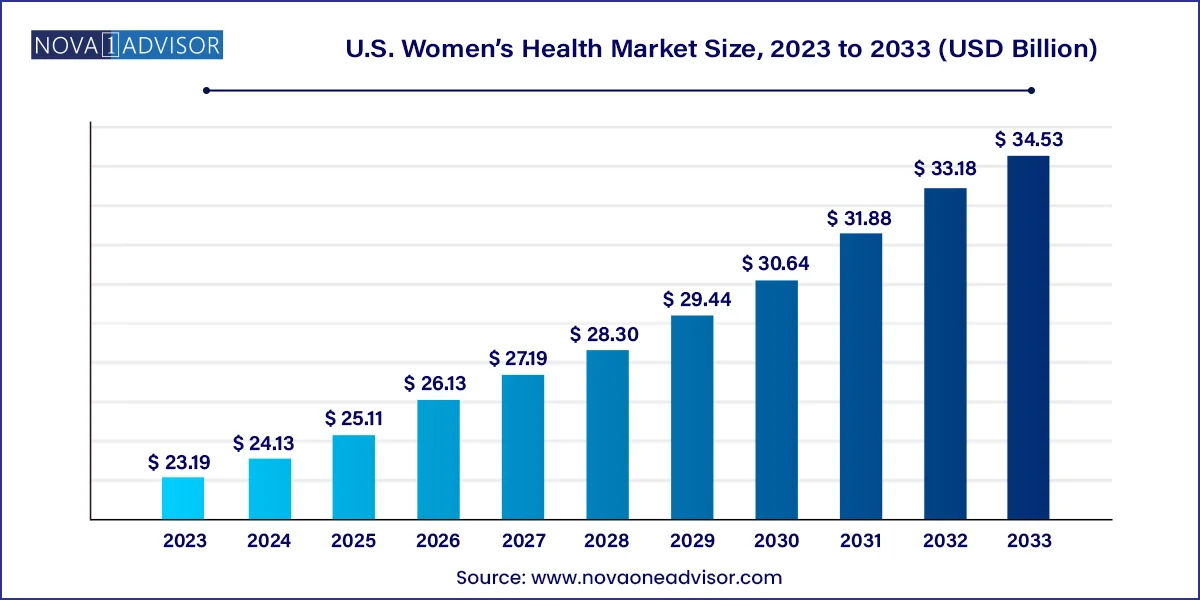

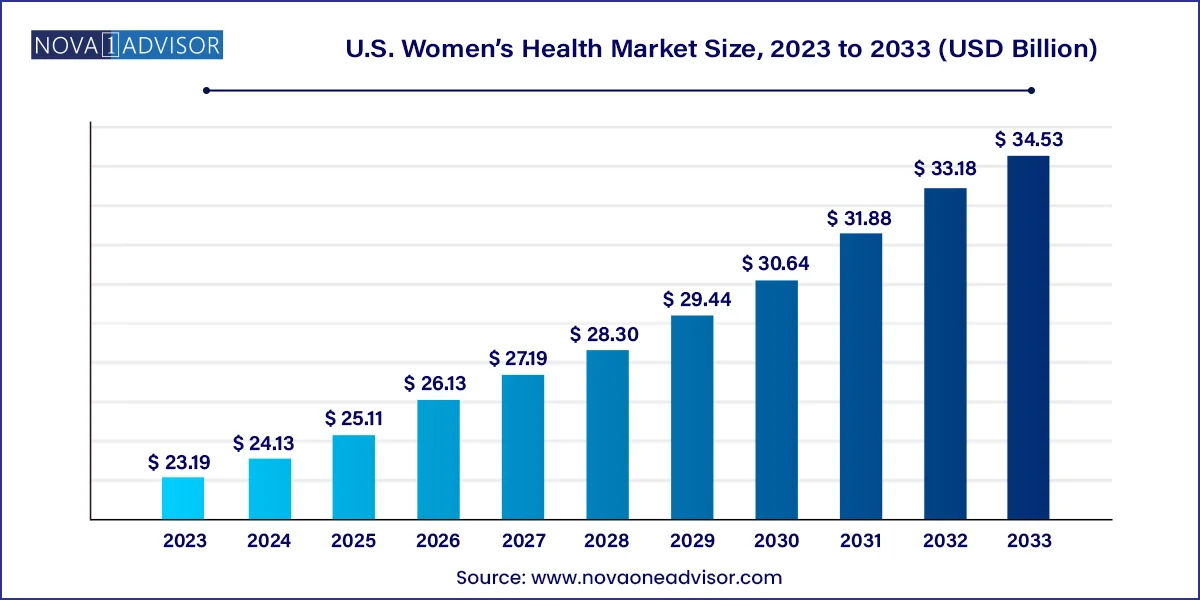

U.S. Women’s Health Market Size and Growth

The U.S. women’s health market size was valued at USD 23.19 billion in 2023 and is anticipated to reach around USD 34.53 billion by 2033, growing at a CAGR of 4.06% from 2024 to 2033.

U.S. Women’s Health Market Key Takeaways

- The contraceptives segment held the highest revenue share of more than 36.16% of the Market revenue in 2023

- The menopause segment is expected to grow at the highest CAGR rate over the forecast period.

- The Prolia segment led the market in 2023, with a share of 20.32%, and is expected to grow at the fastest growth rate over the forecast period.

- XGEVA segment is expected to grow at a lucrative growth rate over the forecast period.

