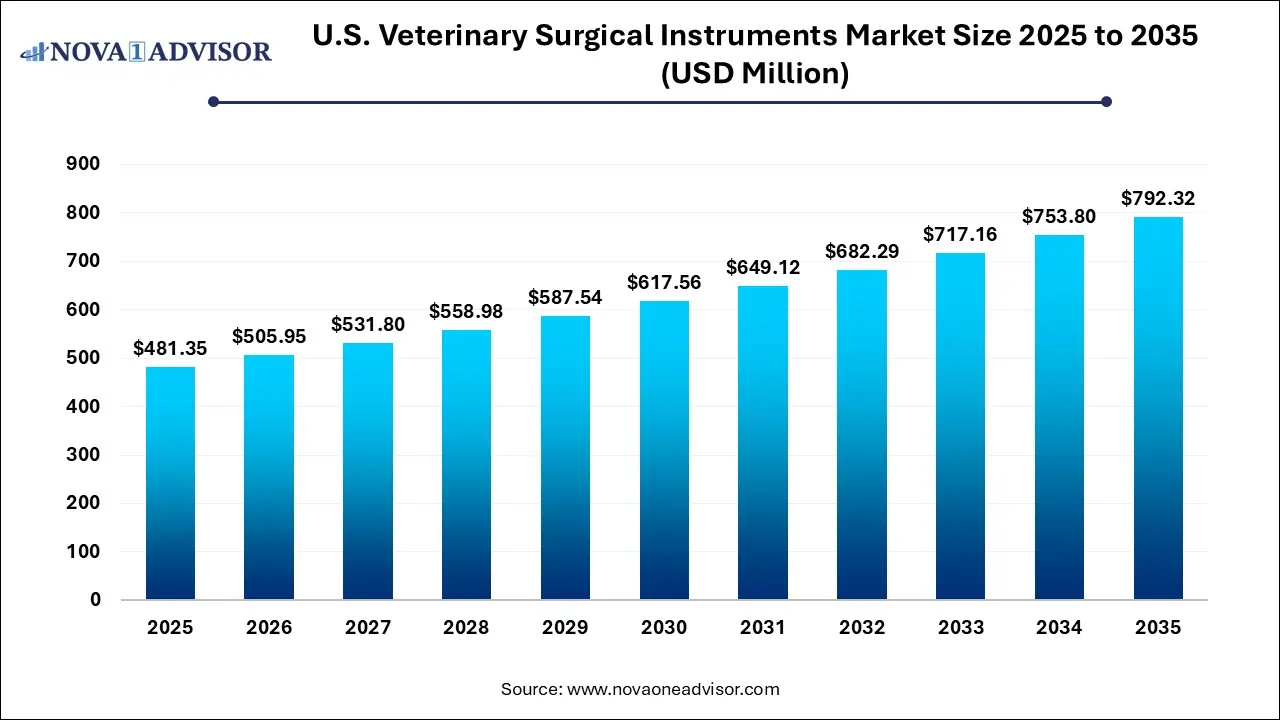

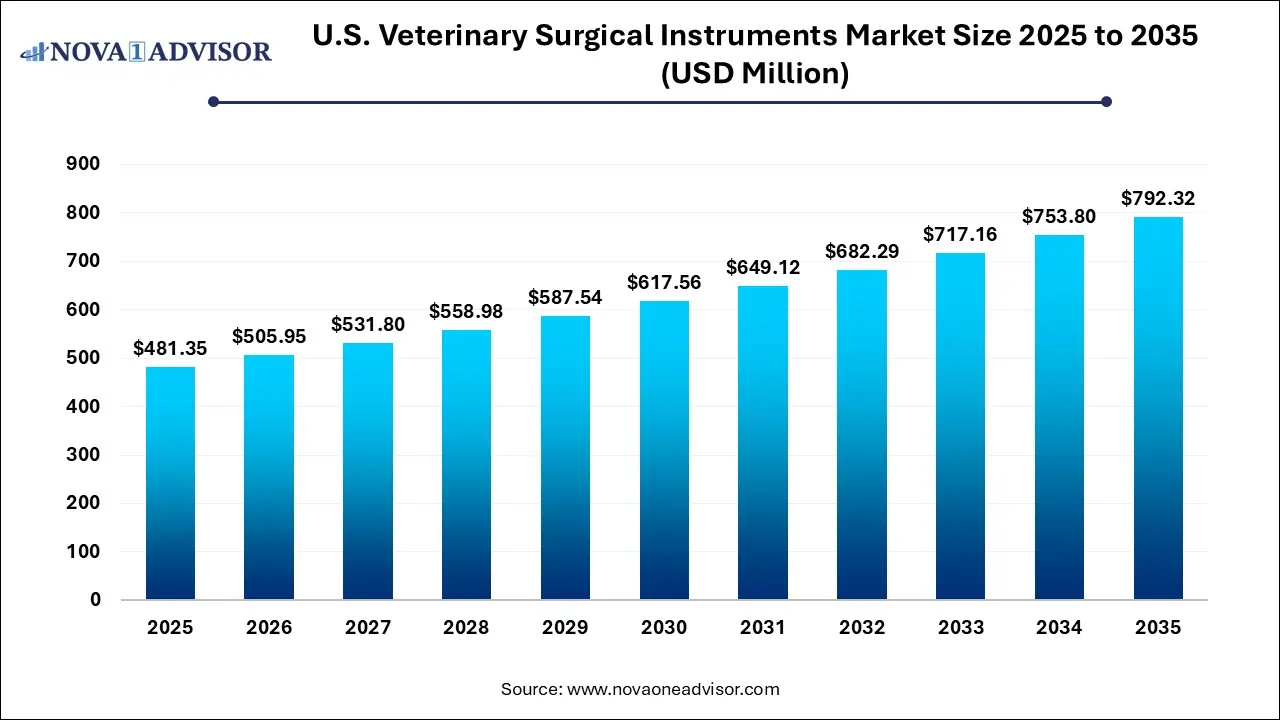

U.S. Veterinary Surgical Instruments Market Size and Growth 2026 to 2035

The U.S. veterinary surgical instruments market size was exhibited at USD 481.35 million in 2025 and is projected to hit around USD 792.32 million by 2035, growing at a CAGR of 5.11% during the forecast period 2026 to 2035.

Key Pointers:

- The surgical scissors segment is expected to exceed USD 190 million by 2035

- U.S. veterinary surgical instruments market from small and medium animals segment is slated to register over 5.9% CAGR from 2026 to 2035

- The dental surgery segment accounted for almost 29.19% of the market share in 2025.

- U.S. veterinary surgical instruments market from veterinary clinics segment held USD 255 million in 2025.

Market Outlook

- Market Growth Overview: The U.S. veterinary surgical instruments market is expected to grow significantly between 2025 and 2034, driven by the rising pet ownership and spending, innovation in surgical techniques, and the rising incidence of cancer, obesity, and orthopedic issues.

- Sustainability Trends: Sustainability trends involve eco-friendly materials and designs, integration of smart technology, and rising demand from pet owners.

- Major Investors: Major investors in the market include Medtronic Plc, Ethicon, Inc., Integra Life Sciences Holdings Corporation, B.Braun Vet Care GmbH, and Neogen Corporation.

Artificial Intelligence: The Next Growth Catalyst in U.S. Veterinary Surgical Instruments

AI is significantly impacting the U.S. veterinary surgical instruments industry by driving the demand for smarter, more precise, and automated equipment. The market is shifting from purely mechanical tools to smart, connected devices that embed AI for enhanced functionality. Specific impacts include the development of AI-guided robotic arms that assist in complex procedures with superhuman precision, minimizing tissue damage and enhancing recovery times.

