, prompting patients to seek immediate evaluation. Urgent care clinicians typically conduct physical exams, perform point-of-care diagnostics, and initiate treatment or referrals based on findings. The appeal lies in the speed of service, affordability, and accessibility without disrupting daily schedules.

Sprains, strains, and fractures are the fastest-growing application area, driven by the expanding scope of orthopedic capabilities within urgent care centers. Many centers are now equipped with X-ray services and splinting materials, enabling immediate diagnosis and stabilization of musculoskeletal injuries. These conditions, often resulting from sports injuries, workplace accidents, or falls, require prompt care but not necessarily emergency room intervention. UCCs are increasingly becoming the go-to choice for initial injury management, especially for parents, athletes, and manual laborers. The time and cost savings, combined with expanded orthopedic services, make this segment a significant growth contributor.

U.S. Urgent Care Centers Market By Ownership Insights

Corporation-owned urgent care centers dominate the ownership landscape, as healthcare conglomerates, private equity firms, and retail giants continue to invest heavily in urgent care infrastructure. These corporations benefit from economies of scale, access to capital, standardized branding, and technology-driven operations. They often operate chains across multiple states, ensuring consistency in service delivery and patient experience. Corporations like MedExpress (Optum), Concentra (Select Medical), and CityMD have become household names in many metropolitan areas. Their resources allow for investment in staff training, digital platforms, and marketing strengthening their competitive position in a fragmented market.

Physician-owned centers represent the fastest-growing ownership segment, particularly in suburban and secondary urban markets. Independent doctors and physician groups are recognizing urgent care as a viable extension of their practice and a means of diversifying revenue streams. These centers often benefit from strong community ties, personalized patient care, and flexibility in operations. Moreover, regulatory support for physician entrepreneurship and lower startup costs have made it easier for providers to establish or convert clinics into urgent care models. Physician-owned UCCs are also increasingly collaborating with larger networks or using telemedicine partnerships to scale their services without sacrificing independence.

Country-Level Analysis: United States

In the United States, the urgent care sector is benefiting from favorable demographics, regulatory backing, and healthcare consumerism. Major urban centers have seen saturation in UCCs, but secondary and tertiary cities are experiencing a surge in demand. Insurance providers, including Medicare Advantage and private payers, have updated policies to reimburse for a wider array of urgent care procedures, encouraging utilization.

Several states, including Florida, Texas, and California, are hubs for urgent care expansion due to high population growth and medical demand. Additionally, the integration of urgent care into accountable care organizations (ACOs) and patient-centered medical homes is improving care continuity. U.S. health systems like Cleveland Clinic and Mayo Clinic are either launching or affiliating with urgent care arms to extend their reach. Legislative efforts to standardize urgent care accreditation and data sharing with hospitals are also gaining momentum, ensuring that UCCs become a permanent fixture in the national care delivery model.

Some of the prominent players in the U.S. urgent care centers market include:

- Concentra, Inc.,

- American Family Care

- CityMD Urgent Care

- MedExpress Urgent Care

- NextCare Urgent Care

- Tenet Health Urgent Care

- FastMed Urgent Care

- Ascension Health Urgent Care

- Aurora Urgent Care

- WellNow Urgent Care

- Sutter Health

- Intuitive Health

Recent Developments

-

March 2025 – MedExpress Urgent Care, owned by Optum, announced a strategic partnership with Walmart Health to co-develop hybrid retail urgent care sites in select U.S. markets.

-

February 2025 – CityMD expanded its New Jersey footprint by opening six new centers, citing strong demand for after-hours pediatric services and digital check-in capabilities.

-

January 2025 – Carbon Health raised $150 million in a new funding round aimed at expanding its presence in underserved urban neighborhoods and introducing AI-supported triage tools.

-

November 2024 – GoHealth Urgent Care and Northwell Health jointly launched a virtual urgent care app offering 24/7 tele-consultations with licensed providers in New York State.

-

October 2024 – Concentra introduced a mobile urgent care van service targeting industrial parks and construction sites, blending occupational health and minor injury services on location.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. urgent care centers market

Application

- Acute respiratory infection

- General Symptoms

- Injuries

- Joint/Soft Tissue Issues

- Digestive System Issues

- Skin Infections

- Urinary Tract Infections

- Ear Infections

- Sprains, Strains, and Fractures

- Influenza Pneumonia

- Disease of Respiratory Tract

- Others

Ownership

- Hospital

- Corporation

- Physicians

- Others