U.S. Veterinary Oncology Diagnostics Market Size and Trends

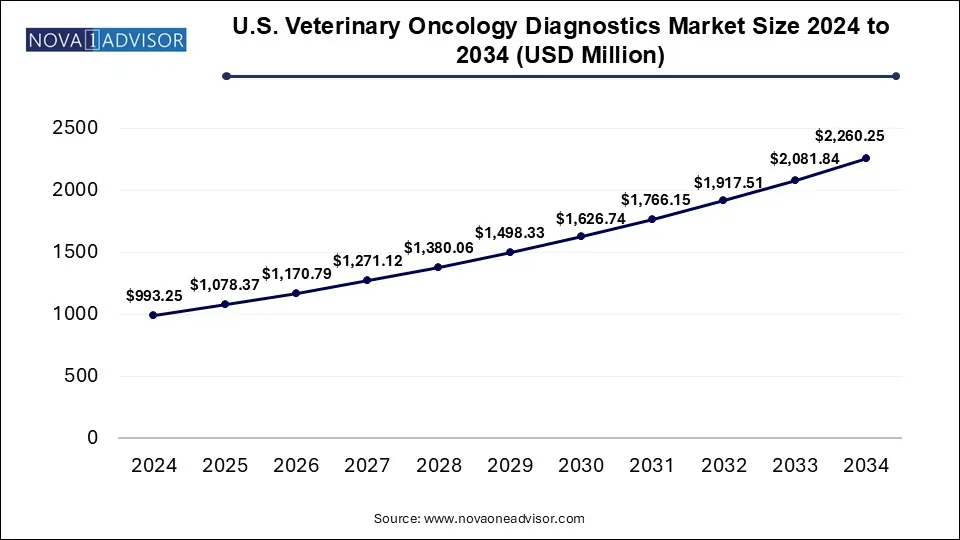

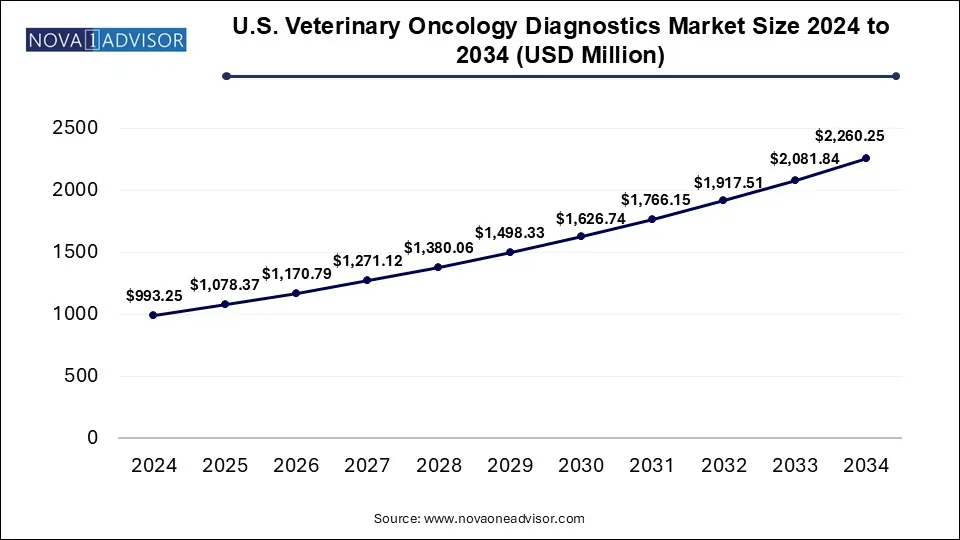

The U.S. Veterinary Oncology Diagnostics Market size was exhibited at USD 993.25 million in 2024 and is projected to hit around USD 2,260.25 million by 2034, growing at a CAGR of 8.57% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, veterinary hospitals and clinics accounted for the highest portion of total revenue, contributing approximately 62% to the overall market share.

- Skin cancer emerged as the top-grossing cancer type in 2024 and is projected to witness the most rapid growth, with a compound annual growth rate (CAGR) of 8.72% throughout the forecast period.