Report Scope of U.S. Veterinary Surgical Instruments Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 505.95 Million |

| Market Size by 2035 |

USD 792.32 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 5.11% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Animal Type, Application, and End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Medtronic plc, Jorgen KRUSSE A/S (Henry Schein), B. Braun Vet Care, Neogen Corporation, Ethicon, Sklar Surgical Instruments, Jorgensen Labs, BMT Medizintechnik GmbH, Vimian Group, and GerMedUSA. |

Segmental Analysis:

By Product:

Surgical scissors dominate the U.S. veterinary surgical instruments market in 2025 due to their essential role across nearly all veterinary surgical procedures. These instruments are widely used for tissue dissection, cutting sutures, and surgical preparation in both routine and complex operations. Their repeated use in general surgeries, emergency procedures, and specialty interventions ensures consistent demand across veterinary clinics and hospitals. The availability of various designs, including straight, curved, blunt, and sharp scissors, along with their durability and reusability, reinforces their dominant market position.

Sutures represent the fastest-growing product segment in the U.S. veterinary surgical instruments market, driven by the rising volume of soft tissue surgeries and increasing pet ownership. The growing prevalence of companion animal procedures, including spaying, neutering, wound closure, and orthopedic repairs, has significantly boosted demand for advanced veterinary sutures. Innovations such as absorbable, antimicrobial-coated, and synthetic sutures are improving healing outcomes and reducing post-operative complications. Additionally, the expansion of veterinary specialty hospitals and increased spending on animal healthcare are accelerating the adoption of high-quality suture materials across the U.S.