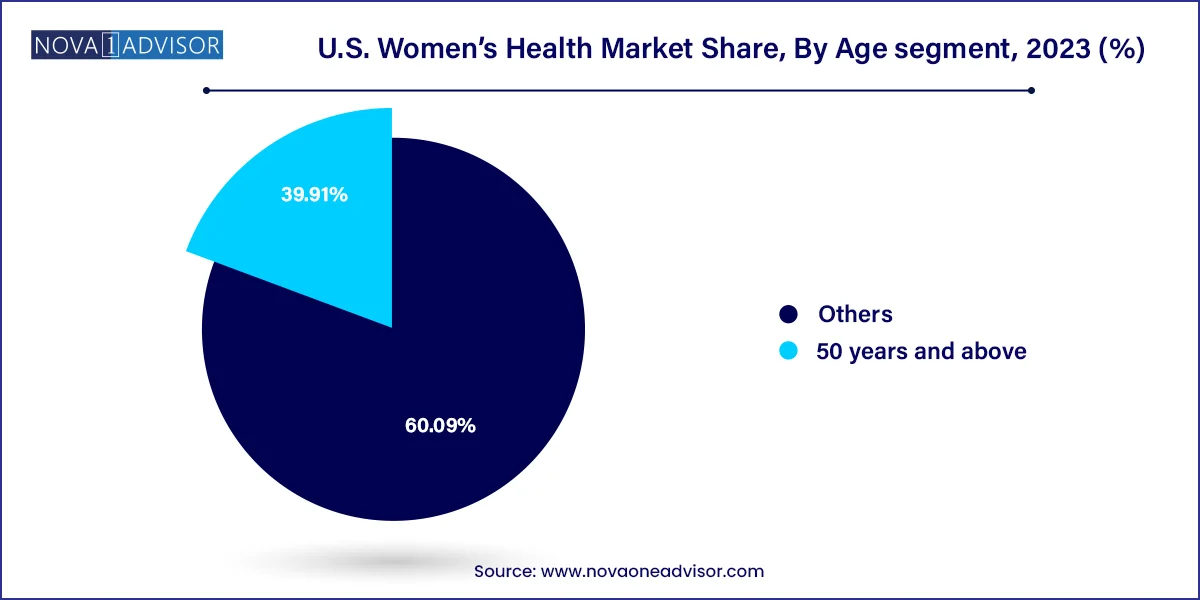

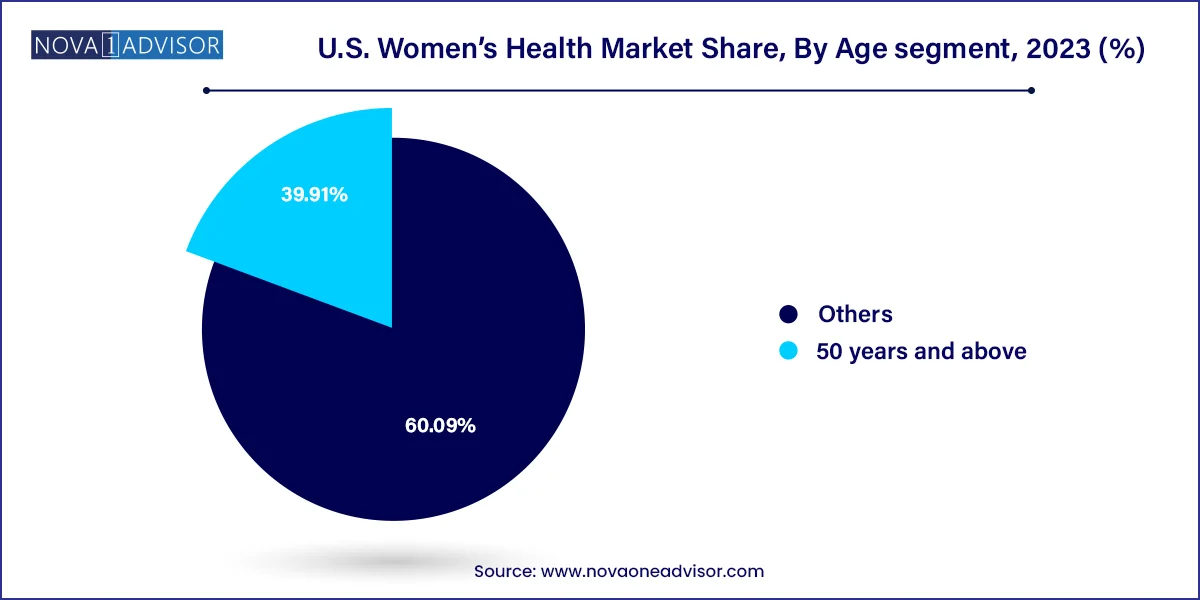

- The other segment held a considerable market share of 60.09% in 2023.

- The 50-year-old & above-age segment is expected to register the fastest growth rate over the forecast period.

Market Overview

The U.S. women’s health market encompasses a broad array of products and services aimed at addressing the unique biological, psychological, and social needs of women across various life stages. From contraception and fertility treatments to menopause management and osteoporosis care, the market continues to evolve in response to technological advances, shifting demographics, and increasing awareness around women-centric healthcare. Women’s health, historically underfunded and underserved, has witnessed a surge in dedicated research, innovation, and investment over the past decade.

Key areas driving market momentum include reproductive health, hormone therapy, and chronic condition management such as polycystic ovary syndrome (PCOS) and endometriosis. In addition to pharmaceutical products, lifestyle interventions, telehealth solutions, and digital platforms for personalized care are being integrated into mainstream women’s healthcare offerings. The U.S. government and advocacy groups have amplified efforts to address disparities in women’s health, with initiatives targeting increased funding for research, access to contraception, and preventative screenings.

With a growing population of aging women and greater emphasis on preventative care, the demand for comprehensive, accessible, and affordable women’s health solutions is projected to increase significantly. Moreover, the COVID-19 pandemic underscored gaps in healthcare access for women, prompting innovations in remote monitoring, fertility tracking apps, and at-home diagnostics that are likely to remain influential beyond the pandemic.