- Among all diagnostic methods, biopsy procedures led the market in 2024, capturing the highest share of revenue.

Canines represented the most significant share of the market in 2024, comprising 74% of total revenue generated.

Market Overview

The U.S. veterinary oncology diagnostics market is experiencing significant growth, driven by a heightened awareness of pet health, increased incidence of animal cancers, and advancements in diagnostic technologies. Companion animals, especially dogs and cats, have increasingly become integral members of households, prompting pet owners to seek sophisticated healthcare options similar to human medicine. Consequently, the veterinary oncology field has evolved to adopt tools like genome sequencing, biopsy imaging, and biomarker-based tests to detect and manage cancers in animals.

Cancer remains one of the leading causes of mortality in pets, especially among aging populations. According to the Veterinary Cancer Society, approximately 1 in 4 dogs will develop cancer at some point in their lives, with nearly half of dogs over the age of 10 diagnosed with some form of cancer. The early detection of such malignancies greatly improves treatment outcomes, making accurate diagnostics crucial. Institutions such as IDEXX Laboratories and Antech Diagnostics have been at the forefront of offering blood-based and molecular cancer testing solutions across veterinary clinics and hospitals in the U.S.

The U.S. market is further shaped by collaborations between veterinary practices and diagnostic laboratories, strategic investments in clinical oncology R&D, and technological advancements such as next-generation sequencing (NGS) and AI-integrated imaging diagnostics. The introduction of digital pathology, minimally invasive biopsy kits, and multi-omics tools is revolutionizing diagnostic accuracy, pushing the market toward a future defined by personalized veterinary oncology.

Major Trends in the Market

-

Rise in Pet Cancer Awareness: Public campaigns and education by organizations like the American Veterinary Medical Association have led to early detection efforts and increased diagnostic testing rates.

-

Growth of Companion Animal Insurance: Insurance providers such as Trupanion are expanding coverage for cancer diagnostics, facilitating access to advanced veterinary oncology services.

-

Integration of Genomics: Whole-genome and targeted gene panel sequencing are becoming increasingly common for the detection of genetic predispositions and tumor mutations.

-

Minimally Invasive Diagnostics: Liquid biopsies and needle aspirations are gaining traction for offering accurate results with reduced animal distress.

-

AI-Enabled Imaging Solutions: Use of artificial intelligence to enhance diagnostic imaging for cancers like mammary tumors and lymphomas.

-

Collaborative Care Networks: Growth in cross-collaboration between veterinary hospitals and centralized reference labs to deliver better diagnostic turnaround times.

-

Expanded Use of Biomarker Panels: Multiplex assays for identifying cancer markers are aiding in early-stage disease detection and differentiation among cancer types.

Report Scope of U.S. Veterinary Oncology Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,078.37 Million |

| Market Size by 2034 |

USD 2,260.25 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 8.57% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Animal Type, Test Type, Cancer Type, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Zoetis; Antech Diagnostics, Inc. (Mars Inc.); IDEXX Laboratories, Inc.; Neogen Corporation; Gold Standard Diagnostics (Eurofins Technologies); Embark Veterinary, Inc.; VolitionRx Limited; CANCAN DIAGNOSTICS; Oncotect, PetDx |

Key Market Driver: Increasing Cancer Prevalence in Companion Animals

The foremost driver catalyzing growth in the U.S. veterinary oncology diagnostics market is the rising prevalence of cancer in domestic pets, particularly dogs and cats. The American College of Veterinary Internal Medicine reports that cancer is the leading cause of death in nearly 47% of dogs, especially those older than 10 years. A similar trend is observed in cats, with lymphomas, sarcomas, and mammary tumors being among the most common malignancies.

This heightened prevalence has intensified the demand for timely and precise diagnostic tools. Early detection significantly improves treatment prognosis and quality of life, making diagnostics a front-line defense in veterinary oncology. Clinics and pet owners are increasingly relying on specialized diagnostic panels, blood markers, and imaging modalities to identify cancer types and progression. As a result, the demand for high-quality veterinary diagnostics is growing in tandem with the cases of pet cancer nationwide.

