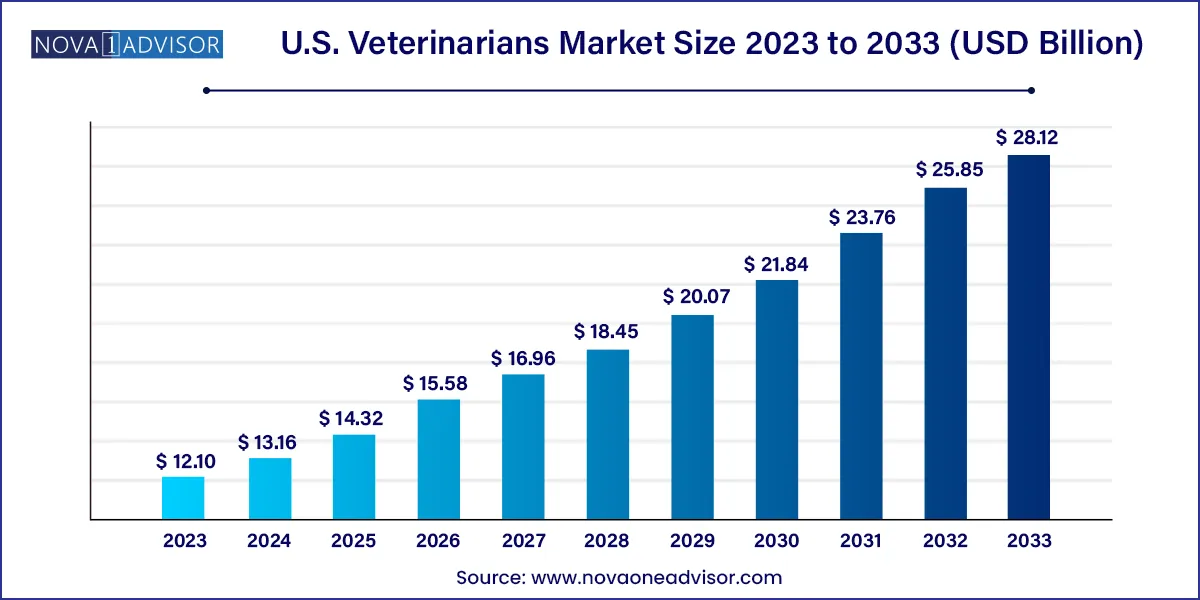

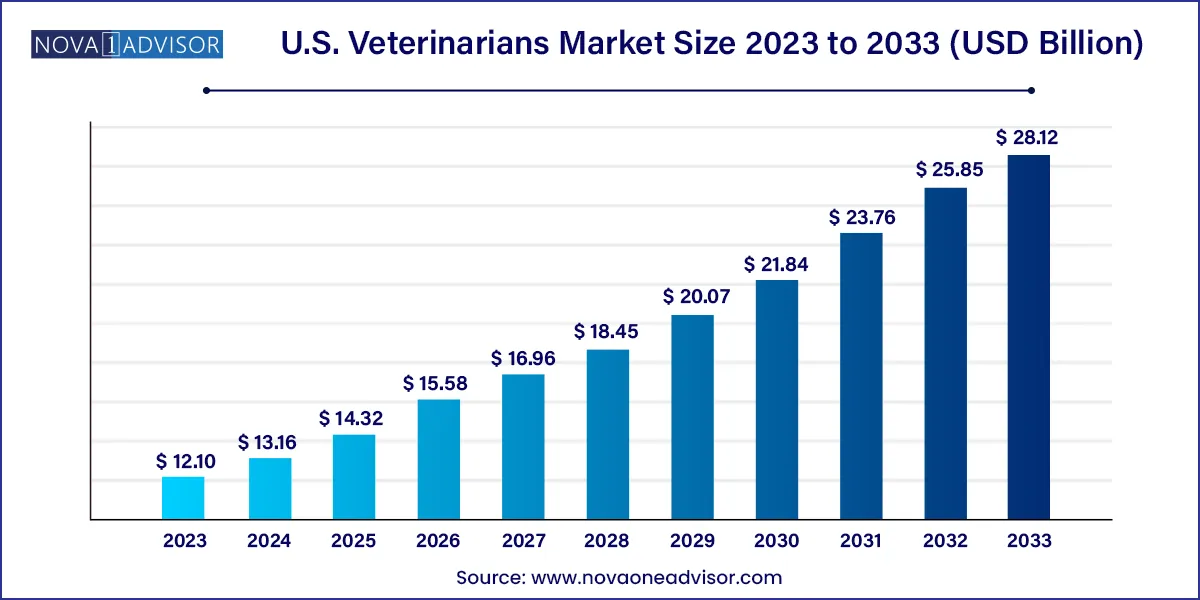

U.S. Veterinarians Market Size and Growth

The U.S. veterinarians market size was exhibited at USD 12.10 billion in 2023 and is projected to hit around USD 28.12 billion by 2033, growing at a CAGR of 8.8% during the forecast period 2024 to 2033.

