U.S. Varicose Vein Treatment Devices Market Size and Research 2024-2033

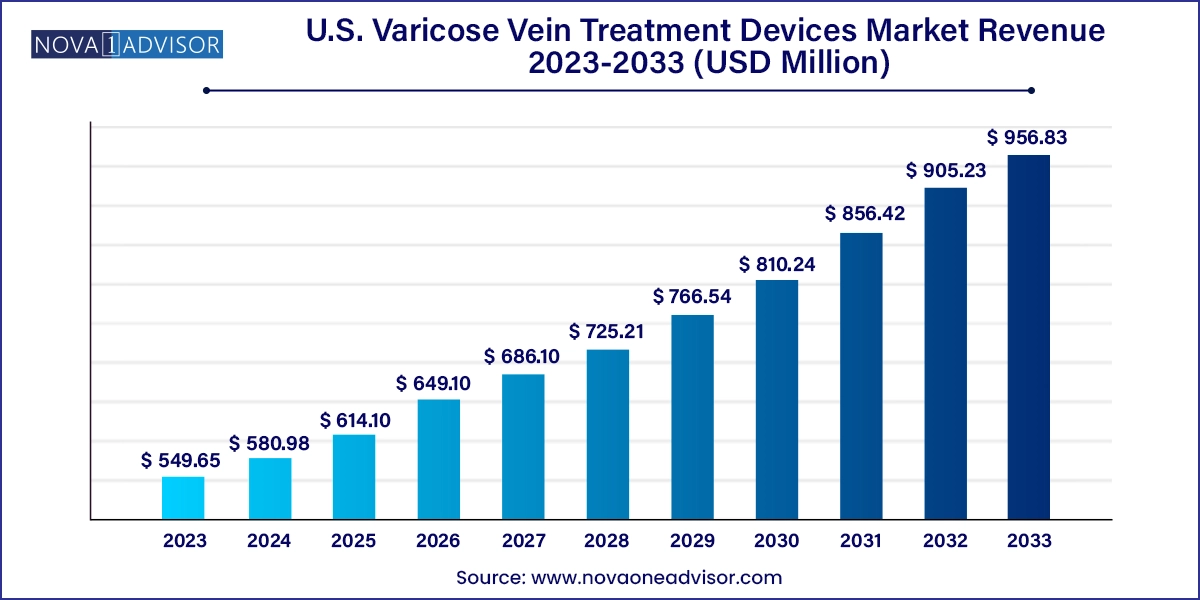

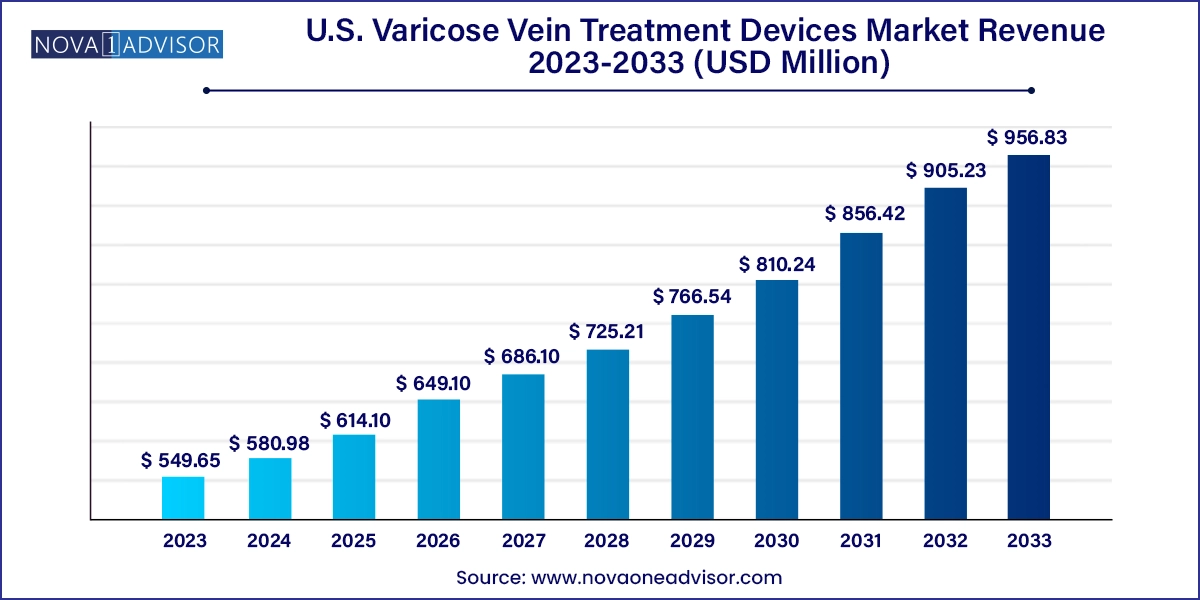

The U.S. varicose vein treatment device market size was exhibited at USD 549.65 million in 2023 and is projected to hit around USD 956.83 million by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