Key Market Restraint: High Cost of Advanced Diagnostic Tests

Despite growing awareness and demand, the market faces challenges related to the high costs associated with advanced diagnostic procedures. Techniques like NGS-based genome testing, immunohistochemistry, and cross-sectional imaging such as MRI and CT scans can be prohibitively expensive for average pet owners without insurance. Even basic blood and biopsy tests can run into several hundred dollars depending on complexity and turnaround time.

This cost barrier limits the accessibility of veterinary oncology diagnostics to a broader demographic. Veterinary practices in rural and small-town settings often lack access to state-of-the-art equipment or collaborations with large diagnostic labs. Furthermore, the high cost of maintaining diagnostic infrastructure and skilled personnel puts pressure on service providers, thereby restricting widespread market penetration.

Key Market Opportunity: Expansion of Pet Insurance Coverage for Oncology Diagnostics

A significant opportunity lies in the growing coverage offered by pet insurance companies for diagnostic testing. Historically, most pet insurance plans covered only basic care or surgical procedures, excluding cancer diagnostics and treatment. However, as pet owners demand more comprehensive coverage, insurance providers are adapting.

Players like Trupanion, Healthy Paws, and Nationwide now offer plans that reimburse diagnostic expenses related to cancer detection. This shift is not only making diagnostics more affordable but is also encouraging pet owners to opt for early cancer screening. With broader acceptance and availability of insurance, diagnostic labs and veterinary clinics can scale their offerings, contributing to market expansion across both urban and semi-urban regions in the U.S.

Animal Type Outlook

Canine Segment Dominated the Market in 2024

Canines account for the largest share of the U.S. veterinary oncology diagnostics market due to their higher cancer susceptibility compared to other companion animals. With over 90 million dogs owned across the United States, the high population density significantly contributes to the demand for oncology diagnostics. Dogs are more frequently diagnosed with cancers such as lymphoma, osteosarcoma, and mammary gland tumors. Their larger body mass also makes it easier to detect tumors, either through physical examination or imaging. Due to the strong emotional bond between dogs and owners, many pet parents are willing to invest in high-end diagnostic services. This has encouraged veterinary practices to expand their oncology offerings, especially for canines.

Feline oncology diagnostics, while a smaller segment, is witnessing rapid growth. This is largely due to increasing incidences of feline-specific cancers like lymphomas and squamous cell carcinomas. Cats typically exhibit subtle clinical signs of illness, making diagnostics vital for early cancer identification. Diagnostic challenges in felines often require more advanced testing, including genome sequencing and specialized imaging, further fueling segment growth. As awareness increases and diagnostic tools become more tailored for feline physiology, this segment is expected to outpace others in CAGR through 2034.

Test Type Outlook

Blood Tests Emerged as the Most Utilized Diagnostic Tool

Blood tests are the most commonly performed diagnostic procedure in veterinary oncology. These tests are cost-effective, minimally invasive, and often provide valuable insights into a pet’s overall health, including indications of systemic diseases such as leukemia or lymphoma. Technologies like CBC (complete blood count), serum chemistry panels, and biomarker testing help veterinarians detect tumor activity, organ involvement, and metabolic disturbances caused by neoplastic conditions. Companies like IDEXX have pioneered blood-based cancer tests, offering comprehensive panels that veterinarians can administer in-house or through reference labs.

The fastest-growing segment in this category is genome testing. The ability to identify mutations, oncogenes, and inherited predispositions is transforming cancer care in veterinary medicine. As costs gradually decrease and genomic literacy among veterinarians rises, these tests are being more frequently adopted. Genome-based diagnostics are especially valuable in complex or ambiguous cases, where traditional tests are inconclusive. With the rise of precision veterinary oncology, genome testing is expected to become an indispensable tool in the diagnostic workflow by 2034.

Cancer Type Outlook

Lymphoma Remains the Leading Cancer Diagnosed in Companion Animals

Lymphoma is the most frequently diagnosed cancer among both dogs and cats, making it the dominant cancer type segment in the market. Its prevalence, estimated at over 20% of all canine cancers, drives the demand for rapid diagnostic tools, including blood tests, fine needle aspirates, and immunophenotyping. Lymphomas can affect various organs, including the lymph nodes, spleen, and gastrointestinal tract, necessitating a multi-modal diagnostic approach. Given its aggressiveness and rapid progression, early and accurate diagnosis is critical, and most veterinary practices are equipped to detect it promptly using in-house or lab-supported diagnostics.

