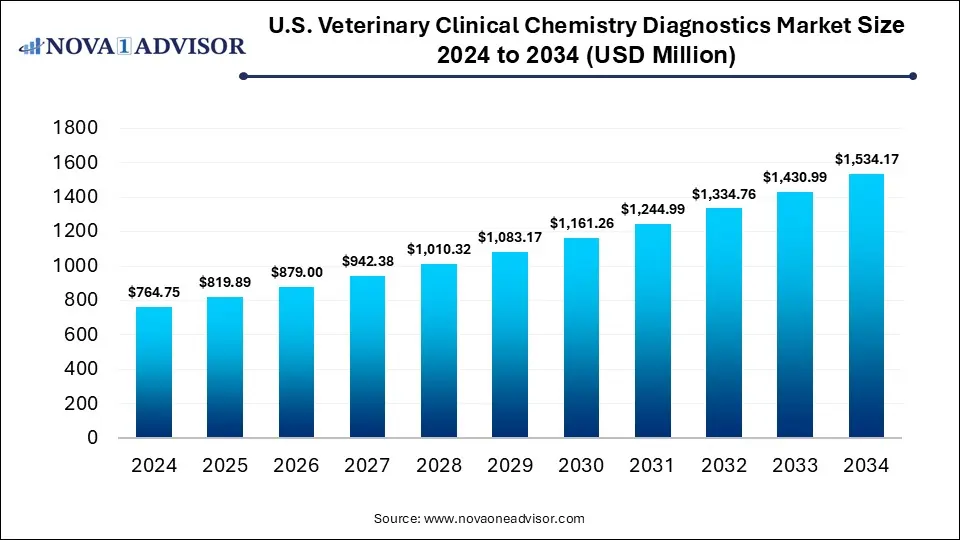

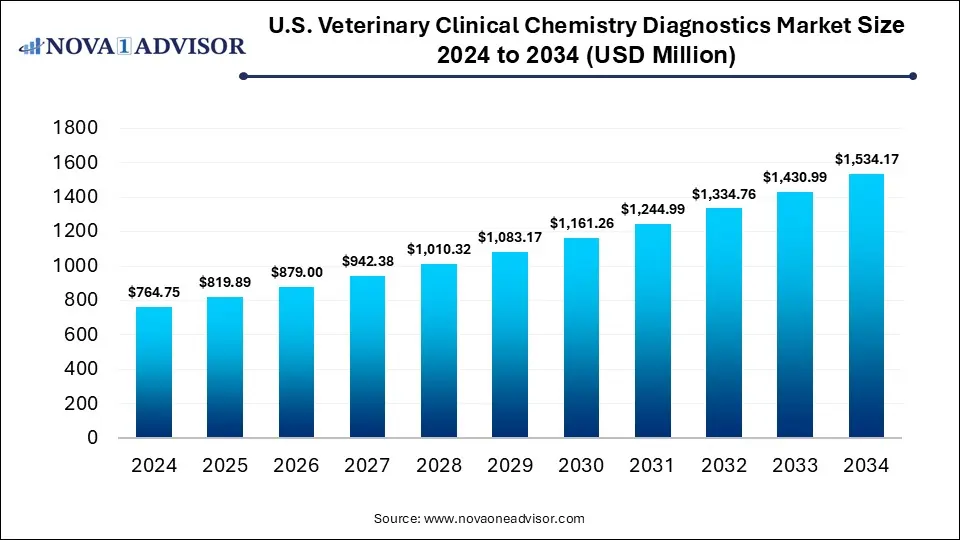

U.S. Veterinary Clinical Chemistry Diagnostics Market Size and Growth 2025 to 2034

The U.S. veterinary clinical chemistry diagnostics market size is calculated at USD 764.75 million in 2024, grows to USD 819.89 million in 2025, and is projected to reach around USD 1,534.17 million by 2034, growing at a CAGR of 7.21% from 2025 to 2034. The market is growing due to rising pet ownership and increasing spending on animal healthcare. Advancements in diagnostic technologies and a shift towards preventive care are further fueling market growth.

U.S. Veterinary Clinical Chemistry Diagnostics Market Key Takeaways

- By product, the consumables, reagents, & kits segment dominated the U.S. veterinary clinical chemistry diagnostics market with a revenue share in 2024.