U.S. Varicose Vein Treatment Devices Market Key Takeaways:

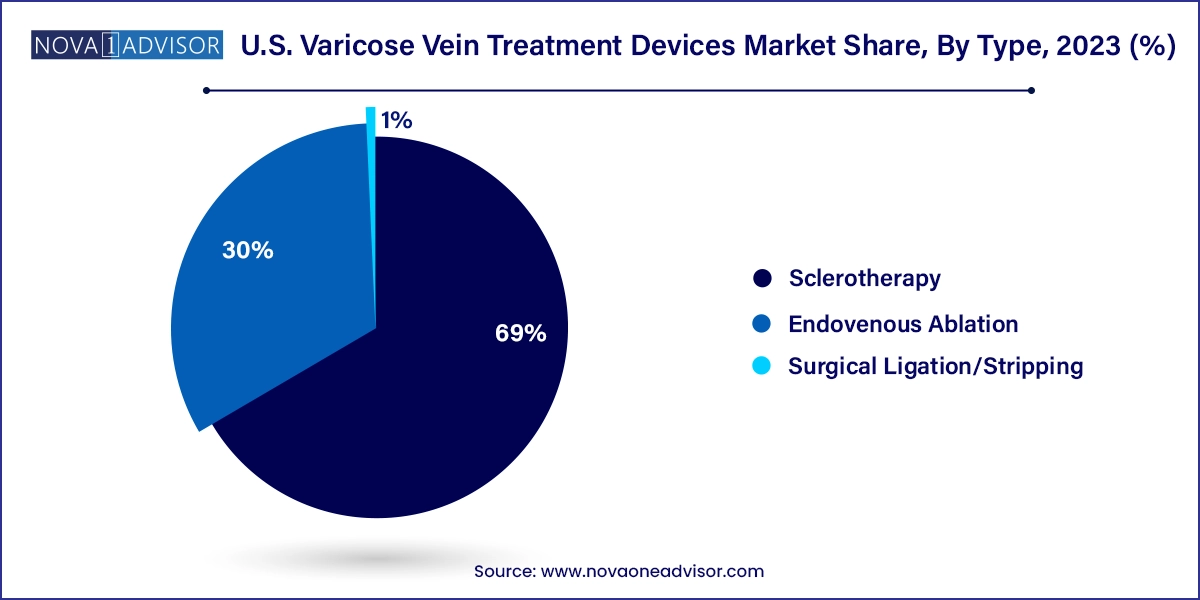

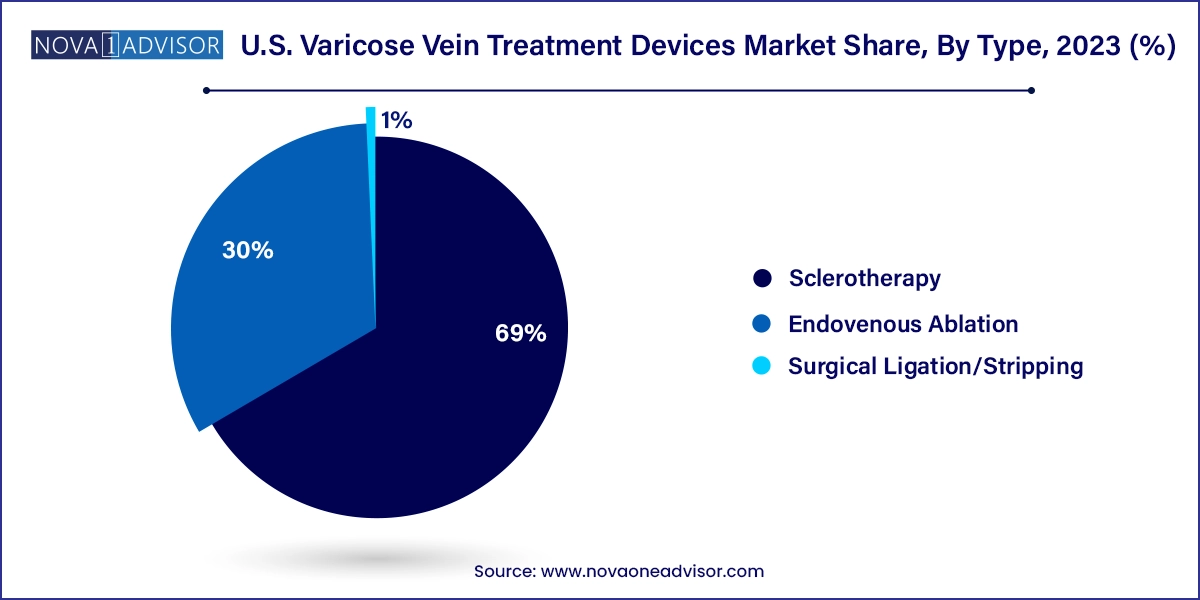

- The injection sclerotherapy segment accounted for the largest revenue share of 69.0% in 2023.