By Animal Type:

Small and medium animals dominate the U.S. veterinary surgical instruments market in 2025, primarily driven by the high population of companion animals such as dogs and cats. Increasing pet adoption, rising awareness of animal health, and higher spending on veterinary care have led to a greater volume of surgical procedures for this segment. Routine surgeries, including sterilization, dental procedures, and soft tissue operations, significantly contribute to demand. Additionally, the growing presence of advanced veterinary clinics and specialty hospitals catering to companion animals reinforces the dominance of this segment.

The large animals segment is notably growing due to increasing investments in livestock health management and productivity. Rising demand for high-quality animal protein and improved farm economics are encouraging greater adoption of surgical interventions for cattle, horses, and other large animals. Advancements in mobile veterinary services and field-deployable surgical instruments are improving access to care in rural areas. Furthermore, heightened focus on disease prevention, animal welfare, and regulatory compliance is supporting steady growth in veterinary surgical procedures for large animals across the U.S.

By End Use:

Veterinary clinics dominate the U.S. veterinary surgical instruments market in 2025 due to their high volume of routine and minor surgical procedures. Clinics serve as the primary point of care for companion animals, handling procedures such as spaying, neutering, wound management, and dental surgeries. Their widespread presence, affordability, and frequent patient visits ensure consistent demand for essential surgical instruments. Additionally, the growing number of privately owned and chain-based veterinary clinics across the U.S. continues to reinforce this segment’s dominant market position.

Veterinary hospitals represent the fastest-growing end-use segment, driven by the rising demand for advanced and complex surgical procedures. These facilities are equipped with specialized surgical suites, advanced imaging technologies, and skilled veterinary surgeons capable of handling orthopedic, neurological, and emergency cases. Increasing pet insurance coverage and higher owner willingness to spend on advanced care are accelerating patient inflow. The expansion of multi-specialty veterinary hospitals and referral centers is further supporting rapid growth in this segment.

Value Chain Analysis of the U.S. Veterinary Surgical Instruments Market

- Research & Development (R&D) and Product Design

This stage involves the innovation, design, and engineering of new surgical instruments, including advancements like minimally invasive tools, 3D printing, and electrosurgical devices.

Key Players: Medtronic plc, B. Braun Vet Care GmbH, Ethicon Inc., Integra LifeSciences Holdings Corporation, and World Precision Instruments

- Manufacturing and Assembly

This stage involves the physical production and assembly of high-quality, durable, and precision surgical instruments from raw materials.

Key Players: B. Braun Vet Care GmbH, Medtronic plc, Ethicon Inc., STERIS plc, Sklar Surgical Instruments, and GerMedUSA, Inc.

- Distribution and Logistics

Finished products are transported from manufacturing facilities to various distribution channels, such as wholesalers, distributors, and directly to veterinary clinics and hospitals. Efficient logistics ensure timely delivery and product availability across the broad U.S. market.

Key Players: Cardinal Health, Inc., Covetrus, Inc., and Henry Schein.

U.S. Veterinary Surgical Instruments Market Companies

Medtronic provides the U.S. veterinary market with advanced surgical technologies, including vessel-sealing devices and specialized stapling instruments originally developed for human medicine.

- Jorgen KRUSSE A/S (Henry Schein)

As a major subsidiary under the Henry Schein distribution network, KRUSSE supplies a comprehensive range of specialized veterinary instruments, from orthopedic sets to general surgical tools.

B. Braun contributes to the market through a specialized portfolio of surgical instruments and closure technologies specifically designed for the ergonomic and physiological needs of veterinary patients.

Neogen focuses on providing durable, cost-effective surgical and veterinary tools, including a wide array of needles, syringes, and specialized livestock surgical instruments.

- Ethicon (Johnson & Johnson)

Ethicon is a global leader in surgical sutures and wound closure devices, providing U.S. veterinarians with advanced materials like antimicrobial sutures and topical skin adhesives.

U.S. veterinary surgical instruments Market Segmentation

By Product

- Sutures

- Staplers

- Forceps

- Scalpels

- Surgical Scissors

- Hooks & Retractors

- Trocars & Cannulas

- Electro-surgery Instruments

- Others

By Animal Type

- Small & Medium Animals

- Large Animals

By Application

- Dental Surgery

- Orthopedic Surgery

- Neurosurgery

- Ophthalmic Surgery

- Others

By End-use

- Veterinary Clinics

- Veterinary Hospitals

- Research Centers & Academia