Key Takeaways:

- By sector, the private segment held the largest revenue share of the U.S. veterinarians market in 2023.

- This contributed to the dominant share of the companion animal exclusive segment in the private sector in 2023.

Market Overview

The U.S. veterinarians market plays a critical role in maintaining the health and welfare of animals, including companion pets, livestock, and exotic species. As the bond between humans and animals continues to grow, particularly in urban and suburban households, the demand for veterinary services has surged. Additionally, the United States is home to a robust livestock and poultry industry that further drives the need for veterinary professionals. The market encompasses services provided by private practitioners, public veterinary health officials, academic institutions, and research entities.

In recent years, the market has evolved considerably due to shifts in consumer attitudes towards pet care, advances in veterinary technology, and increased awareness about zoonotic diseases. This evolution is supported by increased pet ownership, rising expenditures on pet health, and expanded roles for veterinarians in food safety and public health. As of 2025, the U.S. veterinarians market remains one of the most mature and regulated globally, with strong educational infrastructure and certification standards set by the American Veterinary Medical Association (AVMA).

The veterinary workforce in the U.S. is also expanding into interdisciplinary fields such as animal behavior, preventive medicine, and even telemedicine. Although traditionally focused on companion and farm animals, veterinarians now contribute extensively to public health initiatives, biomedical research, and climate resilience strategies involving animal populations. The intersection between veterinary and human health often referred to as the One Health approach continues to gain relevance, especially post-COVID-19, emphasizing veterinarians’ role in early detection and management of zoonoses.

Major Trends in the Market

-

Telehealth integration in veterinary services: The pandemic accelerated the adoption of virtual consultations and remote monitoring for pets, with companies like Vetster and Dutch leading tele-vet platforms.

-

Rising demand for companion animal care: Pet humanization has driven a boom in wellness exams, vaccinations, and even elective surgeries.

-

Shortage of veterinary professionals: Despite growing demand, there is a talent crunch in rural and underserved regions, impacting service availability.

-

Increased veterinary involvement in zoonotic disease surveillance: Public health agencies now collaborate with veterinarians for early outbreak detection.

-

Growth of corporate veterinary chains: Entities such as Banfield Pet Hospital and VCA are consolidating private practices into larger corporate models.

-

Niche specialization among veterinarians: Subfields like dermatology, oncology, and dentistry are becoming mainstream.

-

Veterinary education debt concerns: Rising tuition costs are leading to discussions on debt forgiveness and education reform.

-

AI and data analytics in veterinary diagnostics: Startups are using machine learning to read radiographs and diagnose diseases faster.

-

Sustainable practices in livestock health management: Environmentally conscious practices are reshaping veterinary roles in animal agriculture.

-

Expanded insurance coverage for pets: Providers like Trupanion and Nationwide are driving increased veterinary visits through coverage accessibility.

Report Scope of The U.S. Veterinarians Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 13.16 Billion |

| Market Size by 2033 |

USD 28.12 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Sector |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

Key Market Driver: Rising Pet Ownership and Humanization

One of the primary drivers of the U.S. veterinarians market is the rising trend of pet ownership, particularly among millennials and Gen Z. Pets are no longer viewed merely as animals but are increasingly considered family members. This shift has led to a surge in pet wellness services, nutrition management, behavior training, and preventive care—all requiring veterinary expertise. According to the American Pet Products Association (APPA), U.S. households spent over $147 billion on pets in 2023, a significant share of which was directed toward veterinary services.

This humanization has not only increased visit frequency but also raised expectations for the quality and scope of care. Advanced diagnostics, surgical interventions, and post-operative therapy, once reserved for humans, are now commonplace in pet care. As a result, veterinarians are under greater pressure to diversify their skillsets and provide holistic health solutions. This trend is expected to sustain long-term growth in the market, especially as urban dwellers invest in high-quality care for their companion animals.

Key Market Restraint: Veterinary Labor Shortage

While the demand for veterinary services continues to grow, the supply of qualified professionals has not kept pace. This mismatch is particularly acute in rural and agricultural communities where food animal veterinarians are crucial. According to the U.S. Department of Agriculture, more than 500 counties in the country face shortages of food animal veterinary services. Additionally, a growing number of veterinary graduates prefer companion animal practices in urban areas due to better pay and working conditions.