- By product, the equipment & instruments segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By animal, the companion animals segment led the market with the largest revenue share in 2024.

- By animal, the production animals segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By test, the renal function tests (RFT) segment held the largest market share in 2024.

- By test, the electrolyte panel segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By sample, the blood, plasma, serum segments held the highest market share in 2024.

- By sample, the urine segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the veterinarians segment dominated the market with the major revenue share in 2024.

- By end user, the animal owners and producers segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are Veterinary Clinical Chemistry Diagnostics?

Veterinary clinical chemistry diagnostics refer to laboratory tests that measure biochemical markers in animal blood or fluids to assess organ function, detect diseases, and guide treatment. The veterinary clinical chemistry diagnostics market is expanding as livestock farming and companion animal populations rise globally, creating higher demand for regular health monitoring. The growing incidence of chronic and infectious diseases in animals, coupled with the need for improved food safety and animal productivity, is boosting diagnostic use. Moreover, the adoption of point-of-care testing and the integration of digital veterinary solutions is further accelerating market growth.

What are the Key trends in the U.S. Veterinary Clinical Chemistry Diagnostics Market in 2024?

- In September 2024, Zoetis Inc. launched Vetscan OptiCell, an AI-driven, cartridge-based hematology analyzer that provides accurate CBC results directly at the point of care. The system delivers lab-quality outcomes while saving time, reducing costs, and optimizing space for veterinary clinics.(Source: https://news.zoetis.com)

- In January 2024, Center Point Bio-Tech, LLC (CPB) unveiled AlphaION at the U.S. Veterinary Meeting & Expo, introducing its innovative, patent-pending diagnostic system designed for veterinary practices. (Source: https://www.microvetdiagnostics.com/)

How Can AI Affect the U.S. Veterinary Clinical Chemistry Diagnostics Market?

AI can impact the U.S. veterinary clinical chemistry diagnostics market by facilitating the integration of large datasets from diverse sources, such as lab results, imaging, and electronic health records, to deliver more comprehensive animal health insights. It can also personalize diagnostics by identifying subtle trends across breeds or species. Additionally, AI-driven automation in equipment maintenance and inventory management can streamline operations, while remote diagnostic support powered by AI can expand access to advanced veterinary care in underserved areas.

Report Scope of U.S. Veterinary Clinical Chemistry Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 819.89 Million |

| Market Size by 2034 |

USD 1,534.17 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.21% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Animal, Test, Sample, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Heska Corporation; Beckman Coulter; Siemens Healthineers AG; Randox Laboratories; Skyla Corporation; Woodley Equipment Company Ltd; ARKRAY, Inc |

Market Dynamics

Driver

Rising Prevalence of Chronic and Infectious Diseases

The increasing occurrence of chronic and infectious diseases in animals pushes the U.S. veterinary clinical diagnostic market, and it compels veterinarians to perform frequent and comprehensive testing. This trend drives the adoption of advanced diagnostic tools that can quickly identify health issues, monitor disease progression, and support preventive care. Additionally, pet owners' growing concerns for long-term animal health and productivity in livestock further fuel demand for reliable and efficient clinical chemistry solutions in veterinary practices.

Restraint

High Cost of Advanced Diagnostic Equipment And Consumables

The high cost of advanced diagnostics equipment and consumables limits the growth of the U.S. veterinary clinical chemistry diagnostics market because many small or independent clinics cannot afford the initial investment or ongoing maintenance. Expensive analyzers, test cartridges, and software upgrades increase operational costs, restricting adoption. Even with the ongoing demand for accurate and rapid diagnostics, there financial barriers prevent widespread use, particularly in rural or low-budget practices, slowing market expansion despite technological advancements.

Opportunity

Expansion into Telemedicine and Remote Veterinary Diagnostics

The growth of telemedicine and remote veterinary diagnostics offers new opportunities in U.S. veterinary clinical chemistry diagnostics market by facilitating continuous monitoring of animal health through wearable sensors and connected devices. This approach allowed early detection of metabolic and organ-related issues, enhanced data-driven treatment decisions, and reduced the burden on clinics. Additionally, integration with cloud-based platforms and mobile veterinarians and pet owners expands services' reach and creates demand for advanced diagnostic solutions.