While lymphoma dominates in numbers, skin cancers are emerging as the fastest-growing segment due to increased pet exposure to environmental risk factors such as UV radiation, chemicals, and pollutants. Skin tumors are more easily detectable through visual inspection, and diagnostic confirmation often involves biopsies and histopathology. Additionally, breeds like Boxers, Dalmatians, and Golden Retrievers are genetically predisposed to skin malignancies. With the increasing focus on dermatological health in pets, especially in the U.S., this segment is projected to show strong CAGR throughout the forecast period.

End-Use Outlook

Veterinary Hospitals and Clinics Captured the Largest Market Share

Veterinary hospitals and clinics remain the primary end users of oncology diagnostics due to their role as the first point of contact for pet owners. These facilities perform preliminary diagnostics such as blood panels and physical examinations and frequently partner with reference labs for advanced testing. The widespread presence of veterinary hospitals across urban and suburban areas in the U.S., coupled with improved veterinary education and technology access, supports their market dominance. Many clinics are now adopting digital pathology and cloud-based diagnostic platforms, enhancing their diagnostic throughput and case accuracy.

Reference laboratories, such as Antech and IDEXX Reference Labs, are the fastest-growing end-use segment. These facilities handle complex and specialized tests that are not feasible in small or mid-sized clinics, including genomic analysis, immunohistochemistry, and high-resolution imaging. Their ability to process high volumes and deliver accurate results rapidly has made them essential partners in the diagnostic chain. As cancer diagnostics become more molecular and data-intensive, reference labs are expected to become even more critical, offering integrated diagnostic and analytics platforms to support veterinary oncologists.

Country-Level Analysis: United States

The U.S. veterinary oncology diagnostics market is characterized by a high level of technological adoption, increased investment in veterinary care infrastructure, and a consumer base willing to spend significantly on pet healthcare. The American pet care industry is among the largest globally, with expenditure reaching over $136 billion in 2024, a substantial portion of which is allocated to diagnostics and treatment of chronic diseases like cancer.

Urban centers such as Los Angeles, New York, and Chicago have a high concentration of advanced veterinary hospitals equipped with cutting-edge diagnostic technologies. Additionally, several veterinary schools and research centers including those at UC Davis and Cornell have contributed to innovations in oncology diagnostics. These institutions are also central in clinical trials for new diagnostic biomarkers and platforms. Moreover, the expanding network of pet insurance coverage across the U.S. is facilitating access to premium diagnostic services, creating a more inclusive market environment.

Some of The Prominent Players in The U.S. Veterinary Oncology Diagnostics Market Include:

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- IDEXX Laboratories, Inc.

- Neogen Corporation

- Gold Standard Diagnostics (Eurofins Technologies)

- Embark Veterinary, Inc

- VolitionRx Limited

- CANCAN DIAGNOSTICS

- Oncotect

- PetDx

Recent Developments

-

April 2025 – IDEXX Laboratories launched a new next-generation cancer detection panel combining blood-based biomarkers with genomic profiling to improve early detection of lymphoma and sarcoma in dogs.

-

February 2025 – Antech Diagnostics announced its partnership with several veterinary oncology clinics in the U.S. to provide integrated AI-powered imaging diagnostics for rapid identification of mammary gland tumors.

-

January 2025 – PetDx, a molecular diagnostics company, expanded its testing facility in San Diego and launched its updated “OncoK9” test, aimed at early detection of multiple canine cancers through liquid biopsy.

-

October 2024 – Zoetis announced its investment in veterinary oncology research, focusing on AI-powered genomic diagnostics and novel cancer biomarkers in pets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Animal Type

By Test Type

- Blood Tests

- Biopsy

- Genome testing

- Endoscopy

- Urinalysis

- Imaging

By Cancer Type

- Lymphoma

- Sarcomas

- Mammary Gland Tumors

- Skin Cancers

- Others

By End-Use

- Reference Laboratories

- Veterinary hospitals and clinics