- The endovenous ablation emerged as the fastest-growing segment.

Market Overview

The U.S. varicose vein treatment devices market represents a dynamic and evolving segment of the broader vascular healthcare industry, fueled by the rising prevalence of chronic venous diseases and growing demand for minimally invasive treatment options. Varicose veins, characterized by enlarged, twisted veins—most commonly in the lower limbs—affect a significant portion of the adult population in the U.S., with estimates suggesting that nearly 23% of Americans are impacted to varying degrees.

This increasing incidence, especially among women, aging individuals, obese patients, and those with a sedentary lifestyle, has created a fertile environment for the growth of novel and more effective treatment devices. The market has shifted away from traditional surgical interventions to advanced minimally invasive solutions such as endovenous ablation techniques, radiofrequency-based treatments, and sclerotherapy. These techniques offer benefits such as reduced recovery time, fewer complications, and greater procedural precision.

Technological advancements have further driven innovation, enabling device manufacturers to develop systems that deliver higher success rates with less discomfort. As a result, both outpatient clinics and specialized vascular centers are increasingly adopting these treatments. Favorable reimbursement scenarios, a growing preference for aesthetic wellness, and the increasing awareness of early intervention options are accelerating market adoption.

Major Trends in the Market

-

Minimally Invasive Techniques Replace Open Surgery: Radiofrequency ablation and endovenous laser therapy are replacing surgical stripping due to lower risks and faster recovery.

-

Increased Adoption of Office-Based Procedures: A growing number of varicose vein treatments are being performed in outpatient and office-based labs (OBLs), supported by streamlined reimbursement.

-

Integration of Imaging and Navigation Technology: Real-time ultrasound and image-guided ablation are enhancing accuracy and procedural safety.

-

Shift Toward Aesthetic and Preventive Care: Patients are increasingly seeking treatment earlier for cosmetic reasons and lifestyle quality, rather than waiting for complications.

-

Growth of Combination Therapy Devices: Devices that integrate sclerotherapy with ablation or radiofrequency provide comprehensive treatment in a single session.

-

Rise of Teleconsultation and Early Diagnosis Tools: Virtual consultations are enabling earlier patient assessment and scheduling for elective procedures.

-

Increasing Participation of Ambulatory Surgical Centers (ASCs): The shift to cost-efficient care delivery models like ASCs is expanding accessibility to high-quality vein care.

-

Expansion of Insurance Coverage for Chronic Venous Insufficiency: Better coverage is encouraging more patients to pursue treatment, especially for symptomatic cases.

Report Scope of U.S. Varicose Vein Treatment Devices Market

Market Driver: Rising Prevalence of Chronic Venous Disorders in the U.S.

A primary driver of growth in the U.S. varicose vein treatment devices market is the increasing prevalence of chronic venous disorders (CVD). Aging populations, rising obesity rates, prolonged standing or sedentary lifestyles, and genetic predispositions are all contributing factors. According to studies, nearly one in four adults in the U.S. experiences varicose veins, with a higher prevalence among women and individuals over the age of 50.

The burden of chronic venous insufficiency (CVI) and varicose veins extends beyond cosmetic concerns to serious complications such as leg ulcers, venous stasis dermatitis, and thrombophlebitis. These clinical complications have fueled demand for timely and effective treatment solutions. Healthcare providers are now more proactive in diagnosing and treating early-stage varicose veins to prevent disease progression.

Medical technology companies are responding by delivering increasingly refined treatment options—especially those that can be performed in outpatient settings without general anesthesia. These trends are collectively accelerating market penetration and adoption rates of minimally invasive varicose vein treatment devices across the country.

Market Restraint: High Cost of Advanced Treatment Devices and Limited Access

Despite notable advancements, the high cost of varicose vein treatment devices and associated procedures remains a significant barrier, particularly for patients without comprehensive insurance coverage. While most insurers cover symptomatic cases, treatments performed for purely cosmetic reasons are often excluded from reimbursement plans.