- For Instance, In January 2024, Zoetis enhanced its Vetscan Imagyst® platform with AI-powered urine sediment analysis, enabling clinics to get fast, accurate results for urinary and kidney conditions at the point of care. (Source:https://news.zoetis.com/)

Segmental Insights

What made the Consumables, Reagents, & Kits Segment Dominant in the U.S. Veterinary Clinical Chemistry Diagnostics Market in 2024?

In 2024, the consumables, reagents, & kits segment led the market because these products are easier to adopt across clinics of all sizes, including small and rural practices. Their standardized formats reduce the need for extensive training and maintenance, enabling efficient workflow. Frequent testing for chronic, infectious, and metabolic conditions ensures recurring demand, while the launch of advanced, multi-analyte kits further boosted their usage, making this segment the highest revenue contributor.

The equipment and instruments segment is projected to record the fastest growth in the U.S. veterinary clinical chemistry diagnostics market because of expanding veterinary infrastructure and rising preference for in-house testing. Clinics are increasingly investing in durable, high-throughput analyzers to reduce reliance on external labs and accelerate diagnosis. Innovations in portable and user-friendly devices, along with growing awareness of preventive animal healthcare, are further encouraging adoption, driving the segment’s rapid revenue growth during the forecast period.

U.S. Veterinary Clinical Chemistry Diagnostics Market By Product, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Consumables, Reagents & Kits |

474.1 |

510.8 |

550.3 |

592.8 |

638.5 |

687.8 |

740.9 |

798.0 |

859.6 |

925.9 |

997.2 |

| Equipment & Instruments |

290.6 |

309.1 |

328.8 |

349.6 |

371.8 |

395.4 |

420.4 |

447.0 |

475.2 |

505.1 |

537.0 |

How did the Companion Animals Segment Dominate the U.S. Veterinary Clinical Chemistry Diagnostics Market in 2024?

The companion animal segment dominated the market in 2024 because of the growing trend of pet humanization and higher willingness of owners to invest in advanced healthcare. Innovations in rapid, point-of-care testing for pets, along with increased availability of veterinary clinics specializing in companion animals, further boosted demand. This segment’s focus on accurate monitoring of lifestyle-related and age-related health conditions contributed significantly to its leading revenue share.

The production animal segment is projected to grow rapidly in the U.S. veterinary clinical chemistry diagnostics market as large-scale farms increasingly adopt advanced diagnostic tools to optimize herd health and prevent outbreaks. Regular monitoring of organ function, nutrition status, and disease biomarkers helps reduce mortality and improve yield. Additionally, rising consumer demand for safe, high-quality animal products encourages investment in in-house diagnostic equipment and testing programs, driving faster adoption and higher growth in this segment compared to others.

U.S. Veterinary Clinical Chemistry Diagnostics Market By Animal, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Companion Animals |

520.0 |

559.2 |

601.2 |

646.5 |

695.1 |

747.4 |

803.6 |

864.0 |

929.0 |

998.8 |

1073.9 |

| Production Animals |

244.7 |

260.7 |

277.8 |

295.9 |

315.2 |

335.8 |

357.7 |

381.0 |

405.8 |

432.2 |

460.3 |

How did the Renal Function Tests (RFT) Segment Dominate the U.S. Veterinary Clinical Chemistry Diagnostics Market?

The renal function test segment dominated the market as veterinarians increasingly rely on these tests to assess overall metabolic health and detect early-stage organ dysfunction. Frequent screening for parameters like blood urea nitrogen and creatinine helps in managing aging pets and high-value livestock. Technological advancements in rapid, accurate renal assays and their integration into point-of-care analyzers have also increased their usage, making this segment the largest revenue contributor in the market.

The electrolyte panel segment is projected to grow at the fastest rate in the U.S. veterinary clinical chemistry diagnostics market as veterinarians increasingly use these tests for real-time monitoring during surgeries, critical care, and intensive therapy. Advances in portable and automated analyzers allow quick, accurate results, enabling immediate corrective treatment for imbalances. Rising adoption of preventive healthcare programs in pets and livestock, along with the need for continuous monitoring in high-value animals, further drives the rapid expansion of this segment.