Major Trends in the Market

-

Rise in digital health platforms catering to fertility, menstrual health, and menopause

-

Increased adoption of long-acting reversible contraceptives (LARCs) such as intrauterine devices (IUDs)

-

Growing focus on non-hormonal treatments for menopause and PCOS

-

Integration of AI and machine learning in personalized hormone therapies

-

Expanded coverage for women’s preventative services under public and private insurance

-

Surge in femtech startups offering diagnostics, wearables, and telehealth tools

-

Advancements in hormone replacement therapies with improved safety profiles

-

Higher investment in clinical trials for conditions like endometriosis and uterine fibroids

U.S. Women’s Health Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 24.13 Billion |

| Market Size by 2033 |

USD 34.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.06% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Application, age, drug |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer, Inc; Teva Pharmaceutical Industries Ltd.; Agile Therapeutics; Amgen, Inc; Apothecus Pharmaceutical Corp.; Eli Lilly and Company; Ferring B.V. |

Key Market Driver: Growing Awareness and Demand for Reproductive Health Services

The primary driver of the U.S. women’s health market is the increased awareness and demand for reproductive health services, including fertility treatments, contraception, and hormonal therapies. As women delay childbirth and prioritize career development, demand for assisted reproductive technologies (ART) like IVF, IUI, and egg freezing has surged. Fertility clinics have proliferated, and more women are seeking access to hormone-based therapies to manage menstrual irregularities, PCOS, and infertility.

At the same time, the availability of diverse contraceptive options—from daily oral pills to hormone-releasing IUDs—has empowered women to make informed choices about family planning. Government-led initiatives such as Title X and commercial insurance plans now widely cover contraception and routine screenings, encouraging proactive health management. The cultural shift toward open conversations about menstruation, menopause, and fertility has further propelled women to seek tailored healthcare solutions.

Key Market Restraint: High Cost of Specialty Drugs and Access Disparities

One of the most significant challenges in the U.S. women’s health market is the high cost of specialty drugs and persistent disparities in access to care, particularly for underinsured or low-income populations. Many branded medications for hormone regulation, endometriosis, and postmenopausal osteoporosis come with substantial price tags, making them unaffordable for women without comprehensive insurance coverage.

Moreover, geographic and racial disparities exacerbate the problem. Women in rural areas or minority communities may face long wait times, lack of specialist access, or cultural stigmas that hinder healthcare engagement. While federal programs attempt to bridge these gaps, the healthcare system’s fragmentation limits consistent service delivery. These barriers reduce adherence to treatment, delay diagnoses, and contribute to poorer health outcomes.

Key Market Opportunity: Innovation in Non-hormonal and Personalized Therapies

A notable opportunity in the U.S. women’s health market lies in the development of non-hormonal and personalized therapies, particularly for conditions like menopause, PCOS, and endometriosis. Many women are seeking alternatives to hormone-based treatments due to side effects or contraindications. This demand is driving research into natural, plant-based, and targeted molecular therapies that offer symptom relief without systemic hormonal impact.

Pharmaceutical companies are investing in gene-based screening and biomarker-driven solutions to create personalized treatment regimens. For example, AI-driven hormone tracking apps can guide individualized dosage plans, while new classes of medications are being designed to address specific inflammatory pathways involved in uterine fibroids or endometriosis. These innovations not only enhance efficacy and tolerability but also broaden the patient base that can safely access care.

U.S. Women’s Health Market By Application Insights

Contraceptives dominate the U.S. women’s health application segment, driven by widespread awareness, policy support, and expanding product choices. Oral contraceptives remain a staple, but intrauterine devices (IUDs) and implants are gaining popularity due to their long-term efficacy and convenience. Brands like Mirena and NuvaRing have shown strong market penetration. Public health initiatives have also increased contraceptive access for adolescents and underserved women, making it a consistent growth area.

Postmenopausal osteoporosis is the fastest-growing segment, due to the aging female population and rising osteoporosis-related fracture risks. Treatments like Prolia, Reclast, and Actonel are widely used to strengthen bone density and reduce fracture incidence. With baby boomers entering menopause, the clinical burden of osteoporosis is increasing, leading to greater screening rates, physician awareness, and preventative prescribing patterns.