This labor shortage has significant implications for animal health, food safety, and even public health. Emergency veterinary clinics in underserved regions often operate beyond capacity, leading to increased stress and burnout among existing staff. Furthermore, educational bottlenecks such as limited veterinary school seats and high tuition fees discourage potential candidates. Addressing this restraint requires federal incentives, expanded training programs, and initiatives to improve work-life balance for veterinarians.

Key Market Opportunity: Technological Integration and Digital Health

A substantial opportunity lies in the growing integration of digital technologies in veterinary practices. From AI-powered imaging software to wearable health trackers for pets, digital solutions are transforming diagnosis, monitoring, and follow-up care. Companies like Idexx Laboratories and Zoetis are at the forefront of veterinary tech innovation. Their platforms allow veterinarians to make quicker and more accurate clinical decisions, thereby improving treatment outcomes.

In addition to diagnostics, telemedicine is emerging as a promising avenue, particularly for initial consultations and post-treatment monitoring. For example, Pawp, a U.S.-based startup, offers 24/7 access to licensed vets via video calls, filling gaps in after-hours care. These tools not only enhance the customer experience but also increase veterinarians’ reach without additional physical infrastructure. As regulations evolve to support remote consultations, digital health could become a major pillar in veterinary service delivery.

U.S. Veterinarians Market By Sector Insights

The private segment holds the largest share of the U.S. veterinarians market, encompassing diverse subcategories such as companion animal predominant, food animal predominant, mixed animal, and equine practices. Among these, Companion Animal Exclusive and Companion Animal Predominant dominate due to the high volume of pet visits and revenue-generating services like wellness checkups, dental care, and elective surgeries. According to the American Veterinary Medical Association, over 75% of private practice veterinarians cater primarily to companion animals. This dominance is bolstered by urbanization and shifting lifestyle patterns that favor pet adoption and intensive pet care.

Conversely, the fastest-growing subsegment is the Mixed Animal Practice, which handles both companion and food animals. This growth stems from the need for versatile practitioners in semi-rural and suburban areas where diversified animal populations exist. Veterinarians in this category offer broad services ranging from small animal surgeries to herd health consultations, making them indispensable in geographically expansive states like Texas and California. Their adaptability makes mixed animal practices ideal for filling service gaps in underserved communities.

While the academic segment does not command a large market share, it plays a crucial role in shaping the future of veterinary medicine. Academic institutions such as Cornell University College of Veterinary Medicine and UC Davis are not only centers for education but also engage in high-impact research, especially in zoonotic diseases, comparative genomics, and vaccine development. These institutions collaborate with pharmaceutical firms and government agencies to produce evidence-based protocols, thereby influencing national policies.

The public sector, encompassing veterinarians employed by government agencies such as the USDA, FDA, and CDC, is also critical, particularly in disease surveillance and food safety. Public veterinarians oversee programs like rabies control, livestock health monitoring, and import/export animal inspections. Their work has become increasingly relevant in the wake of pandemics and the globalization of food chains. The fastest-growing area within the public sector is zoonotic disease management, supported by federal funding and collaborative One Health initiatives.

Among specialized private practices, the Equine segment, while niche, holds strategic importance in equestrian-centric regions such as Kentucky and Florida. Equine veterinarians provide specialized services including orthopedic surgeries, reproductive care, and performance evaluations. This subsegment is relatively insulated from economic downturns, as it serves elite horse owners, racing stables, and equine therapy centers.

Additionally, the "Others" category comprising exotic animal care, zoo veterinary services, and marine mammal health—is witnessing modest but stable growth. Veterinarians in this space often work in collaboration with conservation groups and wildlife rehabilitation centers. These services, while not widespread, are vital for biodiversity conservation and public education through institutions like the San Diego Zoo and National Aquarium in Baltimore.

Country-Level Analysis: United States

The United States remains a global leader in veterinary service provision, research, and innovation. With over 120,000 active veterinarians as of 2024, the country has a well-structured ecosystem that spans private practice, academia, public health, and corporate chains. States like California, Texas, Florida, and New York represent significant demand centers due to their large populations, high pet ownership rates, and agricultural output.

Urban areas tend to attract a higher density of companion animal practitioners, while states with significant livestock populations, such as Iowa and Nebraska, see higher demand for food animal veterinarians. The AVMA’s recent workforce studies show a widening disparity in service availability between urban and rural zones. In response, initiatives like the VMLRP (Veterinary Medicine Loan Repayment Program) aim to incentivize practice in underserved areas. Furthermore, increasing multicultural awareness and bilingual vet services are improving accessibility in diverse communities, particularly in Southern and Western states.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. veterinarians market.

Sector

-

- Food Animal Exclusive

- Food Animal Predominant

- Mixed Animal

- Companion Animal Predominant

- Companion Animal Exclusive

- Equine

- Others