U.S. Veterinary Clinical Chemistry Diagnostics Market By Test, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Renal Function Test (RFT) |

214.1 |

230.4 |

247.9 |

266.7 |

286.9 |

308.7 |

332.1 |

357.3 |

384.4 |

413.6 |

444.9 |

| Liver Function Test (LFT) |

191.2 |

205.4 |

220.6 |

237.0 |

254.6 |

273.5 |

293.8 |

315.6 |

339.0 |

364.2 |

391.2 |

| Electrolyte Panel |

183.5 |

198.0 |

213.6 |

230.4 |

248.5 |

268.1 |

289.2 |

311.9 |

336.4 |

362.8 |

391.2 |

| Other Tests |

175.9 |

186.1 |

196.9 |

208.3 |

220.3 |

232.9 |

246.2 |

260.2 |

275.0 |

290.5 |

306.8 |

Why the Blood, Plasma, Serum Segment Dominated the U.S. Veterinary Clinical Chemistry Diagnostics Market in 2024?

The blood, plasma, serum segment dominated the market as these sample types allow simultaneous testing for multiple parameters, improving efficiency in veterinary practices. Their stability during transport and storage makes them ideal for both in-clinic and reference laboratory testing. Additionally, the growing use of automated analyzers and high-throughput testing systems, which are optimized for plasma and serum, has further reinforced their preference, making this segment the largest contributor to market revenue.

The urine segment is projected to grow rapidly in the U.S. veterinary clinical chemistry diagnostics market as veterinarians increasingly rely on urine samples for routine wellness checks and disease monitoring without stressing animals. Advances in automated urine analyzers and AI-assisted sediment analysis enhance accuracy and speed, encouraging wider adoption. Moreover, the growing trend of in-home and point-of-care testing for pets, along with regulatory emphasis on livestock health monitoring, is driving increased utilization of urine-based diagnostics during the forecast period.

U.S. Veterinary Clinical Chemistry Diagnostics Market By Sample Type, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Blood/Plasma/Serum |

565.92 |

607.54 |

652.22 |

700.19 |

751.68 |

806.96 |

866.3 |

930.01 |

998.4 |

1071.81 |

1150.62 |

| Urine |

152.95 |

164.39 |

176.68 |

189.89 |

204.09 |

219.34 |

235.74 |

253.36 |

272.29 |

292.64 |

314.5 |

| Other Samples |

45.88 |

47.96 |

50.1 |

52.3 |

54.56 |

56.87 |

59.22 |

61.63 |

64.07 |

66.54 |

69.04 |

What made the Veterinarians Segment Dominant in the U.S. Veterinary Clinical Chemistry Diagnostics Market in 2024?

The veterinarian segment led the market because veterinarians act as the main decision-makers for adopting new diagnostic technologies. Their preference for in-house testing and real-time results encourages clinics to invest in modern analyzers and consumables. Furthermore, increasing specialization in veterinary practices, such as internal medicine and critical care, drives higher usage of diagnostic tests, making this end-user segment the largest revenue contributor and a key influencer in market growth.

The animal owners and producers segment is projected to grow rapidly because of the rising trend of personalized and precision animal healthcare. Pet owners and livestock producers are increasingly investing in diagnostic services to monitor nutrition, growth, and overall health. The availability of user-friendly, point-of-care devices and mobile apps for data tracking enables real-time monitoring, empowering owners to take timely action. This proactive involvement in animal health is driving faster adoption and higher growth in this segment during the forecast period.

U.S. Veterinary Clinical Chemistry Diagnostics Market By End Use, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Reference Laboratories |

351.8 |

378.8 |

407.9 |

439.2 |

472.8 |

509.1 |

548.1 |

590.1 |

635.3 |

684.0 |

736.4 |

| Veterinarians |

359.4 |

384.5 |

411.4 |

440.1 |

470.8 |

503.7 |

538.8 |

576.4 |

616.7 |

659.7 |

705.7 |

| Animal Owners/ Producers |

53.5 |

56.6 |

59.8 |

63.1 |

66.7 |

70.4 |

74.3 |

78.4 |

82.8 |

87.3 |

92.1 |

Regional Insights

How is the U.S. Contributing to the Expansion of the U.S. Veterinary Clinical Chemistry Diagnostics Market?