Advanced devices such as endovenous laser systems or radiofrequency ablation kits come with substantial capital costs. Smaller clinics and outpatient centers, especially in rural or underserved areas, may be unable to justify the investment. Additionally, training requirements for complex device usage and the need for supportive imaging tools like duplex ultrasound increase the overall procedural cost.

These economic and accessibility barriers can deter early treatment, allowing the disease to progress into more complicated and costly stages. Manufacturers are under pressure to deliver cost-effective, easy-to-use solutions that maintain clinical efficacy while minimizing procedural overhead.

Market Opportunity: Innovation in Patient-Centric, Office-Based Treatment Solutions

One of the most promising opportunities in the U.S. varicose vein treatment devices market lies in the expansion of patient-centric, office-based treatment models. With increasing awareness and comfort around aesthetic procedures, a growing number of patients are seeking quick, outpatient options for managing varicose veins without hospitalization.

This trend has given rise to ambulatory surgical centers (ASCs), dermatology clinics, and vascular outpatient centers equipped with compact, user-friendly devices capable of performing safe and effective treatments. Manufacturers who can deliver systems that are portable, require minimal training, and integrate with standard imaging modalities are well-positioned to dominate this niche.

Furthermore, integration with telehealth tools—such as digital pre-assessments, image uploads, and virtual consultations—can increase patient acquisition and retention, particularly for younger, health-conscious demographics seeking preventive care. Expansion into mobile treatment units or traveling vascular clinics may also open new revenue streams in suburban and rural markets.

U.S. Varicose Vein Treatment Devices Market By Type Insights

Endovenous ablation therapy leads the U.S. market, thanks to its minimally invasive nature and high success rate in treating saphenous vein reflux and other forms of superficial venous insufficiency. It includes both endovenous laser therapy (EVLT) and radiofrequency ablation (RFA), both of which use thermal energy to collapse and seal the problematic vein.

Among these, radiofrequency ablation is slightly more dominant, due to its lower risk of bruising, reduced post-procedure discomfort, and broader physician familiarity. Companies such as Medtronic (with the ClosureFast system) and Venclose (acquired by Boston Scientific) have popularized RFA systems that offer consistent outcomes and are widely used in office-based procedures.

The ease of performing the procedure under local anesthesia and its reduced downtime for patients has made RFA a first-line treatment in most U.S. vein clinics. As newer thermal and non-thermal ablation methods continue to emerge, manufacturers continue to refine RF catheters and fibers for enhanced control and precision.

While endovenous ablation dominates the landscape, sclerotherapy is the fastest-growing segment, particularly for treating smaller varicosities and spider veins. Foam sclerotherapy has gained popularity due to its ability to treat larger vein segments with fewer injections and better patient tolerability.

Sclerotherapy is not only more cost-effective but also increasingly preferred for cosmetic corrections, often delivered in quick 15-30 minute sessions. As a result, dermatology and cosmetic clinics across the U.S. are adopting sclerotherapy devices that offer better delivery precision, smaller gauges, and consistent foam generation.

Recent innovations such as ultrasound-guided sclerotherapy and combination therapies (e.g., using sclerosing agents post-ablation) are expanding its clinical utility. Vendors who develop needleless delivery systems or offer improved visualization during injection are likely to benefit from this trend.

Country-Level Analysis

In the United States, the varicose vein treatment devices market reflects both urban healthcare advancements and disparities in access across rural regions. Urban and suburban populations benefit from widespread access to vein clinics, outpatient surgical centers, and hospital-based vascular services. States like California, Texas, Florida, and New York house a large concentration of cosmetic and medical vein treatment centers due to higher patient volumes and income levels.

However, rural regions often face access challenges due to limited vascular specialists and high procedural costs. Telemedicine and traveling vascular services are slowly bridging this gap. Public and private insurers, including Medicare, generally provide reimbursement for medically necessary varicose vein treatments, which has encouraged older adults to pursue early intervention.

Moreover, the rising popularity of office-based labs (OBLs) in the Midwest and South is making advanced treatments more accessible, driving overall national market expansion. Policy reforms around CMS reimbursements and expanded CPT codes for vein procedures are also facilitating faster billing cycles and greater procedural transparency.

Some of the prominent players in the U.S. varicose vein treatment device market include:

- Medtronic

- AngioDynamics

- Candela Corporation

- Lumenis Be Ltd.

- biolitec Holding GmbH & Co KG

- Eufoton s.r.l.

- Energist

- Quanta System

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. varicose vein treatment device market

Type

-

- Endovenous Laser Therapy

- Radiofrequency Ablation

- Sclerotherapy

- Surgical Ligation/Stripping