U.S. Women’s Health Market By Drug Insights

YAZ, Yasmin, and Yasminelle lead the contraceptive drug market, with wide brand recognition and consistent prescription rates among younger women. These combined oral contraceptives are commonly used to manage both birth control and PCOS symptoms. Their dual utility contributes to market strength and long-standing formulary inclusion across major insurers.

Prolia and XGEVA are among the fastest-growing drugs, targeting postmenopausal osteoporosis and skeletal-related events in cancer patients, respectively. Their extended dosing schedules and robust clinical evidence have contributed to steady adoption. Moreover, increased awareness of bone health post-menopause is driving their use not only in specialized clinics but also in primary care settings.

U.S. Women’s Health Market By Age segment Insights

Women aged 50 years and above represent the dominant age segment, largely due to demand for menopause management and osteoporosis treatment. Conditions such as endometriosis and uterine fibroids, though often diagnosed earlier, continue to affect women in this age group. Hormone therapy, bone health monitoring, and regular screenings drive product usage and service consumption.

Younger demographics are emerging as a fast-growing segment, particularly in areas of hormonal infertility and PCOS. Increased diagnosis, earlier healthcare engagement, and fertility preservation trends have led to higher utilization of hormone therapies and contraceptive support among women under 40. Innovations in menstrual health tracking and fertility apps are expanding engagement in this segment.

Country-level Analysis (U.S.)

In the United States, women’s health is a dynamic and multifaceted market characterized by robust pharmaceutical innovation, active advocacy, and significant disparities in care delivery. Urban areas with academic medical centers are often hubs of innovation, hosting clinical trials for new hormonal therapies and contraceptive technologies. Conversely, rural areas struggle with access, revealing an opportunity for telehealth and mobile clinic expansion.

Healthcare policy plays a crucial role in shaping access and adoption. The Affordable Care Act has expanded preventative service coverage, including annual exams, mammograms, and birth control, without copays. However, recent political debates surrounding reproductive rights have introduced uncertainty in contraceptive and abortion service access. This volatile environment continues to influence investment strategies, patient behavior, and provider preparedness.

U.S. Women’s Health Market Top Key Companies:

- AbbVie, Inc.

- Bayer AG

- Merck & Co., Inc.

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Agile Therapeutics

- Amgen, Inc.

- Apothecus Pharmaceutical Corp.

- Eli Lilly and Company

- Ferring B.V.

U.S. Women’s Health Market Recent Developments

-

March 2025: Organon announced FDA approval for a new non-hormonal treatment for vasomotor symptoms of menopause, a first-in-class product expected to reshape menopause management.

-

January 2025: Bayer launched a nationwide awareness campaign for endometriosis and uterine fibroids, accompanied by the expansion of its patient assistance program.

-

December 2024: TherapeuticsMD received expanded insurance coverage for Annovera, its year-long reusable vaginal ring contraceptive.

-

November 2024: Myovant Sciences began Phase III trials for a dual-action oral therapy targeting both uterine fibroids and heavy menstrual bleeding.

-

September 2024: Modern Fertility (acquired by Ro) launched a new AI-driven at-home hormone testing kit with personalized insights for PCOS and fertility tracking.

U.S. Women’s Health Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Women’s Health market.

By Application

- Hormonal Infertility

- Contraceptives

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Polycystic Ovary Syndrome (PCOS)

By Drug

- ACTONEL

- YAZ, Yasmin,Yasminelle

- FORTEO

- Minastrin 24 Fe

- Mirena

- NuvaRing

- ORTHO TRI-CY LO

- Premarin

- Prolia

- Reclast/Aclasta

- XGEVA

- Zometa

- Others

By Age

- 50 years and above

- Postmenopausal Osteoporosis

- Endometriosis & Uterine Fibroids

- Menopause

- Others

- Others