The U.S. is driving growth in the veterinary clinical chemistry diagnostics market by fostering technological innovation and supporting the commercialization of advanced diagnostic tools. Increasing demand for real-time, in-clinic testing and integration of AI and digital health platforms enhances efficiency and accuracy in animal healthcare. Moreover, rising consumer focus on animal welfare, coupled with strong investment from veterinary diagnostic companies, promotes adoption of modern analyzers and consumables, positioning the U.S. as a leading contributor to market expansion.

Top Companies in the U.S. Veterinary Clinical Chemistry Diagnostics Market

Recent Developments in the U.S. Veterinary Clinical Chemistry Diagnostics Market

- In August 2025, Zomedica collaborated with VerticalVet to provide advanced diagnostic and treatment solutions, such as shockwave and tPEMF therapies, to more than 2,600 independent veterinary practices across the U.S., enhancing access to technology and clinical support nationwide.(Source: https://www.pharmabiz.com/)

- In January 2024, Center Point Bio-Tech introduced AlphaION, a modular veterinary diagnostic system that combines blood, urine, fecal, and bacterial testing with SAW technology and automation, improving diagnostic accuracy, efficiency, and workflow within veterinary clinics. (Source: https://www.microvetdiagnostics.com/)

Segments Covered in the Report

By Product

- Consumables, Reagents & Kits

- Equipment & Instruments

By Animal

-

- Dogs

- Cats

- Horses

- Other Companion Animals

-

- Cattle

- Poultry

- Swine

- Other Production Animals

By Test

- Renal Function Test (RFT)

- Liver Function Test (LFT)

- Electrolyte Panel

- Other Tests

By Sample Type

- Blood/Plasma/Serum

- Urine

- Other Samples

By End Use

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

Lst of Tables

- Table 1: U.S. Veterinary Clinical Chemistry Diagnostics Market Size (USD Million), 2024–2034

- Table 2: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Product, 2024–2034

- Table 3: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Animal, 2024–2034

- Table 4: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Test, 2024–2034

- Table 5: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Sample Type, 2024–2034

- Table 6: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by End Use, 2024–2034

Sub-segment Tables

- Table 7: U.S. Market Size (USD Million) for Consumables, Reagents & Kits vs. Equipment & Instruments, 2024–2034

- Table 8: U.S. Market Size (USD Million) for Companion Animals vs. Production Animals, 2024–2034

- Table 9: U.S. Market Size (USD Million) by Test Type (RFT, LFT, Electrolyte Panel, Others), 2024–2034

- Table 10: U.S. Market Size (USD Million) by Sample Type (Blood/Plasma/Serum, Urine, Others), 2024–2034

- Table 11: U.S. Market Size (USD Million) by End Use (Reference Labs, Veterinarians, Animal Owners/Producers), 2024–2034

- Figure 1: U.S. Veterinary Clinical Chemistry Diagnostics Market Value (USD Million), 2024–2034

- Figure 2: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Product, 2024 vs. 2034

- Figure 3: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Animal, 2024 vs. 2034

- Figure 4: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Test, 2024 vs. 2034

- Figure 5: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by Sample Type, 2024 vs. 2034

- Figure 6: U.S. Veterinary Clinical Chemistry Diagnostics Market Share (%) by End Use, 2024 vs. 2034

Growth & Forecast Figures

- Figure 7: U.S. Veterinary Clinical Chemistry Diagnostics Market CAGR (%) by Product, 2024–2034

- Figure 8: U.S. Veterinary Clinical Chemistry Diagnostics Market CAGR (%) by Animal, 2024–2034

- Figure 9: U.S. Veterinary Clinical Chemistry Diagnostics Market CAGR (%) by Test, 2024–2034

- Figure 10: U.S. Veterinary Clinical Chemistry Diagnostics Market CAGR (%) by Sample Type, 2024–2034

- Figure 11: U.S. Veterinary Clinical Chemistry Diagnostics Market CAGR (%) by End Use, 2024–2034